What is Salam Contract?

The Salam contract, often referred to as ‘Salam financing’ or “بيع سلم”, is a sale contract whereby the purchaser pays the price in advance and the delivery of the subject matter is postponed to a specified time in the future”. Salam in Islamic banking may also be defined as: “A type of sale in which the seller undertakes to supply goods at a future date, against an advanced spot price, paid fully in cash”.

Comparison of Salam Contract with General Rules for Sale in Islam:

According to general Islamic Shariah rules, a sale must fulfill the following three conditions. However, only the Salam and Istisna are exceptional from these conditions:

- Commodity for sale must exist;

- The seller should acquire ownership of that commodity; and;

- The commodity must be in the physical or constructive possession of the seller.

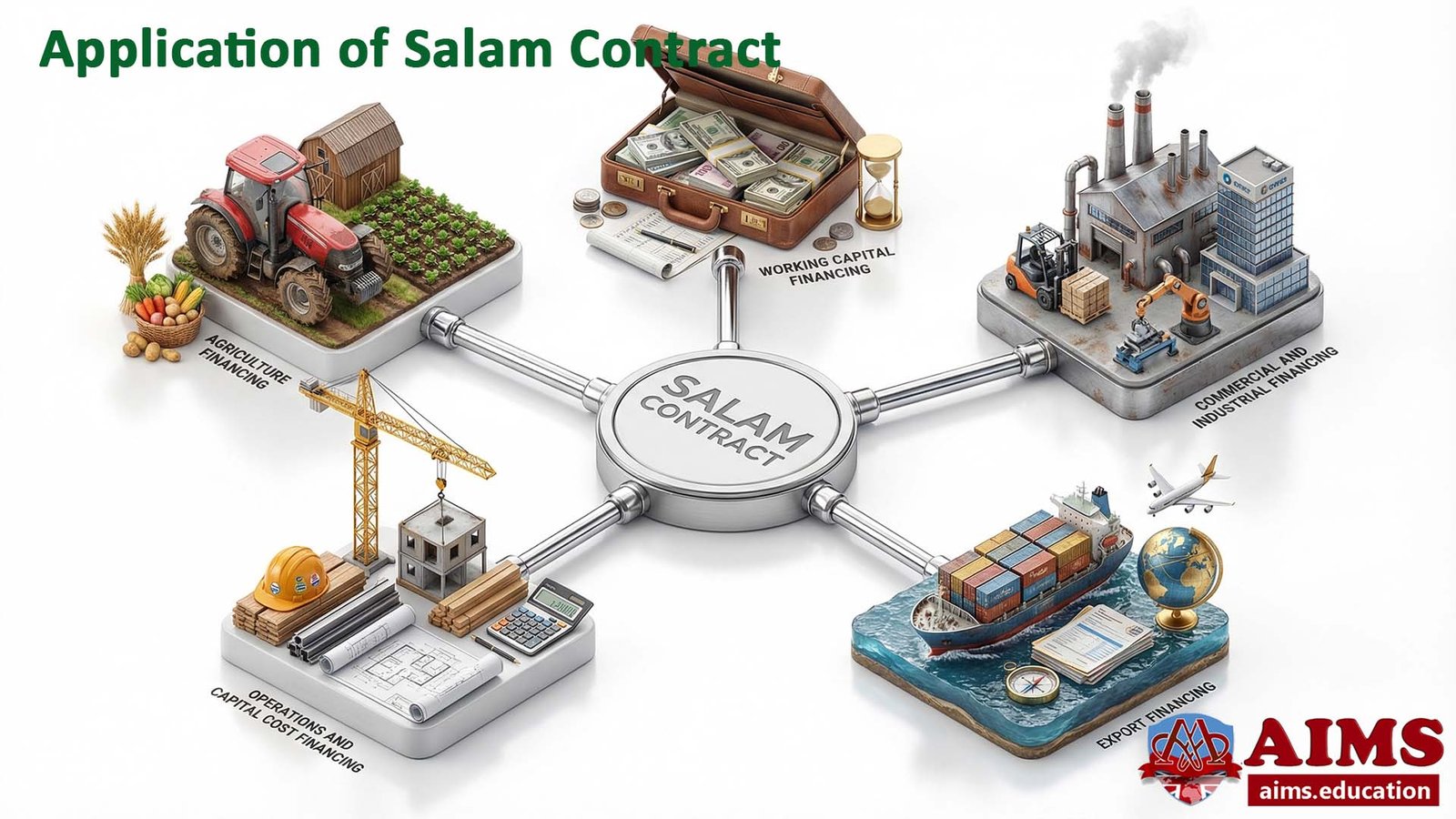

Applications of Salam in Islamic Banking:

It is mostly a mode of finance for farmers and small traders. It is used by micro banks and financial institutions to support small industries. It is mostly used for:

- Agriculture financing;

- Working Capital Financing;

- Commercial and industrial financing;

- Export Financing; and;

- Operations and capital cost financing.

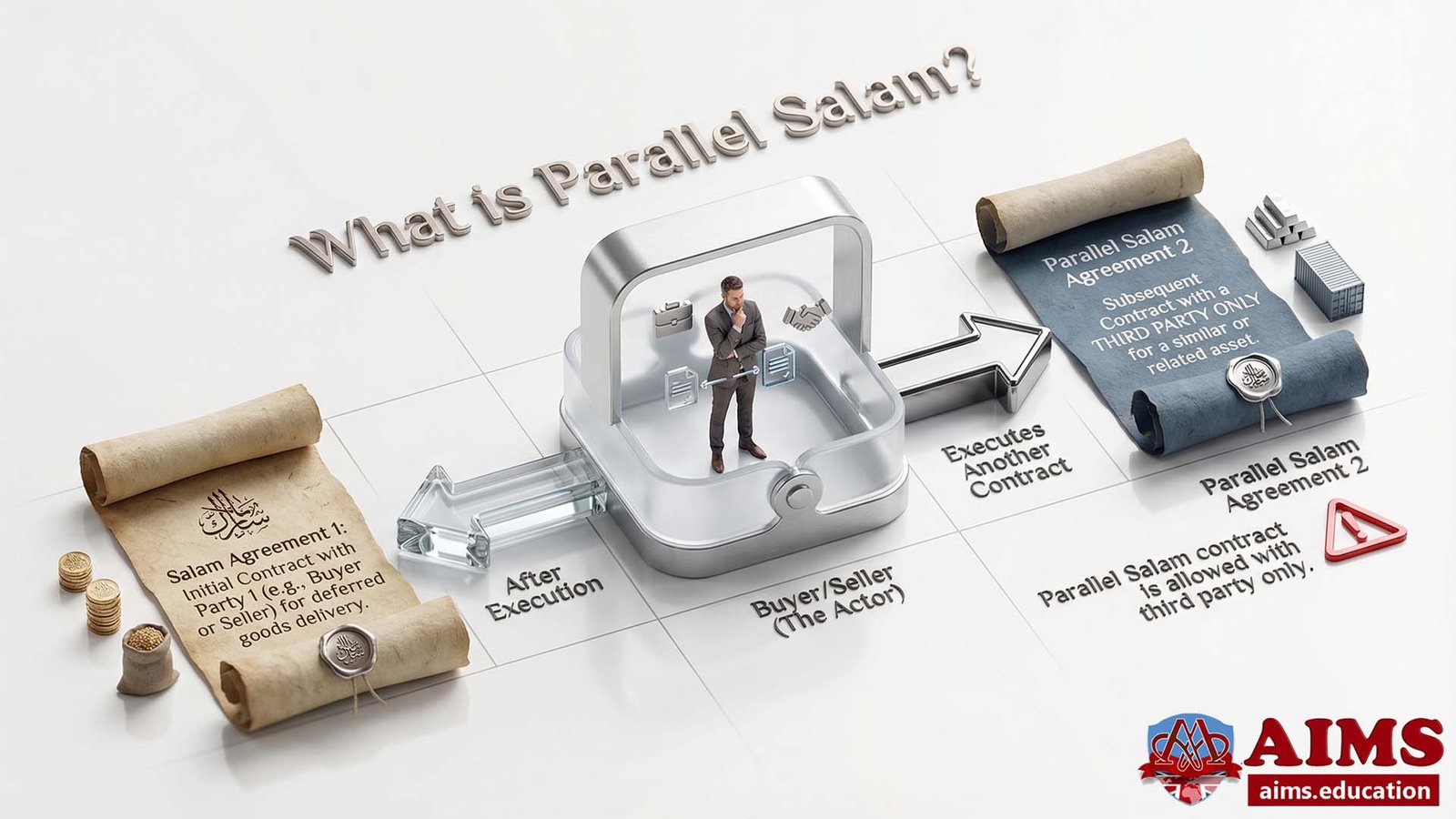

What is Parallel Salam?

After the execution of a Salam agreement with one party, the buyer or seller executes another contract with a third party. Parallel Salam contract is allowed with third party only. They must be two different and independent contracts, and these two contracts cannot be tied up.

Parallel Salam Example:

Let us understand it with the help of an example:

- Bank purchases 500 Bags of Rice from “Ali” through this contract, with full prepayment and to be delivered on June 30th.

- “Ali” delivers 500 bags of rice to the Bank on June 30th.

- The bank sells this commodity to a third party, called a “Company”, on credit.

- After taking its delivery on an agreed date, Bank delivers it to the “Company”.

- After taking delivery from the Bank, the “Company” signs a promissory note against payment, on an agreed-upon specified time.

This lecture is a part of the AIMS Islamic banking certificate course and diploma Islamic banking and Islamic finance programs. AIMS’ curriculum includes all AAOIFI-compliant Islamic finance products and instruments that Islamic Financial Institutions use.

Role of Salam and Parallel Salam Contracts:

These contracts offer Shariah Compliant financing mechanisms, especially in agriculture financing, to empower Shariah Compliant and Ethical financial solutions to Muslims and Non-Muslims, globally. They eliminate the prohibited elements, such as riba, gambling, and uncertainty, which are prohibited in Islam and against Islamic banking principles.

Frequently Asked Questions

Q1: What is a Salam contract in Islamic banking?

Salam is a forward sale where the buyer pays in full now for goods delivered later, with detailed specs set upfront.

Q2: How does Salam financing work in practice?

The bank prepays for specified goods to be delivered on a fixed date and later sells them to clients or the market.

Q3: What are the key conditions of a valid Salam transaction?

Full advance payment, precise specifications, and a defined delivery time/place for goods commonly available at delivery.

Q4: When is Parallel Salam used and why?

To manage delivery and price risks by independently arranging a second Salam as seller with matched quantities and dates.

Q5: What mistakes should be avoided in Salam contracts?

Vague specs, partial prepayment, goods not typically available at delivery, and linking obligations across Parallel Salam deals.

Q6: How is delivery handled and what if it is delayed?

Deliver on the agreed date/place; use performance guarantees or Parallel Salam to mitigate delays and compensate actual losses.

Q7: Which goods are suitable for Salam?

Standardized, fungible goods—e.g., agricultural produce or commodities—that can be precisely defined and delivered later.

Q8: How does Salam differ from Murabaha or Istisnaʿ?

Salam: prepaid for future delivery; Murabaha: cost-plus sale of an identified asset; Istisnaʿ: made-to-order with flexible payment.

Q9: Can Salam goods be sold before delivery?

Not directly; instead, use a Parallel Salam to arrange an independent forward sale that settles upon delivery.

Q10: What are the benefits of Salam financing?

Producers gain upfront liquidity; banks access real-sector assets and manage risk via Parallel Salam and careful inventory planning.