What is Riba?

“Riba” is an Arabic word “ربأ”, and it means Excess, Increase, or Addition. In Quran and Hadith, it is used for ‘usury’, or ‘interest’. There are several types of riba. Now, let us understand riba in Islamic banking and finance, with the help of an example: “Suppose a person lent a sum of money to another person, and asked the debtor to pay it back together with an agreed additional sum of money within a fixed period. Or a rate of interest was fixed for a specific period, and if the principal along with the interest was not paid within that period, the interest rate was enhanced for the extended period, and so on. This enhanced or additional amount is Riba”.

Why Riba is Prohibited in Islam?

Islam prohibits “ربأ” because, it inculcates miserliness, selfishness, callousness, indifference, inhumanity, greed, and worship of wealth. It also destroys the spirit of sympathy, mutual help, and cooperation, and thus affects the feelings of brotherhood and unity among the community.

“ربأ” is prohibited because it causes many economic evils, for example, it leads to hoarding of money, adversely affecting its circulation among larger sections of society. It also causes the establishment of monopolies, cartels, and concentration of wealth in a few hands. And so, the gulf between the rich and the poor widens.

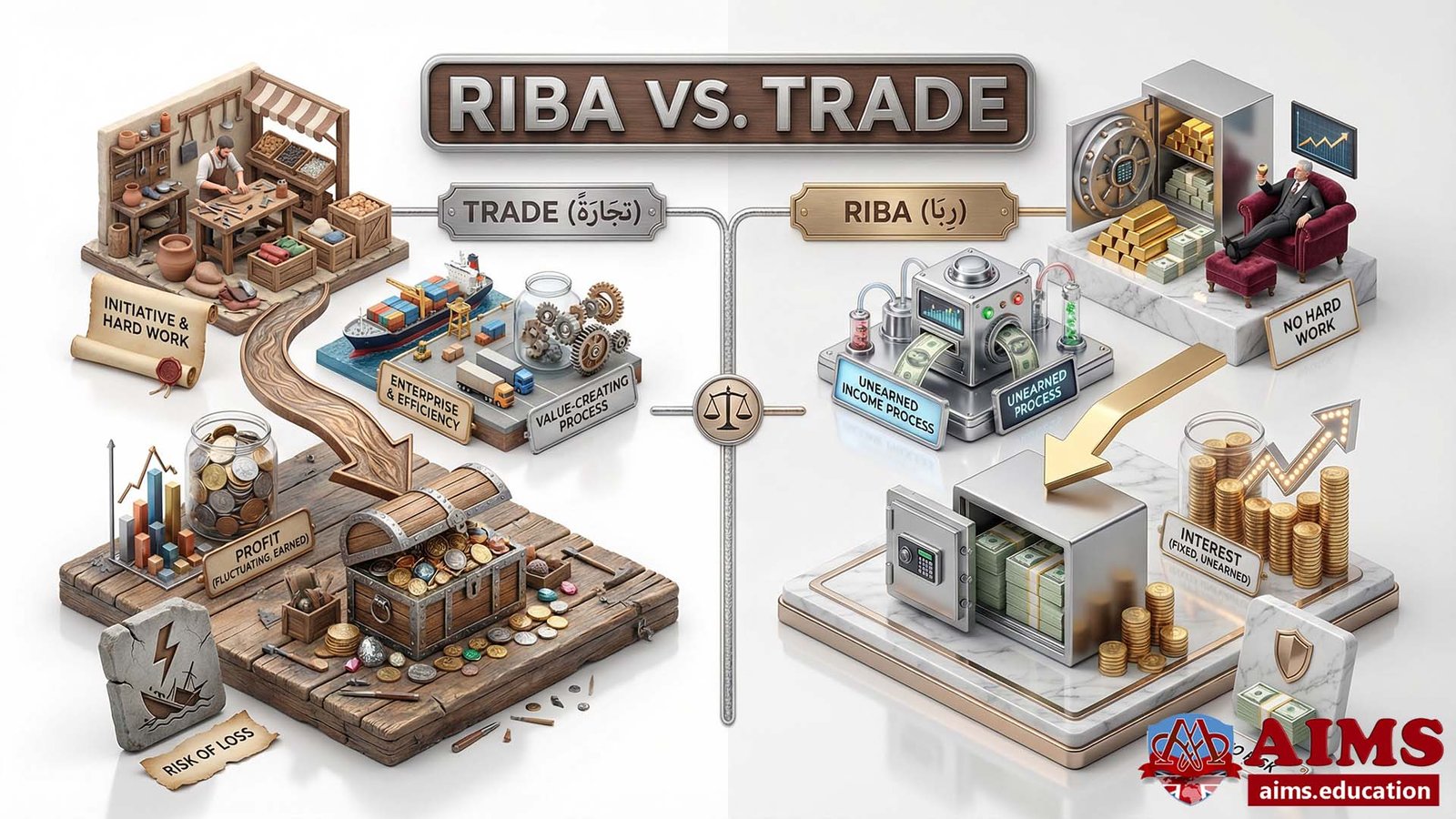

Difference between Trade and Interest

- In Trade, one earns profit as a result of initiative, enterprise, efficiency, and hard work, profit fluctuates, and there is a risk of loss as well.

- In Riba, the interest is not earned through hard work or any value-creating process. It is not the reward of labor but is an unearned income. The lender gets his fixed amount, irrespective of the fact, whether the debtor earns any profit or sustains a loss.

Building a Riba-Free Financial System

Understanding this concept is a fundamental part of the Islamic banking system and a key difference between Islamic and conventional banking. Prohibition of “ربأ”, Maysir, and Gharar are the fundamental elements of the Islamic economic system. AIMS’ CIB Islamic banking course and Islamic finance master degree programs are designed for professionals to operate an Islamic financial system that works under Shariah laws.

Riba in Quran and Hadith:

Taking or paying riba is a major sin in Islam, and it is prohibited in many places in the Quran and Hadith.

Prohibition of Riba in Quran

“And whatever you give for interest to increase within the wealth of people will not increase with Allah. But what you give in Zakath, desiring the countenance of Allah – those are the multipliers.”.

Surah Ar-Rome, Verse-39!

“And [for] their taking of usury while they had been forbidden from it, and their consuming of the people’s wealth unjustly. And we have prepared for the disbelievers among them a painful punishment”.

Surah Al-Nisa, Verse-161!

“O you who have believed, do not consume usury, doubled and multiplied, but fear Allah that you may be successful”.

Surah Aal-e-Imran, Verse-130!

“Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, “Trade is [just] like interest.” But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah . But whoever returns to [dealing in interest or usury] – those are the companions of the Fire; they will abide eternally therein”..

Surah Al-Baqarah, Verse-257!

2. Prohibition of Riba by Prophet Muhammad (PBUH)

The severity of this riba is further highlighted by the Prophet’s warning that:

Practicing riba is equivalent to committing seventy sins. The least severe of which is one committing incest with his mother.

“All of the Riba of Jahiliya is annulled. The first Riba that I annul is our Riba, that accruing to Abbas Bin Abdul Mutallib, it is being cancelled completely.”

Reported by, Hazrat Jabir RadiAllah

Types of Riba?

There are two types of Riba in Islamic banking. We will discuss each of them in detail:

1. Riba An Nasiyah

It is also called Riba Al Jahiliya, and it refers to the addition of the premium, which is paid to the lender in return for his waiting as a condition for the loan. It is technically the same as interest, and this is the real and primary form.

“Every loan that draws excess is Riba.”

Hadith

2. Riba Al Fadl

It is also called known as Riba Al Bai. It is defined as excess compensation, without any consideration, resulting from a sale of goods.

“Sell gold in exchange of equivalent gold, sell silver in exchange of equivalent silver, sell dates in exchange of equivalent dates, sell wheat in exchange of equivalent wheat, sell salt in exchange of equivalent salt, sell barley in exchange of equivalent barley, but if a person transacts in excess, it will be Riba. However, sell gold for silver anyway, you please on the condition, it is hand-to-hand and sell barley for date anyway, you please on the condition, it is hand-to-hand.”

Hadith

LAWS REGARDING RIBA AL FADL

Any difference in value or quality should be ignored and the commodities should be exchanged in equal weight and volume. Instead of direct exchange of commodities of the same kind, a person should sell his commodity against cash at the market value, and buy someone else’s commodity in exchange of cash at the market value.

Key Notes:

- “ربأ” means excess, increase, or addition, and it has two types.

- The loan shall be given without interest.

- It inculcates selfishness, inhumanity, greed, and worship of wealth; it destroys the spirit of sympathy and cooperation.

- Debt should be incurred only, when it is unavoidable. It may be incurred to satisfy basic needs, and it should be taken with a clear intention to pay it back.

- The contract of Islamic loan should be reduced in writing, in the presence of two witnesses.

- Islamic banking is based on the principle of partnership and profit-loss sharing basis.

Frequently Asked Questions

Q1: What is riba in Islam and why is it condemned?

Riba means excess or addition and refers to interest/usury. It is condemned because it concentrates wealth, fuels greed, and undermines social justice. The Qur’an forbids riba and permits trade, which involves value creation and risk.

Q2: What is the riba meaning in everyday financial transactions?

Practically, riba is any predetermined increase on a loan or debt. If repayment must exceed the principal—whether a fixed sum or percentage—that excess is riba. Late-payment additions that raise the debt are also riba.

Q3: What are the main types of riba recognised in Islamic finance?

The two primary types are Riba al-Nasiyah (time-based increase on debts) and Riba al-Fadl (excess in spot exchange of similar commodities). Both are prohibited because they create unearned gain without productive value.

Q4: How is trade different from riba islam practices?

Trade links profit to effort and risk. With riba, the lender receives a guaranteed return regardless of outcome. Islam allows trade and bans riba to align reward with real economic activity.

Q5: When is riba triggered in a loan agreement?

Riba is triggered whenever a loan contract requires more than the principal on repayment, or imposes additional charges for extending time. Any pre-agreed increase constitutes riba.

Q6: What is Riba al-Fadl and what are common mistakes to avoid?

Riba al-Fadl is excess in barter of same-kind commodities (e.g., gold for gold) when amounts are unequal or exchange isn’t immediate. Avoid it by equal measures and hand-to-hand delivery, or by selling for cash and buying separately.

Q7: How can individuals avoid riba in islam while borrowing?

Borrow only when necessary, avoid interest, and consider Qard Hasan or partnership-based contracts. Put terms in writing with witnesses, and exclude late-payment interest clauses.

Q8: What is riba in islam examples from classical sources?

Examples include charging extra on a loan, increasing the due sum for more time, or exchanging unequal amounts of the same ribawi goods. Prophetic guidance mandates equality and immediacy to prevent such excess.

Q9: Why is riba meaning in islam linked to social harm?

Riba encourages hoarding and monopolies, widens the rich–poor gap, and weakens mutual help. Its prohibition aims to circulate wealth and protect the vulnerable.

Q10: What practical steps help build a riba-free financial system?

Adopt trade- and partnership-based contracts (e.g., Murabaha, Musharakah, Mudarabah), ensure transparency and documentation, and avoid guaranteed returns on debt. Education in Islamic finance supports correct implementation.

Q11: How do the types of riba relate to modern banking products?

Interest-bearing loans align with Riba al-Nasiyah. Certain exchanges risk Riba al-Fadl if they mirror unequal barter. Islamic products replace interest with cost-plus sales, leasing, or equity participation.

Q12: What is riba in islam and how should debt be documented?

It is any unjustified increase over principal in a debt. Document debts clearly, specify amounts and timing, and use witnesses to prevent riba-like terms and disputes.