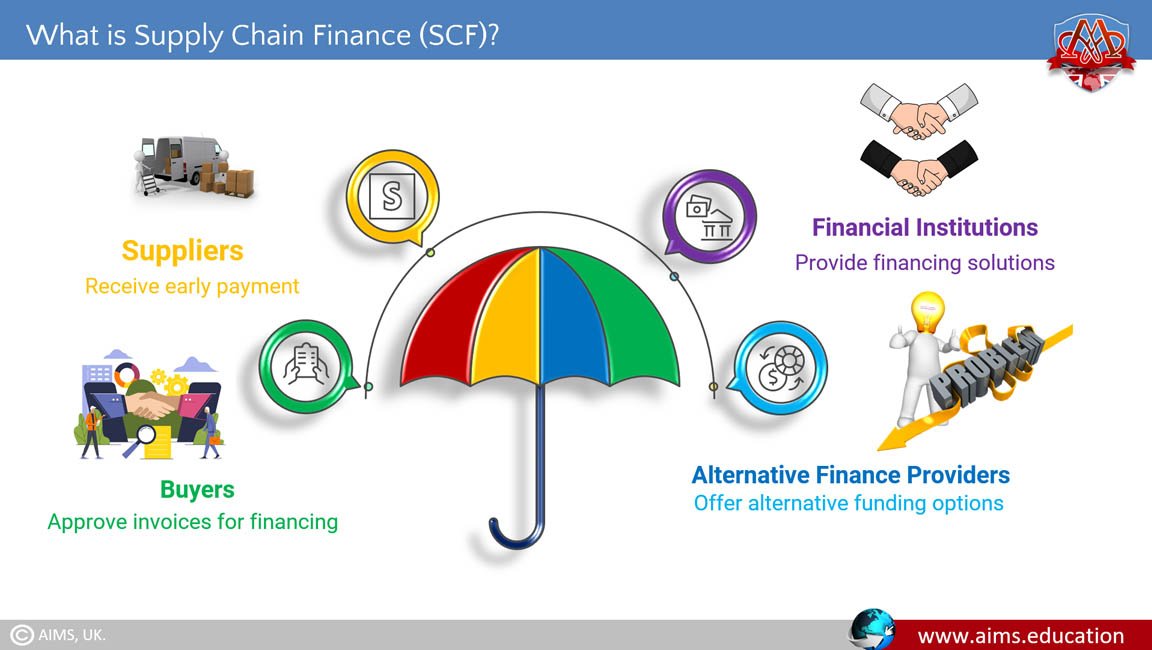

What is Supply Chain Finance?

Supply chain finance, also termed reverse factoring or supplier finance, is a collection of technology-based financing solutions businesses use to heighten cash flow and urge collaboration between supplier and buyer. It aims to reduce financing costs and enhance business competence for sellers and buyers in sales transactions. Supply chain finance procedures based on automatic transactions and tracking invoice consent and payment clearance, from start to end.

Under this concept, buyers approve their suppliers’ invoices for financing through a bank or other resources referred to as “factors” like financial institutions, or alternative finance providers. The outcome is a win-win situation between buyers and suppliers. The supplier creates an additional functional cash flow, and the buyer heightens working capital, reducing risk during the supply chain.

4 Key Areas in Supply Chain Finance

Here are the four key components of supply chain finance:

1. Working Capital Management

It manages the cash flow for daily operations for buyers and improves working capital by extending payment conditions to suppliers.

2. Supplier Financing

Supplier financing allows suppliers to receive early payment on invoices to maintain stable cash flow. Suppliers’ collaboration with financial funding bodies allows buyers to lengthen payment conditions to suppliers when they demand early payment.

3. Buyer Financing

Buyer financing allows buyers to improve their working capital by lengthening payment conditions and ensuring timely payment to the supplier. Buyer collaborates with financial funding bodies to secure funding and control financial competencies to ensure early payment to the supplier.

4. Inventory Financing

It relates to inventory-related costs and improving cash flow by utilizing inventory as security lets businesses secure their inventory financing.

Supply Chain Finance Example

To make things clearer just consider an example. A usual lengthy payables transaction runs as follows:

- The Company ABC buyer purchases products from the Supplier XYZ seller.

- Under conventional conditions, Supplier XYZ ships the products, and then tenders payment invoices to Company ABC, which endorses the payment on standard credit terms of 15 days.

- But if Supplier XYZ urgently requires payment, it can appeal for urgent payment at a discounted rate, from Company ABC’s associated finance body.

- If approved, the financial body agent issues cash to Supplier XYZ, and consecutively, lengthens the payment time for Company ABC, for extra 15 days, for a total credit term of 30 days, rather than the 15 days assigned by Supplier XYZ.

It is a win-win situation because the buyer becomes hold of their working capital for a long period of time without disturbing their association with the supplier, and the supplier receives their payment on an early basis, providing them more working capital to implement and other benefits too.

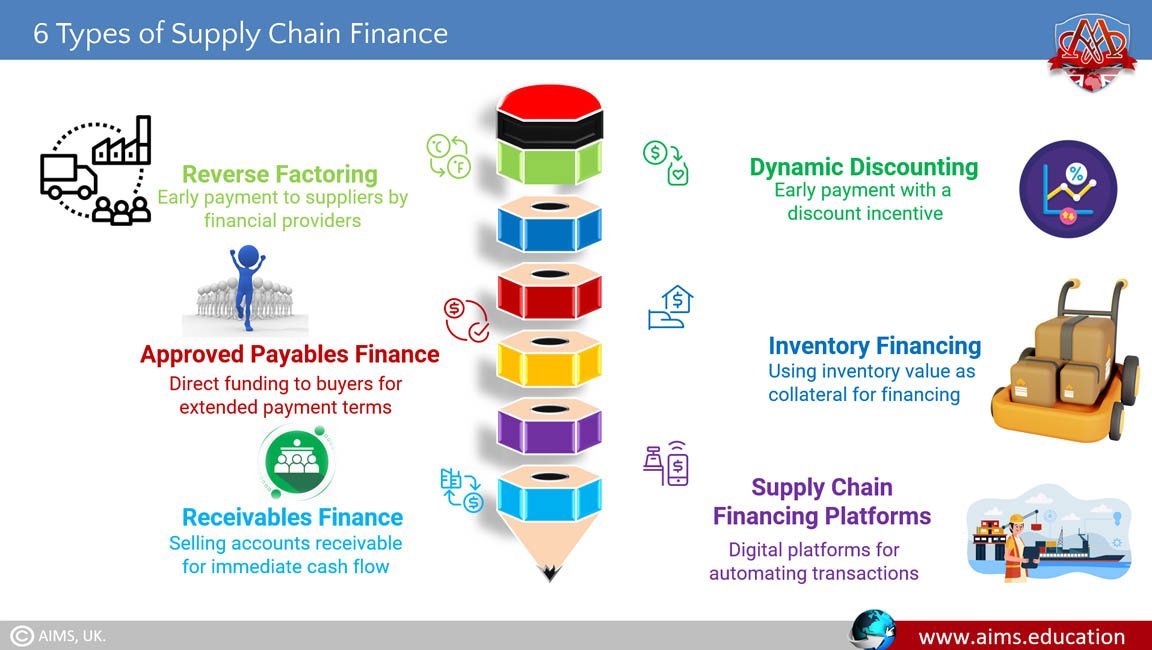

6 Types of Supply Chain Finance

Supply chain finance networks have different kinds, providing businesses flexibility in improving their financial methodologies. Following are some common forms of supply chain finance:

1. Reverse Factoring

It offers finance funding bodies to reach an agreement to pay suppliers in aid of the buyer, making suppliers get early payment. The buyer then disburses the same amount to the financial provider later.

2. Dynamic Discounting

In dynamic discounting, buyers offer suppliers early payment under a discount on the invoiced amount. Therefore the supplier gets an incentive to compensate ahead of schedule.

3. Approved Payables Finance

In this type, the financial funding bodies give direct funding to the buyer. The buyer uses it to lengthen payment conditions to their suppliers. It helps buyers to improve their working capital with assurance of timely supplier payment.

4. Inventory Financing

Inventory financing uses the inventory value as finance security. It offers businesses to make space for capital in inventory and influence further operational processes.

5. Receivables Finance

It implicates selling accounts receivable at a discount to a financial funding body. It offers instant cash flow to the seller.

6. Supply Chain Financing Platforms

Recently, supply chain finance is a digital platform that evolved as a competent solution to associate suppliers, buyers, and financial funding bodies, to reform the process. They offer automation, visibility, and real-time tracking of transactions.

How Does Supply Chain Finance Work?

Supply chain finance can be applied successfully when the buyer has a better credit rating than the seller, and can subsequently obtain capital from a bank or other factors at a reduced cost. This benefits the buyer negotiates better than the seller, like lengthy payment schedules. In the meantime, the seller can deliver its goods faster, to collect instant payment from the financing body agent.

Once supply chain finance is operating, suppliers can demand early payment on invoices. From there, the supply chain finance methodology acts out and predictably appears like this:

- Buyer procurements products from the supplier.

- Supplier releases their payment invoice to the buyer, with a due date.

- Buyer agrees on the payment invoice.

- Supplier demands early payment.

- The finance funding agency issues payment to the supplier after a slight fee deduction.

- Buyer disburses the finance funding agency on the invoice’s due date.

Supply Chain Finance Solutions

Supply chain finance benefits both buyers and suppliers in numerous ways:

1. Benefits for Suppliers

a. Improve Working Capital

Using supply chain finance, suppliers can get earlier payment on invoices, and their day’s sales outstanding (DSO) is minimized, providing them with more working capital.

b. Retrieve Reduced-Cost Funding

If the supplier practices other sources than supply chain finance, the cost of funding is often reduced. Therefore, supply chain finance is an appealing way for the supplier to get funds for suppliers.

c. Enhance Cash Forecasting Accuracy

Supply chain finance offers the supplier more certainty to obtain payment on their invoices, making it easy for them to forecast their cash flow more accurately.

2. Benefits for Buyers

a. Improve Working Capital

Supply chain finance also improves the working capital for buyers as various businesses prioritize supply chain finance methodology to apply together with an initiative to correspond with supplier payment conditions.

b. Enhance Supply Chain Health

Buyers by offering supply chain finance to suppliers lower supply chain disturbance that may affect their processes in the future.

c. Strengthen Supplier Relationships

By applying supply chain finance, Buyers’ association with suppliers gets improved by offering them reduced-cost funding and a stronger negotiating position.

d. Flexible Funding

Some businesses may wish to retrieve supply chain finance in combination with dynamic discounting. For example, when businesses have excess cash at a specific time of the year they go for dynamic discounting but at another part of the year, they go for supply chain finance instead.

Sometimes businesses opt for two different financing solutions from different vendors, but it depends on the supplier experience. Otherwise, vendors offer flexible funding that permits buyers to exchange flawlessly among the two methods as the requirement occurs.

8 Steps to Implement Supply Chain Finance

Supply chain graduates study supply chain finance in detail during the logistics and supply chain diploma and MBA degree in supply and logistics management to develop skills, so the students can smoothly implement supply chain finance methodology. The following steps are involved in smooth execution and continuous financial transactions.

1. Agreement and Setup

The supplier, buyer, and financial funding body are included in the agreements that plan the terms and conditions. It establishes the payment terms, discount rates, and other related information necessary for a contract.

2. Invoice Authentication

After selling goods and services, the supplier sends an invoice to the buyers regarding terms and conditions. The buyers agree on it to verify invoice validity and ensure it aligns with the terms of finance institutions.

3. Invoice Proposal

When an invoice is verified by the buyer, the supplier tenders it to the financial funding body through a digital platform or sends it through a secure channel.

4. Credit Value Estimation

The funder estimates the buyer’s credit rating and assesses the invoice particulars. They estimate the buyer’s payment history and financial solidity.

5. Timely Payment Choice

If the invoice fulfills the funder’s requirements, the financial institution offers a timely payment choice to the supplier. It may include an advance payment option.

6. Supplier Approval

The supplier reconsiders the timely payment offer and if they accept it, they get timely payment from the financial body, promoting their cash flow and liquidity.

7. Payment Clearance

The buyer clears the invoice with the financial body at the scheduled payment date.

8. Reporting and tracking

During the whole process, stakeholders have approached the entire scenario by real-time reporting and tracking of transactions. It offers visibility into payment statuses, timely payment proposals, and financial metrics, assisting in real monitoring and analysis.

Advantages and Disadvantages of Supply Chain Finance

Advantages of Supply Chain Finance

Some of the advantages of supply chain finance are:

- Improved cash flow and working capital management

- Enhanced supplier association with buyers

- Provide access to cheaper financing

- Helps relieve the risk in supply chain regarding delays in payment and non-payment.

Disadvantages of Supply Chain Finance

With bundles of advantages, there are some drawbacks of supply chain finance:

- Potential cost to suppliers in terms of discounts or fees associated with early payment.

- Dependency on financial institutions requires trust in their capabilities and reliabilities

- Program implementation challenges such as administrative complexities, contractual negotiations, and integration arise.

- Potential impact on relationships between buyers and suppliers if not implemented carefully.

Frequently Asked Questions

Q1: What is supply chain finance?

Supply chain finance is a financing system that enhances cash flow between buyers and suppliers by enabling early payment and extending credit terms.

Q2: How does supply chain finance work?

Buyers approve supplier invoices for financing through a bank or funder, giving suppliers early payment and allowing buyers more time to pay.

Q3: What are the key components of supply chain finance?

They include working capital management, supplier financing, buyer financing, and inventory financing.

Q4: What are common types of supply chain finance?

Reverse factoring, dynamic discounting, approved payables finance, inventory financing, receivables finance, and SCF digital platforms.

Q5: Can you give an example of supply chain finance?

Supplier XYZ sells to Buyer ABC. If XYZ needs early payment, ABC’s bank pays immediately while ABC repays later, benefiting both.

Q6: What benefits does SCF offer suppliers?

It provides faster payments, reduced borrowing costs, stronger cash flow, and more predictable financial planning.

Q7: How does SCF benefit buyers?

Buyers extend payment terms, increase working capital, and improve supplier relationships through collaborative financing.

Q8: What are disadvantages of supply chain finance?

It can involve supplier fees, administrative complexity, and reliance on third-party finance institutions.

Q9: What are the steps to implement SCF?

It includes agreement setup, invoice verification, proposal submission, credit evaluation, supplier approval, and payment tracking.

Q10: What is the future of SCF?

Digital platforms with automation, analytics, and blockchain will make supply chain finance faster, transparent, and globally integrated.