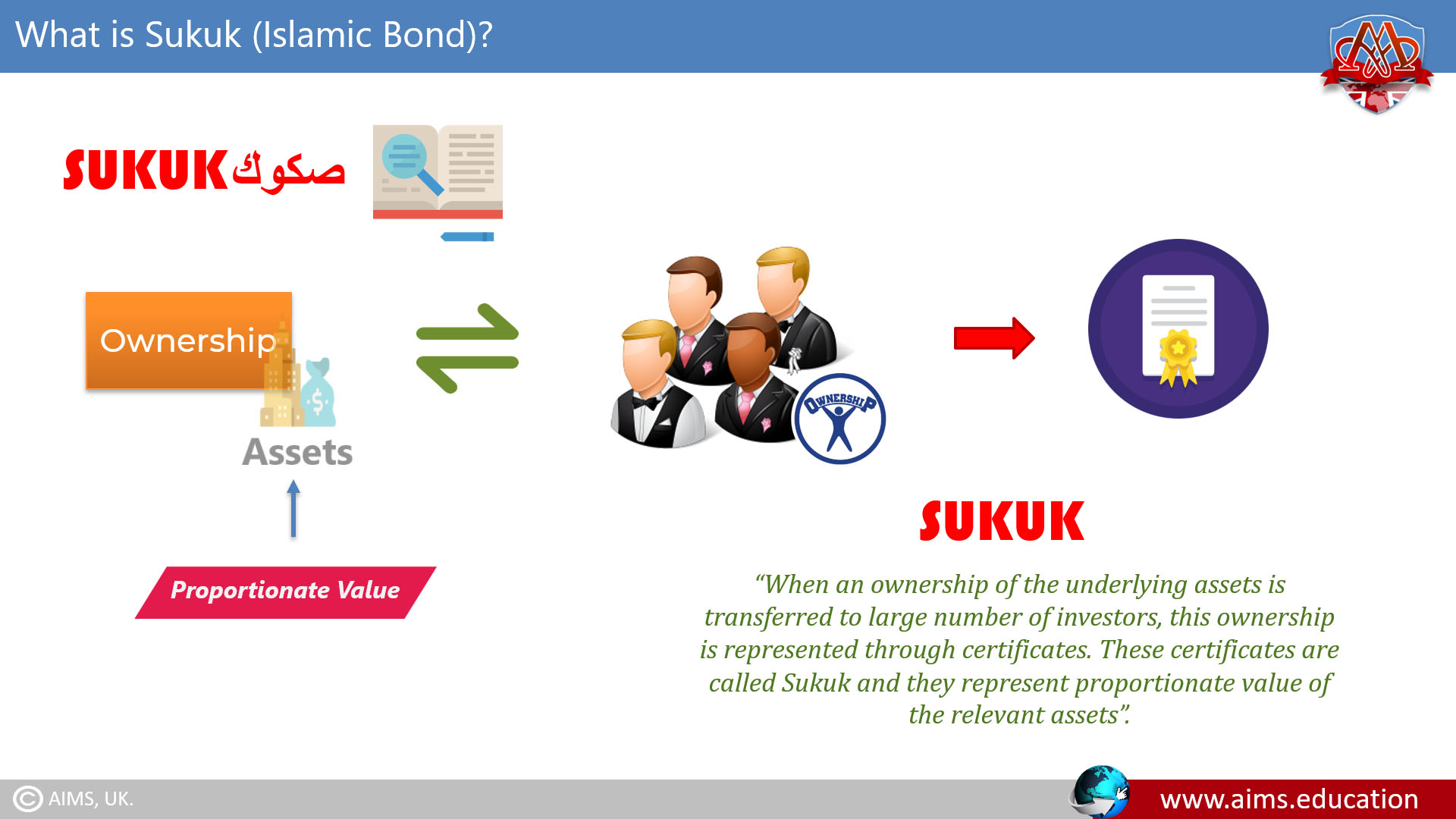

Sukuk Meaning:

Sukuk, commonly known as Islamic bonds, serve as a cornerstone in the realm of Islamic finance. The core sukuk meaning emerges from its Arabic root, which implies “certificates” or “documents”. Despite the moniker “Islamic bonds”, sukuk markedly diverges from traditional bonds. Unlike bonds, which merely signify ownership of a debt, sukuk embodies undivided shares in the ownership of tangible assets tied up to particular investment projects or commercial enterprises. Islamic bonds operate on the principles of Sharia law, and there are different types of sukuk bonds available, such as Ijarah, Diminishing-Musharakah, Musharakah, Murabahah, and Salam. Thus, the sukuk bond meaning extends far beyond the traditional concept of bonds, offering a unique and ethical financial instrument aligned with Islamic principles.

“When an ownership of the underlying assets is transferred to large number of investors, this ownership is represented through certificates. These certificates are called Sukuk and they represent proportionate value of the relevant assets”.

Sukuk Definition!

What is Sukuk Bond in Islamic Finance?

The importance of sukuk in Islamic finance can hardly be overstated. As an alternative to traditional credit-based financial instruments, they fuel the economic engine of countries where Islamic banking is prevalent, promoting economic growth and development without violating Shariah principles. It facilitates the mobilization of funds while adhering to the Islamic prohibition against interest (riba), gharar (uncertainty), ensuring transparency, risk-sharing, and asset-backing. They serve not only as a crucial tool to raise capital but also as a gateway for non-Muslim investors to partake in economically vibrant regions, creating a conduit of financial inclusion. Hence, the role of sukuk bonds in Islamic banking signifies a paradigm shift, which is steering the world of finance towards a more sustainable and ethical trajectory.

Sukuk Bonds VS. Conventional Bonds

What is a Conventional Bond?

Bond stands for a loan, repayable to the holder in any case, and mostly with interest. Investors who buy bonds lend the issuer money, in return for interest payments. When the bonds mature, the investor receives the principal amount of the bonds back.

Types of Conventional Bonds:

- COUPON BOND: A bond that pays its holder, a specified amount of money, at given dates until maturity.

- DISCOUNT BOND: It is bought at a discount, or a price less than its face value. Unlike coupon bonds, discount bonds pay the bearer only once, at its expiry.

- CONVERTIBLE BOND: It gives its holder the right to convert or exchange the par amount of the bond, for common shares of the issuer, at some fixed ratio during a particular period.

- EXTENDIBLE BOND: It gives its holder, the right to extend the initial maturity, to a longer maturity date.

- RETRACTABLE BOND: It gives its holder, the right to advance the return of principal to an earlier date, than the original maturity.

- FOREIGN CURRENCY BOND: It is issued in a currency other than its national currency. Issuers take advantage of international interest rate differentials.

- CORPORATE BOND: It is a loan made by a corporation, who give specific interest for a specified time, plus face value on a specified maturity date.

- HIGH YIELD OR JUNK BOND: They are issued by companies whose credit rating is considered “speculative grade”, or “below investment grade”.

- INFLATION-LINKED BOND: It protects against inflation, and its principal is increased by a change in inflation, over a period.

How does Sukuk Differ from Conventional Bonds?

- Islamic bonds don’t contain any element of interest or gambling.

- Islamic bond represents the ownership of the holder, in the pooled assets.

- The holder of an Islamic bond earns an income of return, which is generated through the asset.

- Islamic bonds represent one’s proportionate ownership in an Asset or a Pool of identified assets. However, trading of Murabahah and Salam-based Sukuk is not permissible.

Acquiring Distinguished Qualifications in Islamic Banking

To further comprehend the intricacies of sukuk, the Centre for Islamic Finance and Banking offers comprehensive education. Their curriculum includes an MBA degree in Islamic banking and finance, a postgraduate Islamic banking diploma, and even an online PhD thesis in Islamic banking and finance. These programs are meticulously structured to provide a thorough understanding of Sukuk bonds, types, and structuring. They offer the best Islamic finance expert certification, a distinguished qualification seen as a mark of proficiency in the field. Additionally, for those seeking flexible learning options, the online Islamic banking course is an excellent choice. It covers key areas of Islamic finance, including sukuk bonds, making it an invaluable resource for those aiming to become experts in the field.

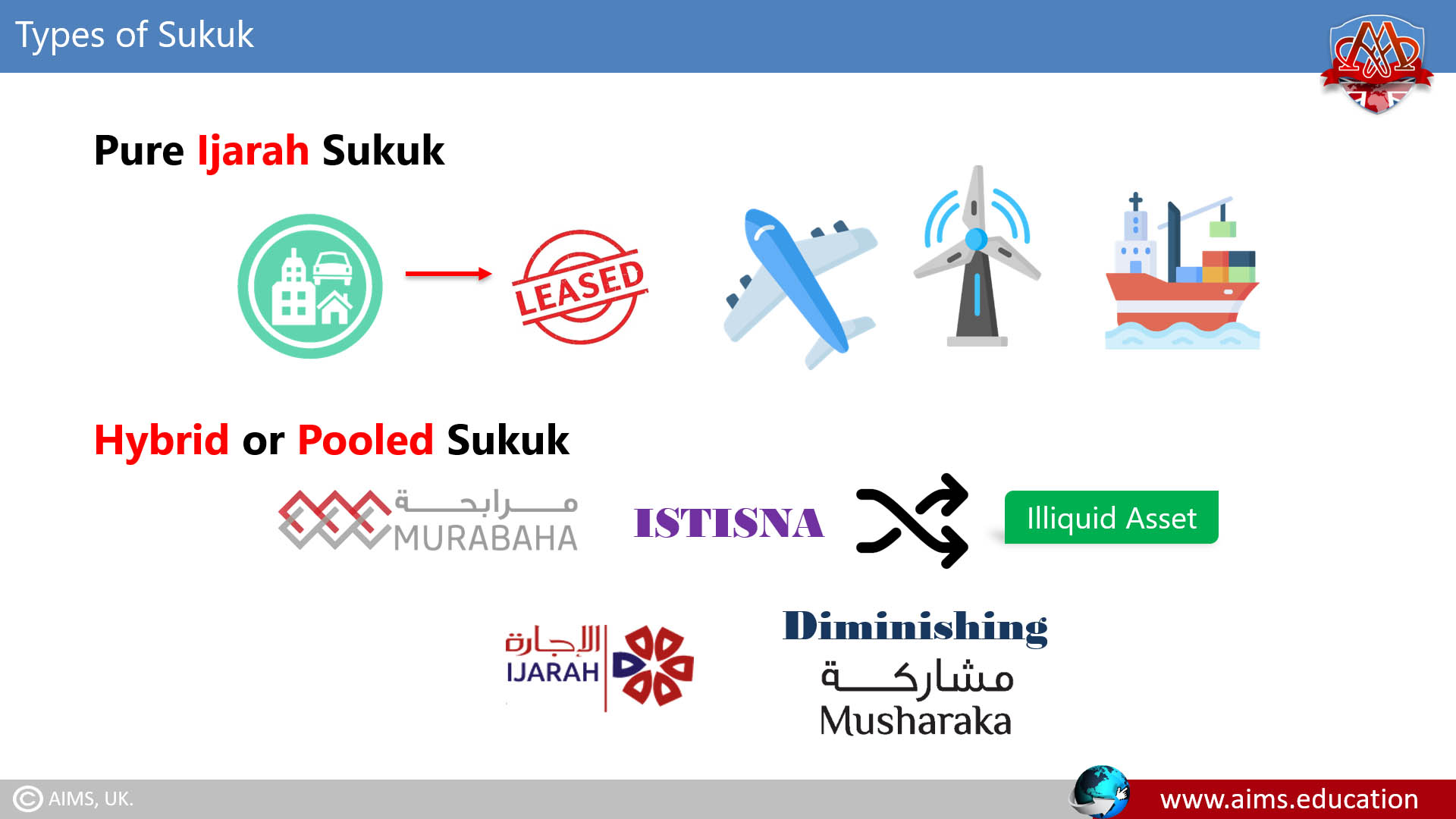

Types of Sukuk and their Structuring:

Issuance of Islamic bonds requires an exchange of assets through a Shariah-compliant commercial contract. Examples of such contracts are Mudharbah, Musharakah, Ijarah, Istisna, Salam, and Murabahah.

- Islamic bonds which are based on the principles of equity-based Mudharbah and Musharakah expose investors to risks.

- Those which are based on the principles of receivable are Ijarah and Murabahah. Their result in predictable and somewhat they give fixed returns.

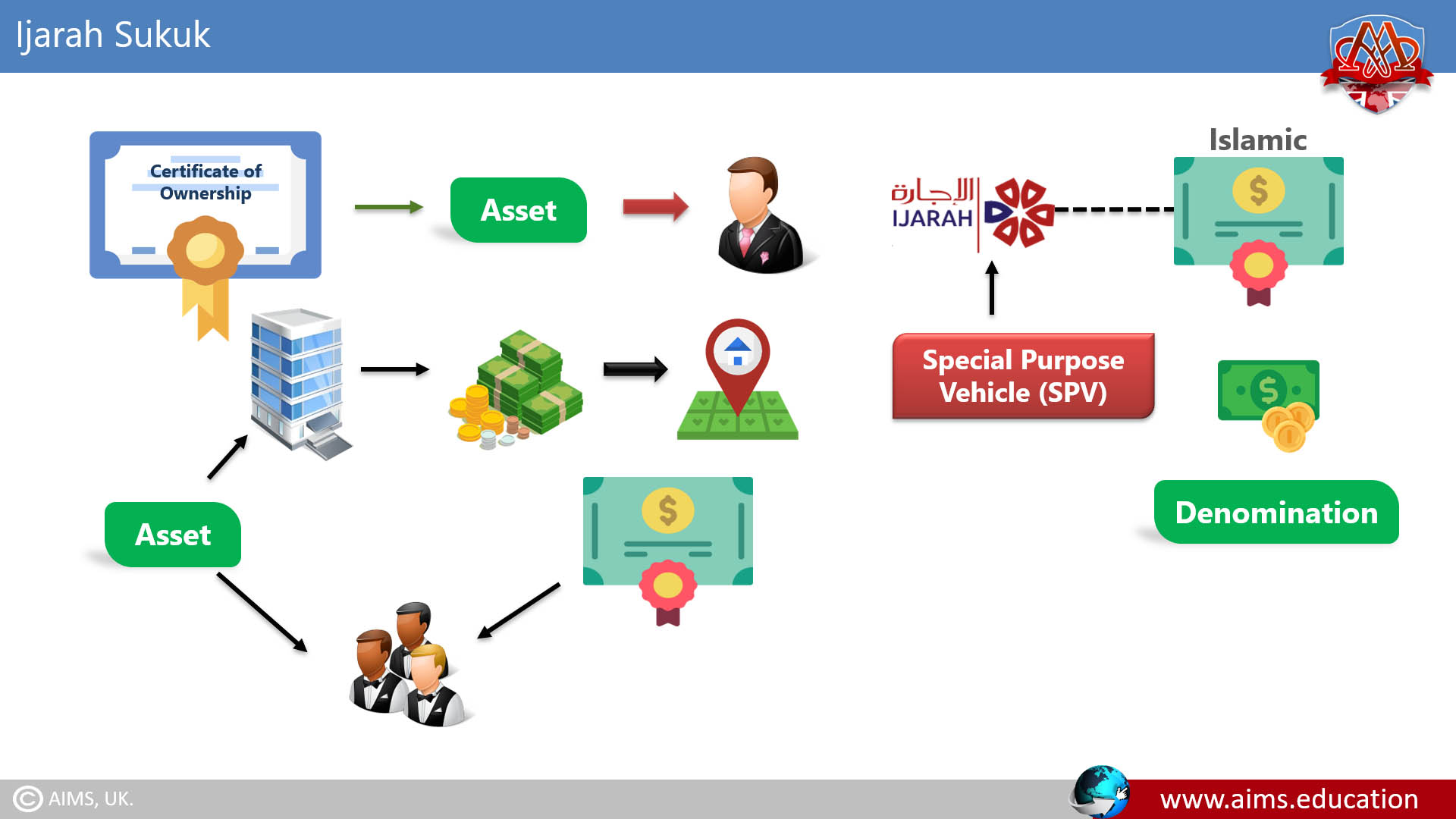

I. Ijarah Sukuk:

These are the “Certificate of Ownership of Assets” owned by a customer and they are based on ijarah.

MECHANISM:

- The company that needs funds to purchase land or equipment establishes a Special Purpose Vehicle.

- The SPV issues Ijarah-based Islamic bonds, by dividing the required amount, into small and equal denominations.

- The asset is then leased to the Company, and bonds are sold to the investors.

- The lease proceeds from the asset are distributed to investors as a dividend.

CASE STUDY: STEP-BY-STEP STRUCTURING OF IJARAH-BASED SUKUK:

- ABC Limited wishes to purchase a plant worth $5 Million through Islamic Bonds.

- The company identifies the supplier of the plant and finalizes the negotiations.

- ABC Limited creates a Special Purpose Vehicle (SPV), as a limited liability Company.

- The SPV issues 10,000 Ijarah-based Islamic bonds, equaling each $500.

- These 10,000 bonds are sold, funds are collected from investors, and the SPV purchases the plant.

- Now the investors are the owners of the plant.

- SPV holds the plant as a Trustee and leases the plant to ABC Limited as per Ijarah.

- ABC Limited pays periodic rentals to Special Purpose Vehicle for tenors, and amounts matching the coupon, and tenor of the Sukuk.

- ABC Limited gives the Special Purpose Vehicle, an irrevocable purchase undertaking to purchase the Asset on maturity.

- In this case:

“Exercise Price” = “Initial Purchase Price of Asset” + “Service Costs”. - Upon payment of the Exercise Price, the Asset is transferred back on maturity to the Special Purpose Vehicle.

IMPORTANT FEATURES:

- Ijarah-based Islamic bonds can be issued through the bank, brokerage house, or directly by the users of the lease assets.

- Since the underlying assets are not liquid, the Ijarah certificate can be freely traded in the secondary markets, at par, premium, or discount.

- They represent the holder’s proportionate ownership in the leased asset.

- In case of destruction of the asset, the holder will suffer the loss to the extent of his ownership.

- It is essential that they are designed to represent real ownership of the leased assets, and not only a right to receive rent.

II. Diminishing Musharakah Sukuk:

These are the “Certificate of Ownership of Assets” owned by a customer and are based on Diminishing Musharakah. Let us understand the Mechanism, and Documents executed under the diminishing musharakah arrangement:

1. INVESTMENT AGENCY AGREEMENT:

Through this Agreement, all participating Investors appoint a Bank as an ‘Investment Agent’ to carry out all actions.

2. ASSET PURCHASE AGREEMENT:

Through this agreement, the investment agent on behalf of investors, buys fixed Musharakah assets in partnership with the Issuer, at a price equivalent to the Sukuk Issue Amount.

3. MUSHARAKAH AGREEMENT:

The Investment Agent, on behalf of the Investors and issuer, enters into a Musharakaha Agreement, to jointly own the Musharakah. Each Investor’s entitlement to the asset constitutes “Sukuk Units”. And, the share of each Co-Owner is specified in the Agreement.

4. SERVICE AGENCY AGREEMENT:

As per this agreement, Issuer is appointed as a ‘Service Agent’. This agreement is signed between the “Issuer” and “Investment Agent”, where the ‘Investment Agent’ acts on behalf of the Investors.

5. PAYMENT AGREEMENT:

Through this agreement, the Investment Agent allows the Issuer to use the Investors’ share of the Musharakah Assets, against periodic rental payments.

6. UNDERTAKING TO PURCHASE SUKUK UNITS:

It is a promise undertaken by the Issuer, in favor of the Investment Agent, to periodically purchase the units. These units represent the Investors’ undivided beneficial ownership in the Musharakah Assets and purchase of all outstanding Investors’ Units in case of Default.

7. UNDERTAKING TO SELL SUKUK UNITS:

It is a promise undertaken by the investment agent in favor of the issuer. The investment agent grants a call option to the issuer, to purchase all or part of the Islamic bonds.

8. TRUST DEED:

It is executed between the Trustee, appointed by Investors for the Sukuk Issue, and the Issuer detailing the responsibilities of the Trustee.

9. LETTER OF HYPOTHECATION OR OTHER SECURITY DOCUMENTS

They are executed by the Issuer in favor of the Trustee for security purposes.

III. Salam Sukuk:

Salam allows sellers to make advance payment for goods, which are to be delivered later, provided that the goods are defined and their delivery date is fixed.

The government of Bahrain first issued Salam-based Islamic bonds, as an alternative to short-term government Treasury bills.

MECHANISM OF SALAM SUKUK:

- Suppose, a government takes an advance payment from the investors, for future delivery of goods, for example: “Crude Oil, at the rate of $50 per barrel”.

- The government issues an acknowledgment of receipt to the investors.

- At the time of completion of the contract and upon the delivery of “Crude Oil”, the Government acts as an agent of investors and sells Crude Oil to the refineries at the rate of $55 per barrel.

- The difference between the Sale and Purchase prices of crude oil is the profit of investors.

- However, these bonds cannot be traded in the secondary market.

IV. Murabahah Sukuk:

They are issued against a Murabahah transaction, where investors provide funding to the issuer, to purchase some assets.

MECHANISM:

- Assets are purchased from the supplier, and they are immediately sold to the issuer, on deferred payment.

- Profit earned from the transactions is distributed among the investors proportionately.

- However, they also cannot be traded in the secondary market.

V. Musharakah Sukuk:

- They are widely used in project financing, when a company requires funds from investors, according to the rules of Musharakah.

- Every sukuk bond would represent the holder’s proportionate ownership in the Musharakah

- Once the majority of the cash is converted into assets, these bonds can be treated as “negotiable instruments” in the secondary market.

FEATURES:

- Profit is shared according to the ratio, agreed between Issuer and Investors.

- Loss is shared on a pro-rata basis.

- To ensure traceability, at least 20% of the value of the Portfolio, should be invested in non-liquid assets.

- It is used for several purposes, including the Construction of Factories, Expansion Projects, and, Working Capital Finance.

VI. Other types of Islamic Bonds:

Islamic bonds are also issued for another mode of finance; however, the focus is given only to those modes, in which usufruct is transferred and not the ownership of the asset.

Other types include:

- Muzaarah or Sharecropping Certificates;

- Mugharasah or Agricultural Certificates; and;

- Musaaqah or Irrigation Certificates.

VII. Hybrid Structures:

- Sukuk are also issued under hybrid structures, where multiple Islamic modes are used to issue a single Sukuk.

- However, while designing such Sukuk, each of the Islamic financial modes is applied at different intervals, to cater to different requirements of the issuer.

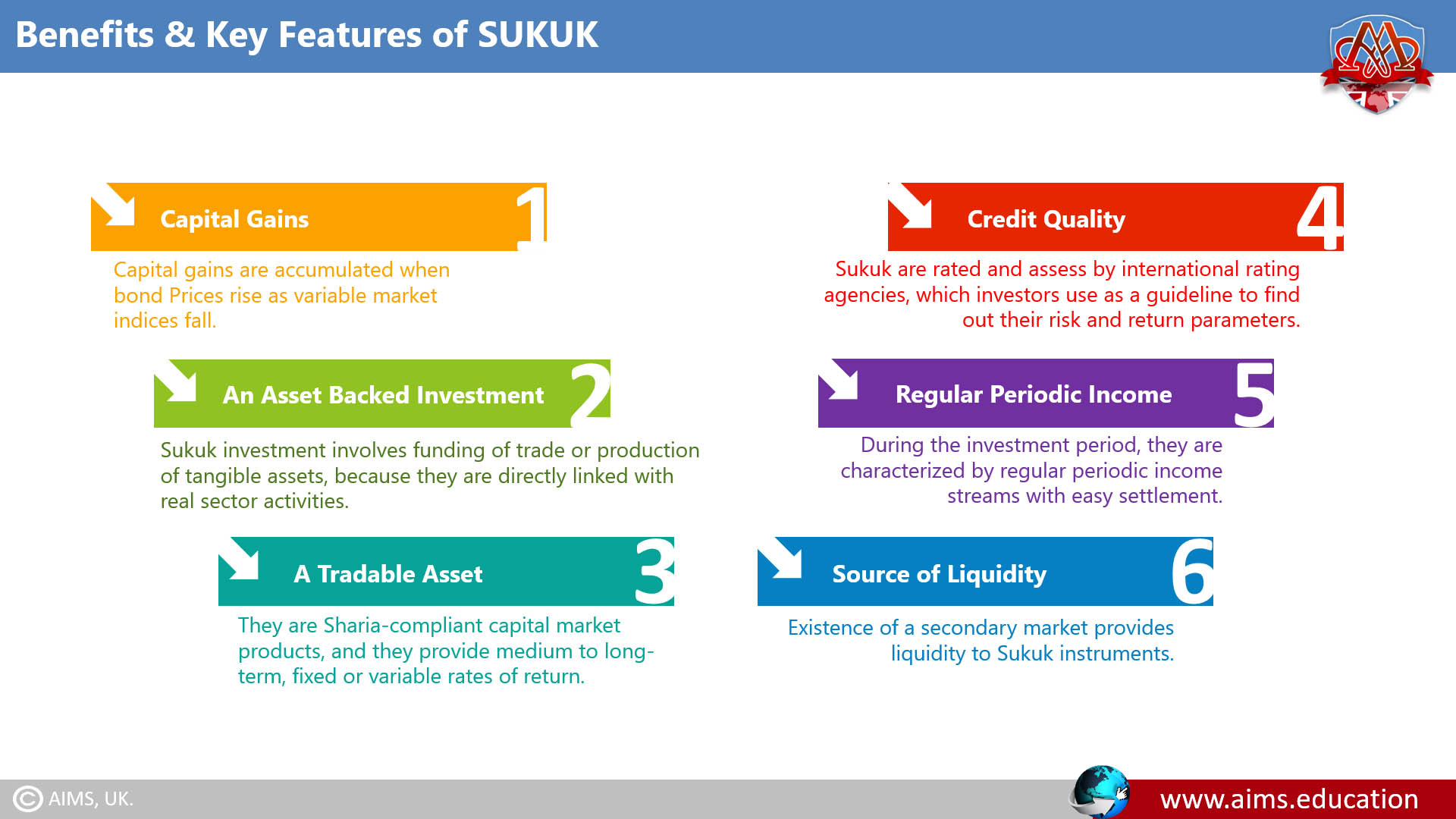

Benefits and Advantages of Sukuk:

The basic premise of Islamic bonds is that investors provide funds to a company or institution, which then uses those funds to invest in a specific asset or project. The investors then receive a share of the profits generated by that asset or project, based on their proportionate ownership in the sukuk.

- They bring a new source of funds to Islamic borrowers, generally at attractive rates.

- They are vital to developing a deeper and more liquid Islamic capital market.

- Great surplus cash in Islamic financial institutions may be tapped through them.

1. Capital Gains:

Capital gains are accumulated when bond prices rise as variable market indices fall.

2. An Asset-Backed Investment:

The investment involves funding trade or the production of tangible assets because they are directly linked with real sector activities.

3. A Tradable Asset:

They are Shariah-compliant capital market products, and they provide medium to long-term, fixed, or variable rates of return.

4. Credit Quality:

Sukuk is rated and assessed by international rating agencies, which investors use as a guideline to find out their risk and return parameters. You may refer to risk management in Islamic banking and finance for details.

5. Regular Periodic Income:

During the investment period, they are characterized by regular periodic income streams with easy settlement.

6. Source of Liquidity:

The existence of a secondary market provides liquidity to Sukuk instruments.

Applications of Sukuk:

They may be designed and issued for:

- Government;

- Corporate body;

- Banking and the financial institution; or;

- Any entity that wants to mobilize its financial resources.

1. Sukuk for Government Projects:

Ijarah-based Islamic bonds are effectively used to finance Government projects.

- When the general public is involved in the construction of these projects, it gives them a sense of ownership.

- Effective usage of these bonds increases the ratio of success and sustainability of the projects.

2. Sukuk in the Private Sector:

The corporate sector can benefit from the unique characteristics of Sukuk:

For Example:

- Musharakah Sukuk associate general customer with the company.

- “Sense of Ownership” and “Share in Company’s Profit” can be used as marketing tools, especially when the company is dealing in customer goods.

3. The Legitimacy:

The collection of assets can be represented in an Islamic bond, and this Islamic bond can be sold at a market price. However, the majority of assets must consist of physical assets, with a small portion of cash and debts.

4. International Sukuk Market:

- Bahrain was the first country to issue domestic sovereign fixed-rate Ijarah and Salam-based Islamic bonds.

- This was followed by both corporate bodies and sovereigns in several countries, who issued floating rates “Ijarah-Sukuk” and “Pooled-Sukuk”.

- Non-Muslim countries are also issuing Islamic bonds to attract surplus money from Muslim countries.

5. Navigating Challenges in Sukuk Structuring: A Global Perspective

Abu Dhabi Islamic Bank and Islamic Development Bank have pioneered the usage of sukuk as a legitimate and socially responsible means of raising capital. However, the road to mainstream acceptance has not been without issues. Challenges in sukuk structuring, such as compliance with Sharia principles and international financial regulations, have necessitated reform proposals. The Netherlands, for instance, has been exploring methods to structure sukuk within its legal and financial frameworks. For those unfamiliar with the intricacies of sukuk, numerous resources, including comprehensive PDFs, explain the concept and practices of sukuk in Islamic finance. These resources delve into various types of sukuk, such as Ijarah, Mudarabah, and Musharaka. Each sukuk type represents a different contractual agreement between the issuer and investor, providing diversity and flexibility. However, the sector also faces challenges, with cases of sukuk defaults highlighting the need for effective distress resolution mechanisms in Islamic finance. Despite these challenges, sukuk remains a fundamental instrument in Islamic finance, offering a unique alternative to conventional financing methods.

Conclusion:

Sukuk, structured to enable investors to yield returns without infringing upon Sharia law’s principles banning interest charges, provides a distinctive investment landscape. Instead of traditional interest-based returns, investors in Islamic bonds become partners in the venture, sharing its inherent risks and rewards. This innovative financial instrument has gained substantial traction in recent years, especially within the Middle East and Asia.

- Numerous governments and corporate entities have leveraged sukuk to garner funds for infrastructural projects, encompassing highways, airports, and power plants. In some instances, sukuk financing has extended to social projects, such as schools and hospitals. They, thus, present a unique investment opportunity that aligns with Islamic principles, attracting a broad spectrum of investors.

- With the continuous expansion of the global Islamic finance market, the popularity of Islamic bonds as an investment avenue is set to persist. It’s noteworthy that Islamic bonds, inclusive of both primary and secondary markets, follow a distinct trading method. In these investments, asset ownership is transferred to investors via certificates, and investments typically fund trade or the production of tangible assets.