What is Islamic Microeconomics, and What Does it Deal With?

Microeconomic theory deals with the behavior of economic agents of the economic system, like consumers, firms, and factors of production. Subsistence and the means of subsistence are bound up individually and collectively, and human life influences one another. They raise some important questions in price theory in Islamic economics and finance that lead to microeconomics in Islam. The questions raised by the Islamic microeconomics in Islam are:

- What are the commands with respect to the individual?

- What is one to earn?

- What is one to spend? and;

- On whom to spend?

According to the Islamic perspective, there are two important questions:

- What income may be looked upon as permissible? and;

- What are the permissible ways to dispose of it?

Islamic Microeconomics is about How to Earn and Spend

Islam encourages one to strive for a living according to one’s capacity. According to the laws of Islamic Shariah, the world is for effort; inertness is death. And Allah has placed many treasures on this earth, but to find them is conditional on us.

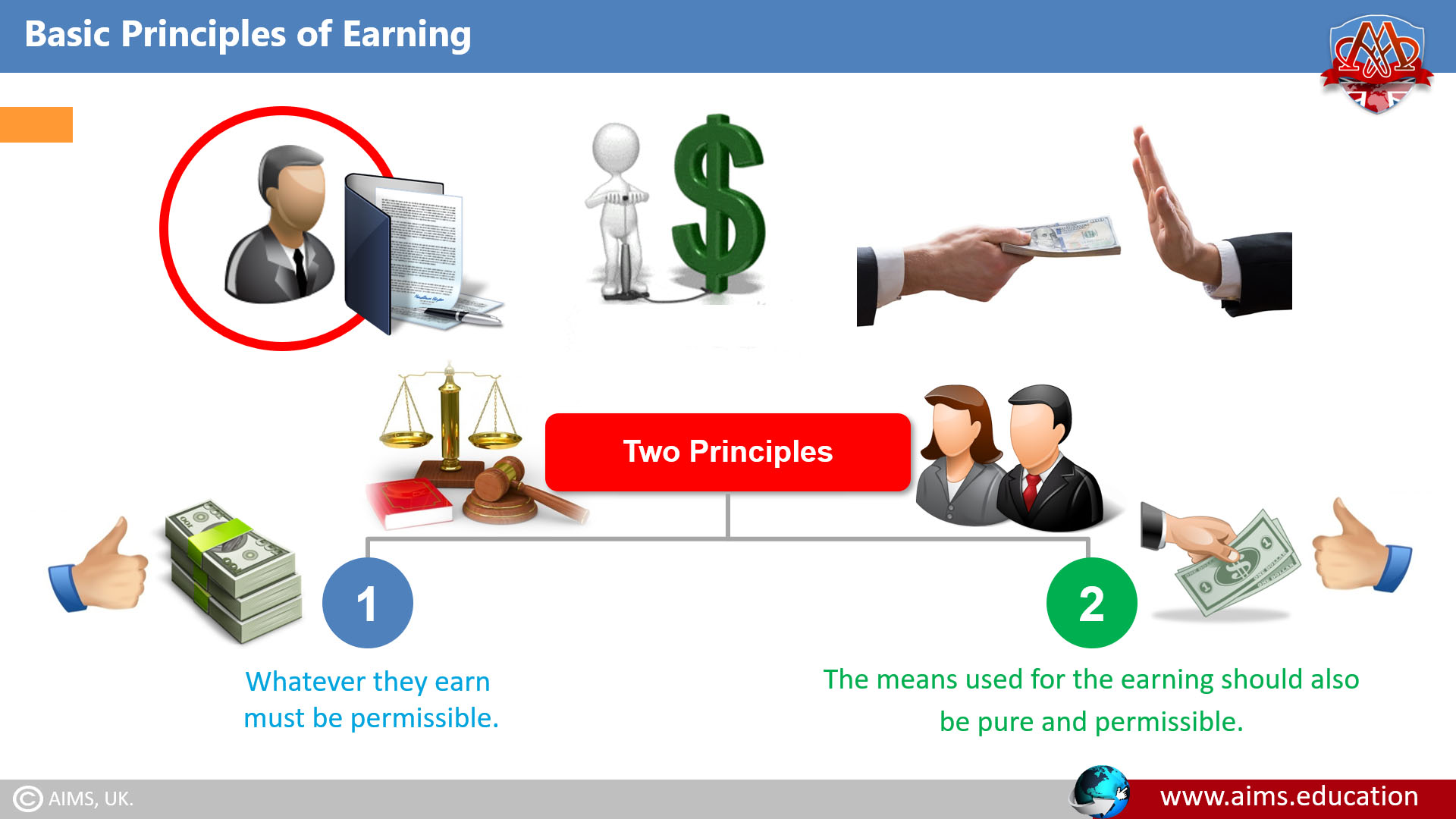

Basic Islamic Principles of Earning

The individual is bound to certain Islamic principles, which prevent the economy from becoming corrupt. According to Islamic Shariah, humans must always keep two principles before them.

- First, whatever they earn must be permissible.

- Second, the means used for earning should also be pure and permissible.

Following these two laws will keep our spirits and hearts pure and safe from evil. Moreover, our means should not create economic difficulties for others, such as oppression and cruelty.

Microeconomics in Islam and Principles of Spending

Spending is necessary for life’s development. So, it is important to know;

- What to spend?

- How much to spend? and

- What to spend?

Humans spend their money on themselves and others. Microeconomics in Islam is based on the complete guidelines given in the Quran and Ahadith.

Islamic Principles for Spending on Personal Needs

According to the spending theory of Islamic microeconomics, neither extravagance, spending on useless things, nor miserliness is proper. A person should be moderate in spending because it contributes to a better collective economic order.

Islamic Principles for Spending on Other’s Needs

According to Islamic Shariah, the more a person earns, the more responsible he or she is for satisfying others’ needs.

- The first rights on the individual’s income are those of the family.

- Besides Zakath, other charities and social rights are also incumbent on the individual.

In normal circumstances, the “secondary dues” should be paid so that a reasonable amount is saved for the family so that they may not be left indigent and begging. However, in special conditions, selfless giving away is commendable.

Scope of Conventional Microeconomics

1. Understanding the Scope of Conventional Microeconomics

Contrary to the scope of Islamic microeconomics, the scope of conventional microeconomics is purely materialistic, as can be seen in the following theories:

2. Price Theory

Each conventional economic system has to decide what to produce, how to produce it, and how to allocate resources.

Under capitalism, all such is performed with the help of the “Price Theory.” That is, those goods should be produced to maximize profits. Those techniques should be adopted to minimize the costs of production. Resources should be allocated to those uses where the resources command higher prices, etc. So, we can say that in microeconomics, we deal with the problems of production, consumption, distribution, and resource allocation.

3. Theory of Consumer Behavior and Demand

Almost everyone faces the problem of multiple wants and limited money. In such a state of affairs, each consumer desires to maximize his satisfaction. When this happens, the consumer is said to be in equilibrium. Microeconomics also deals with the problems of equilibrium.

4. Theory of Production Behavior

In conventional microeconomics, unlike Islamic microeconomics system, four factors of production are responsible for productive activities. According to classical economists, in the short run, production depends upon the labor units only, while the capital is kept fixed. In such a state of affairs, the total production increases at different rates. This phenomenon is known as the “Law of Variable Proportions” in microeconomic theory.

5. Theory of Firm Behavior

Like individuals, firms also want to attain equilibrium. The firm’s equilibrium is attached to the “Minimization of Costs” or “Maximization of Output”. Both these situations are called “Optimum Factor Combination of a Firm.”

6. Theory of Costs and Revenues

In conventional microeconomics, we study different types of production costs. The analysis of costs of production may be from a short-run or long-run point of view. Moreover, different types of revenues are also considered in microeconomics.

7. Theory of Market Structure and Behavior

In conventional microeconomics, markets like Perfect Competition, Monopoly, Duopoly, Oligopoly, and Monopolistic Competition are of greater significance for microeconomics. It is analyzed that firms, under different market conditions, make decisions regarding the determination of price and output.

8. Theory of Income Distribution

A country’s national income is the result of the joint efforts of land, labor, capital, and organization. National income has to be distributed amongst these factors of production. For Example, how will wages be determined in competitive and non-competitive markets? For this purpose, we have the classical and neo-classical theories in microeconomics.

9. Theory of General Equilibrium and Welfare Economics

A general equilibrium is defined as a state in which all markets and all decision-making units are simultaneously in equilibrium. That is, a general equilibrium exists if each market is cleared at a positive price, with each consumer maximizing his satisfaction, and each firm maximizing profit.

Microeconomics in Islam and all Islamic finance products are a part of the AIMS Islamic banking and finance diploma program, which leads to a PhD in Islamic banking offered by AIMS Education.

Frequently Asked Questions

Q1: What is Islamic microeconomics?

It studies decisions by individuals, firms, and factors of production under Shariah, aligning price theory and resource allocation with permissibility, fairness, and social welfare.

Q2: How does price theory in Islamic economics differ from the conventional view?

Conventional models prioritise profit and market clearing. Islamic price theory adds ethical limits—no riba, fraud, or exploitation—so prices reflect market forces and justice.

Q3: Which factors of production are recognised in Islam?

Land, labour, capital, and entrepreneurship—each earning lawful returns tied to real activity, with risk and responsibility clearly shared.

Q4: What income is considered permissible?

Income from halal activities without riba or deception, earned through transparent, asset-based contracts and genuine value creation.

Q5: What principles guide personal spending?

Moderation. Prioritise family needs, fulfil zakat and social rights, and avoid wastefulness or miserliness to support a healthier economic order.

Q6: How should firms make decisions in Islamic microeconomics?

Pursue efficiency within Shariah: avoid riba and gharar, ensure transparency, and ground financing in real assets or services.

Q7: Why do market structures matter?

They shape price and output choices. Islamic microeconomics also evaluates fairness, discouraging exploitation in monopoly or oligopoly settings.

Q8: How is income distributed among factors?

Returns should be fair and linked to contribution and risk; instruments like zakat help correct imbalances.

Q9: When is giving beyond obligations encouraged?

After meeting family responsibilities and mandated dues, additional charity is encouraged if it does not create hardship for dependents.

Q10: Why emphasise the means of earning?

Because both what you earn and how you earn it must be halal; prohibited methods invalidate otherwise acceptable income.

Q11: How does general equilibrium fit here?

Efficiency is valued, but it must be achieved within Shariah limits that protect rights and minimise harm.

Q12: Can you give a practical example linking factors to Islamic finance?

In a partnership, labour and capital share profits from real trade; losses follow capital contribution—aligning incentives with Islamic principles.