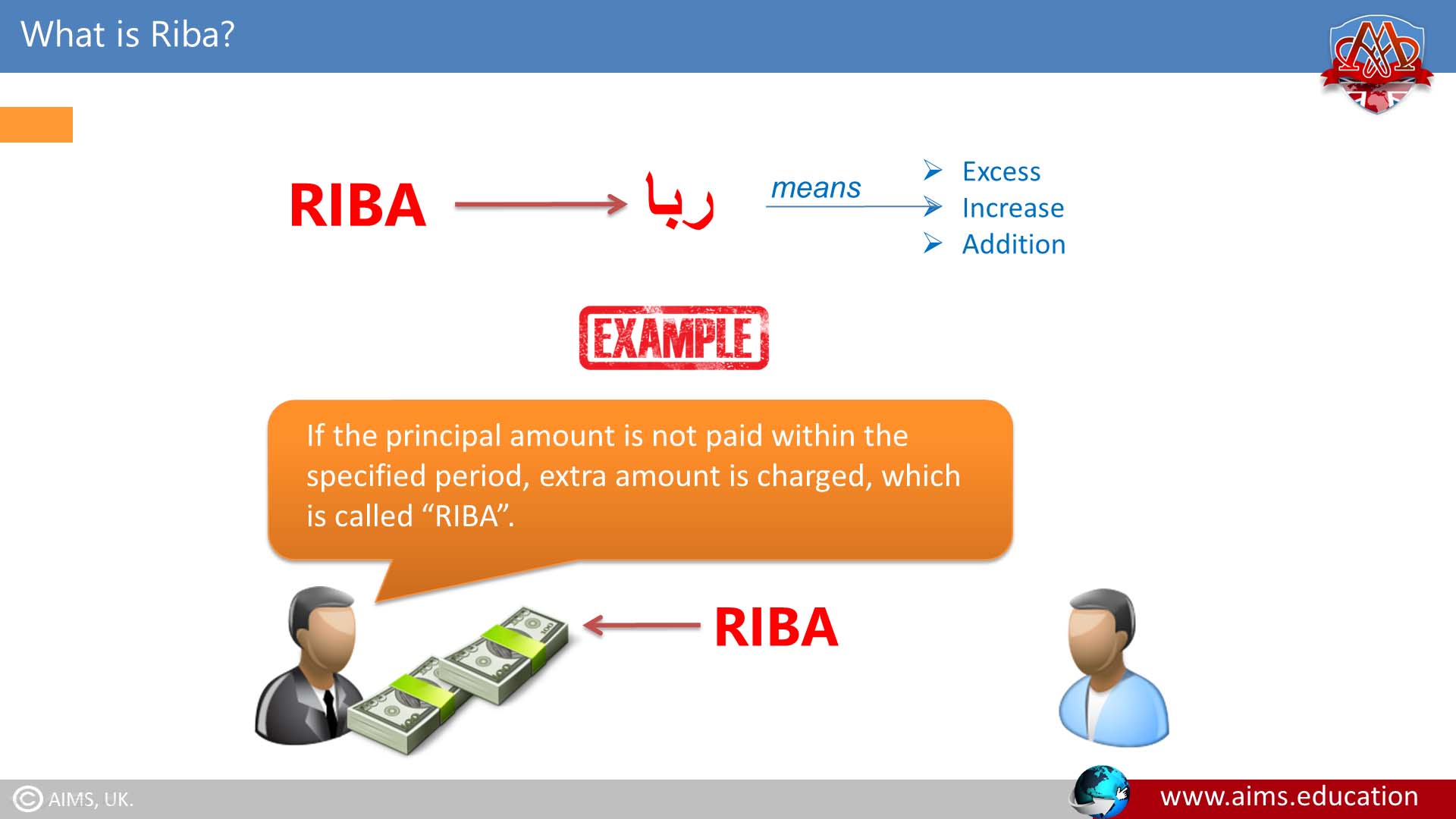

What is Riba?

The term “Riba” comes from the Arabic language and it means “Excess, Increase, or Addition”. Within the context of the Quran and Hadith, it specifically pertains to the concept of ‘interest’. In simpler terms, it refers to the excess amount that a lender receives from a borrower when lending money. This can be seen in various forms such as interest on loans, credit cards, mortgages, and other financial transactions. There are two types of Riba in Islam: Riba An Nasiyah and Riba An Fadl.

Riba Meaning:

In accordance with Islamic doctrine, riba meaning is “the unjustified increment in the capital that is derived from a loan or debt agreement”.

Example of Riba

Gain a deeper understanding of riba through this example: Imagine one person lending a certain amount of money to another person, with the condition that the debtor must repay the borrowed sum along with an agreed-upon extra amount within a set timeframe. Alternatively, if a fixed interest rate was established for a specific period and the borrower failed to meet the payment deadline, the interest rate would be increased for the extended period, and so forth. This additional amount represents the concept of “riba, interest, or usury”.

Why Riba is Forbidden in Islam?

Islam’s prohibition of interest stems from a belief that it cultivates negative traits such as miserliness, selfishness, callousness, indifference, inhumanity, greed, and worship of wealth. It also destroys the spirit of sympathy, mutual help, and cooperation, and thus affects the feelings of brotherhood and unity among the community.

It has a negative impact on the economy is undeniable. It not only hampers the circulation of money among the masses but also promotes the formation of monopolies and the concentration of wealth. Consequently, the gap between the affluent and the underprivileged widens.

Difference between Trade and Interest

- In Trade, one earns profit as a result of initiative, enterprise, efficiency, and hard work, profit fluctuates, and there is a risk of loss as well. On the other hand, the interest is not earned through hard work or any value-creating process.

- Riba is not the reward of labor but is an unearned income. The lender gets his fixed amount, irrespective of the fact, whether the debtor earns any profit or sustains a loss.

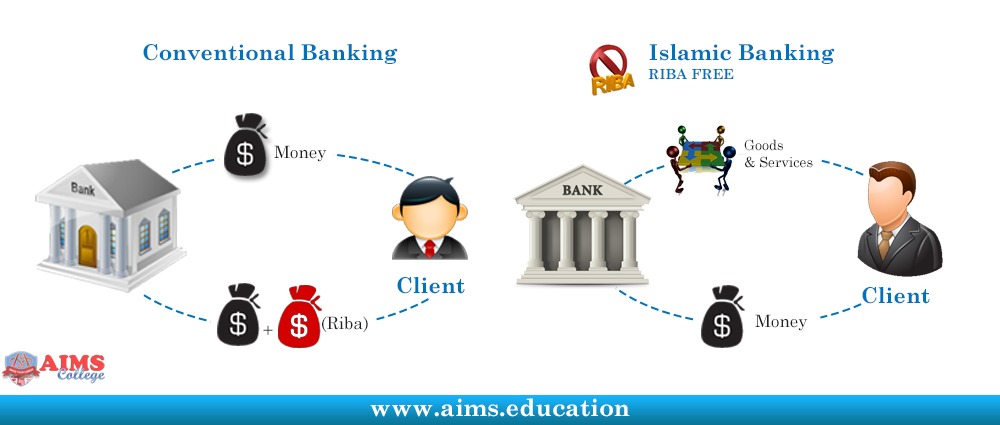

Exclusion of Riba in Modern Islamic Banking

In today’s world, interest has become deeply ingrained in the global economic system, making it challenging for the Islamic economic system to avoid it completely. However, Islamic financial institutions have emerged as an alternative for those seeking to abide by Shariah principles and avoid riba-based transactions. These institutions work on the concept of profit sharing rather than charging interest, making their services accessible to both Muslims and non-Muslims. Islamic financial institutions have devised a variety of Islamic financial products and services that are free from interest. Instead of interest, Islamic banks earn profits through risk-sharing mechanisms, such as Mudharabah and Musharakah.

Building a Riba-Free Financial System

Education, particularly within the realm of Islamic finance, plays a pivotal role in dismantling the interest-based financial system and replacing it with one rooted in fairness and equity. It is through structured Islamic finance education programs such as an online Masters in Islamic Finance, a PhD in Islamic Banking and Finance, or a diploma in Islamic Banking, that individuals can acquire a profound understanding of the principles and practices of Islamic economic structure. These programs, along with comprehensive Islamic banking courses online, equip learners with the necessary skills and knowledge to operate within an interest-free financial system.

Riba in Quran and Hadith:

Riba is considered a major sin in Islam and is strictly forbidden. The word riba has been mentioned multiple times in the Quran and Hadith, with clear instructions to abstain from it. In fact, it is one of the seven major sins that are believed to bring destruction upon an individual’s wealth and well-being in this world and in the hereafter. Here are some references:

1. Prohibition of Riba in the Quran

“And whatever you give for interest to increase within the wealth of people will not increase with Allah. But what you give in Zakath, desiring the countenance of Allah – those are the multipliers.”.

Surah Ar-Rome, Verse-39!

“And [for] their taking of usury while they had been forbidden from it, and their consuming of the people’s wealth unjustly. And we have prepared for the disbelievers among them a painful punishment”.

Surah Al-Nisa, Verse-161!

“O you who have believed, do not consume usury, doubled and multiplied, but fear Allah that you may be successful”.

Surah Aal-e-Imran, Verse-130!

“Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, “Trade is [just] like interest.” But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah . But whoever returns to [dealing in interest or usury] – those are the companions of the Fire; they will abide eternally therein”..

Surah Al-Baqarah, Verse-257!

2. Sayings of Prophet Muhammad (PBUH) About the Prohibition of Riba

The severity of this riba is further highlighted by the Prophet’s warning that:

Practicing riba is equivalent to committing seventy sins, the least severe of which is akin to one committing incest with his mother.

“All of the Riba of Jahiliya is annulled. The first Riba that I annul is our Riba, that accruing to Abbas Bin Abdul Mutallib, it is being cancelled completely.”

Reported by, Hazrat Jabir RadiAllah

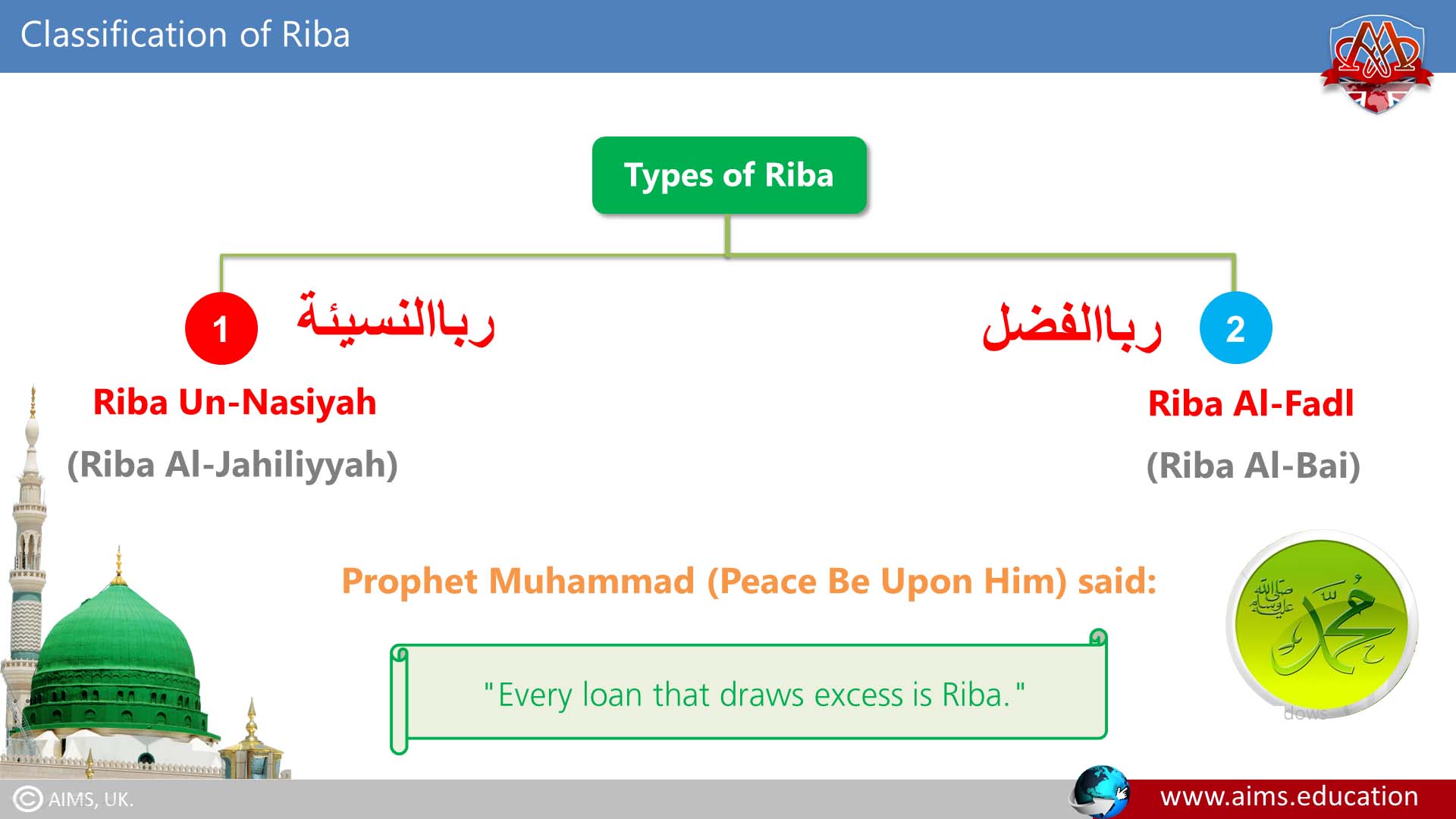

Types of Riba

There are two types of Riba in Islamic banking. We will discuss each of them in detail:

1. Riba An Nasiyah

It is also called Riba Al Jahiliya. Riba al-Nasiyah, also referred to as “riba of delay”, is a type of riba in Islam that arises when there is a delay in the exchange of goods or an increase due to a delay in payment. This is viewed as unjust enrichment and is thus strictly prohibited in Islamic finance.

EXAMPLE OF RIBA AL-NASIYAH

If a person loans someone a sum of money on the condition that it will be repaid with an added amount after a specific period, this constitutes Riba al-Nasiyah. The additional amount is considered an unjust gain due to delayed payment.

“Every loan that draws excess is Riba.”

Hadith

2. Riba Al Fadl:

It is also called known as Riba Al Bai. It refers to the surplus value received in a trade or barter without giving an equivalent counter-value or service at the same time. This form of interest is more prevalent in tangible goods and commodities.

EXAMPLE OF RIBA AL FADL

A perfect instance of Riba al-Fadl would be if an individual trades 1 kilogram of high-quality dates for 2 kilograms of lower-quality dates. Here, the excess 1 kilogram of dates is considered as Riba al-Fadl, even though both are the same product.

“Sell gold in exchange of equivalent gold, sell silver in exchange of equivalent silver, sell dates in exchange of equivalent dates, sell wheat in exchange of equivalent wheat, sell salt in exchange of equivalent salt, sell barley in exchange of equivalent barley, but if a person transacts in excess, it will be Riba. However, sell gold for silver anyway, you please on the condition, it is hand-to-hand and sell barley for date anyway, you please on the condition, it is hand-to-hand.”

Hadith

LAWS REGARDING RIBA AL FADL:

Any difference in value or quality should be ignored and the commodities should be exchanged in equal weight and volume. Instead of a direct exchange of commodities of the same kind, a person should sell his commodity against cash at the market value, and buy someone else’s commodity in exchange for cash at the market value.

Shariah Rules Regarding Riba-Free Loans

The loan may be in any form that is in cash or commodity, it may be big or small, it may be for the personal needs of the debtor or purpose of business, and the loan shall be given without interest. Since the verbal agreements regarding loans lead to disputes, the Quran has made it obligatory for both creditor and debtor to bring the contract of debt into writing in the presence of two witnesses and settle terms and conditions regarding its repayment.

According to a Hadith: “Whoever takes a loan, with an intention of not returning it, is a thief”.

A debtor is eligible for Zakath, for discharging the burden of his debt. Here are some of the duties of Debtor and Creditor in Islam:

1. Duties of Debtor in Islam:

- Debt should be incurred only when it is unavoidable. It may be incurred to satisfy basic needs or to discharge an essential responsibility.

- In no case, debts should be contracted for unlawful purposes or luxurious living.

- The contract of loan should be reduced in writing, in the presence of two witnesses. The debtor has the right to give dictation to the scribe when the contract of loan is being written.

- Debt should be taken with a clear intention to pay it back.

- If a creditor demands some security in the shape of property or asset, the debtor is bound to provide the same.

- The debtor should pay back the debt promptly, on the promised date or earlier.

- The debtor is duty-bound to clear his debts, before his death. Otherwise, his legal heirs should clear the debts.

2. Duties of the Creditors in Islam:

- The loan should be advanced to a genuinely needy person, who requires the loan for genuine needs.

- When a creditor lends money to someone, he should make a contract in writing with the debtor, settling the terms and conditions of the loan, and the time for its return.

- If the debtor has become insolvent and is not in a position to pay back the loan, the creditor is enjoined to remit the debt. It is an act of great virtue and it carries many rewards.

- If the debtor is not able to make full payment, the creditor shall accept payment in installments.

- The creditor is allowed to use harsh words in case of a solvent debtor, who does not repay the loan despite persistent demand. But still, he is instructed not to lose his cool. He should kindly treat his debtor and should not injure the dignity of the debtor.

3. Role of Bait-ul-Maal:

The state-managed Public Treasury is called Bait-ul-Maal and it provides loans to needy people in the society.

FOR EXAMPLE:

The people would do their business with whatever capital and economic sources they have, and they would not be generally too ambitious to expand it with borrowed capital.

“The state would need hardly any loans, but, if the state fails to raise funds and the need is dire, it can resort to borrowing. However, the borrowing should be restricted to need only, and loans should be raised preferably from brother Muslim countries, free of interest”.

Wrapping Up

- Riba means excess, increase, or addition, and there are two types of riba in Islamic banking.

- In trade, one earns profit as a result of initiative enterprise, efficiency, and hard work. However, the interest is not earned through hard work or any value-creating process.

- A loan shall be given without interest, according to the principles of Islam.

- It inculcates selfishness, inhumanity, greed, and worship of wealth; it destroys the spirit of sympathy and cooperation.

- Debt should be incurred only when it is unavoidable. It may be incurred to satisfy basic needs, and it should be taken with a clear intention to pay it back.

- The contract of loan should be reduced in writing, in the presence of two witnesses.

- Islamic banking is based on the principle of partnership and profit-loss sharing basis.