Sukuk Meaning

Sukuk (صكوك) is a plural of the word “Suuk,” which was used by the Muslim societies of the Middle Ages for “Papers.” These papers are used to represent financial obligations originating from trade and other commercial activities. Unlike bonds that yield interest, Sukuk or Islamic bonds may look similar, but they are structured using Shariah laws. There are many types of sukuk, and they are sometimes referred to as Islamic investment certificates. The advantages of Sukuk are as follows:

- They bring new sources of funds to Islamic borrowers at attractive rates.

- They are vital to develop a deeper and more liquid Islamic capital market.

- Great surplus cash in Islamic financial institutions may be tapped through Sukuk.

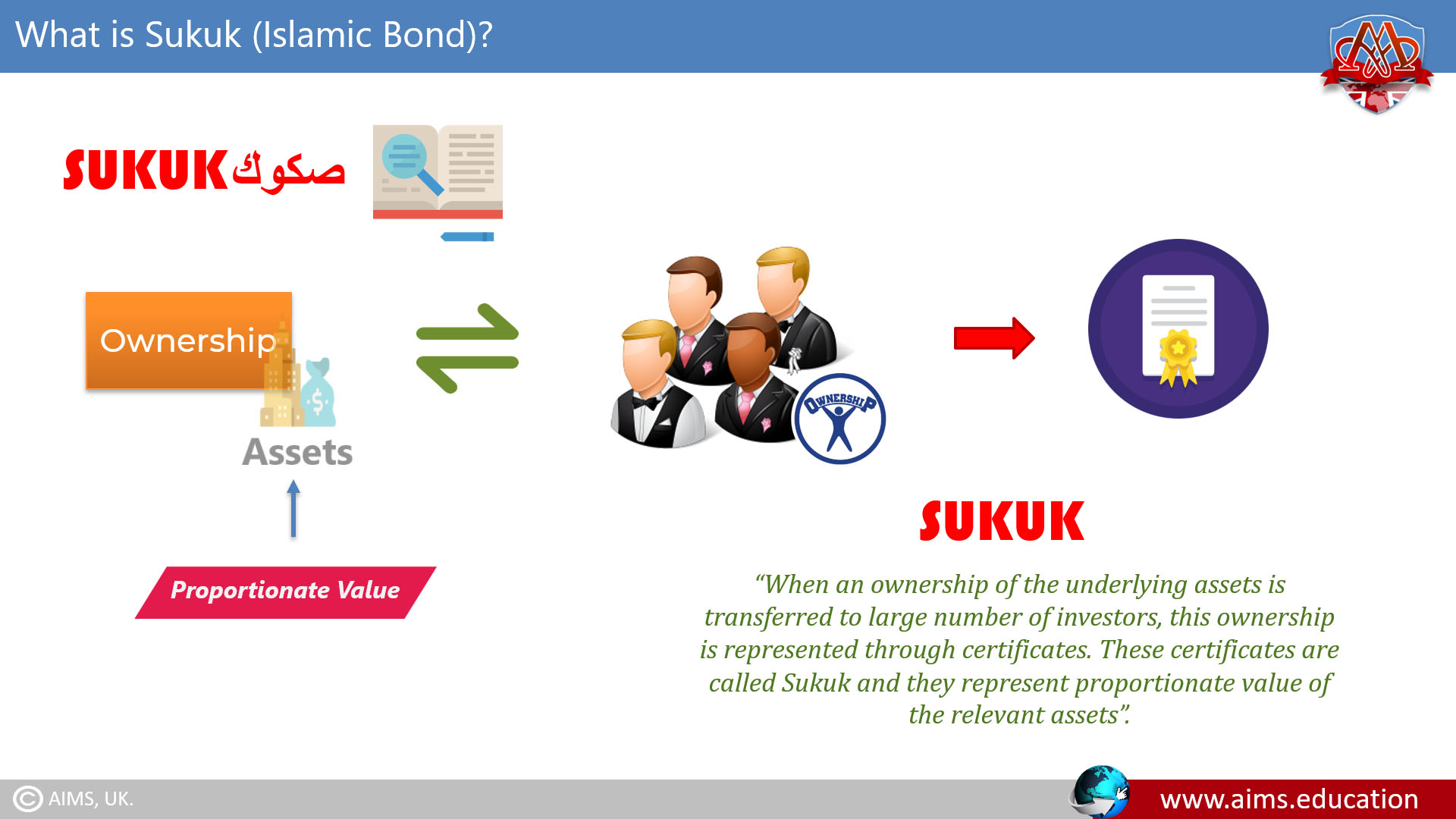

“When an ownership of the underlying assets is transferred to large number of investors, this ownership is represented through certificates. These certificates are called Sukuk and they represent proportionate value of the relevant assets.”

Sukuk Definition!

Conventional Bonds VS Sukuk

Bonds are important because, a developed bond market ensures stable financial system. And that minimizes over-reliance on financing from the banking sector.

However, conventional bonds are not permissible in Shariah due to the following reasons:

- They represent a portion of Riba-based Debt, which is payable by the issuer and;

- Bond transactions involve elements of Gharar.

On the other hand, Sukuk, as an Islamic alternative to Bonds, represents one’s proportionate ownership in an Asset or a Pool of identified assets. However, trading of Murabahah and Salam-based Islamic bonds is not permissible.

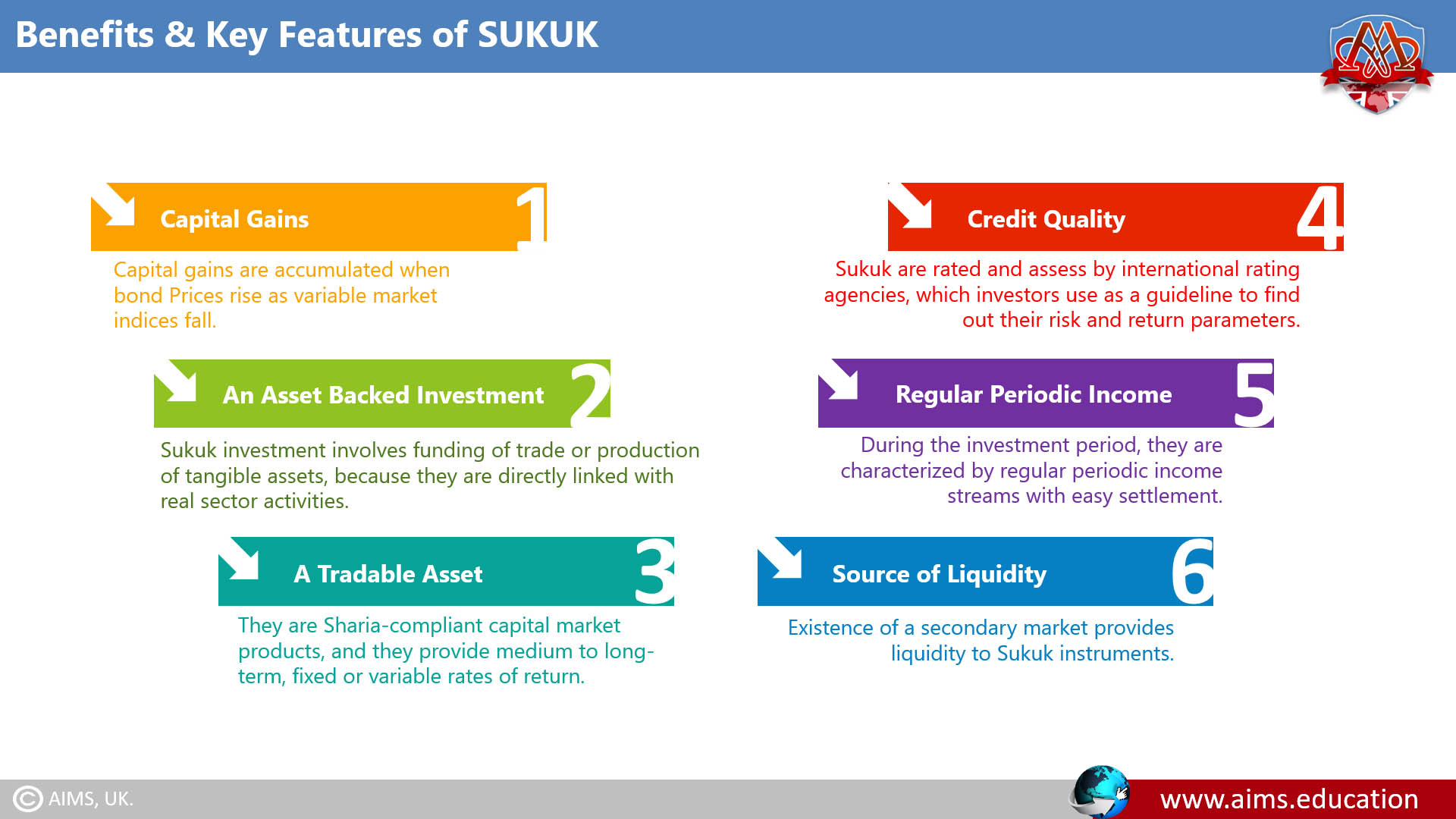

5 Key Benefits of Sukuk

1. Capital Gains

Capital gains are accumulated when Islamic bond prices rise as variable market indices fall.

2. An Asset Backed Investment

صكوك investment involves funding of trade or production of tangible assets because they are directly linked with real sector activities.

3. A Tradable Asset

They are Shariah-compliant capital market products, and they provide medium to long-term, fixed or variable rates of return.

4. Credit Quality

They are rated and assessed by international rating agencies, which investors use as a guideline to find out their risk and return parameters.

5. Regular Periodic Income

During the investment period, they are characterized by regular periodic income streams with easy settlement.

6. Source of Liquidity

The existence of a secondary market provides liquidity to Sukuk bonds instruments.

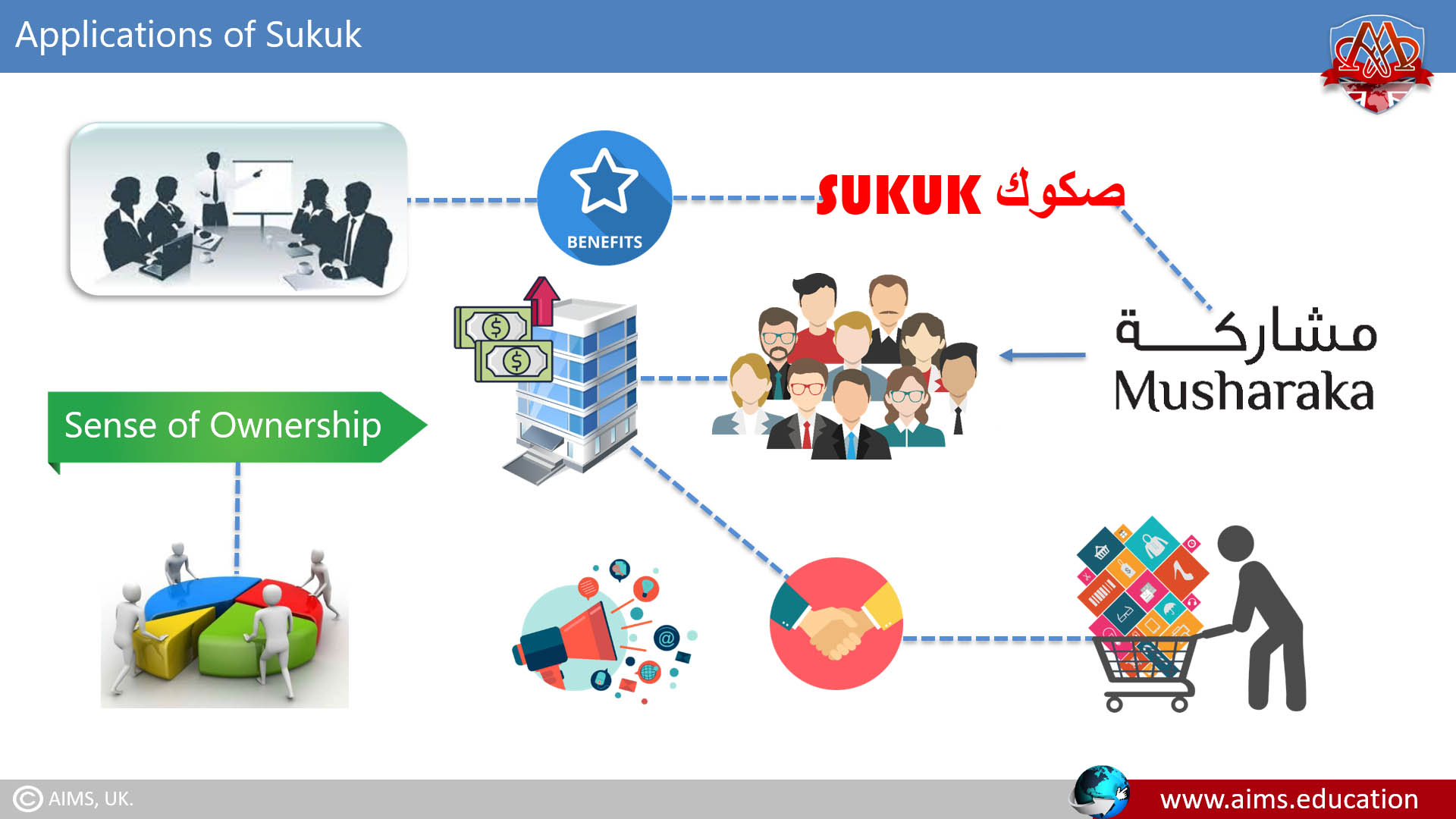

Applications of Sukuk

They may be designed and issued for:

- Government;

- Corporate body;

- Banking and financial institution; or;

- Any entity that wants to mobilize its financial resources.

1. Sukuk for Government Projects

- Ijarah based Sukuk are effectively used to finance Government projects.

- When a general public is involved in the construction of these projects, it gives them a sense of ownership.

- Effective usage of Islamic bonds increases the ratio of success and sustainability of the projects.

2. Sukuk in the Private Sector

The corporate sector can benefit from the unique characteristic of Islamic bonds:

For Example

- Musharakah contract based Sukuk associates general customer with the company.

- “Sense of Ownership” and “Share in Company’s Profit” can be marketing tools, especially when the company deals in customer goods.

3. Legitimacy of Sukuk Bonds

Collection of assets can be represented in an Islamic bond, and they can be sold at a market price. However, majority of assets must consist of physical assets, with a small portion of cash and debts.

4. International Sukuk Market

- Bahrain was the first country to issue domestic sovereign fixed-rate Ijarah and Salam Islamic bonds.

- This was followed by corporate bodies and sovereigns in several countries, which issued floating-rate “Ijarah Sukuk” and “Pooled Sukuk.”

- Non-Muslim countries are also issuing them to attract surplus money from Muslim countries.

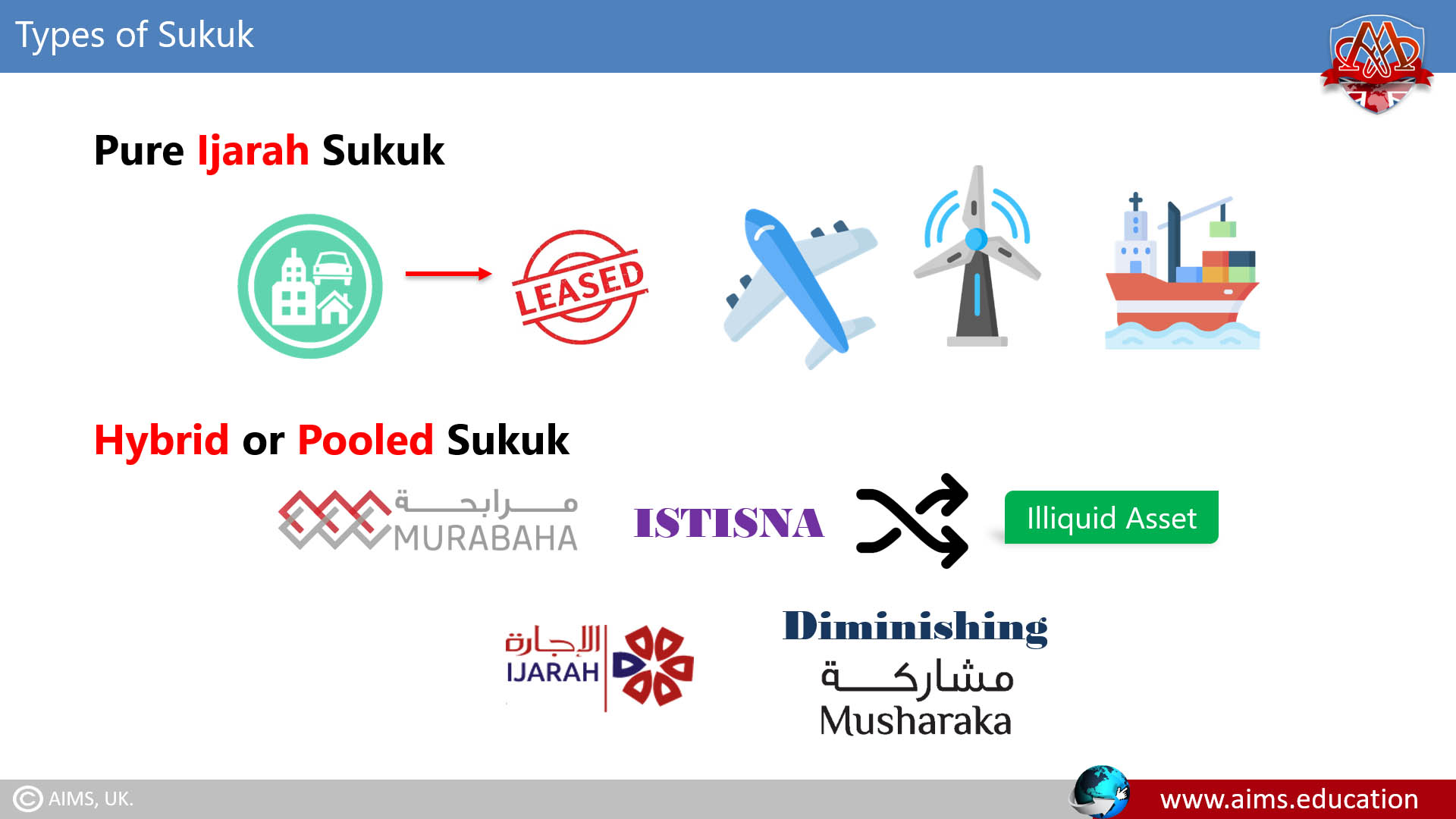

Types of Sukuk and Their Structuring

Their issuance requires an exchange of assets or asset based Islamic financing through a Shariah-compliant commercial contracts. Examples of such contracts are:

- Mudarabah,

- Musharakah,

- Ijarah,

- Istisna,

- Salam, and

1. Murabahah Sukuk

- They based on the principles of equity-based Murabahahh and Musharakah exposes investors to risks.

- They are based on the principles of receivables, and their result are predictable, and somewhat they give fixed returns.

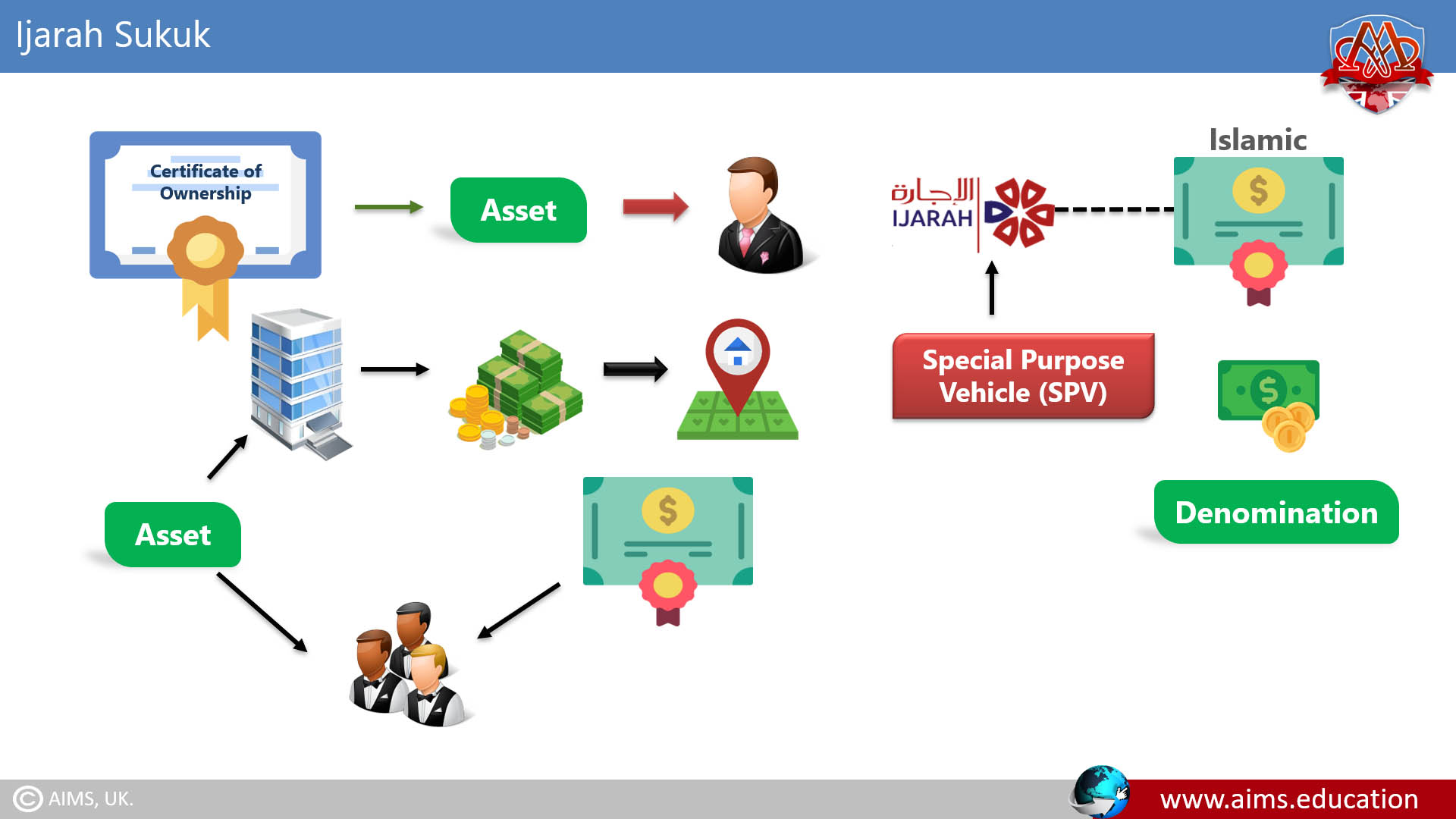

2. Ijarah Based Sukuk

These are the “Certificate of Ownership of Assets” owned by a customer and they are based on Ijarah.

a. This is how it works

- The company that needs funds to purchase land or equipment establishes a Special Purpose Vehicle.

- The SPV issues Ijarah-based Islamic bonds by dividing the required amount into small and equal denominations.

- The asset is then leased to the Company, and bonds are sold to the investors.

- The lease proceeds from the asset are distributed to investors as dividends.

b. Case Study: Step-by-Step Structuring of Ijarah-based Sukuk

- ABC Limited wishes to purchase a plant worth $5 Million.

- The company identifies the plant supplier and finalizes the negotiations.

- ABC Limited creates a Special Purpose Vehicle (SPV) as a limited liability Company.

- The SPV issues 10,000 Ijarah based Islamic bonds, equaling each of $500.

- These 10,000 bonds are sold and funds are collected from investors, and the SPV purchases the plant.

- Now, the investors (bondholders) are the owners of the plant.

- SPV holds the plant as a Trustee and leases the plant to ABC Limited as per Ijarah.

- ABC Limited pays periodic rentals to Special Purpose Vehicle for tenors, and amounts matching the coupon, and tenor of the contract.

- ABC Limited gives the Special Purpose Vehicle an irrevocable purchase undertaking to purchase the Asset on maturity.

In this case

- “Exercise Price” = “Initial Purchase Price of Asset” + “Service Costs”.

- Upon payment of the Exercise Price, Asset is transferred back on maturity to the Special Purpose Vehicle or sukukholders.

c. Important Features

- Ijarah based Islamic bonds can be issued through bank, or brokerage house, or directly by the users of lease asset.

- Since the underlying assets are not liquid, Ijarah certificate can be freely traded in the secondary markets, at par, premium, or discount.

- Ijarah Sukuk represents the holder’s proportionate ownership in the leased asset.

- In case of total destruction of the asset, bondholder will suffer the loss to the extent of his ownership.

- It is essential that they are designed to represent real ownership of the leased assets, and not only a right to receive rent.

3. Diminishing Musharakah based Sukuk

These are the “Certificate of Ownership of Assets” owned by a customer and they are based on Diminishing Musharakah contract. Let us understand the Mechanism and Documents executed under this arrangement.

a. Investment Agency Agreement

Through this Agreement, all participating Investors appoint a Bank as an ‘Investment Agent’ to carry out all actions in respect of the Sukuk bonds Issue.

b. Asset Purchase Agreement

Through this agreement, the investment agent, on behalf of investors, buys fixed Musharakah assets in partnership with the Issuer at a price equivalent to the Issue Amount.

c. Musharakah Agreement

- The Investment Agent, on behalf of the Investors and issuer, enters into a Musharakaha Agreement to jointly own the Musharakah assets.

- Each Investor’s entitlement to the asset constitute of “Units”. And, this halal share of each Co-Owner is specified in the Agreement.

d. Service Agency Agreement

As per this agreement, Issuer is appointed as a ‘Service Agent’. This agreement is signed between “Issuer” and “Investment Agent”, where ‘Investment Agent’ acts on behalf of Investors.

e. Payment Agreement:

Through this agreement, Investment Agent allows Issuer to use Investors’ share of the Musharakah Assets, against periodical rental payments.

f. Undertaking to Purchase Sukuk Units

It is a promise undertaken by Issuer, in favour of the Investment Agent, to periodically purchase Units. These units represent Investors’ undivided beneficial ownership in the Musharakah Assets, and purchase of all outstanding Investors’ Sukuk Units in case of Default.

g. Undertaking to Sell Sukuk Units

It is a promise undertaken by the Investment Agent in favour of Issuer. The Investment Agent grants a call option to the Issuer to purchase all or part of the Units.

h. Trust Deed

It is executed between the Trustee, appointed by Investors for the Islamic Bond Issue, and the Issuer, detailing the responsibilities of the Trustee.

i. Letter of Hypothecation OR Other Security Documents

The Issuer executes them in favor of the Trustee for security purposes.

4. Salam based Sukuk

- Salam is an Islamic financial contract that allows seller to make advance payment for goods, which are to be delivered later, provided that the goods are defined and their delivery date is fixed.

- The government of Bahrain first issued Salam-based Islamic bonds as an alternative to the short-term government Treasury bill.

This is how it works:

- Suppose, a government takes an advance payment from the investors, for a future delivery of goods, for example: “Crude Oil, at the rate of $50 per barrel”.

- Government issues an acknowledgment of receipt to the investors, called Salam Sukuk.

- At the time of completion of contract and upon the delivery of “Crude Oil”, Government acts as an agent of investors and sells Crude Oil to the refineries at the rate of $55 per barrel.

- Difference between Sale and Purchase prices of the crude oil, is the profit of investors.

- However, these bonds cannot be traded in the secondary market.

5. Murabahah Sukuk

They are issued against a Murabahah transaction, where investors provide funding to issuer, to purchase some assets.

Mechanism

- Assets are purchased from the supplier, and they are immediately sold to the issuer, on deferred payment.

- Profit earned from the transactions, is distributed among the investor proportionately.

- However, they also cannot be traded in the secondary market.

6. Musharakah Sukuk

- They are widely used in project financing, when company requires funds from investors, according to the rules of Musharakah .

- Every Islamic bond would represent holder’s proportionate ownership in the Musharakah assets.

- Once the majority of the cash is converted into assets, these bonds can be treated as “negotiable instruments” in the secondary market.

Features

- Profit is shared according to the ratio, agreed between Issuer and Investors.

- Loss is shared on pro rata basis.

- To ensure tradability, at least 20% of the value of Portfolio, should be invested in non-liquid assets.

- It is used for several purposes, including: Construction of Factories, Expansion Projects, and, Working Capital Finance.

7. Hybrid Sukuk Structures

Islamic bonds can also be issued under hybrid structures, where multiple Islamic modes are used to issue a single Sukuk. However, while designing such Sukuk bonds, each of Islamic modes is applied at different interval, to cater different requirements of the issuer.

Applications of Sukuk

Pure Ijarah

It is used for the assets that can be leased: For Example: Air crafts, Turbines, Ships, etc.

Hybrid or Pooled

Modes like Murabahah and Istisna, are mixed with illiquid assets, like Ijarah and Diminishing Musharakah.

Variable Rate Redeemable

Their return is linked with the performance of underline asset. For Example: Musharakah Term Finance Certificates or MTFCs.

Zero-Coupon Non-Tradable

These certificates are based on modes like Istisna and parallel Istisna, which are not readily tradable because assets do not exist.

Embedded

If any of the above mentioned bond is converted into other asset forms, such types of Islamic bonds are called “Embedded Sukuk”.

Other types

Islamic bonds are also issued for other mode of finance; However, focus is given only to those modes, in which usufruct is transferred and not the ownership of asset.

Other types include,

- Muzarah or Sharecropping Certificates;

- Mugharasah or Agricultural Certificates; and;

- Musaqah or Irrigation Certificates.

Steps on How the Sukuk Bonds are Issued?

The primary condition for issuing Islamic bonds is the existence of assets. Usually, there are three main stages to their Issuance, and they are explained here:

Stage 1: Securitization via BBA and Bai Al Enah

- The first step is the creation of a Bai Al Enah underlying asset.

- The next step is their Securitization. Since Asset Securitization is the essence of Islamic bond issues, the bond must assume a property as an object of sale.

Stage 2: Sukuk Issuance via Bai Al Dain

- It takes place in the primary market, where the issuing company sells its “Debt Certificates” or “Bonds” to sell its debt to investors.

- As discussed earlier, debt certificates can be issued only if they are supported by “Asset”, or in other words, Sukuk bonds must be securitized.

- Here the underlying security is BBA or Murabahah Asset, but it is not necessary, and it depends on Stage-1.

- If the first stage involves contract of Ijarah or Istisna, instead of BBA, then the “Debt Certificate” will be Sukuk Al Ijarah or Al Istisna respectively.

Stage 3: Trading of Debt Certificates

Almost all Islamic bonds are bought for long-term investment. Here is a Shariah view on Bond Trading in the secondary market:

- Since Bai Al Dain literally means “Debt Trading,” it refers to the “Exchange of a debt for a debt.”

- Since this transaction involves the sale and purchase of securities, or debt certificates, so it is prohibited in Shariah.

Trading of Islamic bonds in the secondary market for liquidity is also crucial, because there is a lack of secondary markets.

Distinguished Qualifications in Islamic Finance

To further comprehend the intricacies of sukuk bonds, the Centre for Islamic Finance and Banking offers comprehensive education. Their online programs include:

- an MBA degree in Islamic banking and finance,

- a postgraduate Islamic banking diploma, and

- an online PhD thesis in Islamic banking and finance.

AIMS programs are designed to provide a thorough understanding of several advanced areas in Islamic finance, including Sukuk bonds, types, and structuring. The institution also offers:

- CIFE, the top Islamic finance expert certification, is a distinguished qualification that serves as a mark of proficiency in Islamic finance.

- Additionally, for those focusing on Islamic banking, the CIB Islamic banking course is an excellent choice.

Summary

- Conventional bond market is comprised of both primary and secondary markets.

- Primary bond market is where the bonds are initially issued.

- Secondary market is where the bonds are resold to other investors.

- Islamic bonds also have primary and secondary markets, but they are traded differently.

- In Sukum, ownership of assets is transferred to investors, through certificates.

- Investments in Islamic bonds involve funding of trade or production of tangible assets.

Frequently Asked Questions

Q1: What is Sukuk and how does it differ from an Islamic bond?

Sukuk are ownership certificates in assets or usufruct. Returns come from asset cash flows, not interest, making them distinct from conventional bonds.

Q2: What are the most common types of Sukuk?

Popular forms include Ijarah, Murabaha (with constraints), Musharakah, Mudarabah, Salam, and Istisna’. Each defines how assets are created and returns are generated.

Q3: How are Sukuk structured in practice?

An SPV issues certificates, acquires or leases assets, and channels asset-linked income to investors under Shariah-approved documents.

Q4: What does “asset-backed” mean in Sukuk?

Investors hold rights in assets or their benefits. Payments derive from those assets (e.g., lease rentals) rather than interest.

Q5: Who issues Sukuk and why?

Sovereigns, corporates, and multilaterals issue Sukuk to fund real projects, refinance assets, and diversify capital in a Shariah-compliant way.

Q6: How do investor returns on Sukuk work?

Returns mirror asset performance: rentals in Ijarah, profit shares in partnerships, or agreed proceeds in Salam/Istisna’ structures.

Q7: What risks are associated with Sukuk?

Asset performance, credit, legal enforceability of true sale, Shariah compliance, market volatility, and liquidity are key considerations.

Q8: How are Sukuk different from conventional bonds for issuers?

Issuers must identify eligible assets, set up an SPV, and align documents with Shariah, which adds governance and broadens investor reach.

Q9: Can Sukuk be traded?

Yes, when they represent ownership in tangible assets or usufruct. Trading may be limited if the structure is mostly cash/receivables.

Q10: What ensures Shariah compliance in Sukuk?

Asset-backing, avoidance of riba and excessive uncertainty, lawful use of funds, and oversight by qualified Shariah scholars.

Q11: What does “sukuk bond meaning” imply?

It highlights that Sukuk evidence ownership interests with asset-linked returns, not debt with interest obligations.

Q12: When should an issuer choose Sukuk?

When seeking sizable, asset-based, potentially tradable funding for projects like infrastructure, real estate, or equipment.