Islamic Finance Institute:

The AIMS Institute of Islamic Banking and Finance has been around since 2005, and in that time it has established a solid reputation and provided invaluable contributions to the field. Distinguished Shariah scholars and practitioners at AIMS Islamic Finance Institute create and oversee the institute’s programs. These initiatives aim to help individuals and companies improve their Islamic financial systems and become specialists in their respective fields. Students at AIMS’ International Centre for Education in Islamic Finance and Banking have earned degrees in Islamic finance and now work for prestigious companies. Given their ability to take the lead in establishing and running Islamic financial institutions around the world, their services are consistently in great demand.

Our Expertise:

Why Choose AIMS?

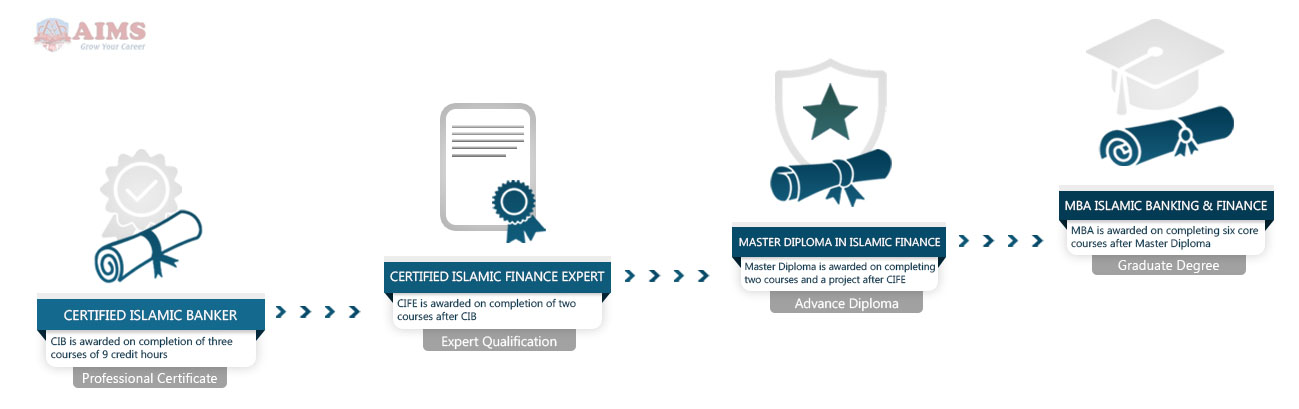

Islamic Finance Qualifications

More than 80,000 skilled workers are needed by organizations that practice Islamic finance in order to meet the needs of the present market. The Institute of Islamic Banking and Finance at AIMS provides academic programs in all areas of Islamic finance; graduates are prepared to take the helm at Islamic financial institutions wherever in the globe.

Hear from Our Global Learners!

“I had a great time studying at AIMS Institute of Islamic Banking and Finance. I first completed my CIFE online with the help of interactive lectures, study manuals, and other academic resources. The study contents are all, very well-organized. The Islamic finance training contents designed by AIMS are excellent and they give the true way of implementing the Islamic banking and financial system in today’s world. The views expressed in the program, are under the views of scholars, like Mufti Taqi Usmani, and they are AAOIFI Shariah compliant. I would strongly recommend this centre for Islamic finance to everyone.”

“AIMS Institute of Islamic Banking and Finance offers comprehensive programs that have significantly enhanced my understanding of Islamic finance. The curriculum is well-structured, combining theoretical and practical aspects seamlessly. The support from instructors was exceptional, making my learning experience rewarding. I highly recommend AIMS to anyone seeking expertise in this field.”

“My experience with the AIMS Islamic Finance Institute has been outstanding. The course materials were up-to-date and aligned with industry standards. The flexibility of the online programs allowed me to balance my studies with work. AIMS is truly a center for education in Islamic finance.”

“AIMS Islamic Finance Education exceeded my expectations. The interactive learning modules and expert guidance provided a thorough understanding of Islamic banking principles. This institute for Islamic banking and finance is ideal for anyone looking to excel in this industry.”