Master Diploma in Islamic Finance (MDIF)

Islamic finance is one of the world’s fastest-growing industries, with more than 2,000 Islamic financial institutions (IFIs) operating across Muslim and non-Muslim countries. Every year, IFIs demand over 20,000 skilled professionals with expertise in Islamic finance applications. AIMS’ internationally accredited Master Diploma in Islamic Finance (MDIF) is designed to meet this growing market need. Our postgraduate diploma in Islamic Banking and Finance is job-oriented, globally recognized, AAOIFI-compliant, and 100% online, making it ideal for professionals seeking higher career prospects.

Leading scholars and practitioners developed AIMS’ Islamic finance diploma, and it does not require any prior education or experience. It prepares experienced professionals with an in-depth understanding of Shariah laws, Islamic financial systems, and consultancy practices. Students acquire versatile skills for both employment and consultancy roles in the expanding Islamic finance sector.

MDIF Course & Learning Objectives!

Through AIMS’ internationally accredited Postgraduate Diploma in Islamic Banking and Finance, graduates learn to:

Level-6 Post Graduate Diploma in Islamic Banking and Finance

AIMS is officially registered with the UKRLP and holds international accreditation. The Master Diploma in Islamic Finance (MDIF) is equivalent to the Level-6 Islamic Finance diploma and fully complies with the AAOIFI Shariah Standards. Our postgraduate diploma in Islamic Banking and Finance awards 27 credit hours, which can be transferred towards a Master’s or PhD in Islamic Finance.

Islamic Finance Diploma: A Quick Review

| Study Mode | 100% Online Education through Self-paced learning. |

| Estimated Duration | 4-5 months. |

| Study Resources | Interactive online lectures. Comprehensive study manual for every course. 24/7 Educational support by leading scholars. Online Islamic Banking and Finance Library. 14 online Assignments for progress monitoring. Real World Project to excel in practical skills. |

| Bonus | CIB and CIFE certifications upon completion of Semester I. MDIF diploma on completion of Semester II. |

| Number of Courses | Eight courses, divided into two semesters. |

| Study Requirements | 10 to 12 hours of study in a week. |

| Certificates Included | Certified Islamic Banker (CIB), Certified Takaful Professional (CTP), Certified Islamic Finance Expert (CIFE), and, Master Diploma in Islamic Finance (MDIF). |

How to Earn the Master Diploma in Islamic Finance (MDIF)?

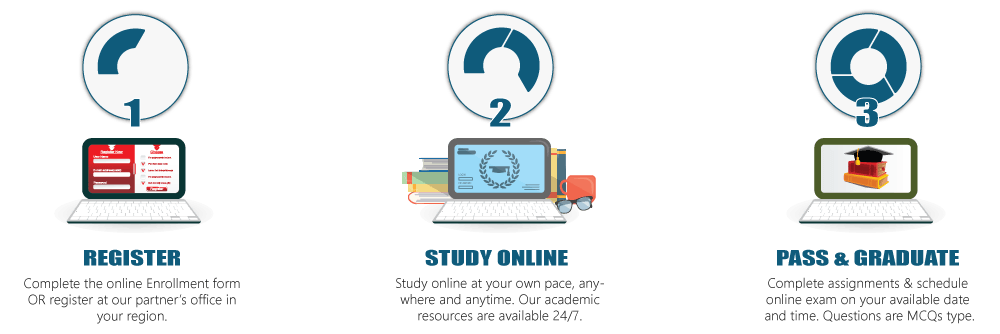

AIMS’ Master Diploma in Islamic Finance (MDIF) begins with fundamental concepts, so no prior experience or education in Islamic Finance is required. The postgraduate diploma in Islamic banking and finance comprises seven theoretical courses and one practical project. The study materials designed for these courses are enriched with real-world practical examples and case studies. Students complete two online assignments per course and enhance their practical skills through a real-world project. Assignments and the final exam are MCQ-based and scheduled online at the students’ convenience. Here are the three simple steps to earn the pg diploma in Islamic banking and finance:

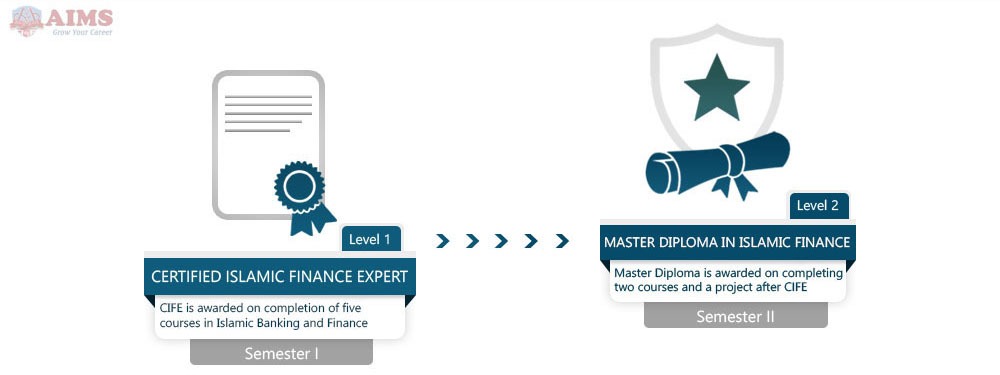

MDIF Program Structure

The Master Diploma in Islamic Finance (MDIF) program consists of 8 courses, divided into two semesters. Here is the program structure of AIMS’ postgraduate diploma in Islamic banking and finance:

Islamic Finance Diploma Curriculum Overview!

Find out more about the detailed MDIF course outline and take advantage of our 35% fee scholarship.

Hear from Our Global Learners!

“I earned my MDIF from AIMS, and it far exceeded my expectations. Throughout my postgraduate diploma in Islamic banking and finance studies, I experienced a truly unique learning approach. AIMS’ training methodology combines both theoretical knowledge and practical applications seamlessly. I appreciated the flexibility to complete my studies at my own pace, which made the learning experience stress-free yet effective. The assignments provided at the end of each module were particularly valuable in reinforcing key concepts. I highly recommend this Islamic banking diploma to anyone aiming to build a high-value, rewarding career in Islamic finance.”

“My experience with AIMS’ diploma in Islamic banking and finance has been truly exceptional. The course materials are comprehensive, well-organized, and cover all essential topics in depth. I was particularly impressed by the additional resources—such as presentations, articles, and books—that allowed me to explore each area of study far beyond the core curriculum. I can confidently apply theory in real-world financial environments. Communication with AIMS has been outstanding. The team is always responsive, professional, and genuinely dedicated to supporting students.”

“AIMS has truly transformed my career with its diploma in Islamic banking and finance. The flexible program structure allowed me to balance work and study seamlessly. After graduating, I feel confident in my knowledge and skills, fully prepared to advance in the Islamic finance industry. I highly recommend AIMS to anyone seeking a thorough, practical, and convenient learning experience.”