Ijarah Meaning:

In the world of Islamic banking, one term that you may come across is Ijara. Ijarah “اجارۃ” is an Arabic term that means “lease”, “rent” or “hire”. In the context of Islamic banking and finance, Ijarah refers to a contract where one party (lessor) leases a tangible asset or property to another party (lessee) for an agreed period of time and at an agreed rental price. This means that the lessor retains ownership of the asset while the lessee has the right to use it in exchange for payment. The Ijarah system is very similar to a leasing contract, and the assets under the Ijarah finance could be used for cars, homes, plants, or machinery.

“Ijarah is a legal binding contract, where the owner of something with value, transfers its usufruct to another party, for a pre-defined period, in exchange of an agreed consideration”.

Ijarah Definition!

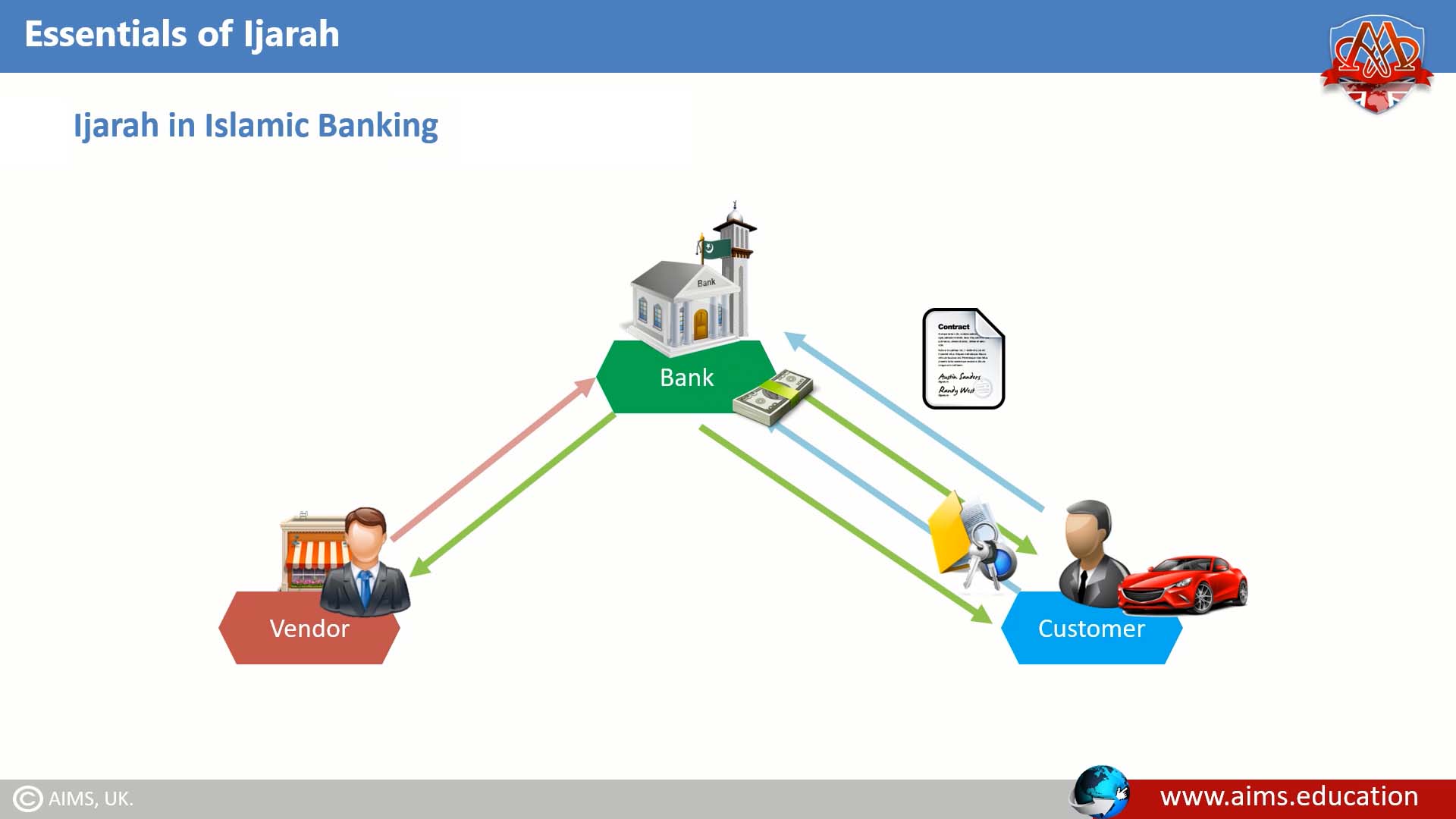

1. Ijarah in Islamic Banking:

It is a Sharia-compliant alternative to conventional leasing and borrowing methods. Since riba/interest-based transactions are not allowed in Islam, Ijarah follows the concept of profit sharing where the lessor earns a profit from the rental payments instead of charging interest. In the context of Islamic banking, اجارۃ signifies the conveyance of a specific asset’s usufruct to another party, based on a mutually agreed duration and cost. The key requirements of the asset in this transaction are that it must hold value, be clearly identifiable, and its quantity must be accurately determined. Assets that are consumed upon use, like money or wheat, are not eligible for lease under this agreement, reinforcing the unique principles of the Ijarah system.

2. Application of Ijarah: Car Financing Example

Let’s consider a practical example of the Ijarah financing system, demonstrating how it operates in the realm of car finance.

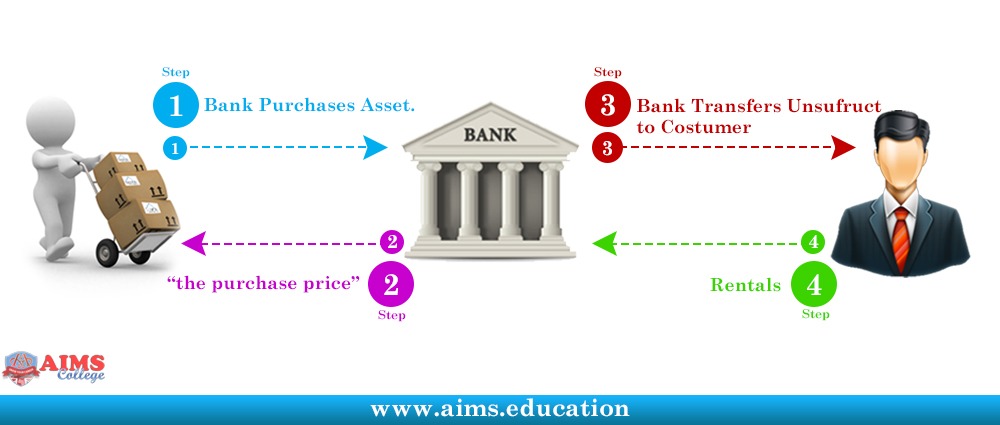

Step 1: THE CONTRACT

A customer (the lessee) approaches an Islamic bank (the lessor) with the intention of leasing a car. Both parties agree upon the terms of the contract, which include the model of the car, the duration of the lease, and the rental fee. For instance, the customer may wish to lease a car for a period of 3 years at an agreed rental fee of $400 per month.

Step 2: ACQUIRING THE ASSET

The Islamic bank purchases the agreed car from the dealer on behalf of the customer. The bank, as the owner of the car, assumes all the risks associated with ownership.

Step 3: LEASING THE ASSET

The car is then leased to the customer in exchange for the agreed rental fee. The customer is allowed to use the car for the lease period while the ownership remains with the bank.

Step 4: RENTAL PAYMENTS

The customer pays the agreed rental fee to the bank monthly. For example, for a 3-year lease, the customer would make 36 monthly payments of $400 each, totaling $14,400.

Step 5: CONCLUSION OF THE CONTRACT

At the end of the lease period, the contract may conclude with the customer returning the car to the bank. Alternatively, in the case of an Ijarah wa Iqtina contract, the customer has the option to purchase the car from the bank for a pre-agreed price. This makes it possible for the customer to become the owner of the car without having to pay the full price upfront.

3. اجارۃ and its Growing Significance in Financial Education:

As the recognition of Ijara system continues to grow within Islamic banking, educational institutions across the globe are incorporating its study into their curriculums. In the UK, for instance, students can pursue a Ph.D. in Islamic finance, where they delve into Islamic banking principles. The master’s program in Islamic finance is also gaining traction, offering in-depth understanding and practical insights into Ijarah contracts and their applications in modern Islamic banking. Furthermore, Islamic banking training courses are being developed to equip financial professionals with the knowledge and skills needed to efficiently navigate Islamic banking and finance products.

Types of Ijarah Financing:

1. Ijarah Tashgheeliah (Operating Ijarah):

Ijarah Tashgheeliah is a simple rental agreement in which the leased asset remains in the ownership of the lessor and comes back to him after the lease period.

2. Ijarah Thumma Al-Iqtiradh (ITAI):

In this type, the lessor agrees to provide a certain service or incur certain expenses for the lessee, in addition to leasing out the asset.

3. Ijarah Thumma Al-Bai (ITAB):

This is a combination of two contracts, ijarah and bai’ (sale). Under this contract, the lessee has the option to purchase the leased asset from the lessor at an agreed price and time.

4. Ijarah Muntahia Bittamleek (Financial Ijara):

This type allows the lessee to eventually own the leased asset upon completion of all rental payments. In this case, the lessor acts as a financier while the lessee is considered the eventual owner. It is impermissible in the Islamic Shariah due to the following two reasons:

- One transaction is tied up with another transaction.

- The lessor does not bear the responsibility of the lessor.

5. Ijarah Wa Iqtina (Hire Purchase):

Ijarah Wa Iqtina, often described as “Lease and Ownership”, is a unique type prevalent in Islamic finance. In this arrangement, the lessee is granted the option to purchase the leased asset at the end of the lease period. The distinctive feature of this contract is the flexibility it offers to lessees, allowing them the freedom to decide whether to acquire ownership or not. Throughout the lease period, the lessee makes regular rental payments, which may also contribute towards the final purchase of the asset if they choose to exercise the purchase option. This feature makes Ijarah Wa Iqtina an attractive choice for individuals and businesses seeking to eventually own the asset without the immediate financial burden of outright purchase.

Rules Regarding Ijarah Wa Iqtina:

Let’s delve into some crucial principles governing the Ijarah Wa Iqtina contract.

A. RENT OF LEASE:

- The rental must be determined at the time of the contract.

- It is permissible in اجارۃ that different amounts of rent are fixed for different phases of the rental period.

- It is permissible to tie up the rental amount with a variable benchmark, the ceiling and floor should be determined.

- Ijara rental will be charged when the leased asset is handed over to the lessee and not from the day the price has been paid.

- The lessor cannot increase the rent unilaterally, and any agreement to this effect is void.

B. PERIOD OF LEASE:

- The period of the lease must be determined in clear terms at the time of the contract.

C. PURPOSE OF USE:

- In the absence of any explicit purpose stipulated in the contract, the Ijarah Wa Iqtina agreement can be flexibly utilized for any standard purpose.

D. RESPONSIBILITIES OF LESSOR:

- As the owner of the leased asset lessor bears and assumes the full risk of the corpus of the leased asset. If the asset is destroyed during the lease period, the lessor will suffer the loss.

- Similarly, if the leased asset loses its usufruct without any misuse or negligence on the part of the lessee, the lessor can not claim the rent.

- The lessor is liable to pay all the expenses incurred in the process of its purchase and its import to the country of the lessor, for example, freight, customs duty, and clearing charges.

- Taxes related to ownership and registration charges of the car will be borne by the lessor, including agent fees if any.

- Insurance of leased assets is the responsibility of the lessor. But he can appoint the lessee as an agent to arrange insurance on his behalf.

E. RESPONSIBILITIES OF LESSEE:

- The Ijara lessee is liable to compensate the lessor for every harm to the leased asset caused by any misuse or negligence.

- Taxes related to the use of assets will be borne by the lessee.

- He is liable for the wear and tear which normally occurs during its use.

F. DETERMINATION OF RENTAL:

- It is permissible in ijarah wa Iqtina (إجارة واقتنا) that different amounts of rent are fixed for different phases during the lease period, provided that the amount of rent for each phase is specifically agreed upon at the time of affecting a lease.

- The determination of rental based on the aggregate cost incurred in the purchase of the asset by the lessor, as normally done in financial leases, is not against the rules of Shariah.

- The lessor cannot increase the rent unilaterally, and any agreement to this effect is void.

- The rent or any part thereof may be payable in advance before the delivery of the asset to the lessee.

- The lease period shall commence from the date on which the leased asset has been delivered to the lessee.

Concluding Remarks:

In conclusion, اجارۃ, with its various forms and applications, stands as a cornerstone in Islamic finance, offering a robust and ethical alternative to conventional interest-based leases. Its inherent flexibility, as illustrated in the Ijarah Wa Iqtina model, allows for a dynamic interaction between lessors and lessees, ensuring the financial needs of individuals and businesses are met in a manner that is in line with Islamic principles. A comprehensive exploration into the ijarah meaning, types, and applications of the Islamic Leasing system illuminates the vast potential it holds for fostering economic inclusivity and promoting financial justice.