CIB Course – Global Islamic Banking Certificate

Islamic banking and finance is one of the fastest-growing industries, creating high demand for thousands of qualified professionals. To meet this need, AIMS introduced the CIB course in 2005. The Certified Islamic Banker (CIB) is among the most job-oriented and globally recognized Islamic banking courses, designed in compliance with AAOIFI Shariah standards and developed by leading Shariah scholars. The CIB Islamic banking certification is delivered 100% online, allowing students to study anytime, anywhere.

The Islamic banking courses offered under CIB use interactive learning methods and are tailored to develop the core skills that employers in the Islamic finance industry seek. Financial institutions widely respect the program, and our Certified Islamic Banker graduates work with renowned Islamic banks and institutions worldwide.

CIB Certification Learning Objectives !

Level-4 Global Islamic Banking Certificate

The Certified Islamic Banker (CIB) is a career-oriented qualification that holds international accreditation and recognition. The Islamic banking courses included in the CIB course are designed in compliance with AAOIFI Shariah standards. The nine graduate-level credit hours earned through this program can be transferred towards a Diploma, MBA, or PhD program in Islamic banking and finance.

CIB Course – A Quick Review

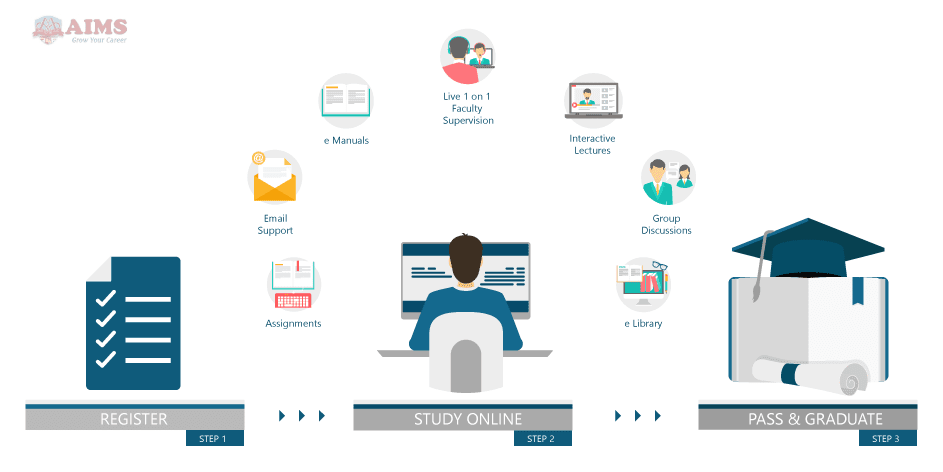

| Study Mode | Online and Self-paced learning. |

| CIB Course Duration | 2-3 Months. |

| Study Resources | Interactive online lectures, Three comprehensive study manuals, Academic support by the Islamic Banking faculty, Online Islamic banking library, and, Six Online Assignments. |

| Number of courses | Three (3) online Islamic banking courses. |

| Study Requirements | 10 to 12 hours of study a week. |

| Credits | 20+ |

| Islamic Banking Certification Awarded | Certified Islamic Banker (CIB) certificate. |

CIB Course Curriculum!

To earn our global Islamic banking certificate, students must complete three Islamic banking courses online, at their convenience. Here’s an overview of the modules covered in the Islamic banking certification program.

Find out more about the detailed CIB course outline and take advantage of our 35% scholarship on fee.

Hear from Our Global Learners!

“The Islamic banking courses offered by AIMS develop expertise for anyone eager to enter the rapidly expanding Islamic banking sector. Earning a Certified Islamic Banker (CIB) certificate is a noteworthy achievement, especially for professionals in the conventional banking industry who are willing to start an Islamic banking career.”

“The Certified Islamic Banker from AIMS is an essential Islamic banking qualification for anyone willing to start a career in Islamic banking. The global recognition of the CIB Islamic banking certification has opened doors for me to work with major Islamic financial institutions. AIMS’ comprehensive Islamic banking training have provided me with the knowledge and skills I needed to take on more significant responsibilities in my career.”

“After becoming a Certified Islamic Banker (CIB), I was able to navigate the complexities of the Islamic banking industry. The online Islamic banking course provided me with practical skills that opened more career opportunities in Islamic banking. CIB is an invaluable Islamic banking qualification that aligns perfectly with the industry’s growing demand for highly skilled professionals.”

“This specialized and internationally recognized Islamic banking certificate course from AIMS significantly advanced my career in Islamic banking. The CIB course’s in-depth coverage of Islamic banking products and real-world management training of these products enhanced my Islamic banking expertise, which helped me perform a versatile role as a banking advisor.”

“The CIB certificate from AIMS has been a crucial stepping stone for me. This global Islamic banking certificate helped me secure a key role in a leading Islamic financial institution. It’s an excellent Islamic banking certification for anyone looking to perform better in or switch careers to Islamic banking.”