What is Musharakah?

Musharakah is a type of Islamic banking contract that involves two or more parties coming together to form a partnership. The term Musharaka means ‘sharing’ or ‘partnership’ in Arabic. Its root word is Shirkah, which means “Being a Partner”. Under this contract, all parties contribute capital towards a venture and share the profits or losses according to their investment ratio. Unlike conventional financing, where interest is charged on the loan amount, Musharaka is based on the principle of risk-sharing, where all parties involved in the contract share the risks and rewards of the venture. Musharakah Contract is a popular financing option in Islamic finance because it offers an alternative to conventional interest-based financing that is prohibited in Islamic law.

“A joint enterprise formed for conducting some business, in which all partners share the profit according to a pre-agreed ratio, and loss is shared according to the ratio of the contribution”.

Musharakah Definition!

“And, verily, many partners oppress one another, except those who believe, and do righteous good deeds, and they are few. The above reminds the partners to bind themselves to ethical values in dealing with each other”.

Al-Quran Surah Sad, Ayah 24!

This verse generally indicates the validity of Musharakah and it specifically underlines the rule of Islamic inheritance. However, in a general context, Muslim jurists have regarded the text as containing, the general permissibility of any form of partnership. The below verse is normally quoted to support Musharakah:

“Now send one of you with this your silver coin unto the city, and let him see what food is purest there, and bring you a supply thereof. Let him be courteous, and let no man know of you”.

Al-Quran Surah Al-Kahf, Ayah 19!

A well-known Islamic scholar indicates three important points in this verse. First, their funds were contributed on a Shirkah basis. Second, they bought goods from Shirkah-based funds. And, third that it gives validity to utilize food purchased on Shirkah basis, though one gets more or less. The following Hadith of Prophet Muhammad (Peace Be Upon Him) highlights the importance of trust between partners.

“Allah says. I am the third of the two partners, as long as they do not cheat one another. But, when one of them cheats the other, I leave them”.

Hadith of Prophet Mohammad صلى الله عليه وآله وسلم!

Benefits of Musharakah:

Musharakah is a profitable and Halal investment option with several benefits.

1. PROFIT & LOSS SHARING:

One of the primary benefits is that it allows partners to share both profits and losses. This means that the risks associated with the project are shared, and no one partner bears the entire burden alone. It also encourages cooperation and teamwork, as partners have a vested interest in the success of the project.

2. ETHICAL NATURE:

Another benefit of Musharakah is that it promotes ethical and social responsibility. Since the profits and losses are shared, partners are motivated to make responsible and ethical decisions that benefit both the project and the community. This concept is in line with the Islamic principles of fairness, equality, and social welfare.

3. ENCOURAGES ENTREPRENEURSHIP:

Musharakah also encourages innovation and entrepreneurship. Since partners share the risks and rewards, they are more likely to invest in new and innovative projects that have the potential for high returns. This can lead to the creation of new businesses and jobs, which can have a positive impact on the economy.

Islamic Finance Education: Forging Innovative Paths

Musharakah has been gaining considerable attention in academia, inspiring the creation of a diverse range of Islamic finance educational programs worldwide. It has evolved to include postgraduate diplomas in Islamic finance and banking, fostering a comprehensive understanding of the principles that govern this system.

Institutions in the UK are at the forefront of this academic advancement, with several institutions, such as AIMS offering a PhD in Islamic finance, reflecting the growing global interest in this field. Additionally, Masters program in Islamic banking and finance provides an in-depth exploration of the operational aspects of Musharakah and other Islamic banking and finance instruments. Furthermore, the CIFE certification and various Islamic finance training programs are shaping a new generation of experts, ready to pioneer innovative, ethical financial solutions.

What is Shirkah? and Its Types:

Comparison of Shirkah with an Interest-Based Economy:

A. SHARING OF RISK:

In an interest-based economic system, the lender lends its money to the borrower for risk-free return. While in Shirkah-based lending, both parties share their risk and reward and remain conscious. Here you may find more about risk management in Islamic finance.

B. INTEREST:

In conventional loans, the borrower is bound to return full principal plus interest, even if the losses are suffered. However, Shirkah is based on justice. Both the financier and borrower enjoy profit or suffer loss.

C. VALUE FOR SOCIETY:

In an interest-based economic system, money circulates in a few hands. While in Shirkah, money circulates in society.

Differences between Musharakah and Conventional Financing:

Musharakah is different from conventional financing in several ways. Conventional financing involves borrowing money from a lender and paying back the loan with interest. This is considered Haram, or forbidden, in Islam, as it involves the payment of interest, which is considered exploitative and unfair.

Musharakah, on the other hand, is a partnership-based investment model, where partners contribute capital and share both profits and losses. The profits are shared in proportion to the amount of capital contributed by each partner, and the losses are shared in proportion to the amount of capital contributed. This model promotes fairness and equality, as partners share both the risks and rewards.

Another difference between Musharakah and conventional financing is the level of involvement of partners. In conventional financing, the lender is not involved in the operation of the business or project. However, in Musharakah, partners are actively involved in the project, and decisions are made collectively.

Types of Shirkah:

- Shirkaht-ul-Mulk.

- Shirkaht-ul-Amwaal.

- Shirkaht-ul-WuJuh.

RULES RELATED TO SHIRKAT-UL-MULK:

- No partner can use the share of another partner.

- Profit and loss will be according to the ratio of ownership.

- Every partner has the right to sell or gift or lease, to the extent of his share.

- One partner can promise to purchase the share of another partner at any price. It could be a face value, market value, or pre-agreed price.

If a property is jointly owned by two partners:

- It may be distributed according to timing or place; OR;

- All partners may use it without physical distribution.

RULES RELATED TO SHIRKAT-UL-AMWAAL:

Since every partner is an agent of another partner, so:

- No need to get the permission of other partners, for any business activity, such as a sale or purchase.

- Another partner is bound to comply with the terms agreed upon by one partner.

- The customer has a right to claim each partner.

- Profit may be agreed at any ratio.

- The loss will be distributed exactly at the same ratio, at which profit is shared.

If the investment is required to run this type of Shirkah, the following four scenarios are possible:

The following two types of partnerships are permissible by all four Imams

- Number-1: If both partners are investors and working partners, any ratio of profit may be agreed;

- Number-2: If only one is an investor, and both are working partners, any ratio of profit may be agreed;

The following two types of partnerships are permissible only according to Imam Ahmed:

- Number-3: If both are investors and only one is a working partner; and;

- Number-4: If one is an investor and the other is a working partner.

RULES RELATED TO SHIRKAT-UL-WUJUH:

- Every partner is an agent of other partner, so any partner can act in the normal curs of business, and other is also responsible for the undertaken work.

- The ratio of ownership may be different in a commodity purchased on credit.

- Profit and loss will be according to the ratio of ownership.

Types of Musharakah:

There are two types of Musharakah:

- Permanent, and,

- Diminishing.

PERMANENT MUSHARAKAH:

In permanent Musharakah, the partners contribute capital to a project and share both profits and losses throughout the project’s life. The partnership is dissolved when the project is completed or when one partner decides to withdraw from the partnership.

DIMINISHING MUSHARAKAH:

In diminishing Musharakah, the partners contribute capital to a project, and one partner gradually buys out the share of the other partner until they own the entire project. This type of Musharakah is commonly used in home financing, where the bank and the homeowner are partners, and the bank gradually buys out the homeowner’s share of the property.

Understanding the Musharakah Contract:

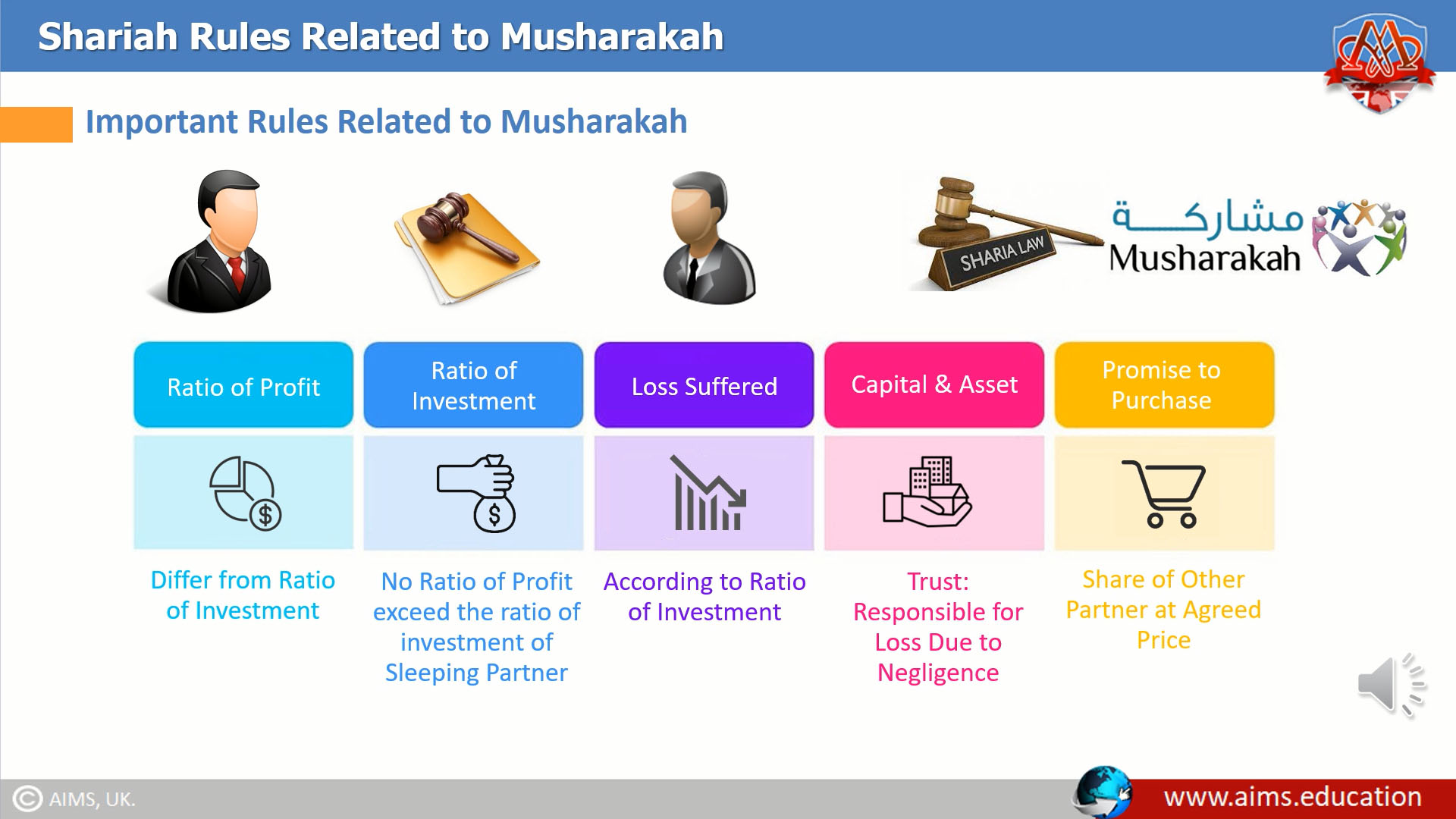

Important Rules Related to Musharakah:

- Partner cannot do any work or activity when there is an apparent loss of business.

- One partner may be a sleeping partner and the other a working partner.

- Any other person may be employed with the mutual consent of all partners. The salary will be accounted from the business expenses, and part of the profit may also be given as an incentive besides salary.

- Any partner may be employed by the business. In this case, his ratio of profit may be increased, or a salary may be given.

- Profit can be distributed at any mutually agreed ratio.

- The ratio of profit may differ from the ratio of capital or investment.

- The ratio of profit of a sleeping partner cannot exceed the ratio of his investment.

- Losses must be suffered, according to the ratio of investment.

- Since the capital and asset of Shirkah is trust, if a loss is occurred due to the negligence of a partner, only that particular partner will be responsible for the loss, not other partners.

- Every partner can promise to purchase the share of another partner at Market Price, or at an agreed price at the time of sale. It is not allowed to agree to a fixed price at the time of promise.

- If capital is in the shape of a commodity, its market value at the time of entering into a partnership will be taken.

- Capital must be specified and existing. Debt cannot be capital, unless it is a nominal part of the capital, for example: in the case of a merger of companies.

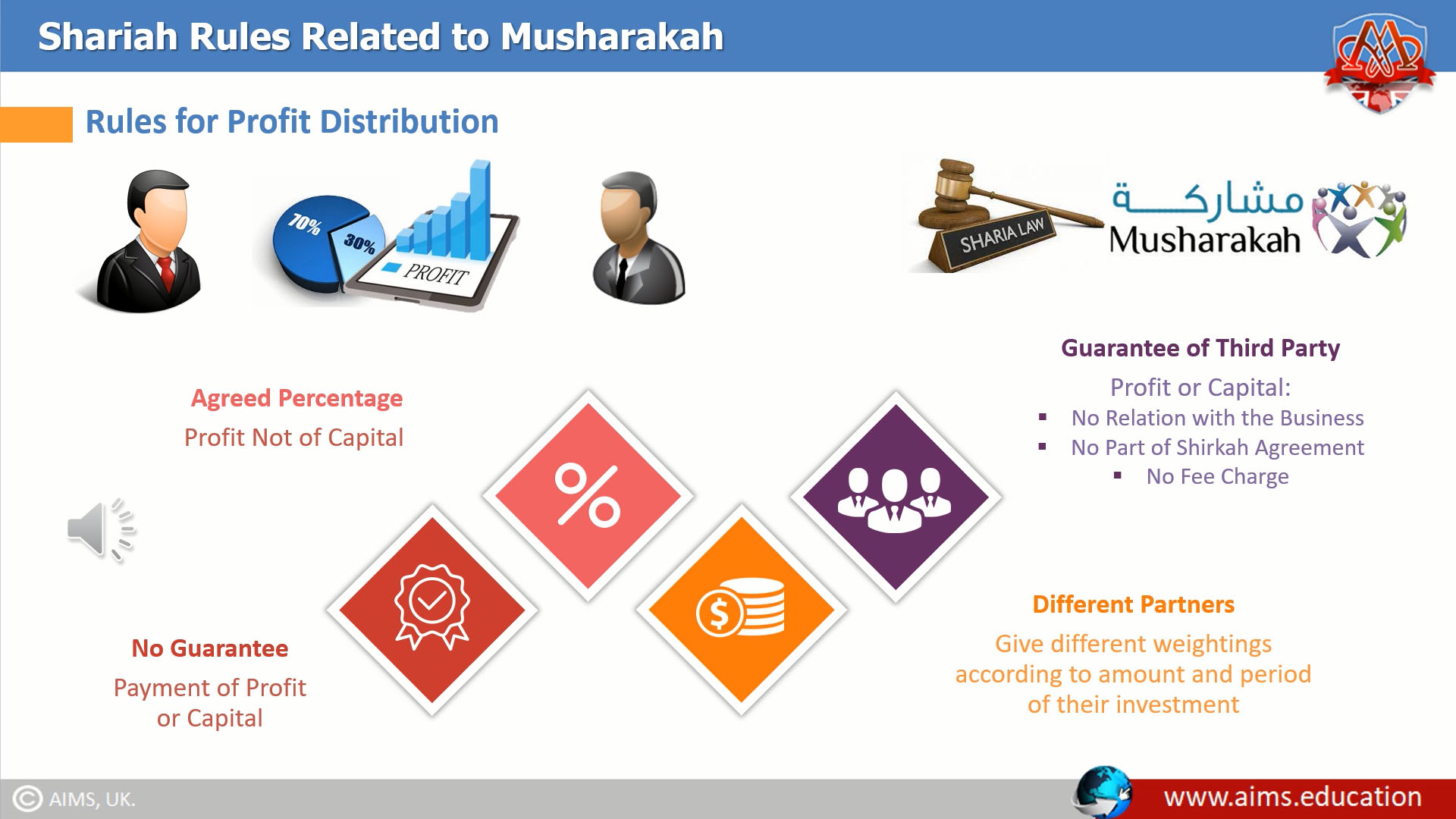

Rules for Profit Distribution:

- The agreed percentage must be a percentage of profit, not of capital.

- Partners cannot give any guarantee for the payment of profit or capital.

- Third-party can guarantee the profit or capital, under the following conditions:

- If it has no relation to the business;

- Guarantee is not a part of the Shirkah Agreement; and;

- Third-party does not charge any fee for the guarantee.

- Different partners may be given different weightings, according to the amount, and period of their investment.

- Partners can agree to share their profit differently, at different times.

EXAMPLE:

- Here, for example, the profit ratio for the first 6 months will be 50-50, and then it will be 30-70.

- The ratio of profit among the partners can also be changed, according to the profit earned. For example, Ratio will be 50-50 if the profit earned is up to one million dollars, and it will be 40-60 if it is above one million.

- Partners may agree that any profit above a certain ceiling will belong to a particular partner.

- If partners are investing and withdrawing money from business almost every day, then the profit will be distributed on a daily product basis, on average balance.

Rules Regarding Termination of Shirkah:

- At the time of termination of Shirkah, if a fixed asset exists, partners may choose to consider its market value and share the profit accordingly. If the market value of the illiquid asset is taken, it is called “Constructive Liquidation”.

- In case of any disputes regarding the distribution of constructive liquidation, the illiquid asset must be sold and transferred, and it is called “Physical Liquidation”.

- After the liquidation, all direct and indirect expenses will be deducted from capital, and Net Profit will be distributed.

- It is permissible to deduct only direct expenses from the capital, distribute Gross Profit, and indirect expenses are borne by any one partner.

- After the deduction of expenses, first, the principal amount will be given to the partners. The remaining amount will be distributed, according to the agreed ratio of profit.

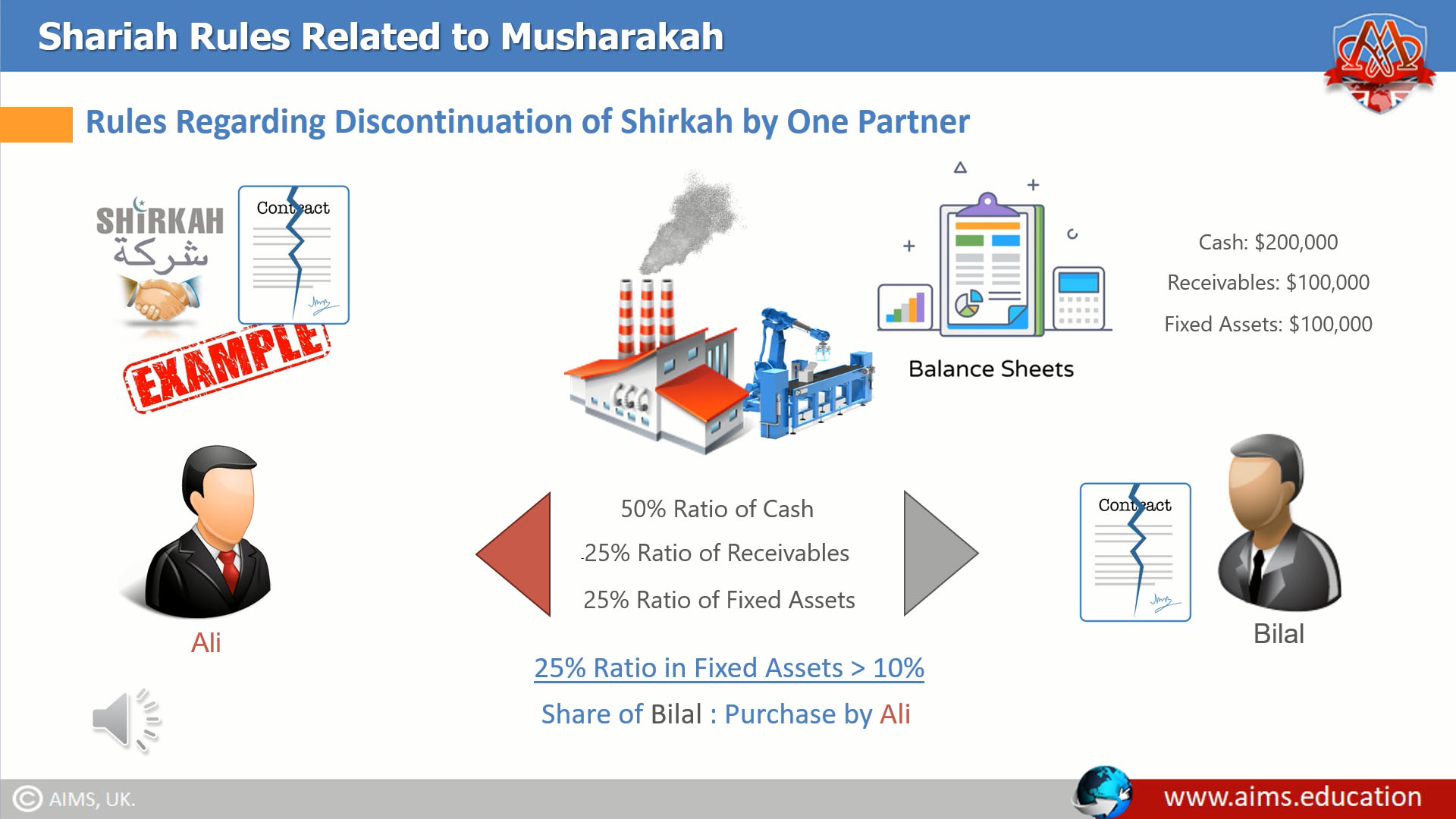

Rules Regarding Discontinuation of Shirkah by One Partner:

If one partner decides to leave and others wish to continue, then the remaining partners or any third party may purchase the shares. There are three possible scenarios to evaluate the price of leaving a partner’s share:

First: Capital is in Cash:

In this case, leaving partner’s share may be purchased by paying his principal and profit.

Second: Capital is in Cash and Receivables:

In this case, his share may be purchased by paying him the principal and actual profit. However, this share price will be provisional, and the final price will be decided after receiving the receivables.

Third: Capital is in Cash, Receivables, and Fixed Assets:

If the value of the fixed asset is more than 10% of the “Total Capital”, that is Cash, Receivables, and Assets. In that case, the share of the outgoing partner can be purchased at the mutually agreed price, before liquidation.

Example:

Ali and Bilal were running a business and Bilal wished to discontinue. In view of the balance sheet:

- The cash is 200 thousand dollars. So each partner has a 50% ratio of cash;

- Receivables are 100 thousand dollars. So each partner has a 25% ratio of receivables; and;

- A fixed asset is 100 thousand dollars. So, each partner has a 25% ratio of fixed assets.

Since, 25% ratio in fixed assets is more than 10%; then the share of Bilal can be purchased by Ali, at the mutually agreed price before liquidation.

Musharakah Rules Regarding Ratio Of Profit:

- According to Imam Malik and Shafi: Each partner’s profit should be exactly according to his ratio of investment;

- According to Imam Ahmad: The ratio of profit may differ from the ratio of investment if it is agreed between the partners with their free consent; and;

- According to Imam Abu Hanifa: the Ratio of profit may differ from the ratio of investment in normal conditions.

Musharakah Rules for Sharing of Loss:

- According to Imam Abu Hanifa and Ahmed: the Ratio of the profit may differ, but the ratio of loss must be divided exactly in accordance with the capital invested;

- According to Imam Shafi: the Ratio of a partner in profit and loss must conform to his ratio of investment; and;

Rights of Partner:

After entering into a Musharakah contract, partners have rights to:

- Sell the mutually owned property for business purposes, since all partners are representing each other;

- Buy raw materials or other stock, on cash or credit, to put into the business.

- Hire people to carry out business activities.

- Deposit money and goods of the business as depositor trust, when necessary.

- Use Shirkah funds or goods in Mudarabah.

- Give Shirkah funds as a gift or loan.

How to Start a Musharakah Partnership?

To start a Musharakah partnership, you need to follow these steps:

- Identify a viable project or business idea.

- Find a partner who is willing to invest capital.

- Draft a Musharakah agreement that outlines the terms and conditions of the partnership, including the amount of capital each partner will contribute, the sharing of profits and losses, and the roles and responsibilities of each partner.

- Register the partnership with the relevant legal authorities.

Application of Musharakah in Islamic Banking:

Musharakah has been used successfully in many projects and businesses. One example is the Islamic Development Bank’s (IDB) Musharakah-based venture capital fund. The fund provides financing to small and medium-sized enterprises (SMEs) in member countries of the Organization of Islamic Cooperation (OIC). The fund has helped to create jobs, promote entrepreneurship, and stimulate economic growth in the region.

Another example is the Musharakah-based home financing offered by many Islamic banks. This model allows homeowners to purchase a home without having to pay interest on a mortgage. The bank and the homeowner are partners, and the homeowner gradually buys out the bank’s share of the property until they own the entire home.

Musharakah Mutanaqisah Home Financing:

Musharakah Mutanaqisah home financing is an Islamic financing concept that allows individuals to purchase a home without having to pay the full amount upfront. This concept is based on the principles of profit and loss sharing, where the bank and the buyer form a partnership to purchase the property. The bank provides a portion of the financing while the buyer provides the rest. The partnership agreement includes an agreement to buy the bank’s share of the property over time. This agreement allows the buyer to eventually own the property outright.

This type of home financing is becoming increasingly popular in Muslim communities because it is a Shariah-compliant way to purchase a home. Unlike traditional home financing, Musharakah Mutanaqisah does not involve the payment or receipt of interest. Instead, the bank and the buyer share the profits and losses associated with the property. This type of financing is also more flexible than traditional financing because it allows the buyer to pay off the loan early without penalty.

Overall, Musharakah Mutanaqisah home financing is a unique and innovative way for Muslims to purchase a home while remaining true to their religious beliefs. It is a win-win situation for both the buyer and the bank, as both parties share in the profits and losses associated with the property. If you are looking for a Shariah-compliant way to finance your home, consider Musharakah Mutanaqisah home financing.

Musharakah VS Other Islamic Financing Options:

Musharakah is one of several Islamic financing options, including Murabaha, Mudarabah, and Ijara. Each of these options has its own unique features and benefits.

- Murabaha is a cost-plus financing model that allows individuals to purchase goods without paying interest.

- Mudarabah is a profit-sharing financing model, where one party provides the capital, and the other party provides the labor and expertise.

- Ijara is a leasing model, where one party leases an asset to another party for a specified period. Musharakah differs from these models in that it is a partnership-based investment model, where partners share both profits and losses.

Common Misconceptions About Musharakah:

There are several misconceptions about Musharakah that need to be addressed. One of the most common is that it is only for Muslims. Musharakah is a business model that can be used by anyone, regardless of their religious beliefs.

Another misconception is that it is only for large projects or businesses. Musharakah can be used for small and medium-sized enterprises (SMEs) as well. In fact, it is an excellent option for SMEs that are looking for funding but do not want to take on the burden of debt.

Main Issues Related to Musharakah:

LIQUIDITY OF CAPITAL:

A question commonly asked is, whether the capital investment needs to be in liquid form or it could be in the form of commodities. This can be answered in the light of views from the following schools of thought:

According to Imam Malik:

- Liquidity is not a condition, and the share of a partner can be determined by evaluating the market price of the commodity, at the date of the contract;

According to Imam Abu Hanifa and Ahmed:

- Commodities given by one partner will always be distinguishable from the commodities by the other. So, they cannot be treated as homogenous capital. Another reason is that the redistribution of share capital cannot take place in the future, because the commodities may have been sold by that time.

Imam Shafi has an opinion of dividing commodities into two:

- Commodities, which if destroyed, can be compensated by similar commodities in quality and quantity. For example rice and wheat; and;

- Commodities that cannot be compensated, by similar commodities. For example animals.

MIXING OF CAPITAL:

- According to Imam Shafi, partners’ capital should be mixed so well that they cannot be discriminated against, and this must be done before any business is conducted; and;

- According to the remaining three Imams, the partnership is complete with an agreement, and the mixing of capital is not important.

Tenure of Musharakah:

Before fixing the tenure of the Musharakah, the following points must be remembered:

- A partnership is fixed for such a long time that, at the end of the tenure, no other business can be conducted.

- A partnership can be for a very short time period during which partnership is necessary, and neither partner can dissolve the partnership.

AAOIFI Shariah Standards for Musharakah:

This standard is applicable to all forms of traditional Fiqh nominate partnerships, that operate on the basis of Shirkat-ul-Aqd or Contractual Partnership. It may be defined as:

“An agreement between two or more parties to combine their assets, labor or liabilities, for the purpose of making profits”.

And, it is classified into two main categories:

- Traditional Fiqh Nominate partnerships; and;

- Modern Corporations.

Traditional Fiqh Nominate partnerships are categorized as:

- Contractual Partnership or Shirkat-ul-Inam;

- Liability Partnership or Shirkaht-ul-Wujooh; and;

- Vocational partnerships and partnerships for undertaking difficult work or accepting jobs; or Shirkaht-ul-Aamal.

Well-known forms of modern corporations are as follows:

- Stock company.

- Joint-liability Company.

- Partnership in Commendams.

- Company limited by shares.

- Allotment partnership.

- Diminishing partnership.

These standards are applicable to all these forms of partnership, except the following:

- Ownership partnership, where the parties jointly own an asset.

- Shirkaht-ul-Mufawazah, because practical application of this form of partnership, is rare.

- Mudarabah, because it has a separate standard.

- Sharecropping Partnerships such as irrigation and agricultural partnerships.

- Modern Partnerships with Regulatory Policies and Procedures are necessary for operations in the market.

Conclusion:

Musharakah is a Halal investment option that promotes ethical and social responsibility, encourages innovation and entrepreneurship, and allows partners to share both profits and losses. It is a business model that can be used by anyone, regardless of their religious beliefs, and can be used for small and medium-sized enterprises (SMEs) as well as large projects.

By using Musharakah, individuals and businesses can achieve their financial goals while also ensuring that their investments are Halal, or permissible under Islamic law. It is an excellent option for those who are looking for funding but do not want to take on the burden of debt, and it promotes fairness, equality, and social welfare. So, if you are looking for a Halal investment option that promotes ethical and social responsibility, Musharakah could be the perfect solution for your financial needs.

Here are the key points:

- Musharakah is an ideal alternative for interest-based financing, with far-reaching effects on production and distribution.

- In Musharakah, each partner must get the profit exactly in the proportion of investment.

- It is permissible for a partner to rent or lease the share of another partner, for a specified amount and whatever duration.

- AAOIFI Shariah standards for Musharakah are applicable to many forms of traditional Shariah nominate partnerships.