Islamic Banking and Finance Principles

Islam has set values and goals that meet all the economic and social requirements of human life. Islam is a religion that not only focuses on the success of the afterlife but also organza the life of a person perfectly. The Islamic laws are known as Sharia which means clear path. The present banking system is based on prohibited financial elements, which are against the principles of Islamic banking. Here we discuss the seven major principles of Islamic finance:

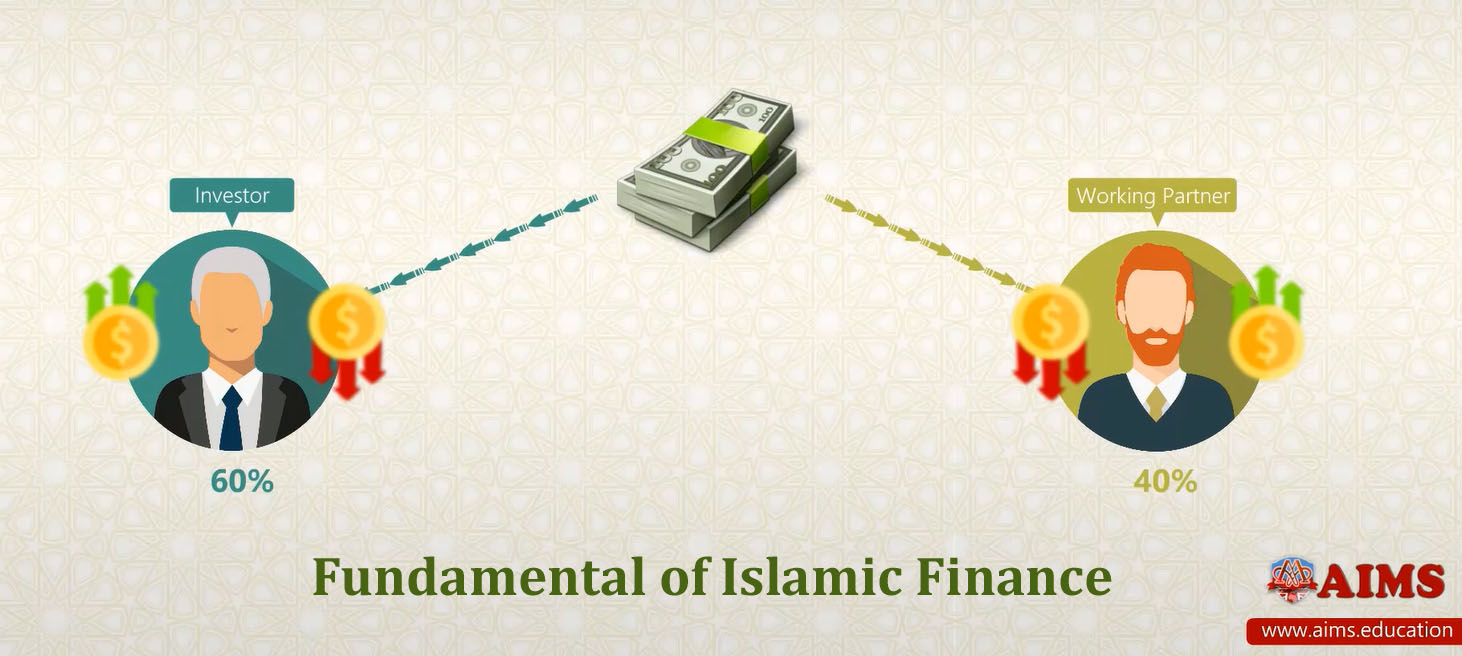

1. Profit and Loss Sharing:

It is one of the key principles of Islamic finance, where the partners will share their profit and loss according to the part they played in the business. There will be no guarantee on the rate of the returns that the Muslims will play the part of a partner and not a creditor.

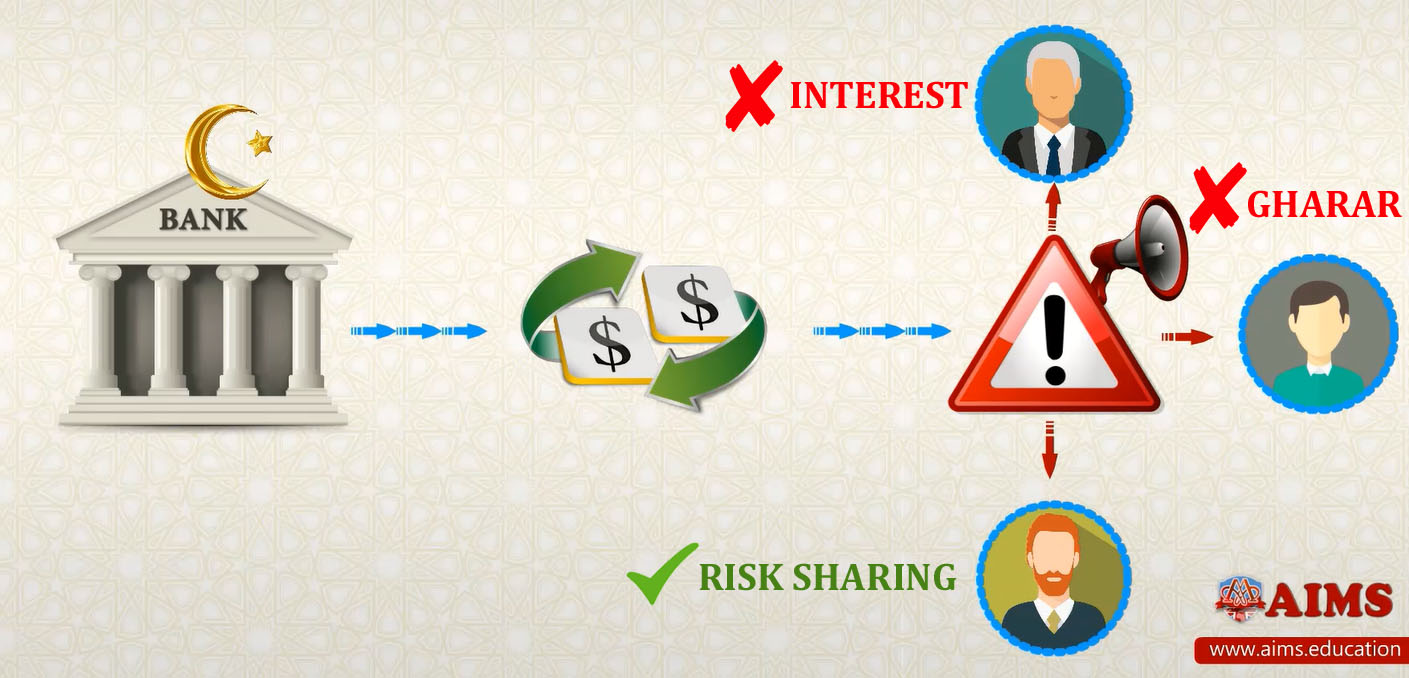

2. Shared Risk:

In economic transactions, risk sharing is promoted by Islamic banking. When two or more parties will share the risk, which is based on the principles of Islamic banking, the burden of the risk will be divided and reduced among the parties. So it will improve the economic activity of the state.

3. Riba:

It can be regarded as the prohibition of interest:

- The wealth will get a return without any risk or effort.

- Regardless of the outcome of economic activity, the person who gets the loan has to return the money and Riba to the lender.

- According to the principles of Islamic finance, taking advantage of the issues that others are facing is unjust.

4. Gharar:

According to Islamic finance principles, Muslims are not allowed to participate in the ambiguous and uncertain transactions. According to Islamic rules, both parties should have proper control over the business. As well as the complete information should be shared with both parties so that the profit and loss will be equally shared.

5. Gambling:

In Islam, the acquisition of wealth through evil means or participation in gambling is prohibited. It will protect Muslims from conventional insurance products because that is a type of gambling. On the other hand, Islamic banking works in Takaful involve mutual responsibility and shared risks.

6. No Investment in Prohibited Industries:

Industries that are harmful to society or have a threat to social responsibilities are prohibited in Islam. They include:

- Pornography.

- Prostitution.

- Alcohol.

- Pork.

- Drug.

One is not allowed to invest in such industries, or even participate in the mutual funds that will help the industry to flourish.

7. Zakat:

There is a property tax included in the rules of Islam that is known as Zakat, which allows the balanced distribution of wealth. According to Islamic banking principles, a fair amount of Zakat is deducted from the accounts of Muslims in the holy month of Ramadan. Islamic banks promote this social responsibility and distribute the amount among the needy.

CONCLUSION:

Principles of Islamic banking guide us to invest in an industry that will help us to achieve the financial and social objectives that have been determined by Islam. They have been designed to make an economy successful. So it is a way of saving our money from being invested in the wrong path. To may continue to learn more about Islamic banking. This lecture is a part of AIMS’ international certificate in Islamic banking, and an executive online diploma in Islamic finance.