Takaful Meaning:

Takaful, also known as Islamic insurance, is an ethical and mutually beneficial risk management concept based on the principles of solidarity, cooperation, and mutual assistance. The word “التكافل” comes from the Arabic root word “kafalah”, which means a mutual guarantee or joint responsibility. Takaful meaning is “Mutual Protection” and “Joint Guarantee”, and it is a Shariah-compliant alternative to conventional insurance. It is a form of cooperative insurance that provides protection against loss or damage to people and their property through a system of shared responsibilities among participants. It has two main types: General Takaful and Family Takaful.

1. What is Takaful Operating Principle?

The main ideology is to bear other person’s burdens and there is no profit in this system. Some of its’ important principles are as follows:

- For the common good, the policyholders will cooperate.

- The contribution of the policyholders is considered donations.

- To help those who need assistance, all their policyholders will pay their share.

- The liabilities are shared according to the pooling system of the community and losses are divided.

- According to compensation and subscription, there is no uncertainty.

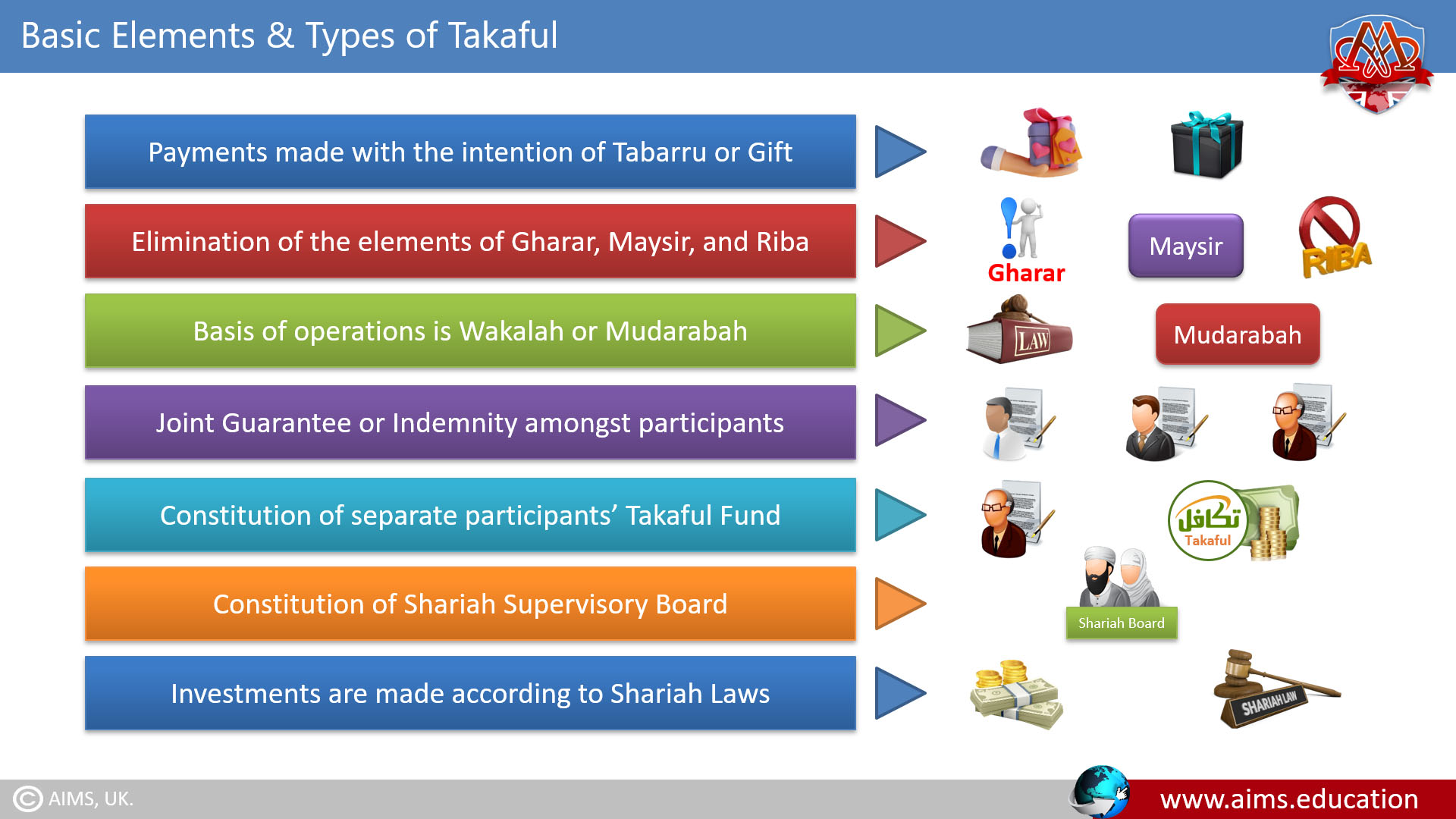

2. Forbidden Elements Islamic Insurance

In alignment with Islamic principles, it strictly forbids certain elements that are common in conventional insurance. These prohibited elements include:

a. RIBA (Interest):

Islamic law prohibits interest or usury, known as ‘riba’. Any gain obtained from the use of money is considered exploitative and is thus forbidden. Therefore, Islamic insurance does not allow the earning of interest on contributions.

b. GHARAR (Uncertainty):

التكافل discourages contractual ambiguity or uncertainty, known as ‘gharar’. So, the contracts must have clear terms, avoiding any form of uncertainty in the agreement terms about the benefit and contribution.

c. MAYSIR (Gambling):

Gambling or ‘maisir’ is also prohibited in Islamic insurance. This rule is in place to prevent participants from treating the takaful fund as a speculative venture where they may contribute less, hoping to gain more.

3. How Does Takaful Work?

It operates on a unique mechanism of mutual cooperation, solidarity, and shared responsibility. Here’s how it works:

Step 1: Agreement

Participants agree to contribute a certain sum of money to a common pool for the purpose of mutual indemnity.

Step 2: Contributions for Funds

Each participant makes a regular contribution to the pool based on the principle of Tabarru’ (donation). These contributions form the التكافل fund.

Step 3: Management of Funds

This fund is managed and administered by a Takaful operator who charges a fee for their services. The operator is responsible for paying claims and maintaining the overall health of the fund.

Step 4: Paying Claims

In the event of a loss, the operator pays the claim from the التكافل fund. The claim is equivalent to the participant’s loss or the policy’s limit, whichever is lower.

Step 5: Profit and Loss Sharing

At the end of a defined period, if the Takaful fund has a surplus (after administrative costs and claims), the surplus is shared among the participants and the operator in a proportion agreed upon in the contract.

Step 6: Retakaful

In some cases, general Takaful operators may engage in Retakaful operations. This involves the operator distributing its risks by placing part of it to other operators or Retakaful operators, thus reducing the exposure of each operator.

4. Takaful VS Conventional Insurance:

| Islamic Insurance | Conventional Insurance |

| It is based on a model of shared responsibility and mutual cooperation, underpinned by the principles of Islamic law (Sharia). | Conventional insurance is a contract established between two parties, largely driven by the objective of generating profits. |

| The goal of Islamic insurance is not primarily focused on profits, but rather on mutual assistance and solidarity among participants. | In conventional insurance, the planning and execution of the agreement are predominantly profit-oriented. |

| Both risk and rewards are distributed equally among participants. | One party (the insurer) assumes the risk on behalf of the other (the insured). |

| It guarantees assistance for participants in line with the agreed terms. | Assistance in times of need is not guaranteed. |

| It adheres to the principles of Sharia law. | It operates based on business principles and regulations, often with profitability as a major consideration. |

| Takaful typically requires fewer policies for comprehensive protection compared to conventional insurance. | In conventional insurance, multiple policies might be needed for complete coverage. |

| It covers both major and minor losses. | Conventional insurance often provides coverage only for specific emergencies or significant losses. |

You may also learn about the key differences between conventional banking and Islamic banking.

5. Examples of Takaful

1. MOTOR VEHICLE

It can be exemplified by a motor vehicle takaful. Here, a group of individuals each own a car. They contribute a certain amount of money to a common fund managed under the Islamic Insurance model. If one of the participants faces a loss due to an accident, the التكافل fund would cover the cost of repair and damages. The goal is to indemnify the loss suffered by the participant, not to provide them with any form of unjust financial gain.

2. DEATH

An example of family takaful can be seen in a life takaful scheme. Suppose a person, who is the sole earner in his or her family, participates in a life Islamic Insurance plan. They contribute to the takaful fund regularly. If the participant passes away or becomes permanently disabled, the التكافل scheme would provide a sum of money to the family. This sum is not a form of profit but a means for the family to cope financially in the absence of their primary earner.

“Since 622 AD the concept has been practiced in different forms. The foundation of insurance in Islam was laid with the help of sharing the responsibilities between the Muslims. In 1976 a Fatwa was issued by the Higher Islamic Council of Saudi Arabia that Islamic Insurance is legitimate as compared to conventional insurance. Since then considering Islamic values the rules and regulations for the التكافل have been formulated. Today, there are more than 1,000 companies that are working under these rules.”.

Historical Backgroud of Takaful!

Takaful Models:

1. Mudharabah Model

The Mudharabah model of Takaful is a profit-sharing agreement between the participants and the Islamic Insurance operator. In this model, participants contribute to the التكافل fund, and the operator manages the fund. The operator is entitled to a predetermined share of the profits, while the remaining profit is distributed among the participants. In case of a loss, it is borne entirely by the participants as the operator has provided only the expertise and not the capital.

2. Wakalah Model

The Wakalah model is an agency-based model where the Takaful operator acts as an agent for the participants. The operator is paid a fixed fee (wakalah fee) from the Takaful fund for managing the investments and claims. Any surplus from the fund after setting aside reserves and payment of claims is returned to the participants.

3. Musharakah Model

The Musharakah model is a partnership model where all parties contribute capital and share in the profits and losses. In an Islamic Insurance context, both the operator and the participants contribute to the fund. The profits are shared as per a pre-agreed ratio, while the losses are shared in proportion to each one’s capital contribution. This model is less common in the industry, but it embodies the ideal Islamic principle of shared risk and reward.

Rising Global Interest in Islamic Insurance

The global growth of the Takaful industry has been remarkable. As the acceptance of Islamic finance principles widens, more individuals and institutions are gravitating towards التكافل, as it offers a harmonious blend of ethical finance and risk mitigation. Education in Islamic banking and Insurance has also seen a surge, with an increasing number of students investing in an online Islamic finance PhD, or an affordable MBA in Islamic banking and insurance. These top-tier online programs help in understanding the nuanced mechanics of Takaful, preparing individuals for the burgeoning opportunities in this sector. The rise of التكافل signifies a change in consumer sentiments, with an increasing demand for financial products that align with their values and beliefs.

Types of Takaful:

There are two basic types of takaful: general takaful and family Takaful.

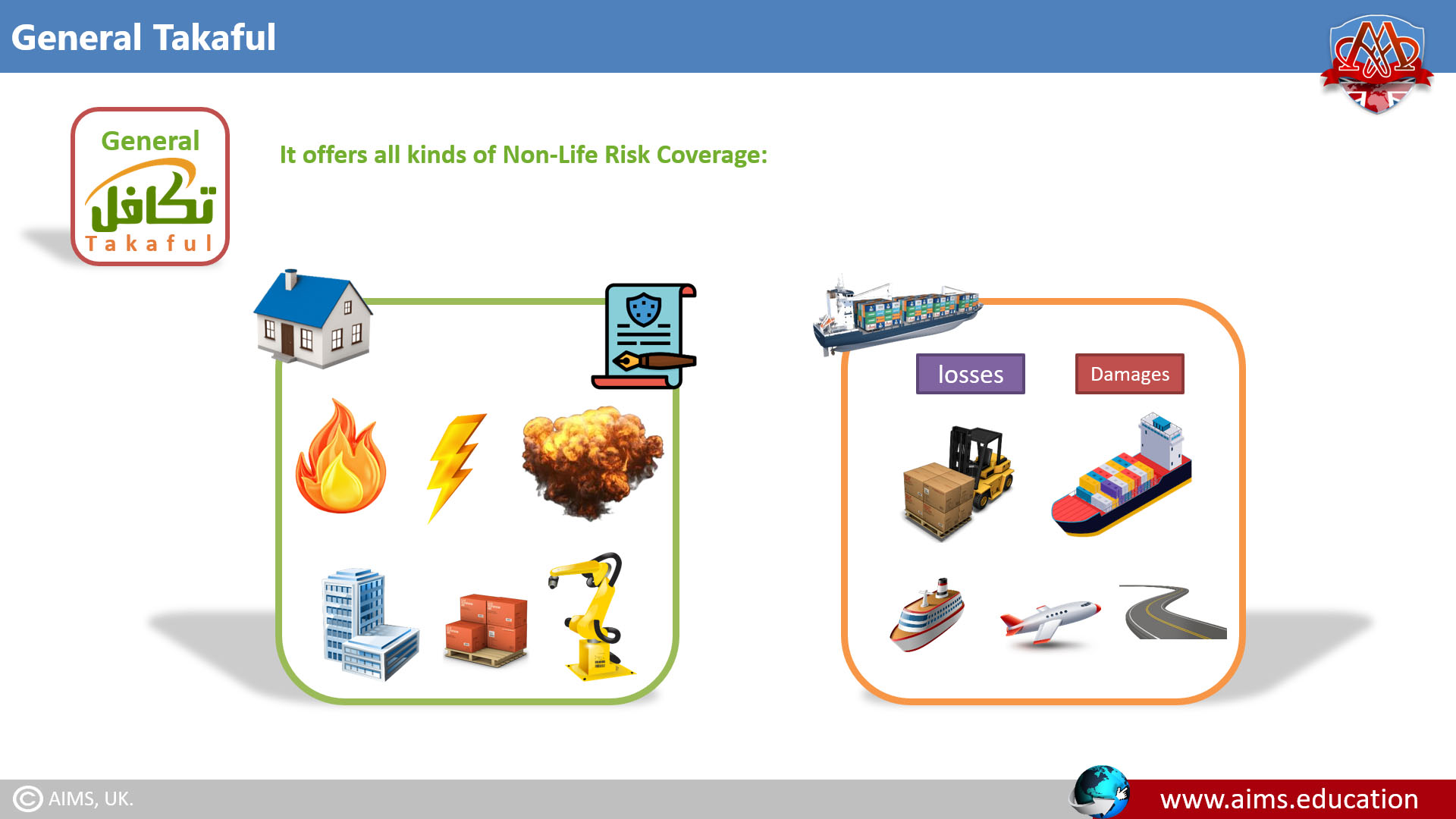

General Takaful:

General Takaful plans are intended to meet the insurance needs of people and corporate bodies in connection to materialistic loss or damage done due to any catastrophic condition.

- Participants pay their premiums in the Islamic Insurance store as a Tabarru’.

- This will wipe out the components of al Gharar and bet. That is, the member consents to give their premium to the reserve with a mission to help different members secure under the different Islamic Insurance plans when in trouble.

- In this way, the individuals convey the hazard and the التكافل administrator is just an overseer.

IMPORTANT NOTES:

Musharakah, Mudharabah, and Wakalah models can be actualized under this approach. For the most part, all the physical properties and resources are secured like homes, cars, and buildings.

The measure of commitment to be paid by any members who take an interest in any of the assortment of plans of General Takaful relies upon and is corresponding to the fitting rates and the estimation of properties being secured. The benefit-sharing proportion will be made known to the member in advance and concurred by the two gatherings.

General Takaful Products:

It offers all kinds of non-life risk coverage, and it is divided into the following classes:

- Property: This policy provides compensation in the event of damage to the property caused by fire, lightning, and explosion. And, it applies to buildings, stock, machinery, and similar contents.

- Marine: It compensates losses or damages to cargo or freight on Vessels, Aircraft, or roads.

- Motor/Vehicle: It is applicable to damage to the vehicle, incurred as a result of any accident.

- Miscellaneous: This coverage is personalized and tailor-made, to the corporate requirements.

Family Takaful:

It is a contract of Taburru where the non-zakat gift is made in customary interims to the Waqf Fund by the members. Under this Islamic Insurance, all dangers related to human life are secured like demise, handicap, and ailment including here-and-now and long-haul speculation needs.

The Role of Tabarru:

These items tend to be normal reserve funds designs where a member demonstrates his need to accomplish an objective singular amount by a predetermined time later on.

- Under this plan, the members pay their premiums into the التكافل store.

- A bit of the premium is allotted only for funds and ventures, and the adjustment goes as a Tabarru to develop saves as claims hold, unmerited premium saves, and much more, to coordinate costs, and to pay for Retakaful.

This policy covers all risks associated with human life such as death, disability, and illness; through short-term and long-term investment needs.

Types of Family Islamic Insurance Plans:

- Term Life: If the life assured dies within a specified period, it provides payment of the sum assured only.

- Whole Life: This contract theoretically covers the insured and a level premium is payable for life.

- Endowment: It provides endowment benefits at retirement. Or, in case of an earlier death of the insuree, they are paid to the dependents.

- Universal: It provides lifetime financial security, with the flexibility to the changing needs and aspirations of the insuree.

- Marriage Plan: It is designed to fulfill parents’ needs for their children’s marriage.

- Educational plan: It especially caters to a child’s future financial needs for education.

Benefits and Global Popularity

التكافل is an Islamic insurance concept that offers many benefits such as compliance with Islamic principles, transparency, and social responsibility. It has become a popular alternative to conventional insurance in many Muslim-majority countries. With its focus on mutual assistance and risk-sharing, takaful promotes community solidarity and strengthens the concept of brotherhood in Islam. So if you are looking for an ethical and equitable insurance solution, consider opting for Islamic Insurance instead of traditional insurance. It not only provides financial protection but also aligns with your values and beliefs. So why wait? Explore the world of takaful and make a responsible choice for yourself and your loved ones.