Islamic Banking and Finance Blog

Welcome to the Islamic finance blog at AIMS Education, your resource on information and the Islamic banking and financial industry, products, and services. Our Islamic banking blog provides insightful perspectives, analyses, and updates on the ever-expanding Islamic finance domain in the finance sector worldwide. Our articles on Islamic banking and finance will help you keep up with what is new and developing in the Islamic banking and finance industry.

What is Hawala? Mechanism & Role in Islamic Finance

What is Hawala (حوالہ)? In Arabic, the term ḥawala or حوالہ refers to "transfer" or "trust", and it is an informal way of transferring funds where no actual cash is interchanged. The origin of [...]

Understanding the Concept of Capital in Islam

Understanding Capital in Islam Capital in Islam is a “third factor of production” or “produced means of production.” It refers to a set of acquired consuming values spent to generate more of the same [...]

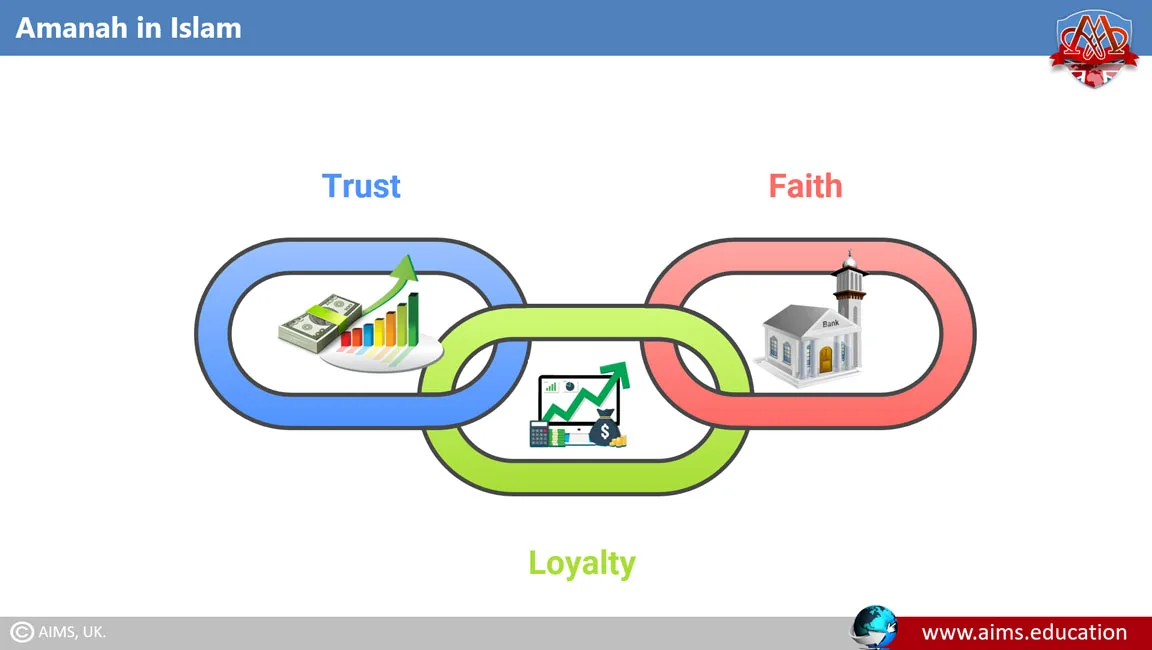

Amanah in Islamic Banking and Finance

What is an Amanah? “Amanah” (امانة) originates from an Arabic word that means trust or loyalty. In Islamic banking and finance, it refers to a transaction when a person gives something (such as property [...]

What is Iqtisad (اقتصاد) or Moderation in Spending in Islam?

What is Iqtisad and Ilm-ul-Iqtisad? The term Iqtisad (اقتصاد) is derived from the Arabic word “Qas’d” (قصد), which means to signify moderation or balance in spending, actions and behavior. In Islam, Iqtisa'd implies a [...]

Muzara’ah (مُزارَعَة) in Islamic Finance

What is Muzara'ah (مُزارَعَة) in Islam? The term Muzara’ah (مُزارَعَة) is derived from the Arabic root word "Zara", which means "to sow the seed." In Islam, Muzara’ah refers to a contractual arrangement wherein the [...]

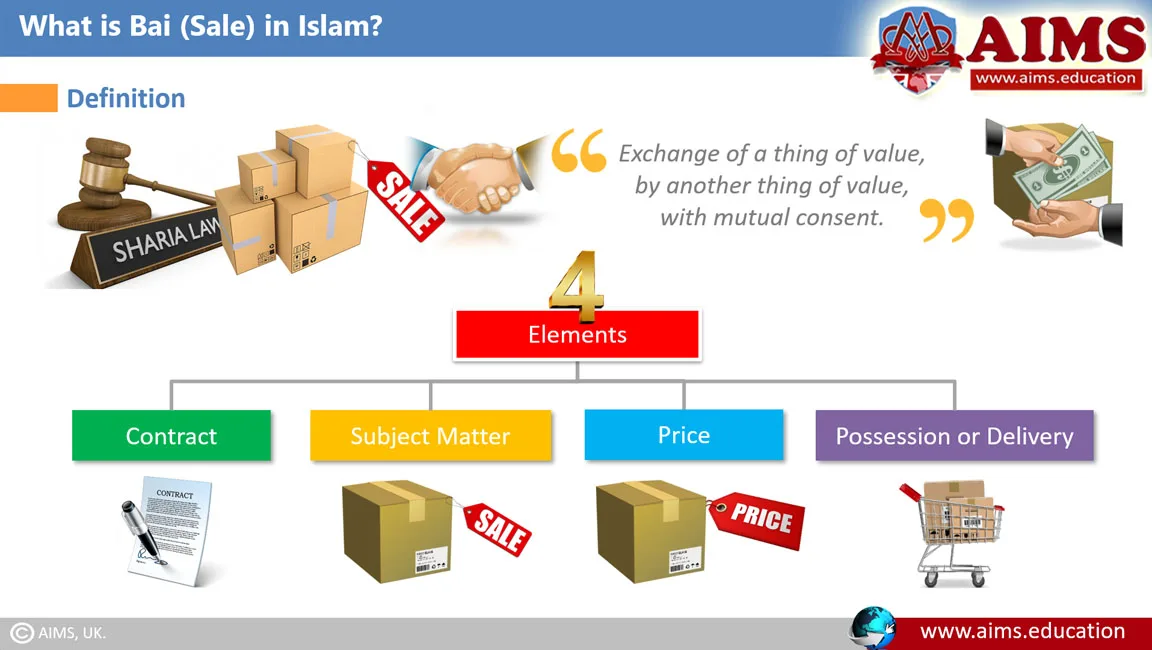

What is Bai (Sale) or بيع? Types, Conditions for Valid & Invalid Bai

What is Bai (Sale)? Sale or Bai (بيع) is defined as the “Exchange of a thing of value, by another thing of value, with mutual consent." More specifically, Bai may be defined as the [...]

What is Istijrar? Meaning, Types and Role in Islamic Banking

What is Istijrar? Istijrar (اِستِجرار) is a type of sale agreement in which a buyer purchases goods from a seller in different quantities over time, and the payment is made at the end of [...]

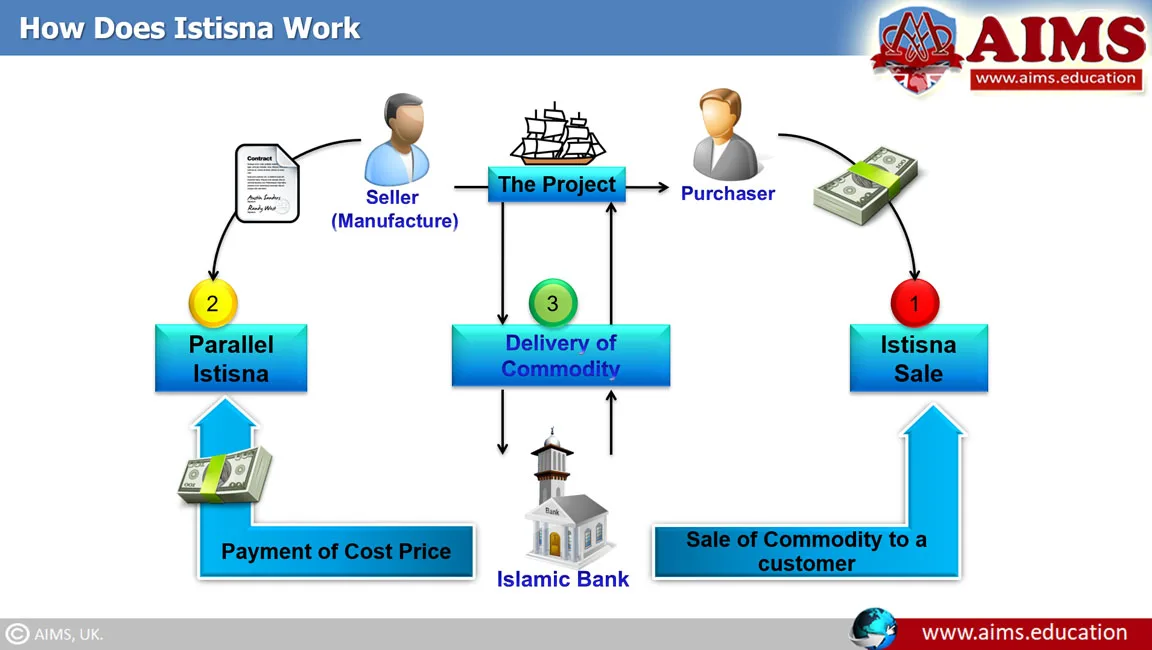

Istisna in Islamic Banking & Parallal Istisna

What is Istisna? Istisna is a special sale contract where the commodity is transacted before it comes into existence. Istisna in Islamic banking is mostly an order for the producer to manufacture a specific [...]

What is Musawamah in Islamic Banking? Examples & Contract Overview

What is Musawamah? Musawamah is an Arabic word derived from the word “sawa” which means “equalizing”. Musawamah means “bargaining” or “negotiation”, and in Islamic banking, it represents a type of sale where the seller [...]

Asset Backed Financing in Islamic Banking

What is Asset Backed Financing in Islamic Banking? According to the Islamic religion, not all investments and financial transactions are allowed for Muslims, and each of them must be compliant with the sources of [...]