What is Diminishing Musharakah?

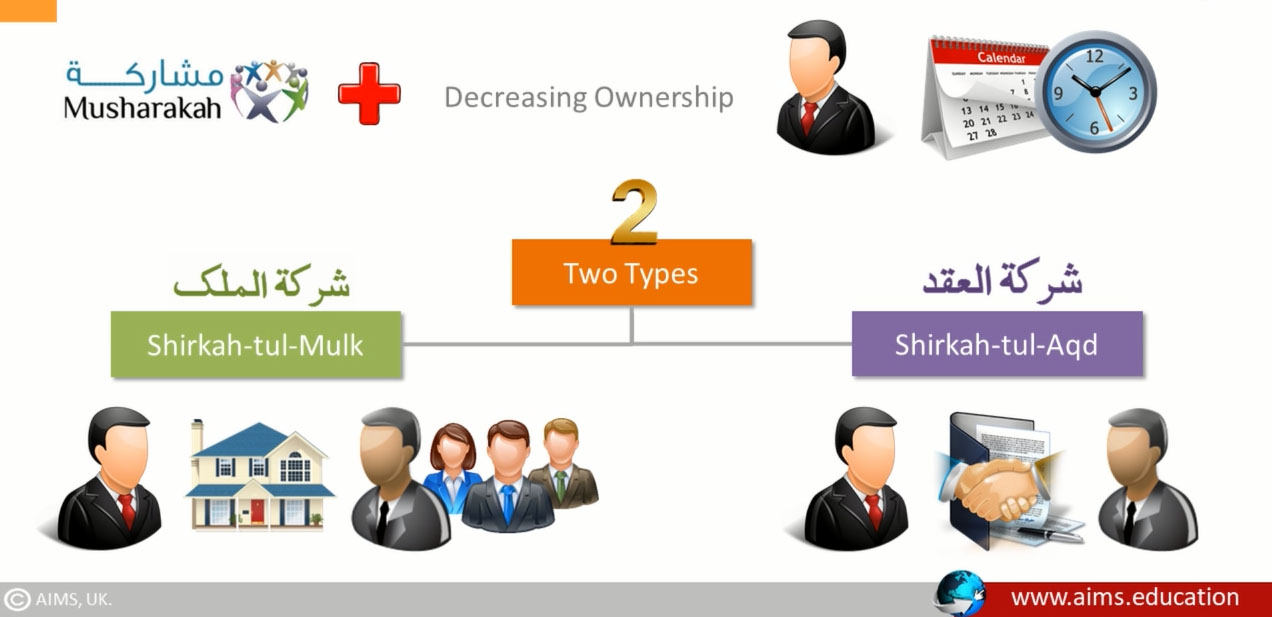

Diminishing Musharakah is a type of Shirkah, where one partner purchases the shares of the other partner, gradually. According to the Diminishing Musharaka definition, “Shares of the investor are divided into units, and it is pre-agreed that the purchaser will purchase all those units over a period of time, and will become the sole owner of that asset.”. An investor jointly owns a fixed asset with another person, under the condition that the share of one partner is drawdown until the entire shares are transferred to another partner. It is also called “Shirkah Al Mutanaqisah”. An example of Diminishing Musharaka assets is a house, car, plane, or machinery. There are two types of diminishing musharakah: Shirkat-Ul-Aaqd and Shirkat-Ul-Milk.

Types of Diminishing Musharakah:

Unlike the general types of Musharakah, Diminishing Musharakah can be classified into two types: Shirkat-ul-Aaqd (Joint Venture) and Shirkat-ul-Milk (Joint Ownership).

1. Shirkat-ul-Aaqd (Joint Venture):

A. Features of Shirkat-ul-Aaqd:

- Two partners initiate a business under Shirkah intending to generate profit.

- There is a commitment from one partner to gradually buy out the share of the other, either monthly or annually.

B. Guidelines for Shirkat-ul-Aaqd:

Both partners enter into a Shirkat-ul-Aaqd agreement, investing equally and agreeing on a profit ratio. One partner commits to acquiring the other partner’s share, under three key conditions:

- The agreement to purchase should not be part of the original Shirkah agreement.

- The price per unit is not predetermined in this promise, but the purchase should be based on the market value at the time of purchase.

- The unit price will be determined by the business’s market value at the time of acquisition, with the purchase executed through an Offer & Acceptance procedure.

2. Shirkat-ul-Milk (Joint Ownership):

A. Features of Shirkat-ul-Milk:

- An asset such as machinery or property is jointly purchased by two partners to use it or rent out their share.

- One or both partners undertake to incrementally purchase the other’s share.

B. Rules Regarding Shirkat-ul-Milk:

- An agreement is formed under Shirkat-ul-Milk that outlines each partner’s investment amount.

- The purchased asset is owned by each partner by their investment ratio, and all the rules of Shirkat-ul-Milk apply.

- A partner may rent out their share to the other partner or a third party, necessitating the signing of an Ijarah Agreement. During the Ijarah period, Shariah Ahkaam relating to Ijarah applied.

- A partner may promise to buy the other’s share, at which point the unit’s price may be established. The purchase of the unit is contingent on Offer & Acceptance.

- All agreements and undertakings must be independent and not interconnected.

Note: Though the Islamic banking contract of Murabaha is used for consumer financing, it does not involve rent, unlike Ijara financing agreement and Diminishing Musharakah (DM).

Diminishing Musharakah VS Musharakah:

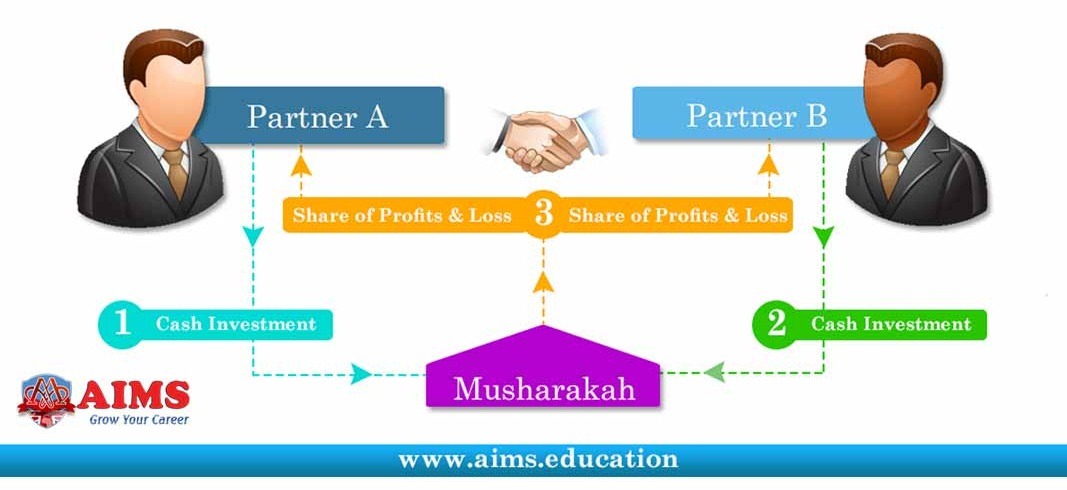

Musharakah and Diminishing Musharakah are two distinct forms of partnerships in Islamic finance that operate under different principles.

- In a Musharakah, all partners contribute capital and share the profit and loss in proportion to their capital contributions. The partnership continues indefinitely until all parties agree to dissolve it.

- Contrastingly, Diminishing Musharakah operates on a buyout agreement. In this partnership, one party gradually buys the share of the other party over a predetermined period until the owning partner’s equity becomes zero. This diminishing process results in the transfer of ownership from one party to the other, hence its name ‘Diminishing Musharakah’.

Key Steps in the Diminishing Musharakah Agreement:

The Diminishing Musharakah arrangement consists of several key steps:

- Establishing joint ownership in the asset, also known as Shirkat-ul-Milk.

- The financier leases their share of the asset to the client.

- The client pledges to acquire portions of the financier’s share in the asset.

- The client proceeds to buy these units over various stages, ultimately leading to full ownership.

Diminishing Musharakah Examples

1. Diminishing Musharakah for Car Purchase

The following diminishing musharaka arrangement allows the financier to claim rent according to his proportion of ownership in the property and at the same time allows him a periodical return of a part of his principal through purchases of the units of his share.

- ‘A’ wants to purchase a car to use for offering transport services to passengers and to earn income through fares recovered from them, but he is short of funds.

- ‘B’ agrees to participate in the purchase of the commercial vehicle (car), therefore, both of them purchase a car jointly. 80% of the price is paid by ‘B’ and 20% is paid by A.

- After the car is purchased, it is employed to provide transport to the passengers whereby a net income of $1000/- is earned daily.

- Since ‘B’ has an 80% share in the car, it is agreed that 80% of the fare will be given to him and the rest of 20% will be retained by ‘A’ who has a 20% share in the car. It means that $800/- is earned by ‘B’ and $200/- by ‘A’ on a daily basis.

- At the same time, the share of ‘B’ is further divided into eight units. After three months ‘A’ purchases one unit from the share of ‘B’.

- Consequently, the share of ‘B’ is reduced to 70% and the share of ‘A’ is increased, after the first term of three months increased to 30% meaning thereby that as from that date ‘A’ will be entitled to $300/- from the daily income of the car and ‘B’ will earn $700/-.

- This process will go on until after the expiry of two years, the whole car will be owned by ‘A’, and ‘B’ will take back his original investment along with income distributed to him as aforesaid.

2. Diminishing Musharakah for Business Partnership:

- ‘A’ wishes to start a business of ready-made garments but lacks the required funds for that business. ‘B’ agrees to participate with him for a specified period, say two years. 40% of the investment is contributed by ‘A’ and 60% by ‘B’.

- Both started the business based on Diminishing Musharaka. The proportion of profit allocated for each one of them is expressly agreed upon.

- At the same time, ‘B’s share in the business is divided into six equal units, and ‘A’ keeps purchasing these units on a gradual basis until after the end of two years ‘B’ comes out of the business, leaving its exclusive ownership to A.

- Apart from periodical profits earned by ‘B’, he gains the price of the units of his share which, in practical terms, tend to repay to him the original amount invested by him.

3. Diminishing Musharakah for the Purchase of a House

In the context of purchasing a house under a Diminishing Musharakah agreement, the process can be broken down as follows:

- The client, within the bank’s approved area, chooses the house.

- The bank and client enter a Diminishing Musharakah agreement, outlining the joint purchase of the house and each party’s investment ratio.

- Both parties become property owners, with ownership ratios corresponding to their investment shares. The property is registered under the client’s name, establishing Shirkat-ul-Milk.

- Each party is responsible for any loss according to their ownership ratio.

- The bank separates its share of the property into units, which the client promises to purchase at a predetermined price.

- Upon acquiring the house, the bank leases its share to the client by implementing an Ijarah Agreement.

- The rent, ideally based on market rates or mutual consent, may also be accounted as the bank’s monthly profit and is included in the unit price.

- The Ijarah Agreement stipulates a fixed lump sum amount of rent for a specific duration, with the remaining rent potentially linked to an agreed benchmark.

- Each unit is bought based on an Offer & Acceptance process.

4. Diminishing Musharakah for Purchasing of Plot and Construction

In the case of purchasing a plot and construction, the Diminishing Musharakah agreement unfolds as follows:

- An agreement is signed between the bank and the client, defining everyone’s investment.

- The client, as a working partner, is tasked with handling the construction.

- Both partners own the property proportional to their investment ratio, establishing Shirkat-ul-Milk.

- The property is registered under the client’s name.

- Each party is liable for any loss according to their ownership ratio.

- The bank divides its share of the property into units, and the client commits to purchase these at a pre-agreed price.

- Upon completion of the house, an Ijarah Agreement is implemented, allowing the bank to lease its share of the house to the client. Rent cannot be charged before the construction is finished.

- The rent, either based on the prevailing market value or agreed upon mutually, may also include the bank’s monthly profit. This is factored into the unit price, allowing the recovery of the principal amount.

- The Ijarah Agreement necessitates a lump sum rent for a specific period, with the remaining rent potentially linked to an agreed benchmark.

- Each unit is bought through an Offer & Acceptance process, initiated after the signing of the Diminishing Musharakah Agreement.

5. Diminishing Musharakah for Balance Transfer Facility (BTF)

Diminishing Musharakah (DM) for BTF applies when a house is purchased with an interest-based loan.

- The house’s value is appraised, forming the client’s investment in the DM agreement, while the bank’s loan amount constitutes its investment.

- Both parties sign a DM agreement, outlining each party’s investment.

- Ownership of the property reflects the investment ratio, with the client named as the property owner. This constitutes Shirkat-ul-Milk.

- Losses are absorbed in line with the ownership ratio.

- The bank’s share of the property is divided into units for sale to the client at a predetermined price.

- An Ijarah Agreement is signed, permitting the bank to rent its share of the house to the client.

- Rent is established based on current market value or mutual agreement, and can include the bank’s monthly profit.

- The unit price recovers the principal amount along with the bank’s monthly profit.

- A lump sum rent is fixed for a specific period under the Ijarah Agreement, with subsequent rent potentially tied to a benchmark.

- Bank units cannot be purchased by the client within the first year.

- Units are purchased through an Offer & Acceptance process.

A Gateway to Mastery Islamic Finance:

To deepen understanding and application of Diminishing Musharaka in Islamic banking, pursuing advanced Islamic finance education can provide a solid grounding. Many learners consider undertaking a PhD thesis in Islamic Economics and Finance, delving into the practical and theoretical aspects of concepts like Diminishing Musharakah. Notable universities across the globe offer such doctoral programs, fostering critical thinking and research skills in the realm of Islamic finance. Additionally, an online Islamic banking diploma can serve as a valuable stepping stone for those wishing to break into the field. With flexible study hours and a comprehensive curriculum, these programs offer insights into the intricacies of instruments like Diminishing Musharakah, preparing students for challenging roles in Islamic banking and finance.

Benefits of Diminishing Musharakah: An Ethical Financing:

With its potential for promoting fair and responsible financing, Diminishing Musharakah is gaining popularity in the world of Islamic banking. So, businesses looking for Shariah-compliant financing products should consider exploring the benefits of this agreement. It not only provides a solution for avoiding interest but also promotes a sense of shared responsibility and long-term partnership between the bank and the business owner. Diminishing Musharakah may be more complex to structure compared to traditional loans, but its potential benefits make it an intriguing option for businesses seeking ethical financing options. Overall, this guide has provided a comprehensive understanding of what Diminishing Musharakah is, how it works, and its potential benefits.