Certified Islamic Finance Expert (CIFE)

Islamic finance is one of the world’s fastest-growing industries, expanding at a rate of over 20% annually. With a demand for more than 80,000 qualified professionals, the industry urgently needs skilled experts. To meet these demands, AIMS’s experienced faculty developed the Certified Islamic Finance Expert (CIFE) – a global Islamic banking and finance certification that balances theoretical knowledge with practical application.

CIFE is the best Islamic finance certification and a top-rated Islamic finance course, globally recognized, internationally accredited, and career-oriented. It aligns with AAOIFI standards and has been offered 100% online by AIMS since 2005. This Islamic finance qualification includes five in-depth Islamic banking and finance courses, delivered through an interactive and self-paced online learning system.

Islamic Finance Course Learning Objectives!

Level-5: Global Islamic Banking and Finance Certification

AIMS, based in the United Kingdom, offers the Level-5 Islamic finance certification, which is internationally accredited and fully compliant with AAOIFI Shariah standards. The Islamic finance course carries 15 graduate-level credit hours, which may be transferred toward the Postgraduate Diploma and MBA in Islamic Finance programs. This Islamic finance qualification also meets the entry requirements for a PhD in Islamic Finance.

Islamic Banking and Finance Courses – A Quick Review

| Study Mode: | Online and Self-paced learning. |

| Estimated Duration: | 2-3 months. |

| Study Resources: | Interactive online lectures. Five comprehensive study manuals. 24/7 Academic support by Islamic finance scholars. Islamic Finance e-Library. Ten Online Assignments. |

| Number of Courses: | Five (5) specialised Islamic banking and finance courses. |

| Study Requirements: | 10 to 12 hours of study a week. |

| Certifications Awarded: | Certified Islamic Finance Expert (CIFE) and, Certified Islamic Banker (CIB) on equivalency. |

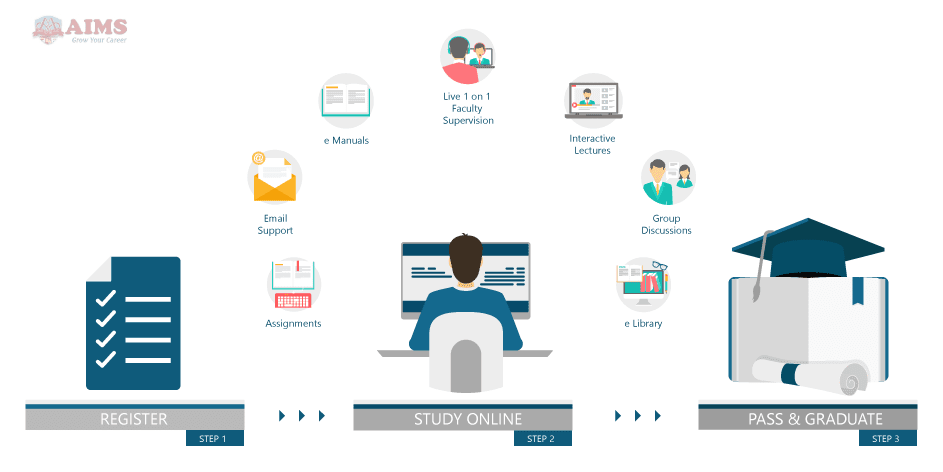

How to Earn the Islamic Finance Certification Online!

To earn the CIFE Islamic finance qualification, students are required to register online, study five Islamic banking and finance courses using our interactive lectures, comprehensive study manuals, and Islamic finance library at their convenience. They must complete two assignments for each Islamic finance course and finally request the final examination, which can be scheduled at their convenience. Details are available here:

Islamic Finance Course Curriculum!

Each Islamic finance course included in the CIFE certification has been carefully developed to ensure alignment with AAOIFI standards. The Islamic banking and finance courses keep a balance between theoretical knowledge and real-world application.

Find out more about the detailed CIFE course outline and take advantage of our 35% fee scholarship.

Hear from Our Global Learners!

“I recently completed the Certified Islamic Finance Expert (CIFE) program from AIMS, and it significantly enriched my professional expertise. The CIFE Islamic finance course is perfectly aligned with AAOIFI Shariah and Auditing standards. The Islamic banking and finance courses are well-structured and effectively simplify complex concepts. The program not only deepened my understanding but also enhanced my ability to implement Islamic financial instruments in the real world.”

“I greatly benefited from AIMS in gaining the knowledge and confidence to become an Islamic finance expert. Their Islamic finance course is well-structured and supported by valuable and practical study materials. I truly appreciate the effort AIMS has invested in designing the online lectures and study manuals for their Islamic banking and finance courses. Every topic was clearly explained with real-world examples. I can confidently say that enrolling in AIMS’ CIFE ertification was one of the smartest career decisions I’ve made.”

“AIMS’ Islamic finance qualification has exceeded my expectations. As a corporate banker in the UAE, I was looking for a global Islamic banking and finance certification that offers practical learning. This Islamic finance course has helped me apply Shariah-compliant finance principles to real-world corporate scenarios. I’m truly thankful to AIMS.”

“AIMS’ Certificate in Islamic Finance gave me both academic depth and job readiness. The CIFE certification was flexible, online, and the faculty support was outstanding. AIMS truly offers the best Islamic finance certification for students planning a growth and career in top Islamic financial institutions (IFIs).”

“The online Islamic finance course offered by AIMS was a perfect fit for me as a busy professional. Their user-friendly study portal, strong academic support, and high-quality learning resources, make CIFE the best Islamic finance certification. The program keeps a good balance between theory and industry application, making it ideal for professionals (like me) who are seeking both knowledge and practical expertise.”

Key Benefits of AIMS’ Islamic Finance Qualification

AIMS’ Islamic finance certification offers numerous career-boosting and personal development benefits. Whether you’re advancing professionally or deepening your expertise in Islamic banking and finance, our Islamic finance course is a globally respected qualification.