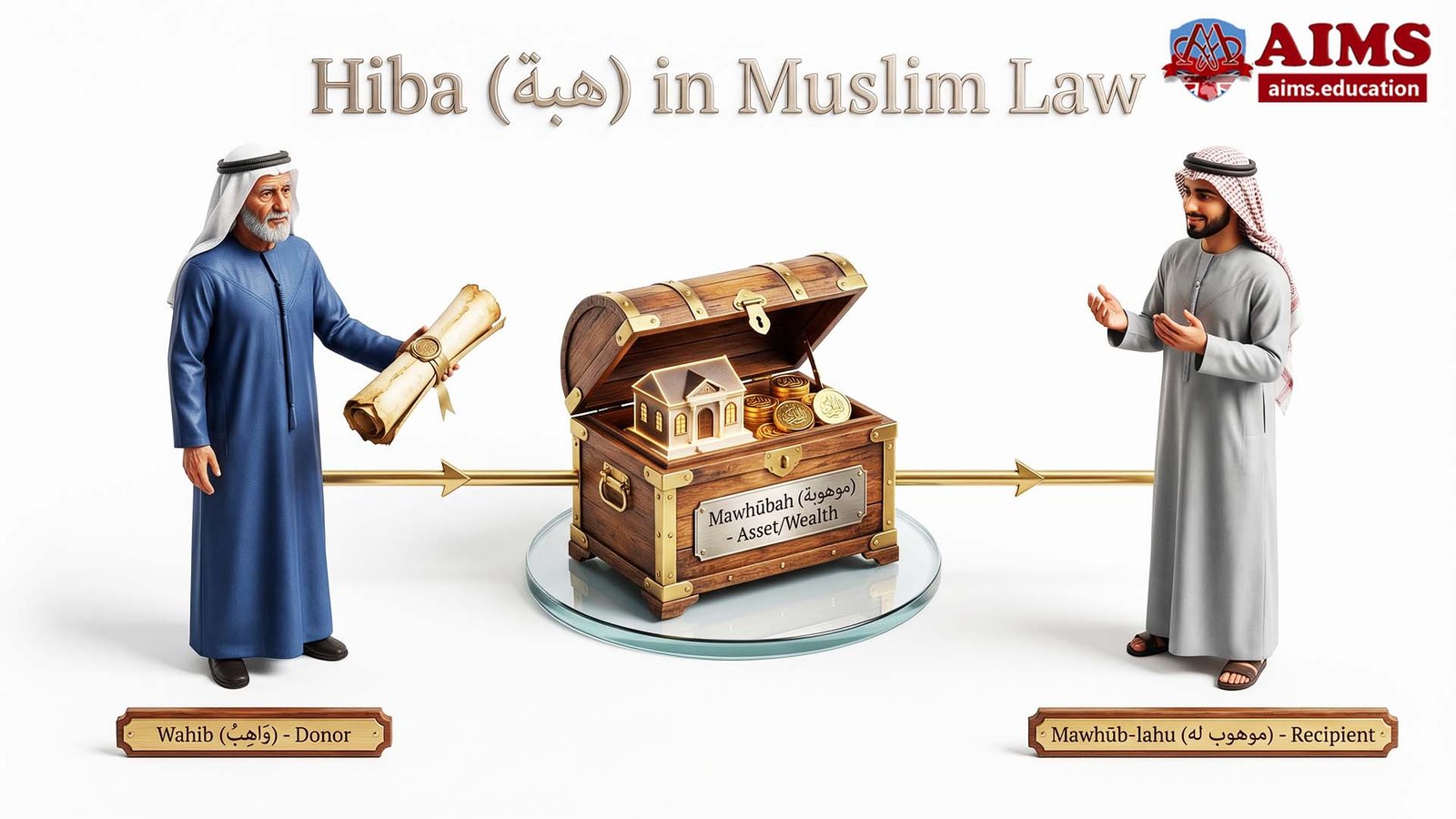

What is Hiba (هبة) in Muslim Law?

A Hiba (هبة) is an Arabic term that means “gift”, and it is also synonymous with ‘Atiyya (عطية). Hiba in Muslim Law refers to the voluntary transfer of ownership of assets or wealth (whether movable or immovable) from one individual to another without any expectation of compensation (ʿiwāḍ or عِوَض).

Parties Involved in Hiba

- The individual who initiates the transfer is known as the donor ( Wahib or وَاهِبُ).

- The asset or wealth being transferred is called the Mawhūbah (موهوبة).

- The recipient or donee is termed the Mawhūb-lahu (موهوب له).

This transaction is a unilateral act of donation, and it does not involve any form of exchange or payment from the donee (موهوب له) .

Shariah Conditions for Valid Hiba

The absence of compensation is a core requirement of a valid Hiba in Muslim law. Here are the important conditions regarding Hiba in Shariah:

- It is permissible in Shariah, based on its legal foundation and the consensus (ijmāʿ) of Islamic scholars.

- Hiba may become impermissible in cases where it is linked to future uncertainties (contingencies) or when it is offered solely for reputation or ostentation.

Concept of Hiba Explained in Hadith

An act of Hiba is considered incomplete unless the donor relinquishes actual possession of the donated item. Additionally, the declaration of the gift must be made in clear and unambiguous terms. Prophet Muhammad (صلى الله عليه وسلم) reinforced the significance and ethics of Hiba in Muslim Law through various Ahadith (Prophetic traditions):

“Give presents to one another, for this will increase mutual love among you.”

Sahih Muslim Book 12

This Hadith not only confirms the permissibility of giving gifts (Hiba) but also encourages mutual exchange to foster love and unity among Muslims.

Ibn ‘Umar narrated that ‘Umar ibn al-Khattab (RA) donated a horse for the sake of Allah. Later, he saw it being sold and considered buying it back. He consulted the Messenger of Allah (صلى الله عليه وسلم), who replied:

“Do not buy it back, and do not take back what you have given in charity.”

Sahib Muslim Book 12, Hadith 3952

Similarly, Ibn ‘Umar and Ibn ‘Abbas narrated a Hadith from the Prophet (صلى الله عليه وسلم):

“It is not permissible for a man to give a gift and then take it back, except a father taking back what he gave to his son. The example of one who gives a gift and then takes it back is like a dog that eats until it is full, vomits, and then returns to its vomit.”

Sunan An-Nasa’i Hadith 3720, Chapter: Ahkam and Issues Related to Hiba.

Nu’man Ibn Bashir narrated that his father gifted him a portion of his estate. However, his mother, Amrah bint Rawaha, disapproved and insisted that Allah’s Messenger (صلى الله عليه وسلم) be made a witness. When his father presented the case, the Prophet (صلى الله عليه وسلم) said:

“Have you given a similar gift to every one of your children?”

He replied, “No.”

The Prophet responded: “Fear Allah and be just with your children.”

His father then withdrew the Hiba.Sahih Muslim, Book 12, Hadith 3965

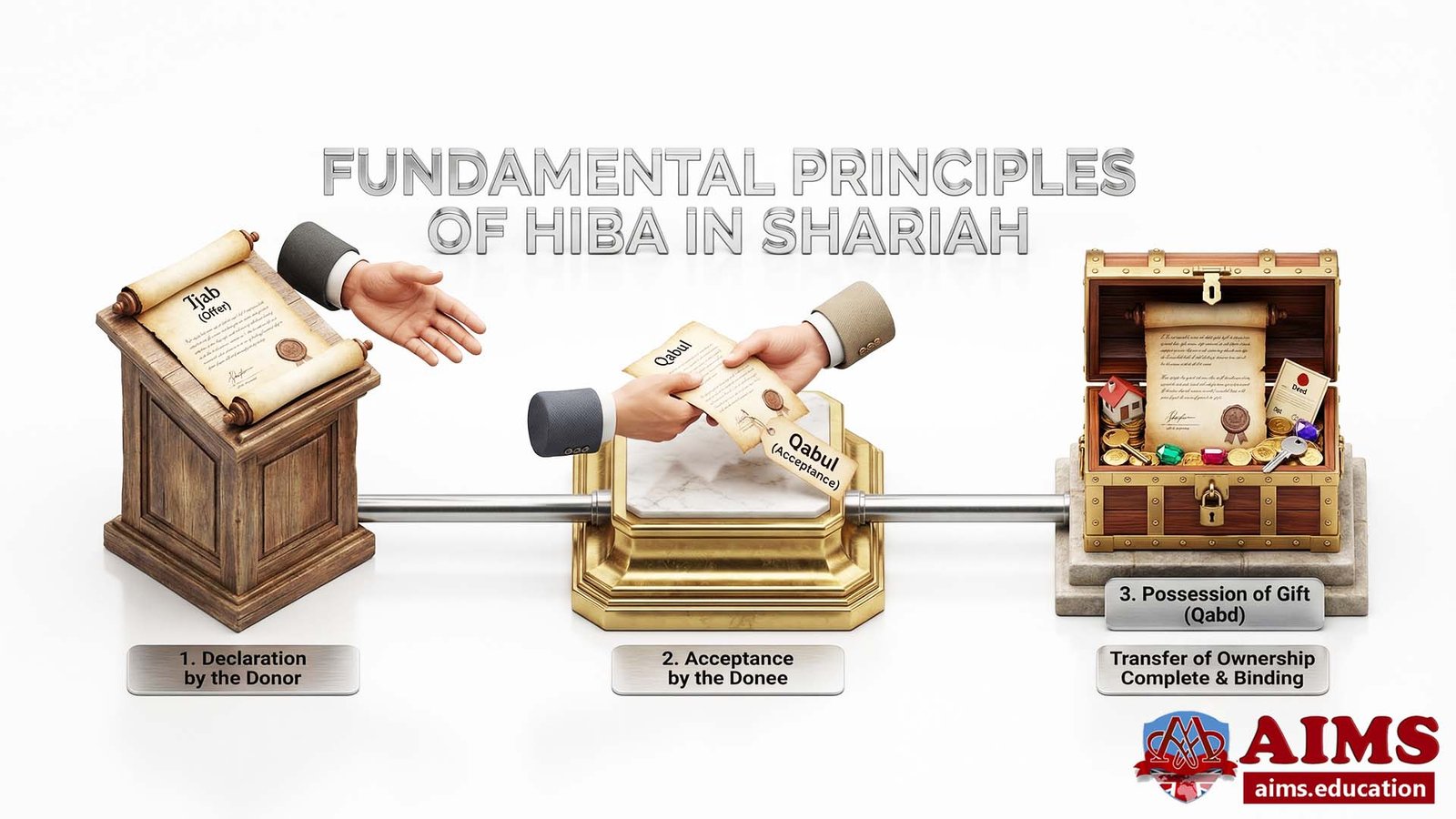

Fundamental Principles of Hiba in Muslim Law

The fundamental principle of Hiba in Muslim law involves the transfer of ownership from one person to another without consideration or compensation. This transfer must occur immediately, without attaching conditions or delays. A Hiba (هبة) may involve either movable or immovable assets, and the recipient must accept the gift for it to be legally valid.

1. Declaration by the Donor

- The donor must clearly express the intention to transfer ownership, either verbally or in writing.

- This declaration must be explicit, voluntary, and free from coercion, deception, or undue influence.

- A genuine and unambiguous intention to make the gift is essential for the validity of Hiba in Muslim Law.

2. Acceptance by the Donee

- The donee (recipient) must accept the gift, either explicitly (through spoken or written acknowledgment) or implicitly (through conduct, such as taking possession).

- This acceptance must occur during the lifetime of the donor and prior to any revocation.

- If the donee refuses or fails to accept, the Hiba becomes void.

3. Possession of Gift

To complete the Hiba process, the donee must take possession of the gifted property — either through actual physical delivery or symbolic handover, depending on the nature of the asset.

- The method of delivery depends on the type of property involved.

- Possession signifies the donor’s relinquishment and the donee’s acquisition of ownership rights.

8 Conditions for a Valid Hiba in Muslim Law

The following are the 8 essential conditions defined by Muslim Scholars for executing Hiba (هبة) is considered valid in Islamic Shariah:

1. Voluntary Transfer

- Hiba is a voluntary transfer of ownership rights from the donor to the donee, carried out without any coercion.

- Its focus on voluntariness aligns with the Islamic principle of sincerity in action.

- A valid Hiba must stem from sincere intention, reflecting the donor’s desire to help the recipient and seek spiritual reward.

2. Immediate and Unconditional

- The transfer of ownership in Hiba must take place instantly and unconditionally.

- The donor’s intention is actualized at the time of gifting, and the Hiba becomes effective upon the donee’s acceptance.

- This immediacy ensures clarity and prevents future disputes regarding ownership.

3. Acceptance by the Donee

- While the donor’s intent is crucial, the acceptance by the donee holds equal legal weight.

- Acceptance can be verbal or implied and must occur during the donor’s lifetime.

- Acceptance serves as confirmation of the transaction, distinguishing Hiba from other types of property transfers under Islamic law.

4. Absence of Consideration

- A defining feature of Hiba (هبة) is that it is given without any form of compensation.

- Unlike commercial exchanges, Hiba is driven by altruism, not by expectations of monetary or material return. This reinforces the values of generosity and selflessness emphasized in Islam.

5. Transferred Property and Ownership

- The property being gifted must be clearly identified and described.

- Whether movable or immovable, the gift must be specific and owned by the donor at the time of the Hiba.

- This ensures the legality and enforceability of the transfer, avoiding ambiguity or disputes.

6. Soundness of Mind and Legal Capacity

- To execute a valid Hiba in Muslim Law, both the donor and the donee must have legal capacity.

- The donor must be of sound mind and legally competent to make independent decisions.

- Similarly, the donee must have the legal authority to accept the gift. This guarantees the transaction is entered into knowingly and willingly.

7. Donor’s Intent and Purpose

- The donor’s motivation must align with the Islamic principles of charity and goodwill.

- While expressing love or concern through a Hiba is valid, the gift must not serve as a tool to bypass legal duties, such as those related to inheritance (Mīrāth).

- The intent should remain free of manipulation or concealed objectives.

8. Non-retrospective and Irrevocable

- Once accepted, Hiba is typically irrevocable and non-retrospective. This ensures stability in ownership and protects the donee’s rights.

- However, revocation may be allowed in specific, Shariah-compliant circumstances, particularly if stipulated and agreed upon at the time of the gift.

Restrictions Regarding Hiba in Shariah

The following points outline key restrictions and limitations on Hiba (هبة) as prescribed by Shariah law regarding Hiba:

- A donation (Hiba) may be made either verbally or in writing, by any individual who possesses the legal capacity to enter into a contract.

- A Hiba made by a person who is in debt is generally considered invalid, as it may infringe upon the rights of creditors.

- A donation made during a terminal illness (Marḍ al-Mawt) must not exceed one-third of the individual’s estate, and only after all debts and funeral expenses are settled. This aligns with Islamic inheritance laws.

- Hiba can only be made to living individuals. Gifts directed toward deceased persons are not valid under Islamic law.

- Only existing, tangible property can be gifted. For example, a gift of oil from unpressed sesame seeds or butter from milk yet to be churned is considered invalid, as the asset must be in existence and clearly defined.

- Once a valid Hiba has been executed and accepted, it cannot be revoked, except in exceptional cases permitted by Shariah, such as fraud, misrepresentation, or if explicitly agreed upon.

- A father may revoke a gift given to his children, provided that such revocation does not violate Shariah principles or result in injustice or favoritism.

- The revocation of a Hiba requires a formal ruling from a competent Islamic court, to ensure the action is legally justified and compliant with Shariah.

Understanding Hiba in Islamic Banking and Finance

Hiba in Islamic Banking and Finance refers to an unconditional and voluntary gift of property or asset from a financial institution to its customer, without expecting anything in return.

Application of Hiba in Islamic Finance

Hiba or Gift in Islam is one of the important component of Islamic banking and finance. It is used is used in various Islamic financial contracts. A comprehensive study of Hiba is an essential part of Islamic finance certification course, career focused diploma in Islamic banking and finance, and an accredited online MBA in Islamic banking and finance program offered by AIMS. Hiba is not a financial product but used as a component within Islamic financial contracts.

Here are few applications of Hiba (or Gift) in Islamic banking and finance:

Ijarah (Islamic Lease)

At the end of an Ijarah Muntahia Bi Tamleek, upon competion of payments from the customers, the bank transfers the ownership of the leased asset to the customer through Hiba.

Takaful (Islamic Insurance)

In Takaful (Islamic Insurance system), participants contribute to a risk pool. The operator grant surplus (if any) back to participants as Hiba, rather than as a contractual right under the Islamic Shariah.

Mudarabah Contracts

In some cases, the capital provider (Rab al-Mal) in Mudarabah contract offers the entrepreneur (Mudarib) an extra reward beyond the agreed profit share. It can be given as a Hiba, but it must not be pre-agreed or conditional.

Other Types of Hiba

The actual Hiba is Gift without conditions. According to Shariah guidelines, there are four other types of Hiba (هبة), and they are discussed below:

1. Hiba-Bil-‘Iwāḍ (Gift with Consideration)

Hiba-Bil-‘Iwāḍ refers to a gift that is exchanged for some form of consideration, resembling a sale. In this arrangement, the donor transfers ownership of property and receives something in return from the donee. This type of Hiba in Muslim Law requires the actual transfer of both ownership and possession to be considered valid and complete.

Example:

A person transfers ownership of his residence to his son, and the son gives his father a car. This is a valid case of Hiba (هبة) with consideration, as it must fulfill the conditions of declaration, acceptance, and transfer of possession.

2. Hiba-Ba-Sharṭ al-‘Iwāḍ (Conditional Gift)

Hiba-Ba-Sharṭ al-‘Iwāḍ is a conditional gift, where the donor stipulates specific conditions that the donee must fulfill for the gift to become effective. These conditions must be reasonable, making the transaction similar to a contractual agreement. The delivery of possession is essential, and the gift remains revocable until the conditions are fulfilled. Once the conditions are met, it assumes the legal nature of a sale.

Example:

A person tells his son, “I will gift you my car, provided you pay for the fencing and irrigation system within three months.” Son agrees and takes possession of the care. The gift remains revocable until he fulfills the condition. Once his son installs the fencing and irrigation as agreed, the car becomes irrevocable and takes the form of a completed transaction, resembling a sale.

3. Sadaqah (Charitable Hiba)

S0adaqah is a religiously motivated form of Hiba, given purely for the sake of Allah (SWT). It is driven by piety and the desire for spiritual reward. Unlike other types of Hiba, Sadaqah is irrevocable once executed. The three essential conditions for a valid Ṣadaqah are:

- Clear declaration,

- Acceptance by the recipient, and

- Delivery of possession.

Example:

An individual donates a piece of land to a mosque for religious use. This act, done for the sake of Allah, and it is classified as Sadaqah, a spiritually motivated form of Hiba. This type of Hiba is irrevocable once executed.

4. Ariyah (Loan of Usufruct)

Ariyah is a form of gratuitous permission to use the usufruct of a property, without transferring ownership. The benefit (usufruct) is granted while the ownership and possession of the property remain unchanged. Here are some important points related to ariyah:

- It is subject to revocation, and

- It grants the right to use the property, but not the right of ownership.

Example:

A farmer allows his neighbor to use his tractor during harvest season without transferring ownership. The neighbor may use it temporarily, but the ownership and full possession remain with the lender.

Key Takeaways

- The Islamic Law of Gift (Hiba / هبة) embodies the principles of generosity, sincerity, and altruism, aligning with a universal philosophy of giving that transcends cultures and religions.

- While the concept of unconditional Hiba is inherently straightforward, conditional gifts (e.g., Hiba-Ba-Sharṭ al-‘Iwāḍ) introduce complex legal and ethical considerations.

- The interpretations of these complexities by Islamic jurists and courts continue to shape the legal structure surrounding Hiba in Muslim law.

- As social and legal environments evolve, the central challenge is to preserve the spiritual and ethical foundations of Hiba while adapting to contemporary circumstances and regulatory developments.

- In striking this balance, both classical Islamic jurisprudence and modern legal systems promotes justice, transparency, and equity in the practice of gift-giving. This ensures Hiba remains both authentic and applicable in today’s world.

Frequently Asked Questions

Q1: What is the meaning of Hiba in Muslim Law?

Hiba (هبة) means a voluntary transfer of ownership without compensation, symbolizing generosity and goodwill in Islam.

Q2: Who are the parties involved in a Hiba contract?

The donor (Wahib), the donee (Mawhūb-lahu), and the asset (Mawhūbah) constitute the core parties of a Hiba transaction.

Q3: What are the essential conditions for a valid Hiba?

A valid Hiba requires declaration, acceptance, and delivery of possession, ensuring voluntariness and clarity of ownership.

Q4: Can Hiba be revoked under Islamic Law?

Generally, Hiba is irrevocable once accepted, except where a father revokes a gift to a child in line with Shariah justice.

Q5: How is Hiba different from a sale or exchange?

Unlike sales, Hiba involves no consideration. It’s a one-sided act of giving rooted in spiritual sincerity rather than trade.

Q6: What are the main types of Hiba?

They include Hiba-Bil-‘Iwāḍ, Hiba-Ba-Sharṭ al-‘Iwāḍ, Sadaqah, and Ariyah — each with unique rules and applications.

Q7: How is Hiba used in Islamic Banking and Finance?

Hiba facilitates ownership transfer in Ijarah, surplus sharing in Takaful, and goodwill rewards in Mudarabah agreements.

Q8: Is written proof necessary for Hiba?

Written proof is advisable to prevent disputes and confirm transfer, especially for valuable or immovable assets.

Q9: Can Hiba be made during illness?

Yes, but it must not exceed one-third of the estate and must comply with Islamic inheritance regulations.

Q10: What is the ethical importance of Hiba?

Hiba promotes social justice and compassion, reinforcing the moral essence of giving in Islam.