What is an Ariyah?

Ariyah is an Arabic term that refers to the lending of non-fungible objects for a gratuitous purpose. In classical Islamic jurisprudence, Ariyah (also spelled Aariyat) is defined as making another person the owner of the benefit of something without compensation. This includes lending items such as tools, utensils, clothing, jewelry, or animals for temporary use. The key distinction is that the borrower is expected to return the same item after use and not something similar or its value, unlike in monetary loans (Qard).

According to Islamic jurists

“The ummah is unanimous that Aariyat is not only permissible but also good because it helps the distressed and those who do not possess with what they need.”

Aariyah and Islamic Social Values

Lending small things temporarily is seen as a high moral value in Islam, for which moral inducements are given. The borrower is advised not to look upon the borrowed item as his own but to return it promptly after use.

“The responsibility for returning the thing borrowed is on the borrower.”

Ariyah is closely associated with the values of generosity, social solidarity, and the ethics of community welfare.

Concept of Aariyah from Quran and Hadith

Aariyah in the Quran

Although the term “Ariyah” is not explicitly mentioned in the Qur’an, the concept is deeply embedded in the spirit of Islamic teachings. Verses encouraging kindness, trust, and returning what is borrowed are foundational to the practice of Aariyah:

“And refuse maa’un (small kindnesses).”.

Surah Al Maa’un 107:07

“Verily, Allah commands that you should render back the trusts to those, to whom they are due.”.

Surah Al’Nisa 4:58

“Is there any reward for good other than good?”.

Surah Ar-Rahman 55:60

These verses support the notion that lending and returning items responsibly is part of righteous behavior.

Ariyah in the Ahadith

The Prophet Muhammad (peace be upon him) emphasized helping others and lending without compensation as acts of virtue:

“A Muslim is the brother of another Muslim. He should not oppress his brother or hand him over to the enemy. The individual who fulfills the need of his Muslim brother, Allah will fulfill his need …”.

Sunan Abu Dawood Vol. 2, P. 314

“During the journey of Me’raj, I saw written on the door of Jannah: ‘The one who gives charity is rewarded tenfold. The one who gives a loan is rewarded 18 fold.’ I asked Jibrail: ‘Why the one who gives a loan gets more reward?’ Jibrail replied: ‘The one who gets charity (usually possesses a small amount already) and the one who seeks a loan only does so when in dire necessity.” .

Sunan Ibn Majah: 175

“Whoever relieves a Muslim from worldly hardship, Allah will relieve him from the hardship of the Day of Judgment.”.

Sunan Ibn Majah: 225

Ariyah as a Benevolent Act

Ariyah is a benevolent contract that allows one to benefit from another’s property without charges. It enables borrowers to:

- Increase their access to resources.

- Fulfill basic or urgent needs.

- Perform actions otherwise beyond their financial means.

In Islamic banking and finance education, Aariyah is discussed as a socially responsible contract and a moral alternative to commercial lending.

Practical Application of Ariyah in Islamic Banking and Finance

In modern Islamic finance, Ariyah can be structured into contracts where a lender allows temporary use of an asset, such as lending a building for religious or charitable purposes without rent. Though not a profit-making contract, it reflects Islamic values of cooperation and community service.

For example, an individual might lend their farmland for community agricultural use or allow the use of equipment to someone starting a business. The property remains under the ownership of the lender, and the borrower must return the item in its original condition unless damaged beyond their control.

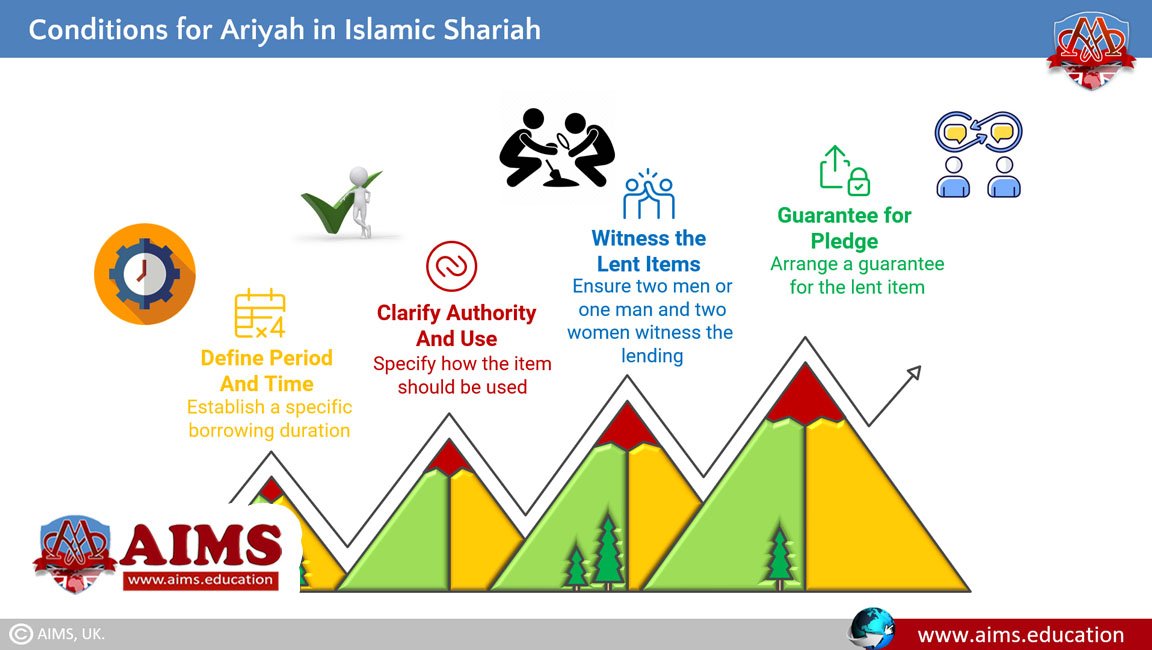

Conditions for Ariyah in Shariah

Islamic law outlines the following conditions:

1. Defined Period and Time:

The borrowing duration should be agreed upon in advance.

2. Clear Usage Authority:

The lender may specify how the item should be used.

3. Proper Documentation and Witnessing:

It is preferable to have two male witnesses, or one male and two females, especially for significant items.

4. Pledge as Security:

A pledge may be requested to ensure the return of the item.

Guidelines for Keeping an Ariyah

The lender has the right to demand the return of the item even before the agreed time.

- If the item is lost despite the borrower’s due care, the borrower is not liable.

- If negligence is proven, the borrower must compensate the owner.

- With the owner’s permission, the borrowed item may be lent to another.

- Parents must not use or lend immature children’s belongings; doing so requires compensation if lost.

- Upon the owner’s death, the borrower must return the item immediately and refrain from further use without the heir’s consent.

Comparative Insight – Ariyah VS Other Contracts

To better understand Ariyah, we compare it with Amanah (trust), Qard (Islamic loan) and Ijarah contract in Islamic banking and finance:

| Contract Type | Nature | Object Type | Compensation | Responsibility of Return | Liability for Loss |

|---|---|---|---|---|---|

| Ariyah | Lending for use | Non-consumable (tools, property) | No | Return same item | Yes, if negligent |

| Amanah | Safekeeping (Trust) | Any valuable | No | Return in same condition | No, unless negligent |

| Qard | Loan | Consumable (money, food) | No | Return equal value | Always liable |

| Ijarah | Lease or Rent | Property, services, assets | Yes | Return in the same condition, subject to contract terms | Yes, unless due to fair wear and tear |

Contemporary Relevance

The principle of Ariyah can be integrated into ethical finance and non-profit operations. In humanitarian contexts, Ariyah contracts can provide needed items without financial strain. AIMS Education cover this subject thoroughly in their online Islamic banking diploma and certification in Islamic Finance, helping students apply classical jurisprudence in today’s financial practices.

Final Words

Ariyah exemplifies the Islamic ethos of generosity, mutual aid, and community support. Unlike Qard, it does not involve consumables or monetary value but rather centers on lending usable goods without expectation of return or profit. The simplicity, flexibility, and moral strength of Ariyah make it a valuable tool in Islamic finance and personal ethics. For Islamic scholars and practitioners in Islamic Banking and Finance, understanding Ariyah is essential for preserving ethical standards and promoting socio-economic justice.