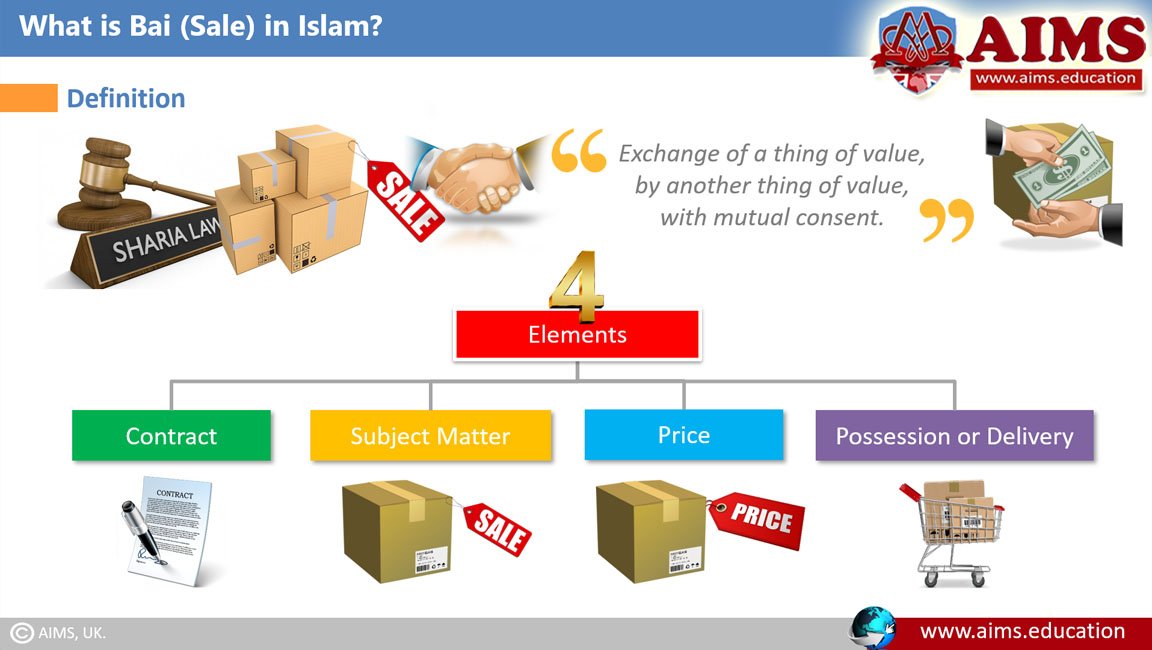

What is Bai (Sale)?

Sale or Bai (بيع) is defined as the “Exchange of a thing of value, by another thing of value, with mutual consent.” More specifically, Bai may be defined as the “Exchange of cash against commodity.” There are two types of bai according to the principles of fiqh-ul-muamlat (Islamic laws for dealings). They are Bai Sahih (بيع صحيح) or Valid Sale, and Bai Batil (بيع باطل) or Invalid Sale. According to the Islamic Shariah, for a sale to become valid (halal), any kind of bai (sale) must have four elements present. They are:

- Contract,

- Subject Matter,

- Price, and,

- Possession or Delivery.

Shariah Laws Regarding Valid Bai (بيع صحيح)

Following are some Shariah-defined laws regarding the sale of goods or assets:

- An agreement of Bai (sale) becomes effective on “Offer and Acceptance” by the seller and buyer.

- Any condition not ancillary to the sale makes the contract void.

- The article for sale must exist, and it must be in the legal possession of the seller.

- A debt or abstract thing cannot be the subject of a sale.

- Delivery of an item being sold must be possible.

- The quality and quantity of an item must be precisely determined and known to the buyer.

- The unit of currency, amount, and mode of payment must be precisely determined.

- In the case of installments, the period of payment must also be determined and followed.

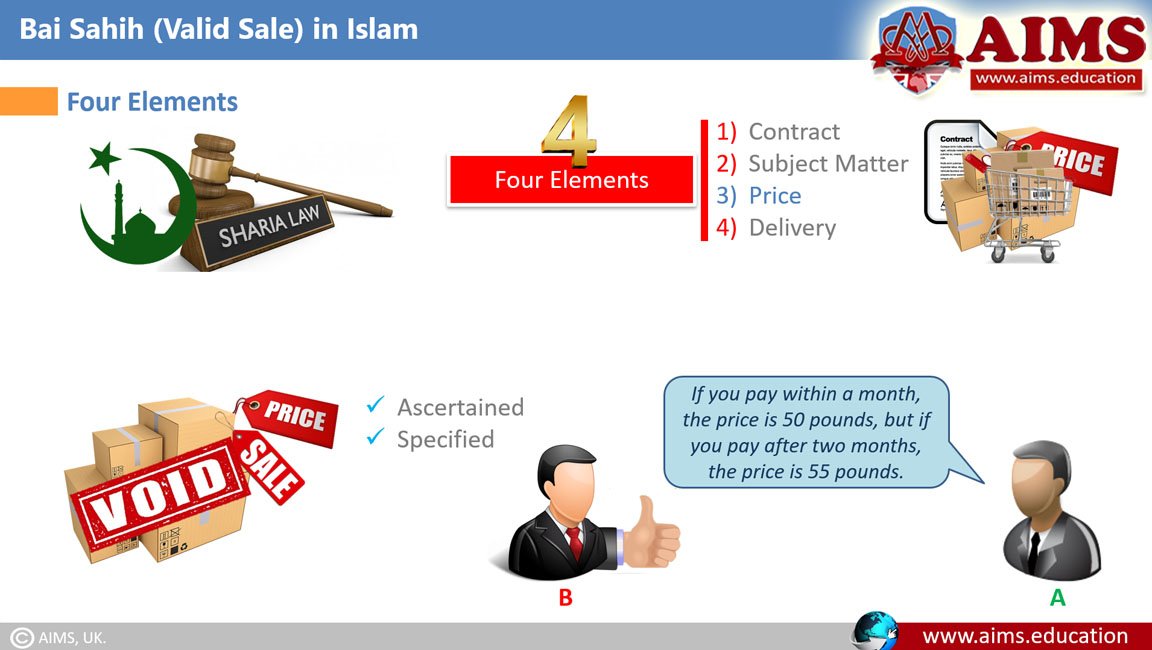

Valid Sale (Bai): 4 Essential Components & Conditions

We will now discuss the four elements of a Valid Sale in light of Islamic Shariah: Contract, Subject Matter, Price, and Delivery.

1. Contract

For a sale to become valid, there must be an agreement or contract between the buyer and seller. Where the seller offers, and the buyer accepts. The term “Offer” means a proposal to sell or buy a commodity by one person, and “Acceptance” means approval of the proposal by the other person. Here are some possible conditions for sale at this stage:

a. Sale Must be Unconditional

- According to Islamic Shariah, sale must be unconditional. If a bai is conditional, it becomes invalid.

- For Example: If ‘A’ buys a car from ‘B’ with the condition that B will employ A’s son in his firm.

b. Reasonable Condition of Sale is Acceptable

- These are the conditions that do not go against the contract, and so they make the bai as Valid.

- For Example: ‘A’ tells ‘B’ to deliver the goods within a month.

c. Unreasonable Condition, but in Market Practice

- If a sale is under unreasonable conditions but is in market practice, the sale is valid. However, the condition must not be against any of the Shariah rules.

- For Example: ‘A’ buys a refrigerator from ‘B’ with a condition that, ‘B’ undertakes its free service for 2 years.

2. Subject Matter

a. Existence of Good

- The subject matter of sale must exist at the time of sale. Thus, a thing that has not yet come into existence cannot be sold. If a non-existent thing has been sold, even with mutual consent, the sale is void, according to Shariah.

- For Example, If ‘A’ sells his cow’s unborn calf to ‘B’, the bai is void.

b. Value of Good

- The subject of sale must be a property of value.

- The sale of a valueless thing is not valid.

c. Usable Good

The subject of sale should not be a useless thing.

d. Ownership of Good

- Subject matter should be something capable of ownership or title.

- For Example, according to Shariah laws for sale (bai), the sale of Sea or Sky is not valid.

e. Capable of Possession

- The good must be capable of delivery or possession.

f. Good Must be Specific

- The subject of sale must be specifically known and identified either by pointing or by detailed specifications that can distinguish it from other things.

- For Example: Consider a building comprising several similar apartments. ‘Person-A,’ the owner of the building, says to ‘Person-B’: “I sell you one of these apartments.” And B accepts. But, this bai is void unless the apartment is specifically identified.

Seller Must Have Title and Risk

- The subject matter of sale must be in the ownership of the seller, at the time of sale. If the seller sells something before acquiring its ownership and risk, the sale is void.

- For Example: ‘A’ sells to ‘B’ a car, which is presently owned by ‘C’, but ‘A’ is hopeful that, he will buy it from ‘C’, and shall deliver it to ‘B’, subsequently. The sale is void because the car was not owned by ‘A’ at the time of sale.

3. Price

- The price should be ascertained and specified for a sale to be valid.

- For Example, ‘A’ says to ‘B’, “If you pay within a month, the price is 50 pounds, but if you pay after two months, the price is 55 pounds.” And ‘B’ agrees. However, the sale is invalid or void since the price is uncertain.

4. Delivery or Possession

- The subject of sale must be in the seller’s physical or constructive possession at the time of sale.

- However, this condition is applicable in the case of movable goods, not immovable.

Types of Bai Sahih (بيع صحيح) or Valid Sales in Islam

a. Bai Wafa or BuyBack

Bai Wafa is an arrangement in which the buyer will return the goods intact at the end of a certain period at an agreed enhanced price. However, here two things are contrary to the general Islamic law on sales:

- Repayment of a different price by the seller; and,

- Condition of return is imposed on the buyer.

This cannot normally be ancillary to the sale because a purchaser becomes the owner of the goods and has a right to dispose of them as he likes.

The following Conditions Can Be Made Incase of Bai’y Wafa or Buy Back:

- The seller can demand the return of the goods by returning the original price, and the buyer can demand the price paid by returning the goods.

- Neither the buyer nor the seller can sell the goods to a third party.

- Some of the benefits derived from the goods shall go to the buyer.

b. Bai Muajjal

Bai-Muajjal is an Arabic acronym for “Sale on Deferred Payment Basis.” This deferred payment becomes a loan on the buyer, and it can be paid in lump sum or on an installment basis, as agreed between the two parties. Bai Muajjal is commonly used in Islamic banking and finance, and it is defined as ” a type of sale in which delivery is spot, while payment is deferred, but cost is not known.”

The following two points must be carefully considered for Bai-Muajjal:

- If the quality of items doesn’t make a difference but the intrinsic value does, these items come under the definition of Capital, and they can be sold on a deferred payment basis.

- If the quality of items can be compensated for by the price, these assets do not come under the definition of Capital. And according to an ijma by Sha-re-ah scholars, in such cases, demanding a high price on deferred payment is permissible.

Conditions in Bai Muajjal

- The price to be paid must be agreed upon and fixed at the time of the deal.

- The buyer must take complete possession of the object, and deferred payment should be treated as debt.

- Once the price is fixed, it cannot be decreased in case of earlier payment or increased in case of default.

- The seller may ask the buyer to furnish a security, either a mortgage or an item, to secure the payment.

- If the commodity is sold in installments, the seller may put a condition that if the buyer fails to pay any installment on its due date, the remaining installments will become due immediately.

Here are some other common types of Valid Sales or Bai Sahi in Islam, which are used as Islamic financial products/instruments:

- Bai Musawamah refers to normal sale, in which cost price is not known.

- Bai Murabahah refers to a sale in which the buyer knows both the cost and sale price.

- Bai Muqayadah refers to barter sales, excluding currency sales.

- Bai Sarf refers to the exchange of various kinds of money or goods representing money, such as Gold, Silver, Dollars, and Pounds.

- Bai Salam is a type of sale in which payment is spot, while the delivery of the good is deferred.

- Bai Istisna refers to a sale in which a commodity is transacted before it comes into existence. It is, basically, an order to manufacture.

3 Main Categories of Invalid Sale (بيع باطل) in Islam

1. Void or Non-Existing Sale

A sale becomes void if any of the following are not complied with:

- Conditions of offer and acceptance; or;

- Conditions of Buyer and Seller; or;

- Conditions of goods sold.

2. Void but Existing Sale

The sale will exist if any defect is found, but it will be void. In that case, the buyer should not possess the item and must return it to the seller. However, if the defect is rectified, the sale becomes valid.

3. Valid but Disliked Sale (Bai Makruh)

Following are some examples of Disliked or “Makruh” sales:

- The transaction was made after Jumma (Friday) Azhan, before Jumma Salah;

- Sale after hoarding of goods; or;

- Sale is when a third party intervenes to buy something already being negotiated between other parties.

Types of Invalid Bai (بيع باطل)

Many types of bai were declared prohibited and unlawful by the Prophet Mohammad (Peace Be Upon Him), as they involved some element of Riba, exploitation, fraud, blackmail, deception, misrepresentation, injustice, gamble (maisir or qimar), chance, or, unfairness.

Discussed below are the types of invalid bai:

Bai Muzabanah

It is the sale of a known quantity against an unknown quantity or price. For example, fruit is on trees in exchange for dry fruits.

Bai Munabazah

It is a sale by throwing a commodity to the buyer. For Example, a man throws a cloth that he has for sale toward another. The other person has to buy it without touching or even seeing it.

Bai Habal Al Habala

It is the Sale of a fetus in the womb. For Example, one purchases a female camel with the promise that he will pay the price when it gives birth to a female camel.

Bai Mulamasah

It is a sale by touch only. For example, one purchases cloth by touching it without opening it, seeing it, or examining it.

Bai Muhaqalh

It is a sale of Grain-in-ear for dry grain. For Example, Buying a crop is still in growth, and grains are in the ears in exchange for corn.

Bai Mukhabarah

It is an agreement to lease land on rent for cultivation, with the condition of sharing the produce in a given ratio.

Bai Sunayah

It is a sale of fruits upon trees, after leaving some fruit from the subject matter of the sale.

Bai Talqi-Jalab

It is a purchase of food-stuffs on the way before merchandise actually reaches their destined places.

Bai Enah or Inah

It is a sale of commodities, especially perishable, without obtaining their possession.

Bai Sarf

Bai (sale) of gold and silver for gold and silver is prohibited unless sold hand to hand and in equal quantity. Otherwise, it is considered a form of riba.

Bai Al-Hadir-Libad

Some people worked as agents of grain sellers (middlemen), and all grain was sold through them. They earned a profit from both the seller and the buyer and often deprived the cultivator of his just profit and the buyer of a just and fair price. The Holy Prophet Mohammad (PBUH) forbade this type of bargaining in the interest of the cultivator as well as the buyer.

Bai al-Gharar

Any sale by deceiving the opposite party is Gharar. Examples of bai gharar are as follows:

- Misrata: Sale of an animal which is not milked for a number of days and its milk is left in the udder to deceive the buyer.

- Bai Najsh: Raising the price of an article of merchandise or outbidding in the sale, not from a desire to purchase it, but with a view to trapping the buyer.

- Sale by Oath: To sell articles by taking oaths regarding their superior quality.

Other types of Bai Batil (بيع باطل)

- Adulteration of articles of inferior quality with superior quality as water in milk.

- Sale of fruits and corn till they are ripe and fit for human consumption.

- Sale or lease of water and grass.

- Sale of grapes till they are black, and corns till they become hard.

- Sale of goods without delivery and cash price, i.e., sale with a promise of delivery of goods for a promise of price.

- Bargaining with the needy persons and the poor.

- A sale in exchange for carrion, blood, a person of free man, uncaught fish in water, a bird in the air which will not return, milk in the udder, and hair or wool upon an animal.

- Sale of wine, pork, or other prohibited products in Islamic Shariah etc.

- Any article which cannot be separated from its situation without injury or of which the quality or existence cannot be ascertained or the quantity of which can be judged by conjecture.

- The sale of an absconded slave, woman’s milk, bristles of heg, human hair, and undressed hides. It is lawful to sell or apply in use bones, wools, sinews, horns, or hairs of all animals that are dead except those of men and hogs.

Frequently Asked Questions

Q1: What is Bai (بيع) in Islamic finance?

Bai is a sale contract defined as the exchange of one thing of value for another with mutual consent. It typically means exchanging cash for a commodity under Shariah-compliant rules covering contract, subject matter, price, and delivery/possession.

Q2: What elements must exist for a valid sale (Bai Sahih)?

Four elements are required: (1) a contract with clear offer and acceptance; (2) a valid subject matter that exists, is ownable, specific, and deliverable; (3) an ascertained price; and (4) delivery or constructive possession by the seller at sale time.

Q3: Which conditions can invalidate a Bai contract?

Conditions not ancillary to the sale, uncertainty in price, selling non-existent goods, lack of ownership or possession, and impossible delivery can void the sale. Deceptive practices (gharar), riba elements, and prohibited items also invalidate Bai.

Q4: How does Bai Muajjal (deferred payment sale) work?

In Bai Muajjal, delivery is spot but payment is deferred as a debt. The price is fixed at the time of contract and cannot be changed for early payment or default. Security may be required, and installments can be scheduled with clear due dates.

Q5: What is the difference between Bai Musawamah and Bai Murabahah?

Bai Musawamah is a standard sale where the cost price is not disclosed to the buyer. In Bai Murabahah, the seller discloses the original cost and adds an agreed profit margin, so both cost and sale price are known to the buyer.

Q6: What are Bai Salam and Bai Istisna?

Bai Salam is a forward sale where the price is paid upfront and delivery is deferred. Bai Istisna is an order to manufacture or construct, with delivery upon completion per agreed specifications.

Q7: Which sales are prohibited due to gharar or unfairness?

Examples include Bai Muzabanah (known for unknown), Bai Munabazah and Mulamasah (sale by throwing or touch without inspection), Habal al-Habala (fetus in womb), and practices like Najsh (false bidding) and deceptive milk-retention in animals.

Q8: Is currency exchange (Bai Sarf) allowed in Islam?

Bai Sarf—exchange of gold and silver or their monetary equivalents—is permitted only if exchanged hand-to-hand and, for the same kind, in equal quantities, to avoid riba. Otherwise, the transaction is prohibited.

Q9: What is Bai Wafa (buy-back) and why is it controversial?

Bai Wafa is a sale where the buyer returns the goods at a set time, often at an enhanced price. It conflicts with general sale rules because it imposes a return condition on the buyer and may resemble a loan with benefit, so it is restricted.

Q10: What are examples of disliked but valid sales (Bai Makruh)?

Makruh sales include transactions after Friday adhan before Salah, sales following hoarding, or when a third party interferes in ongoing negotiations. Though legally valid, these are discouraged due to ethical or social concerns.

Q11: When is a sale void but existing vs. completely void?

A sale is void but existing if a rectifiable defect is present; the item should be returned until correction. It is completely void when fundamental requirements—like offer and acceptance, qualified parties, valid goods, or certain price—are missing.

Q12: Why must the seller have title and risk before selling?

Shariah requires the seller to own and bear risk of the item at sale time. Selling something not yet owned or possessed transfers risk improperly and creates uncertainty, rendering the sale invalid until ownership and risk are acquired.