Masters in Islamic Finance Online – An Overview

The Islamic finance industry is growing globally, and it is driven by its ethical and Shariah-compliant principles. It is expected to generate over 1.6 million jobs globally, with a 10–12% annual growth rate. In response to the rising demand for skilled professionals, AIMS designed the MBA in Islamic Finance program, which is professionally desgined and taught by highly knowledgeable Shariah scholars and leading Islamic finance experts.

Our MBA in Islamic Banking and Finance online program is globally recognized, internationally accredited, AAOIFI-compliant, career-focused, and delivered 100% online. The AIMS masters degree in Islamic banking and finance follows a flexible, self-paced learning system. The program covers both essential and advanced areas of Islamic banking and Islamic finance, making it an ideal choice for professionals pursuing a masters in Islamic finance online. The program has been offered by AIMS since 2008, and our graduates hold key positions in leading Islamic financial institutions worldwide.

MBA Islamic Finance Program Objectives!

Level-7: Masters Degree in Islamic Banking and Finance

AIMS is a UK-registered and internationally accredited educational institution. The masters degree in Islamic banking and finance awards 45 credit hours, and fully aligns with global standards for a Level-7 postgraduate qualification. It also allows students to pursue an industry-leading PhD Islamic finance degree. AIMS’ MBA Islamic banking and finance follows AAOIFI guidelines and incorporates the latest Islamic finance and business management practices.

MBA Islamic Finance: A Quick Review

| Mode of Study: | Online & Self-paced learning. |

| Average Duration: | 12 months. |

| Study Resources: | Online Interactive lectures. Comprehensive Study manuals. 24/7 faculty support from Shariah experts. Islamic Finance e-Library. Online Assignments. |

| Courses to Study: | 13 courses & a Project in Islamic finance. |

| Study Requirements: | 10 – 12 hours of study in a week. |

| Final Assessment: | Assignments [35%], final exam [55%] and project [10%]. |

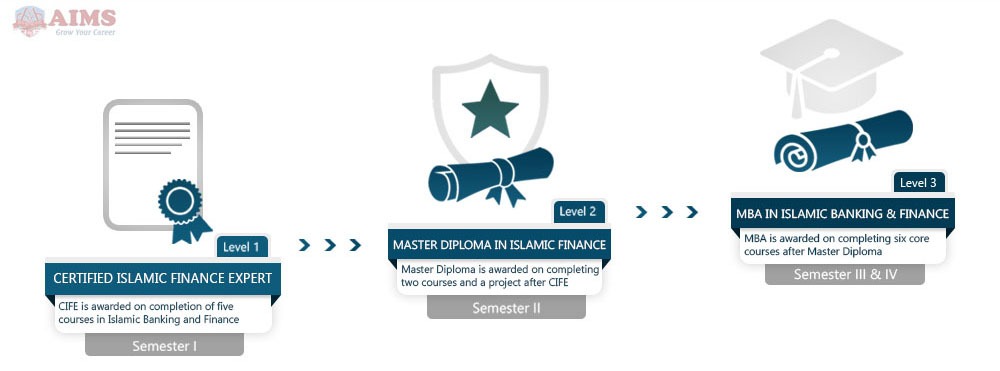

| Bonus Awards: | CIB and CIFE certifications on completion of Semester-I, and, CTP and MDIF Diploma on completion of Semester II. |

| Degree Awarded: | MBA in Islamic Banking and Finance. |

How to Achieve an MBA in Islamic Banking and Finance Online?

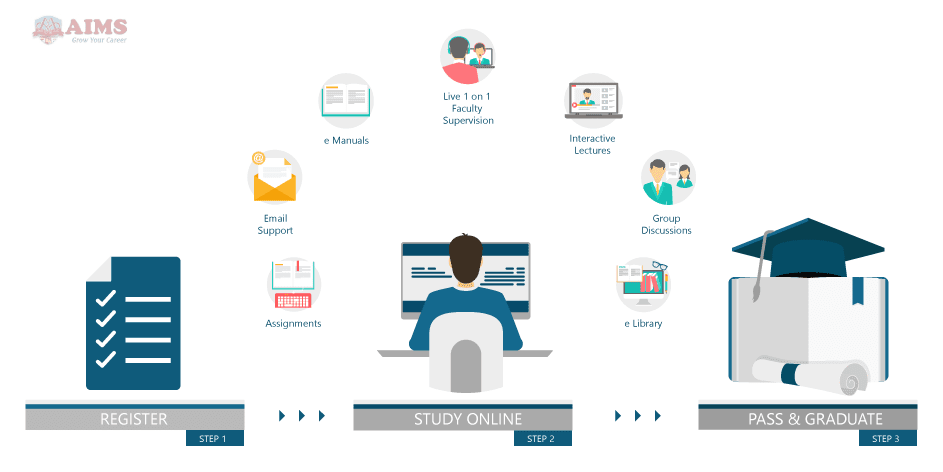

AIMS’ MBA in Islamic Banking and Finance program is offered through a flexible and self-paced learning system. The program begins with fundamental concepts of Islamic finance, and it doesn’t require any prior knowledge or experience. Students are required to study thirteen (13) courses over four semesters and submit 2 MCQ-type assignments for each course. At the end, they complete a project that applies theory to a real-world scenario. The MBA Islamic finance online studies are supported by interactive lectures, expert faculty, detailed study manuals, and a comprehensive Islamic finance e-library. They are enriched with case studies and real-world examples. The Masters in Islamic Finance online degree is completed in three simple steps:

MBA in Islamic Finance Program Structure!

AIMS’ Masters in Islamic Finance online equips students with advanced knowledge and practical skills in Islamic banking and finance, which today’s employers demand. AIMS’ Masters in Islamic banking and finance covers seven concentration courses in Islamic banking and finance (21 credit hours), followed by six core business management courses (18 credit hours), and concludes with a real-world Islamic finance project (6 credit hours).

Masters in Islamic Finance – Curriculum Overview!

AIMS’ MBA in Islamic Banking and Finance offers a comprehensive, four-semester curriculum that blends global Islamic finance expertise with modern business management skills. The first two semesters cover seven (7) Islamic finance concentration courses and an Islamic finance project. The remaining two semesters of our Masters degree in Islamic banking and finance cover six (6) business management core courses, preparing graduates for key roles in IFIs worldwide.

Explore the comprehensive MBA Islamic Finance curriculum and discover our 35% scholarship opportunity.

Hear from Our Global Learners!

“The Masters degree in Islamic Banking and Finance from AIMS transformed me into an Islamic finance expert. With an outstanding curriculum, expert faculty, and continuous online academic support, I was equipped with both theoretical knowledge and practical skills. The well-organized curriculum, interactive lectures, and e-manuals were invaluable in my learning journey. The assignments and real-world project helped me apply concepts through real-life case studies, truly enhancing my professional expertise. Choosing AIMS for my MBA in Islamic Banking and Finance was a decision I’ll never regret.”

“Studying Islamic finance at AIMS helped me realize the gap in understanding Islamic financial products and Shariah requirements at top levels of our local Islamic Finance Window. AIMS’ MBA in Islamic Banking and Finance program developed my analytical skills to advise companies on Shariah-compliant practices. The curriculum is well-structured, and the faculty was highly supportive. I strongly recommend AIMS’ MBA in Islamic finance program to everyone, especially my colleagues.”

“Enrolling at AIMS for Islamic Banking and Finance was one of the best decisions for my career. AIMS’ flexible masters degree in Islamic banking and finance fit perfectly into my busy schedule, while the expert faculty and high-quality lectures set the program apart. The industry-focused MBA in Islamic banking and finance qualification enhanced my confidence and deepened my understanding of managing Islamic financial institutions. I highly recommend AIMS to anyone seeking career growth in Islamic banking and finance.”

“I chose AIMS because I wanted an internationally accredited and respected masters degree in Islamic banking and finance — and I was not disappointed. The course not only gave me a solid foundation in Islamic banking, but also prepared me for a PhD in Islamic Finance, which I’m now pursuing. The structured progression, global recognition, and exceptional academic support make this MBA Islamic Banking and Finance program the best investment I’ve made in my future”

“AIMS’ Masters in Islamic Finance Online exceeded my expectations. The curriculum is not just academic — it’s industry-ready. I proudly earned the CIB, CIFE, and MDIF certifications along the way, and they’ve become key credentials in my current leadership role. As a full-time professional and mother of three, AIMS’ flexible and self-paced learning system was the perfect solution. The MBA in Islamic Banking and Finance program allowed me to balance my career, family, and studies without compromise. The interactive lectures, e-manuals, and faculty support made complex concepts easy to grasp.”