What is Islamic Economics?

The Islamic economic system is based on the principles of Shariah, which is derived from the teachings of Islam. It has a unique approach to economics that differs from conventional economic systems in many ways. The fundamentals of Islamic economics start with the differences it has with the capitalistic, communistic, socialistic, and other mixed types of economic engines. Islamic economic system consists of organizations, institutions, and social values. Those who follow Islam are encouraged to lead a life that shows respect for others. There are six characteristics of the Islamic economic system, that in some ways mirror their capitalistic and socialistic counterparts, but are still unique and vibrant only to the economic system of Islam.

Key Principles of the Islamic Economic System:

1. The Superiority of God-Made Laws over Manmade Laws:

Manmade laws are influenced by lawmakers on social and racial biases. The United Nations Organization is the best example of how policies are enforced only when they suit the interests of the superpowers.

However, the laws made by Allah are superior, because Allah is:

- Above class status;

- Above racial prejudice; and;

- Above gender rivalry.

2. Mission of Islam

Islam creates a divine contract between the Individual and the Islamic Economic System. It generates the spiritual strength to achieve human well-being in all aspects of life, such as:

- Social,

- Economics, and,

- Political.

Allah does not feed the hungry directly with his own hands but does so through the agency of humans. The Islamic social order established to enforce Divine laws makes itself responsible for the discharge of this responsibility.

Concept of Halal & Haram in Islamic Economics

Halal means “Lawful” and Haram means “Unlawful”. In Islam, certain means of earning livelihood and wealth have been declared as Haram.

Let us take a look at the Haram or Un-lawful elements:

- Interest, bribery, gambling, games of chance, speculation, short weighing, short measuring, and business malpractices are Haram in Shariah.

- Similarly in the field of consumption, certain items of food are Haram, such as Dead animals, blood, swine flesh, and animals slaughtered in the name other than Allah.

- Even the use, expense on, or trading of certain items is not allowed. These items include Alcoholic drinks, narcotics, debauchery, prostitution, pornography, obscenity, vulgarity, lotteries, and gambling.

References from the Holy Quran and Hadith:

“O mankind, eat from whatever is on earth [that is] lawful and good and do not follow the footsteps of Satan. Indeed, he is to you a clear enemy”.

Chapter-2 Verse-168 of the Holy Quran!

“Messenger of Allah prohibited intoxicants, games of chance, card-playing, and Gobairah, and he said: Every intoxicant is unlawful”.

Hadith Reported by Hazrat Abdullah bin Umer (RA)!

Policy of Moderation in the Economic System of Islam

Islamic Shariah condemns Monasticism, as well as Materialism, and recommends its followers to adopt the middle way, between these two extremist ways of life. Islam teaches us moderation in every aspect of life.

Benefits of Moderation

According to Islamic banking principles, moderation gives us the following benefits:

1. Achievement of Success (Falah)

That is spiritual, moral, and socio-economic well-being in this world and success in the Hereafter.

2. Fair and Equitable Distribution

Following the policy of moderation, we can distribute wealth, income, and economic resources fairly and equitably.

Institutional Development and Education in Islamic Economics

The field of Islamic economics has seen significant institutional development in recent years, with entities such as the Institute of Islamic Economics and Finance playing a crucial role. AIMS provides comprehensive education and research opportunities in the Islamic economy and finance. It offers a range of courses including a highly regarded diploma in Islamic economics and finance. For those desiring to delve deeper into the subtleties of this economic system, the institute also offers a Ph.D. in Islamic Finance and Economics. This rigorous program allows scholars to explore in-depth the principles, mechanisms, and potential of the Islamic economic system, equipping them with the knowledge to contribute meaningfully to the evolution of this distinctive economic paradigm.

“And do not make your hand [as] chained to your neck, or extend it completely and [thereby] become blamed and insolvent”.

Chapter-17 Verse-29 of the Holy Quran!

“Moderation in expenditure is half of the livelihood, and love for people is half of the wisdom, and good questioning is half of the learning”.

Hadith of Prophet Mohammad (PBUH)!

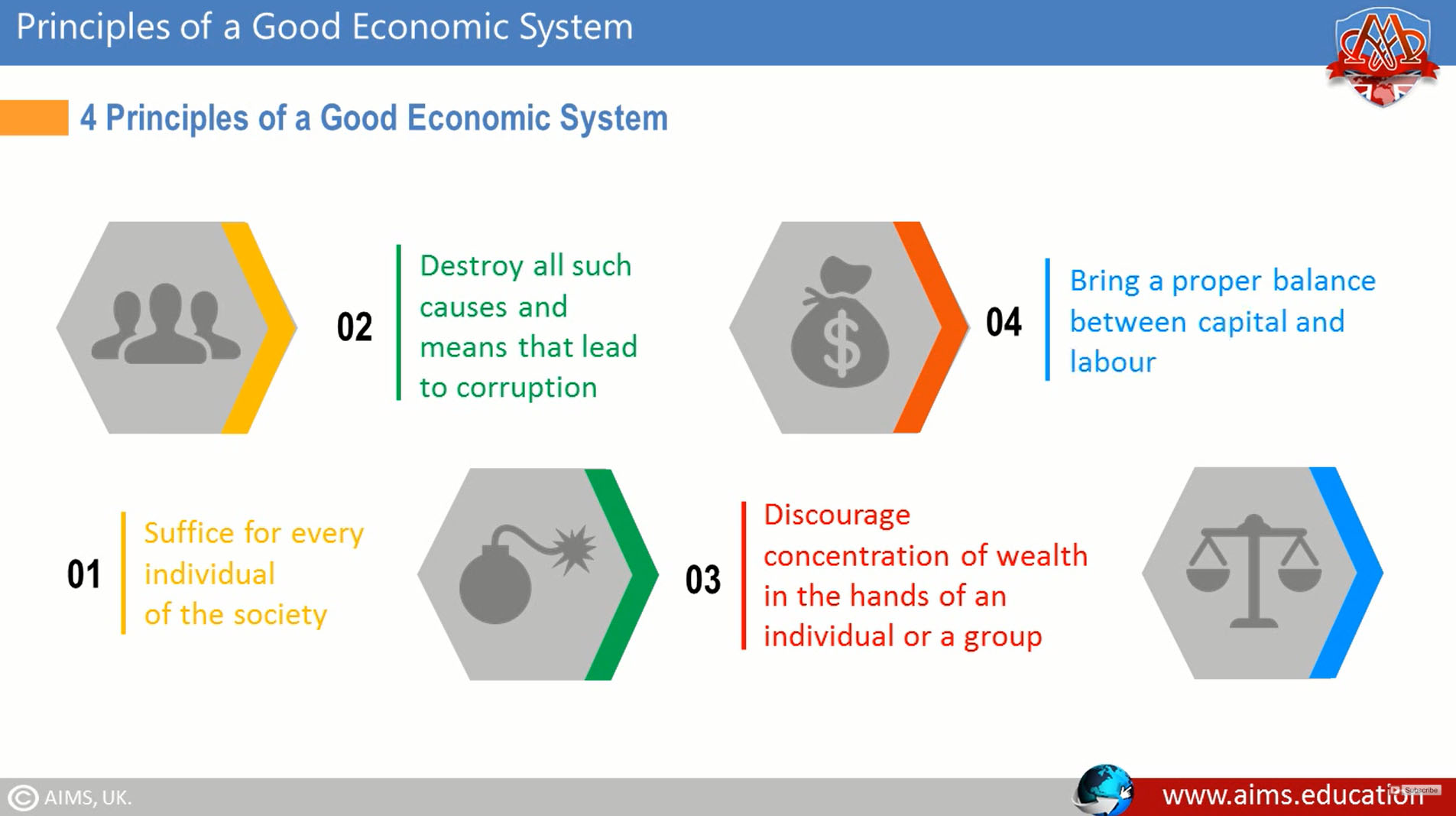

Six Main Characteristics of the Islamic Economic System

1. Consumption

Basic consumption is a fundamental part of all economies, including the Islamic economic system. People have needs and businesses exist to fulfill them either through goods or services.

2. Government Services

The government serves to keep down activities that are considered non-Islamic such as the black market, gambling, smuggling, and similar activities. In addition, the poor have their basic needs fulfilled in terms of basic life necessities such as food, health, and clothing. Also, there is a requirement for equal opportunity employment and security so that everyone has a chance to work and prosper.

3. No Riba

According to the Islamic economic system, the Islamic state should run without interest, which means that the financial system does note use any type of Riba as part of the lending procedures when running their banks and financial institutions. It is one of the key characteristics of the Islamic economic system, and also a fundamental element of an Islamic banking system.

“O you who have believed, fear Allah and give up what remains [due to you] of interest, if you should be believers. And if you do not, then be informed of a war [against you] from Allah and His Messenger. But if you repent, you may have your principal – [thus] you do no wrong, nor are you wronged.”

Chapter-27 Verse-278 & 279 of the Holy Quran!

4. Private Property

This is encouraged, although the property itself cannot be used against the interest of the public. The payment of Zakat for the ownership of the property is mandatory.

5. Production

As with capitalistic systems, production is an essential element as it not only addresses the needs of consumers but also provides employment and opportunity. Under the principles of the Islamic economic system, production is part of the social fabric, which makes it vital to society and includes a price system.

6. Wealth

The acquisition of wealth is not discouraged, although it does include payment of Zakat. It should be noted that purchasing luxuries is not encouraged either, so the focus on wealth is more along the lines of the greater good for the family and community.

Zakath & Sadaqah: Fundamental Features of Islamic Economic System

1. WHAT IS ZAKATH?

Zakath means “to purify”, and it refers to the purification of a Muslim’s wealth and soul. It is one of the five pillars of Islam. Payment of Zakath is one of the major characteristics of the Islamic economic system, as well as a major resource for the stability of the poor in Islamic society. It regards as a type of worship, in which a proportion of wealth is collected from the rich and given to the poor on an annual basis. This also provides support to the state by reducing the number of needy people.

Every Muslim male or female, who at the end of the year has in possession, the equivalent of 85 grams of gold or more in cash or articles of trade, must pay his or her Zakah at the rate of 2.5%, every year.

2. WHAT IS SADAQAH?

In Islam, rich Muslims are bound to spend on the needy in several ways. These spending are generally called Sadaqah. It means a good loan to Allah, Who Himself would compensate and reward a person in the life and hereafter.

Sadaqah ensures equitable distribution of wealth in society. Through them, Islam discourages the concentration of wealth in a few hands, so the gap between the rich and the poor is bridged.

Sadaqah includes the following:

- Compulsory contributions such as Zakah and Sadaqah-ul-Fitr;

- Donations to charitable causes and;

- Waqf.

Comparison of Islamic Economics with Other Economic Systems:

The Islamic Economic System significantly diverges from the capitalistic, socialistic, communistic, and mixed economic systems. To align with Islamic economics, we must substantially modify the fundamental principles of capitalism, though it’s worth noting that some foundational aspects related to wealth acquisition bear similarities. Nonetheless, the uniqueness of the economic system of Islam manifests in the application of wealth and its integration into production, setting it apart on the global stage.

Conclusion:

In conclusion, the Islamic economic system is a unique approach to managing and organizing an economy based on the principles of equity, justice, and social responsibility. It offers a balance between individual freedom and communal welfare, providing a framework for sustainable development and ethical business practices. By understanding its principles and features, we can gain valuable insights into creating an inclusive and responsible economy that benefits all members of society. Let us continue to explore and learn more about this fascinating and dynamic system of economics. So, let’s delve deeper into the six main characteristics of the Islamic economic system and understand what makes it stand out from other economic systems.