What is Islamic Trade Finance?

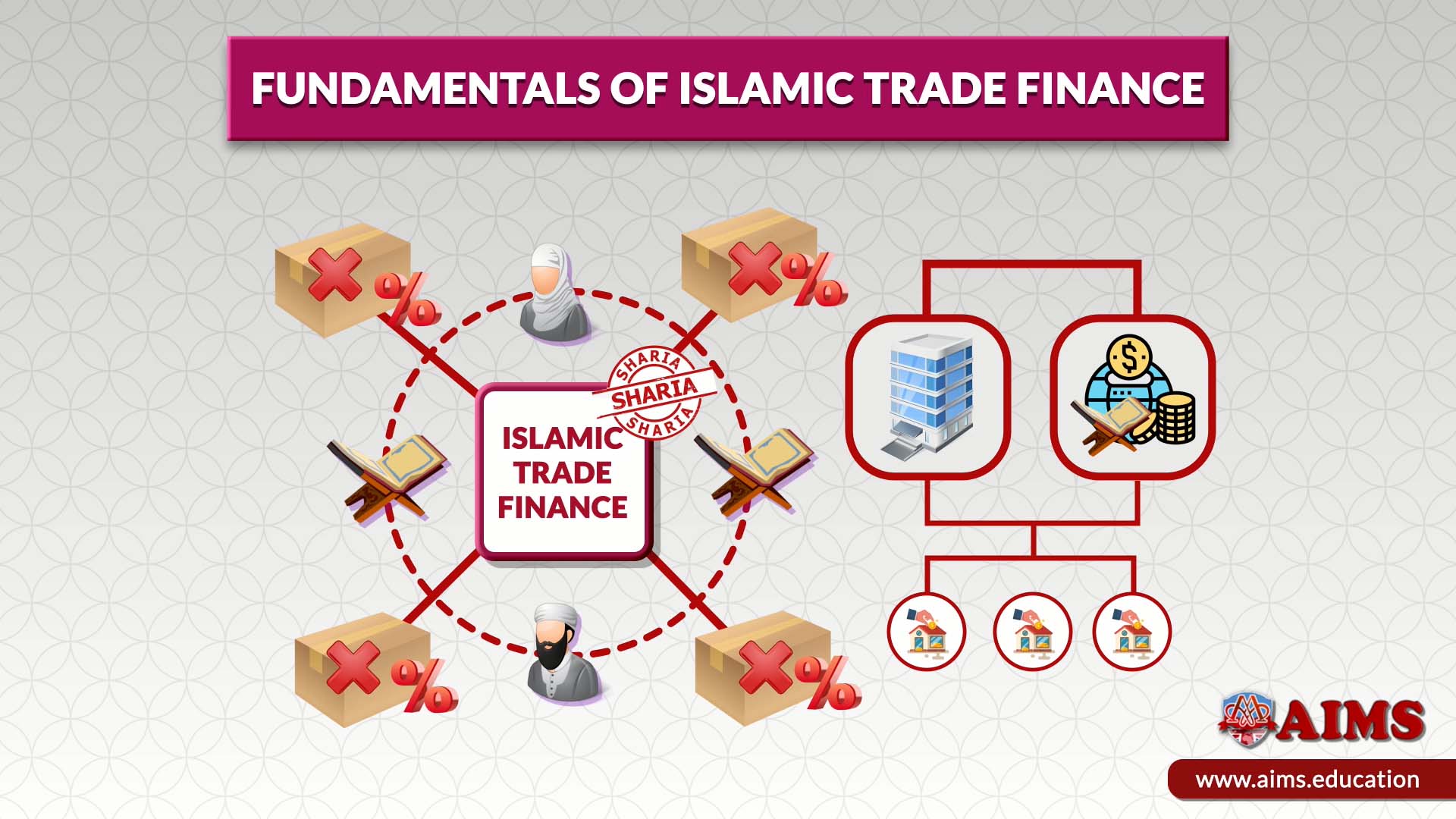

Islamic teachings guide Muslims in all aspects of life, including setting up their economies and infrastructure. This meant their systems differed from Western economies- making it difficult for them to collaborate. To overcome some of these differences in the world of finance, around the year 1950, Islamic trade finance products came into being. Islamic trade finance is based on the principles of Shariah for trade, and it is practiced internationally with the help of Shariah-compliant Islamic trade finance products and services. Since international trade involves the exchange of foreign currencies, you will also learn how the laws for forex trading in Islam are administered in a manner that complies with Islamic Shariah rules.

Principles of Islamic Trade Finance

Based strongly around morals and religious belief, Islamic trade finance products avoids the involvement of ‘riba’ which translates to interest– which Islamic laws (i.e. Sharia) strongly prohibit. In order to systematize international trade to an Islamic economy, several credit techniques have been developed to substitute the role of interest within transactions.

Evolution of Islamic Trade Finance

To help support Islamic trade finance, the International Islamic Trade Finance Corporation (ITFC) was established in the year 2008. The purpose of this organization was to aid countries such as Bahrain and Saudi Arabia in adopting the practices of Islamic trade finance products. It does this by providing them with the necessary tools to compete in the international market and develop methods to provide banks with incentives to partake in the system.

‘Murabahah’ is one of the ways organizations incentivize banks whilst remaining within the limits of Shariah. It is the amount that becomes the bank’s return when that good is sold to a customer for payment at a later date. With both the buyer and seller agreeing on a specific profit margin added to the cost, this is not seen as interest; rather, it is a technique of profit and loss sharing. Islamic trade finance is growing internationally, and there is a role of the rise of Islamic banking in Europe.

Conventional Trade Finance VS Islamic Trade Finance: 7 Key Differences

Here are the seven key differences between Conventional and Islamic Trade Finance:

| Islamic Trade Finance | Conventional Trade Finance |

| In compliance with the principles of Islamic banking and finance. | Does not consider any religious principles. |

| Does not involve the role of interest or riba. | Heavily relies on an interest-based environment. |

| Trade operations may be financed through profit and loss techniques. | Trade transactions are financed exclusively through credit. |

| Administers technique of profit and loss sharing Transactions almost always involve interest. | Both parties decide on the profit margin. Sellers primarily decide the profit margin. |

| Uses Riba free contracts, such as Murabaha, Ijarah and Diminishing Musharakah to incentivize sellers/exporters. | Uses interest-generating opportunities to incentivize banks. |

| Is mostly practiced in Muslim countries. | Is practiced worldwide. |

Islamic Trade Finance Products

A wide range of tools and instruments regulate how cash, credit, investments, and other assets can be utilized for trade. Students of AIMS’ CIFE and diploma Islamic banking and finance study the detailed theory and practical implementation of Islamic finance trading products. They include but are not limited to:

- Letters of credit.

- Trust Receipts.

- Accepted bills.

- Shipping guarantees.

- Working capital financing.

- Export credit financing.

Let us discuss each of them in details:

1. LETTER OF CREDIT

The Islamic bank provides a guarantee to the seller’s bank in the form of L/C (which is riba free), and payment is made for goods that needs to be imported.

2. TRUST RECEIPTS

These are used to provide Shariah-compliant financing, where Islamic bank holds the imported goods in trust for the buyer and give them to the buyer when financial obligations are fulfilled.

3. ACCEPTED BILLS

These bills of exchange are used in Islamic Trade Finance as a form of payment for goods.

4. SHIPPING GUARANTEES

Type of guarantee provided by an Islamic bank or financial institution to cover the cost of shipping goods. These guarantees are used in Islamic trade finance to protect the seller in cases when a buyer is unable to pay.

5. WORKING CAPITAL

Working capital financing is a financing used for company’s day-to-day operations, and Islamic banks uses Salam Contract for such transactions.

6. EXPORT CREDIT FINANCING

Funds are provided by Islamic banks to help businesses meet the costs associated with exporting their products.

Shariah Compliant Contracts Used for Islamic Trade Financing

Given below are some standard Islamic financial instruments used for Islamic trade finance:

1. MURABAHAH

Murabahah offers a cost-plus financing structure, in which the bank purchases goods and resells them to customers at a profit.

2. IJARAH

In Ijarach (Islamic leasing structure, Islamic bank purchases an asset and leases it to the customer, with the customer having the option to purchase the asset at the end of the lease period.

3. MUSHARAKAH

Musharakah offers business partnerships, where the Islamic bank and the customer jointly invest in a project or business on a profit and loss-sharing basis, on a pre-agreed ratio.

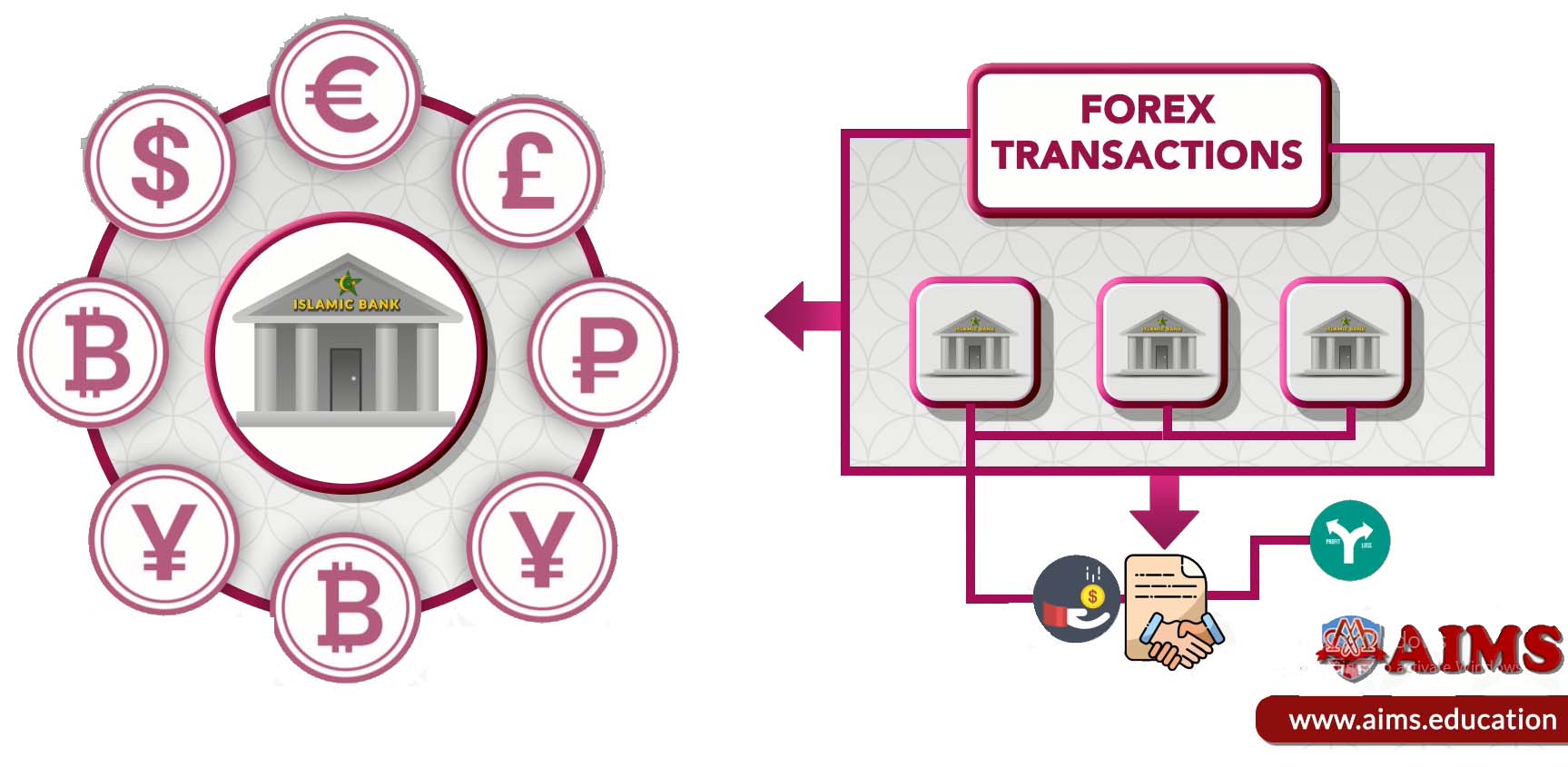

Rules Forex Trading in Islam

Regarding transactions in foreign currencies, Islamic banks tend to exchange these currencies on the spot for international trade. Forex trading is carried out by Islamic banks for Islamic financial contracts or currency arbitrage. While Islamic banks incorporate a profit sharing or margin into the contract or transaction, forex trading in Islam sticks to the values of profit-loss sharing, as per the Islamic Shariah law.

Islamic Trade Finance Challenges

Islamic trade finance faces several challenges, such as:

- Lack of awareness of Islamic finance options.

- The Islamic banking system requires regulatory challenges from governments and central banks.

- Relatively high costs are charged by Islamic banks.

- Lack of standardization.

- Limited range of Shariah-compliant products.

- Complex Risk Management structure in Islamic banking and finance.

Role of International Islamic Trade Finance Corporation (ITFC)

The International Islamic Trade Finance Corporation (ITFC) is a member of the Islamic Development Bank (IsDB) Group. ITFC plays a role in Islamic trade finance by providing trade financing and other financial services to its member countries. ITFC’s main goal is to promote cross-border trade among its member countries by providing trade financing, trade guarantees, and other trade-related services. It also provides funding for infrastructure and development projects in member countries.

Some roles of the International Islamic Trade Finance Corporation are:

- Promotion of Islamic Trade Cooperation.

- Assist in financing Islamic trade.

- Capacity Building to improve Islamic trade-related skills.

- Advisory Services to member countries.

- Promotion of Shariah-compliant products and services for Islamic trade financing.

- Helps businesses mitigate risks related to international Islamic trade.

- Contributes to socio-economic development.