CIFE Certification:

Achieve the Certified Islamic Finance Expert (CIFE) certification from AIMS Education and witness firsthand the booming Islamic financial sector. This industry needs 80,000 trained specialists every year due to its 20% growth rate. With a focus on both theory and practice, our all-encompassing online Islamic finance qualification is just what companies are looking for. The CIFE Islamic Finance Certification is Adherent to AAOIFI Shariah Principles, has Level 5 Ofqual Qualification, is CPD Accredited in the UK, and is Recognized Worldwide.

Level-5: Certified Islamic Finance Expert

AIMS is registered with UKRLP and accredited by CPD in the United Kingdom. CPD accreditation ensures that students acquire extensive knowledge, address intricate challenges, and develop expertise. The Islamic finance certificate holds a value of over 35 credits and adheres to the guidelines established for the Level-5 Ofqual Regulated Qualifications Framework (RQF). Additionally, the program is in compliance with AAOIFI Shariah Standards.

Program Objectives !

CIFE Certification – A Quick Review

| Study Mode: | Online and Self-paced learning. |

| Estimated Duration: | 2-3 months. |

| Study Resources: | Interactive online lectures. 5 comprehensive study manuals. 24/7 Academic support by Shairah scholars. Islamic Finance e-Library. Ten Online Assignments. |

| Number of Courses: | Five (5) specialized courses. |

| Study Requirements: | 10 to 12 hours of study in a week. |

| Certifications Awarded: | Certified Islamic Finance Expert (CIFE) and Certified Islamic Banker (CIB). |

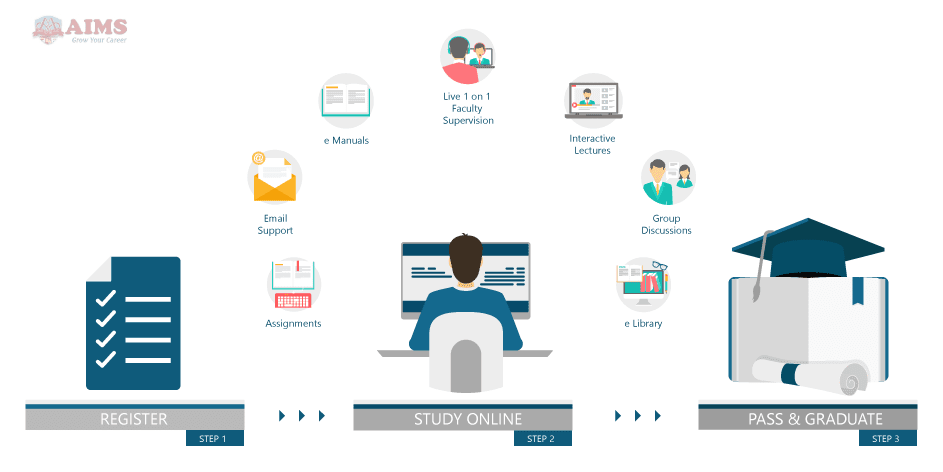

How to Achieve the CIFE Certification?

The online Islamic finance certification allows you to study on your own schedule. Gaining it requires a substantial financial and time commitment. We provide an Islamic finance library, online lectures, thorough study guides, and homework to help you learn the subject. Academic assistance is accessible at all times.

Hear from Our Global Learners!

“I greatly benefited from AIMS in obtaining the necessary knowledge and expertise to become an Islamic finance expert. The CIFE certification is efficiently structured, and the study materials provided are extensive and valuable. I genuinely appreciate the dedication AIMS has put into creating its online lectures and study guides. Each topic was clearly explained, with a wealth of practical information included. I must say that choosing to study Islamic finance with AIMS turned out to be an astute choice on my part.”

“The CIFE certification from AIMS is the best Islamic finance certification I have encountered. The detailed study materials and interactive lectures provided a comprehensive understanding of Islamic banking. The qualification has significantly boosted my career, making me a recognized Islamic finance expert in the industry.”

“The CIFE certification from AIMS was instrumental in advancing my career. The course content, particularly the comprehensive study manuals and online lectures, were excellent. This Islamic finance qualification has made me more proficient and recognized as an Islamic finance expert.”

“AIMS offers the best Islamic finance certification program. The Islamic banking certification and the structured curriculum have equipped me with the necessary expertise to excel in my field. I highly recommend this qualification to anyone aspiring to become an Islamic finance expert.”

Key Features of CIFE

Earning the Islamic finance certification has numerous personal and professional benefits. From a professional standpoint, it will pave the way for greater prospects in the Islamic finance sector and help you climb the corporate ladder. In addition to helping you stand out from other candidates for the job, it will showcase your experience in the industry. On a more individual level, it will help you learn more about Islamic finance and banking, which can improve your whole skill set.