Islamic Banking and Finance Blog

Welcome to the Islamic finance blog at AIMS Education, your resource on information and the Islamic banking and financial industry, products, and services. Our Islamic banking blog provides insightful perspectives, analyses, and updates on the ever-expanding Islamic finance domain in the finance sector worldwide. Our articles on Islamic banking and finance will help you keep up with what is new and developing in the Islamic banking and finance industry.

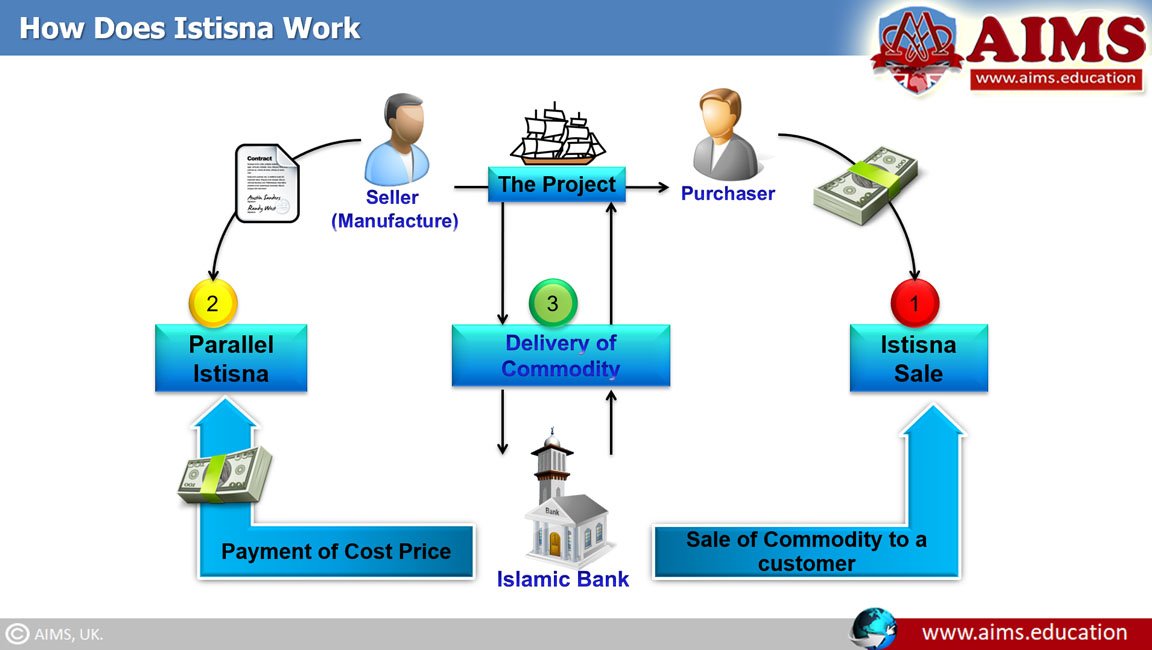

Istisna in Islamic Banking & Parallal Istisna

What is Istisna? Istisna is a special sale contract where the commodity is transacted before it comes into existence. Istisna in Islamic banking is mostly an order for the producer to manufacture a specific [...]

What is Musawamah in Islamic Banking? Examples & Contract Overview

What is Musawamah? Musawamah is an Arabic word derived from the word “sawa” which means “equalizing”. Musawamah means “bargaining” or “negotiation”, and in Islamic banking, it represents a type of sale where the seller [...]

Asset Backed Financing in Islamic Banking

What is Asset Backed Financing in Islamic Banking? According to the Islamic religion, not all investments and financial transactions are allowed for Muslims, and each of them must be compliant with the sources of [...]

Musharakah Contract: Meaning & Types in Islamic Banking

What is Musharakah? Musharakah (مشاركة) is a word of Arabic origin that literally means 'Sharing.' Its root word is Shirakah (شركة), which means “Being a Partner”. In Islamic banking and finance, Musharakah definition may [...]

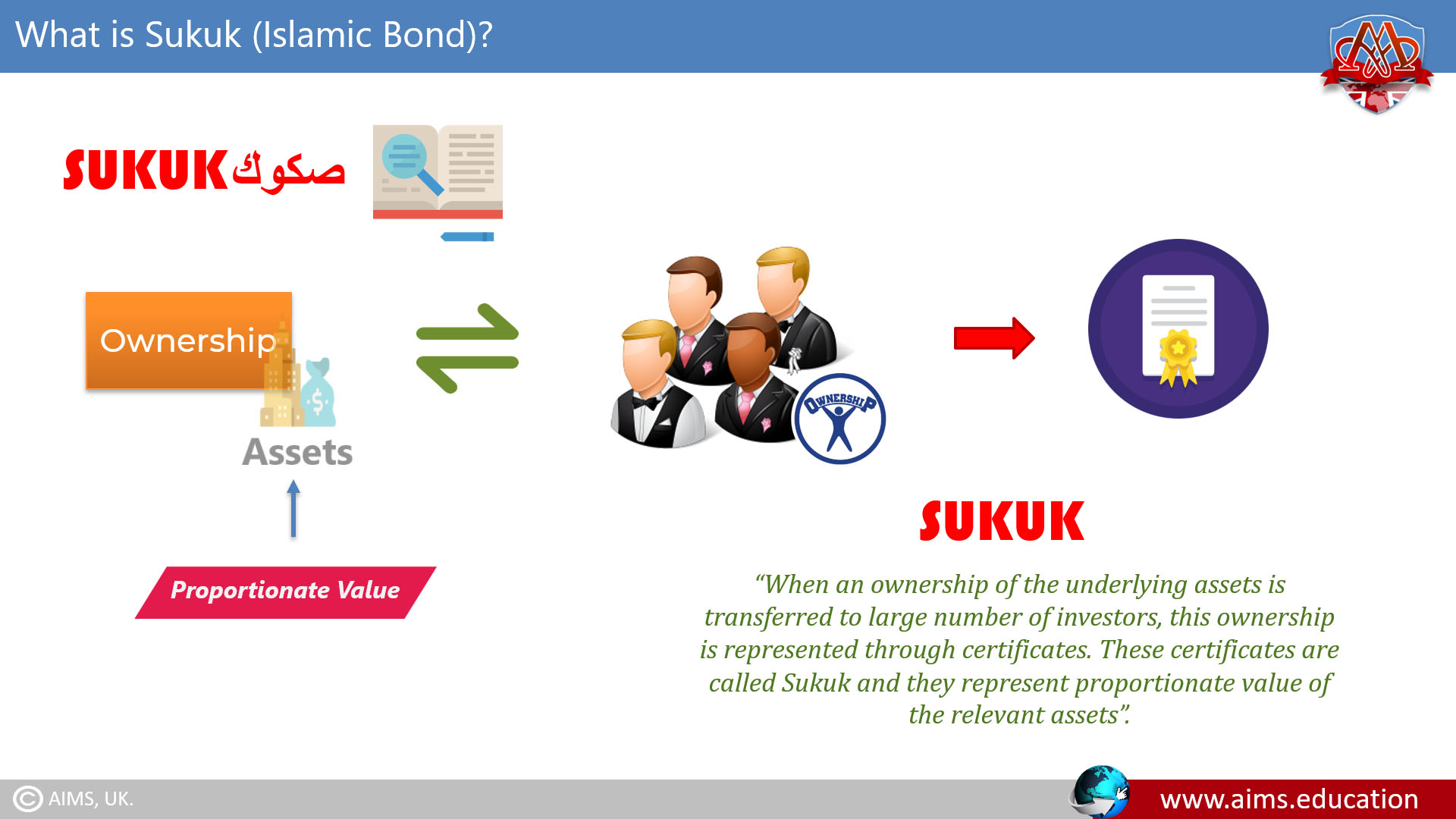

Sukuk (Islamic Bond) – Meaning, Types, Structuring & Applications

Sukuk Meaning Sukuk (صكوك) is a plural of the word “Suuk,” which was used by the Muslim societies of the Middle Ages for “Papers.” These papers are used to represent financial obligations originating from [...]

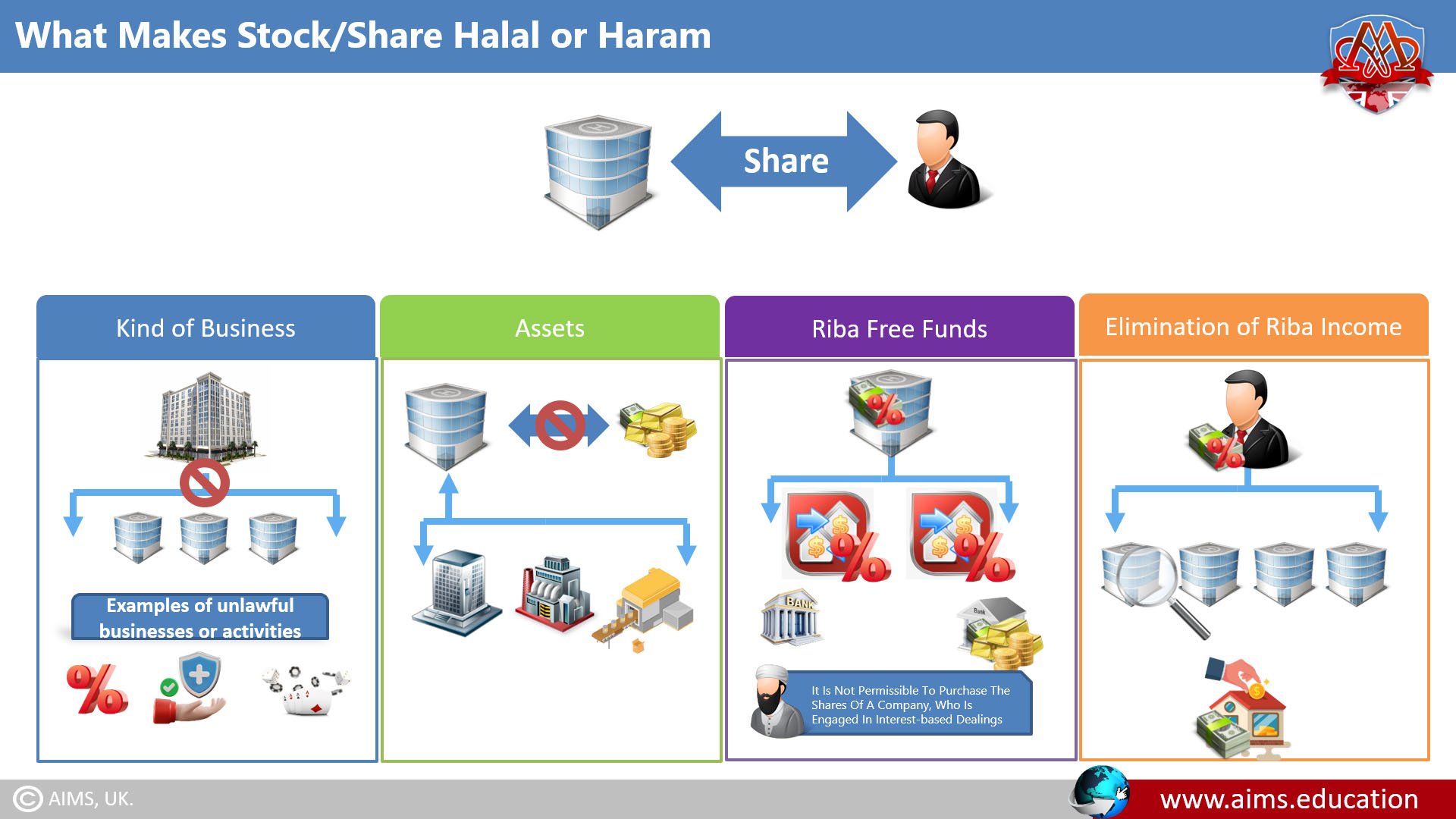

Is Investing in Stocks Haram or Halal?

Are Stocks Haram or Halal? Investing in stocks often raises questions such as “Is investing in stocks haram?” or “Are stocks haram?”. The answer depends on the nature of the stocks in question and [...]

Wadiah and its Types

Waidah Meaning: Wadiah means "custody" and "trust." In Islamic banking, it refers to a deposit. It has two types: Wadiah yad Dhamanah and Wadiah yad Amanah. وَدِيعَة differs from Qard; the concept involves safekeeping [...]

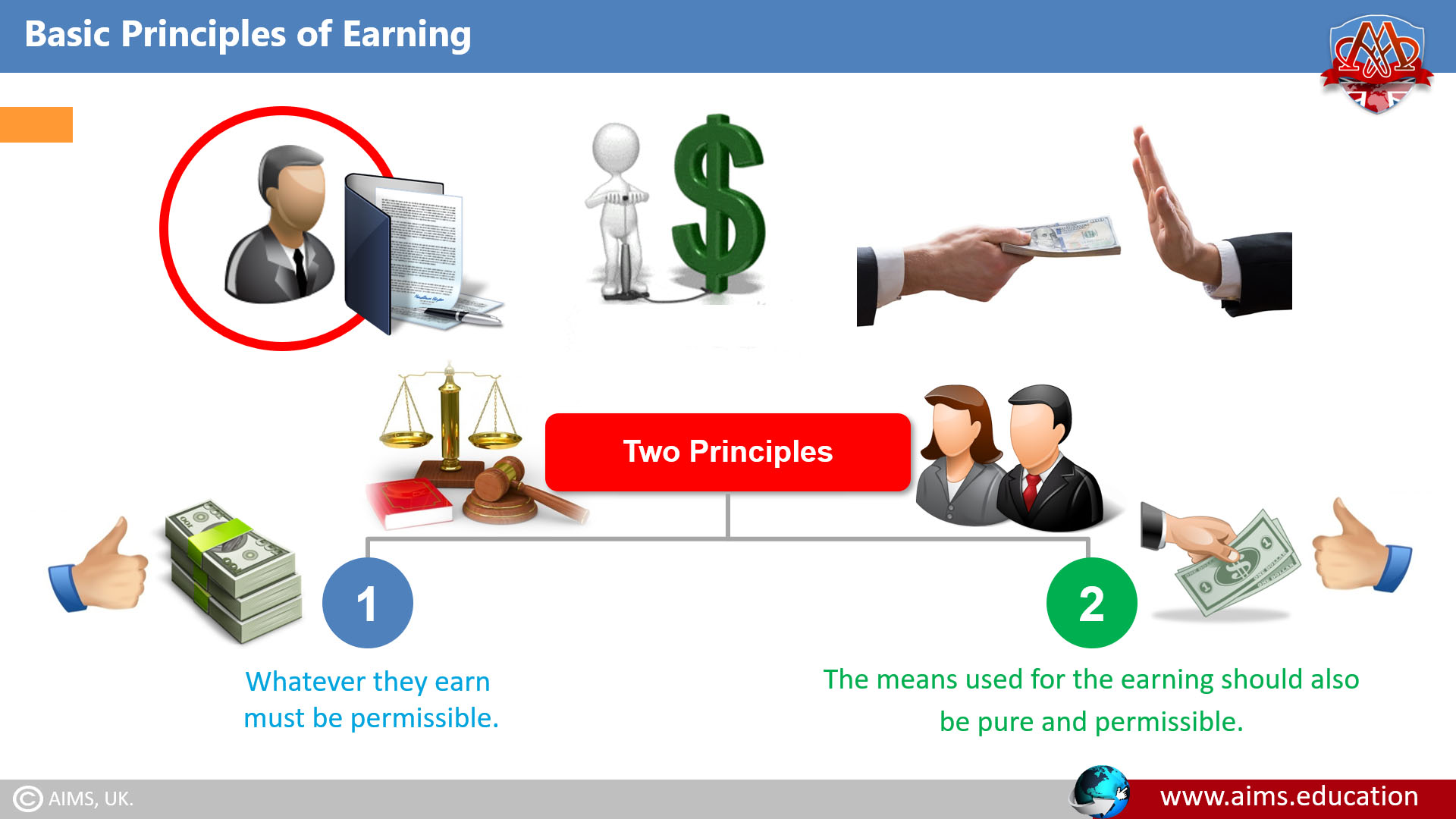

Islamic Microeconomics

What is Islamic Microeconomics, and What Does it Deal With? Microeconomic theory deals with the behavior of economic agents of the economic system, like consumers, firms, and factors of production. Subsistence and the means [...]

Reverse Murabaha or Tawarruq Contract in Islamic Banking

What is Tawarruq Contract or Reverse Murabaha? Tawarruq contract is also referred to as Reverse Murabaha. It is defined as, "A financial instrument in which a buyer purchases a commodity from a seller on [...]

Gharar (Uncertainty) in Islamic Finance: Meaning, and Types with Examples

Gharar Meaning in Islam: Gharar (الغرر) means uncertainty, hazard, chance or risk. Islamic dictionary describes it as “The sale of what is not present”. Now let us understand, what is gharar in Islamic banking. [...]