What is Islamic Banking?

Islamic banking, also known as Sharia or halal banking, is banking practised under the principles of Islamic law. Recently, Sharia banking has grown in popularity and is recognized worldwide due to its Shariah-compliant money management and ethical investments. The Islamic banking system involves sharing profit and loss and prohibits some elements, including the collection and payment of interest or Riba by lenders and investors. Here are the key features:

- The Islamic banking system does not allow the use of interest (Riba) but supports risk-sharing and ethical investments in financial transactions.

- Sharia law prohibits certain financial activities, including gambling, unethical business activities, and speculation.

- The ethical banking system was limited to Muslim-majority countries but has recently expanded worldwide.

How does Islamic Banking Work?

1. Practical Implications of Islamic Banking Principles

Islamic banking operates with two primary principles.

- One is sharing both profits and losses.

- The other is the prohibition of some elements, including Riba, Gharar, Maysir, etc.

In other words, Islamic banks invest in various projects by becoming partners instead of charging interest or offering loans.

2. How the Islamic Banking System Invests In A Business Venture Or Project

A business or an individual will offer a proposal to the bank. The bank will evaluate the practicality and possible profits gained through the venture or project. In turn, the bank and the business share the profits as well as the risks.

3. Islamic Banking Operates on Ethical Commitments

Outside of the above principles, Shairah banking refrains from investing in businesses dealing in alcohol, pork, or anything considered forbidden or anything that is prohibited by Islamic law. Islamic banking is a system based on social responsibility and is ethically committed.

4. What Part The Shariah Board Plays In The Islamic Banking System?

- The Shariah board is a critical part of the halal banking system, serving as a moral perimeter while remaining compliant with Islamic law or Shariah.

- The Shariah board comprises scholars who are highly educated in Islamic law and finance.

- The board stays on top of the bank’s practices, products, and contracts, guaranteeing the bank parallels Islamic banking and finance principles.

- The board not only approves actions in the bank but offers guidance and recommendations for solving non-compliant issues.

- The Shariah board also plays a very important role in foreseeing the integrity and credibility of Shairah banking and is committed to ethics and responsibility when addressing financial executives.

5. Early Stages of Shariah Banking

Islamic banking and finance history dates back to the 7th century.

- Hazrat Khadija (RA) was a businesswoman and wife of the Prophet Muhammad (PBUH). Prophet Mohammad (PBUH) developed her business by applying many of the same standards used in contemporary perceptions.

- During the Middle Ages, commercial practices and trade in the Muslim world were guided by the same principles influencing economics in many areas, including Spain, the Baltic States, and the Mediterranean, creating the groundwork for some Western principles.

- During the 1060s and 70s, the world realized the potential for the current economics of today.

6. The Alignment of Modern Islamic Banking Practices with Old Values

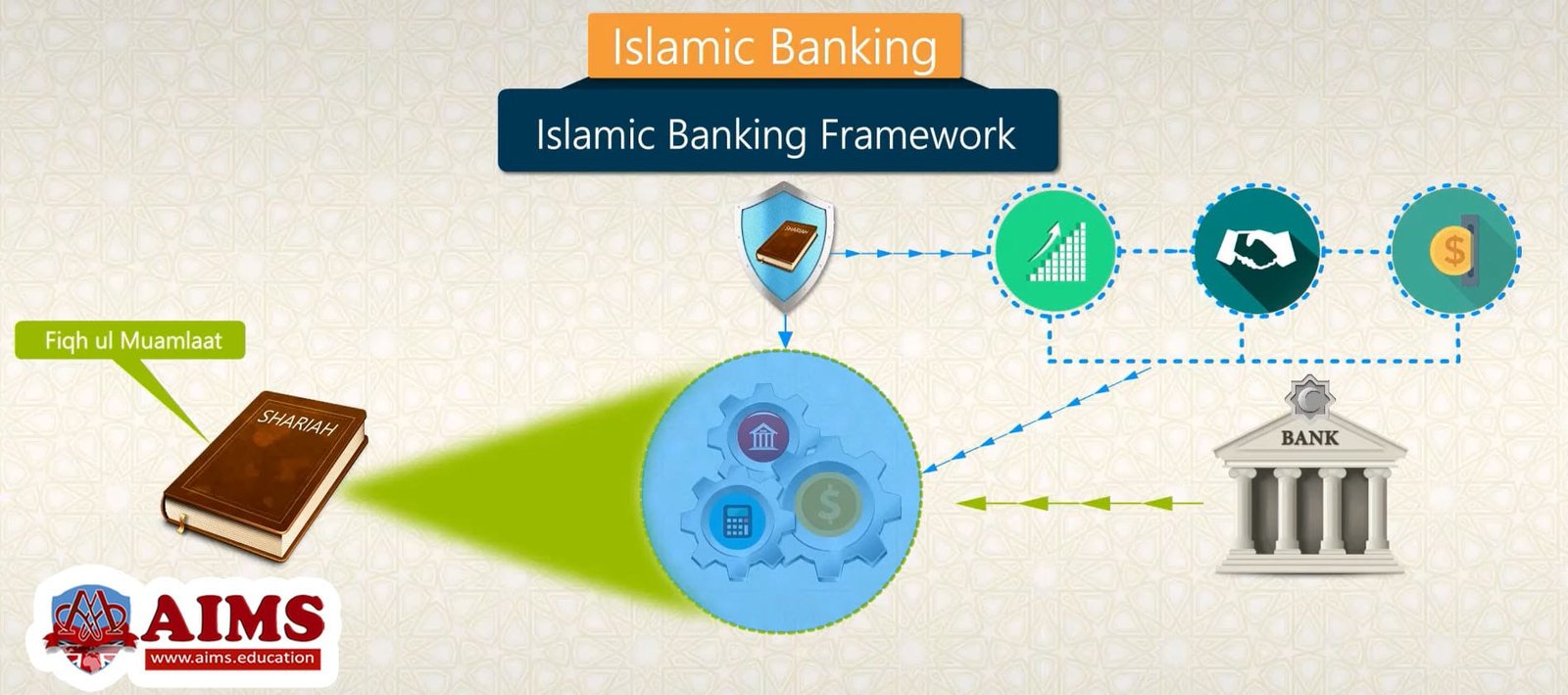

The Shairah banking practices are very similar to traditional banking systems, and the operations abide by Sharia rules, also known as Fiqh al-Muamalat. Islamic banking practices must conform to Shari’ah principles, in a practical sense, through the progression of Islamic economics. Many of these principles have gained worldwide recognition. The principles have survived over hundreds of years by adopting changes without losing the original values.

7. The Path of Islamic Banking to Loan Repayment

To understand the workings of Islamic banking, you have to understand the rules. Shariah scholars agree on the principle that the credit price of a commodity is more than the cash price. The difference in price has been allowed by the Islamic Fiqh Academy of OIC and the Sharia boards in all Islamic banks. Once the price has been agreed upon, no further actions can be taken.

Islamic banks can earn money without adding interest by using equity participation systems. When the bank lends money to a business, the payment comes without added interest, but the bank gets a share of the profits. In some cases, in a loan default or non-profitable situation, the bank will refrain from making a profit.

Frequently Asked Questions?

Is Islamic Banking Really Islamic?

Halal banking adheres to the principles of Islamic law or Shariah. The banking system believes in ethics, fairness, and transparency. Unlike conventional banking, Islamic banking follows the prohibition of Riba by following profit and loss sharing. Islamic banking does not invest in industries that are forbidden but encourages halal investments that contribute to social well-being.

While Conventional Bank Accounts Are Forbidden, Are Profits from Islamic Banks Halal?

Profit-and-loss-sharing accounts under conventional banking might seem similar to Sharia banking due to the shared risk and profit model. However, the differences lie in the formation of Islamic banking compared with conventional banking. Conventional banking operates on a fixed interest rate known as Riba, and riba is forbidden in Islamic law. If a conventional account shares profits and losses, the earned interest is prohibited under Shariah law.

The unique principle of an Islamic banking account does not include the provision of overdrafts and, therefore, does not contribute to making money in a traditional sense. Investment accounts in a halal banking system can vary from conventional savings accounts. When it comes to investment accounts, Islamic banks are committed to repaying the depositor depending on the outcome of the investment, which speaks for the principles of Islam.

Basic Forbidden Aspects Directly Or Indirectly Related To Islamic Finance

In the books of Shariah, nine basic do-nots are directly or indirectly related to Islamic finance.

1. Riba

Riba is an excess compensation beyond the principle. All levels of interest are prohibited under Islamic law.

2. MAYSIR:

Maysir is known as gambling. The bottom line is that one party wins while the other loses.

3. Ghaban

This means fraud, and it is not allowed by Shariah.

4. Iq’rah

Iqrah is imposing a condition or contract on the unwilling individual.

5. Bai-Al-Muttar

Exploiting those financially in need by charging high costs.

6. Ehtikaar

This is price gouging or hoarding goods.

7. Najash

This is increasing prices by manipulating false bids.

8. Gharar

Gharar means deals that are risky or hazardous.

9. Jhahala

Little to no information about a commodity, its quality, price, etc.

Key Features of the Islamic Banking System

1. Uncertainty

If all the terms and conditions are not clear or understood, uncertainty is not allowed.

2. Identifiable Assets

All financial transactions must be connected to a tangible asset. Money is not considered an asset.

3. Profit and Risk Sharing

All transactions must be shared by all parties associated with the risks and profits.

4. Investment Must Be Ethical

Some business investments are prohibited, such as alcohol, gambling, pornography, and pork.

Stepping into the Halal Banking Career:

If you fully understand and practice the Sharia banking system, AIMS’ Islamic Finance online certification, and Islamic banking online courses provide global opportunities to professionals with career-oriented opportunities. For those with past qualifications and experience in the banking sector, our diploma in Islamic banking and finance develops advanced skills to manage ethical finance products and services. The MBA in Islamic Finance degree and Ph.D. in Islamic Economics and Finance are designed for individuals seeking senior roles in managing Islamic financial systems.

Islamic Banking Operations

1. Role of Central Banks in the Islamic Banking

Central banking holds an important position by overseeing commercial banking and its operations. In Muslim countries, interest-based banks control a large portion of the money market.

2. Islamic Banking and Finance Regulatory Requirements

There are 10 Islamic Finance Instruments on the assets side and 12 instruments on the liability side. Islamic financial institutions must provide the following information to central banking:

- The compliance and structure of new products.

- How do Islamic banks audit in accordance with Shariah?

- Who delivers the investment in shares?

- The principles and policies for profit distribution between the banks and their partners.

- Provide financial reports and general disclosures.

3. Impact of Islamic Banking on Monetary Growth

- Central banks treat Islamic banks at par with the deposits.

- Islamic banking products are different from conventional debit-creating products and might show monetary growth.

- Islamic bank’s generation of money is similar to the generation of money in real business.

- Because Islamic banks cannot liquidate their assets like conventional banks, they must keep more cash on hand in their vaults to meet withdrawal obligations.

4. Managing Funds in Islamic Banks

1. NATURE OF INVESTMENT ACCOUNTS

- To understand how money is created and what the appropriate requirements are for the Islamic bank to operate.

- When a new account is activated, money is created, resulting in monetary growth.

2. PREMIUM PAYMENT AND PROFIT DISTRIBUTION

Investment accounts are similar to savings and time deposits in conventional banks. COIs in Islamic banks and TDR of conventional banks are very much the same. So, Premium Policies and Profit Distribution are not different.

3. PREMATURE ENCASHMENT

Islamic banks allow investment account holders to withdraw all the money from the account. On the other hand, conventional banks do not pay the full investment at premature encashment.

4. GROWTH THROUGH ISLAMIC BANKS

Let us see how the Islamic modes of finance may contribute to monetary expansion:

- Funds collected in Islamic banks are invested in several financial products, such as Islamic trade finance, Salam for agriculture partnerships, Shirkah based contract, etc.

- The funds are given to individuals as salaries, wages, prices for new materials, rent, etc. Some of the funds will go back to the bank and be distributed among current accounts and investment accounts.

5. DEBT FINANCE AND PARTICIPATORY FINANCE DIFFERENCES

Most profit-sharing investments are based on additional production. This does not necessarily apply to debt finance, where the borrower has the ability to take precedence over the project’s expected profits. In some cases, when a business experiences a loss, lower profits are earned by the bank. The Islamic bank will take the loss in proportion to its investment.

7. DIFFERENCES BETWEEN MURABAHAH FINANCE AND PARTICIPATORY FINANCE:

- Practicing Murabahah, Islamic banks will receive a continuous flow of repayments. The out-flow and in-flow of cash are taken at the same time.

- Murabahah creates a loan agreement for the customer who pays back the agreed amount even when there is a loss in trade.

Wrapping Up

Despite the dominance of interest-based banks, even in Muslim countries, the growth of Sharia banking has created a way for more inclusive and ethical financial systems. As more people and businesses become aware of the many advantages of Islamic banking and equitable risk-sharing in Islamic finance, Islamic banking is taking on a very important role in global financing.