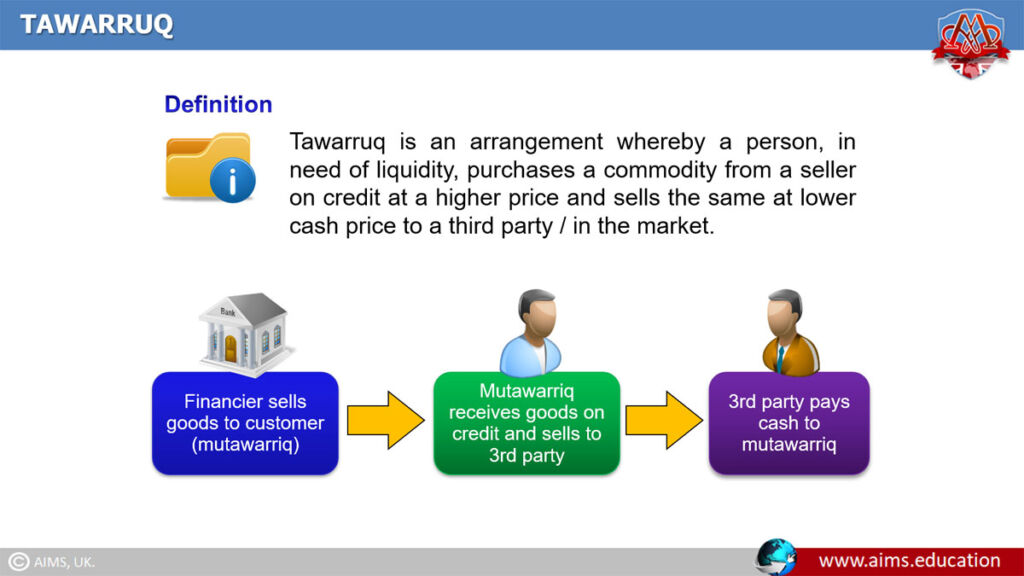

What is Tawarruq Contract or Reverse Murabaha?

Tawarruq contract is also referred to as Reverse Murabaha. It is defined as, “A financial instrument in which a buyer purchases a commodity from a seller on a deferred payment basis, and the buyer sells the same commodity to a third party on a spot payment basis”. To fully understand what tawarruq is, it is important to observe that in Tawarruq “Commodity” is not the actual need of the buyer, and it is only bought to fulfill the running cash requirements.

“Tawarruq in Islamic banking is basically a legal trick and a lawful way out. However, it may impede the natural path for the Islamic economy, on which Islamic Shariah urges. So, it is necessary for the Shariah boards to strictly monitor all Tawarruq based transactions.”.

Tawarruq in Islamic Banking!

Difference between Tawarruq and Enah

In Tawarruq, the person who acquires liquidity, sells the commodity to a third party; While in Enah, the buyer resells it to the same seller, from whom the commodity was bought, with a difference in the sale and purchase price.

Example of Tawarruq

- “Ali” owns a small textile mill, and to complete a $20,000 order of 1,000 shirts, he immediately needs $10,000.

- “Ali” needs this amount to buy raw materials; such as cloth, buttons, and yarn. “Ali” is expecting to complete and deliver 1,000 shirts, and get its payment in less than 3 months.

- So, to fulfill the cash requirement for the raw material, “Ali” purchases a car of value $11,000 from his friend “Bilal” on deferred payment, and agrees to pay this amount in three months.

- “Ali” sells this car to another friend on a spot payment of $10,000.

- This way, “Ali” gets $10,000 for three months, to complete the order.

- “Ali” completes the order in 80 days, delivers it to the ordering firm, and gets his payment of $20,000.

- “Ali” pays $11,000 to “Bilal” for the car that he bought on deferred payment.

Tawarruq/Reverse Murabaha in the View of Jurisprudence

- Imam Ahmed Bin Hanbal and Imam Shaafi generally allow Reverse Murabaha.

- Imam Malik, who is very strict about Enah, does not see a major problem and considers it a way to avoid Riba.

- Some other scholars do not see it as permissible. However, the preferred view of all four schools of thought is that it is permissible.

- In view of AAOIFI, if a commodity is sold back to the original seller on a deferred payment, it is invalid. However, it is acceptable if the commodity is sold to a third party.

Verdicts on Tawarruq

- Its nature is allowed by the Jurists. Here are some views:

- Tawarruq sale is the purchase of a commodity acquired and possessed by the seller at a time-fixed price, which the buyer will later sell to another person.

- Consider the Shariah Ruling: “Allah allows the selling, but forbids Riba”. And, there is no trace of a Riba in the type of this transaction.

- Reverse Murabaha is permissible, only if the selling price is higher than the buying price. If it is not, then it will eventually fall into an unlawful credit sale.

- It is to support cooperation and mercy among Muslim Brothers, to secure them from debt; and to save them from prohibited transactions.

Mechanism of Tawarruq Contract

Tawarruq Financing Agreements

According to Islamic jurists, it consists of some simple agreements:

First Agreement

Seller sells a commodity in his possession to the Buyer for a fixed particular period of time.

Second Agreement

The buyer sells this commodity to a third party, that has no connection with the first seller.

Third Agreement

Banks and institutions add another agreement. The bank authorizes the seller to sell the commodity in the market. Unlike Murabahah or other main Islamic banking products, Islamic banks are practising reverse murabaha in the international stock market because stock exchanges are the shortest way to process fast sales.

Classical Tawarruq Contract

Let us understand its classic form, through the following scenario:

- Islamic Bank purchases the commodity from Trader “Ali”, on cash, and ownership is transferred to an Islamic bank.

- Islamic bank then sells the commodity to the “Bilal” on deferred payment and on cost price plus profit margin basis. And the ownership of the commodity is transferred to “Bilal”.

- “Bilal” then sells the commodity to “Zayn” on a cash basis, in the commodity market, and its ownership is transferred to “Zayn”.

Mechanism of Tawarruq Contract Among Financial Institutions

It may be executed in the following manner:

- Suppose Bank-B needs funds, and Bank-A intends to place funds.

- Bank-A selects a commodity or stock that is liquid in nature.

- Bank-A approaches Bank-B for a Reverse Murabaha contract.

- Bank-A purchases the commodity on cash payment from the market or broker.

- Bank-B bank purchases it from Bank-A on a credit or Murabahah basis.

- After taking delivery, Bank-B sells it in the market.

- Bank-B uses this amount to fulfill its financial needs, and pays the amount to Bank-A, over the agreed period of time.

Detailed study of the Reverse Murabaha Contract is a part of our job-oriented Islamic banking and finance courses, and a globally accredited masters in Islamic banking and finance. AIMS offers Islamic finance programs through highly interactive learning content.

Islamic Banking Practices of Tawarruq (Reverse Murabahah)

Agency Agreement with Buyer

Suppose a bank appoints a person to purchase the commodity on its behalf. If the bank is buying to sell it to the same person, this transaction is “not” valid. But if bank sells it to that person through another contract, with an offer and acceptance, this transaction becomes valid.

Conditional Agency Agreement

Suppose that the client, after purchasing the commodity from the bank, appoints the bank as his agent to sell it in the market. If this agency is stipulated as a condition in the contract of sale, the transaction is “not” valid. If the agency was not a condition in the sale contract and was affected after the unconditioned sale, this transaction is valid but not advisable.

Areas of Application

Reverse Murabaha is used to provide short-term working capital financing and short-term personal finance. Along with Enah, both are used in structuring credit cards (tawarruq credit cards).

Time Gap between Transactions

There must be a time gap between the sale by the bank to the client and the sale by the client in the market. This time gap is essential to expose the parties to price risk. It ensures that gains are a reward for risk borne, and hence they are free from Riba.

Frequently Asked Questions

Q1: What is a Tawarruq (Reverse Murabaha) contract?

Tawarruq is a financing method where a buyer purchases a commodity on deferred terms and then sells it to a third party for cash. The commodity is used to obtain liquidity while avoiding Riba.

Q2: How does Tawarruq differ from ‘Inah?

In Tawarruq, the commodity is sold to a third party; in ‘Inah, it is sold back to the original seller at a different price, which many jurists consider problematic.

Q3: Can you give a simple example of Tawarruq?

A firm buys an asset on deferred terms for $11,000, immediately sells it to a third party for $10,000 cash, and later repays the deferred price—obtaining short-term liquidity.

Q4: What do jurists say about Tawarruq?

Most classical jurists allow it with conditions. Some disallow it, but the preferred view across the four schools is permissibility with proper oversight.

Q5: What is AAOIFI’s position?

Selling back to the original seller on deferred terms is invalid; selling to an unrelated third party is acceptable if other Shariah conditions are met.

Q6: What agreements make up a typical Tawarruq?

Initial deferred sale of a possessed commodity, followed by the buyer’s spot sale to a third party; banks may add an agency agreement to execute the market sale.

Q7: How does interbank Tawarruq work?

One bank buys a liquid commodity for cash, sells it on Murabaha to another bank, which then sells it in the market for cash and repays over time.

Q8: When is an agency arrangement invalid?

If agency to sell is tied as a condition within the sale contract, or if the bank buys only to sell to the same person acting as agent, the arrangement is invalid.

Q9: Where is Tawarruq used in practice?

Common uses include short-term working capital financing, personal finance, and certain credit card structures requiring rapid liquidity.

Q10: Why include a time gap between sales?

It ensures genuine price risk and makes profit a reward for risk rather than hidden interest, keeping the structure free from Riba.