MBA in Islamic Finance Degree

Islamic finance is growing rapidly, driven by its ethical, interest-free principles, with a 10-12% annual growth rate. Expected to create over 1.6 million jobs by 2026, AIMS offers a meticulously designed, UK-accredited MBA in Islamic Banking and Finance. This flexible, self-paced program, adhering to AAOIFI Shariah standards, is created by renowned scholars and practitioners. The MBA in Islamic Finance program covers key areas of Islamic banking and finance, providing a comprehensive and ideal degree for professionals seeking a Masters in Islamic Finance online.

Program Objectives!

MBA Islamic Finance Degree: A Quick Review

| Mode of Study: | Online & Self-paced learning. |

| Average Duration: | 12 months. |

| Study Resources: | Online Interactive lectures. Comprehensive Study manuals. 24/7 faculty support from Shariah experts. Islamic Finance e-Library. Online Assignments. |

| Courses to Study: | 13 courses & a Project in Islamic finance. |

| Study Requirements: | 10 – 12 hours of study in a week. |

| Final Assessment: | Assignments [35%], final exam [55%] and project [10%]. |

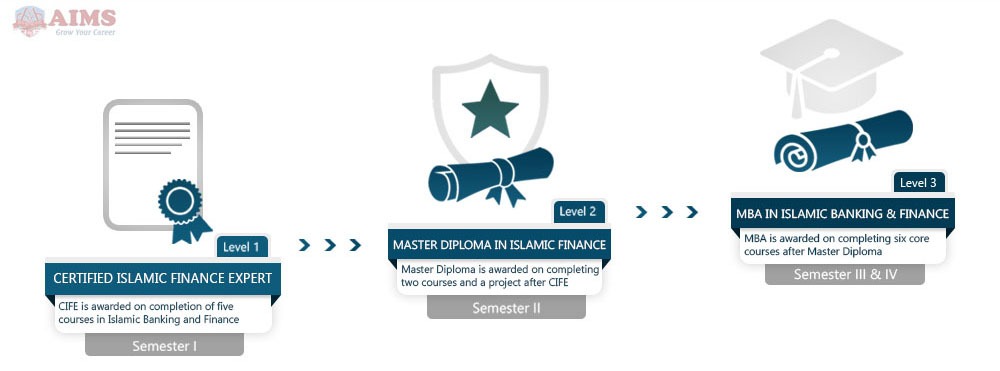

| Bonus Awards: | CIB and CIFE certifications on completion of Semester-I, and, CTP and Master Diploma on completion of Semester II. |

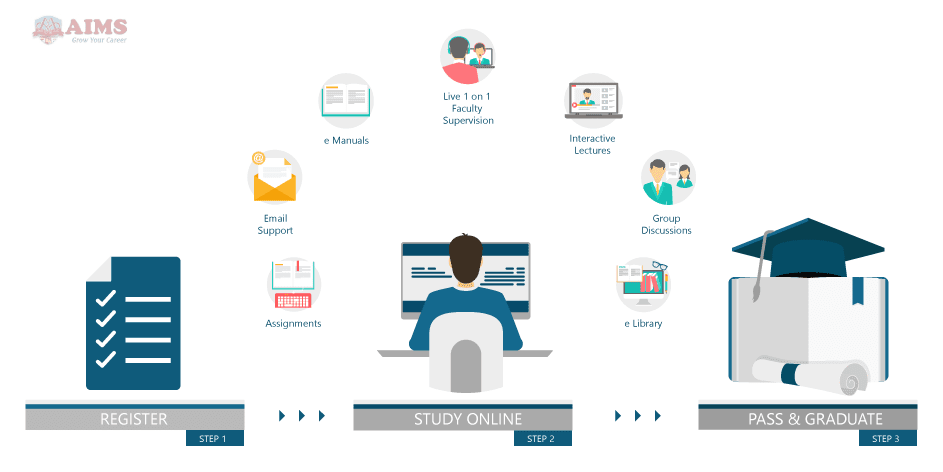

How to Achieve Masters in Islamic Finance?

Earn your MBA in Islamic Banking and Finance from AIMS with flexible online classes. Create your personalized study plan upon enrollment. Our e-learning program offers convenience for busy professionals, with interactive lectures, online manuals, and an Islamic finance e-library. Submit assignments at your convenience and take tests online whenever suits you best.

Structure of MBA Islamic Finance Program

The MBA in Islamic Banking and Finance consists of six core courses in business management (18 credit hours), seven concentration courses in Islamic banking and finance (21 credit hours), and a real-world project (6 credit hours).

MBA in Islamic Banking and Finance Curriculum!

For details on MBA Curriculum and our 35% Fee Scholarship offer, CLICK HERE.

Hear from Our Global Learners!

“The MBA in Islamic Banking and Finance degree program provided me with the knowledge I needed to become an expert in this field. The course material is well put together. The interactive lectures and other study resources are excellent. Assignments are also valuable, and every subject is treated in detail. It was a sensible decision to earn an Islamic finance degree from AIMS.”

“The MBA in Islamic Finance at AIMS is exceptional. The online learning platform is flexible, allowing me to balance my job with my studies. The curriculum is comprehensive and covers essential topics like Shariah compliance and Islamic financial instruments. Completing this Masters in Islamic Banking and Finance has significantly enhanced my career prospects in Islamic finance.”

“Enrolling in the MBA in Islamic Banking and Finance at AIMS was a great decision. The interactive lectures and supportive faculty made learning enjoyable and effective. The program’s accreditation and recognition are a huge plus, providing international career opportunities. This masters degree in Islamic banking and finance has truly enriched my knowledge and skills.”

“The MBA in Islamic Banking and Finance at AIMS exceeded my expectations. The self-paced learning and comprehensive study materials are excellent. The program’s focus on ethical and interest-free banking aligns perfectly with my career goals. I am grateful for the valuable insights and certifications I gained from this Islamic finance masters online.”

Accreditation!

Our online MBA in Islamic Finance program is Accredited by CPD and Registered with UKRLP in the UK. We adhere to the prestigious guidelines of the Ofqual Regulated Qualifications Framework (RQF), ensuring a Level-7 Masters Degree. Plus, we follow the stringent Shariah Standards set by AAOIFI.