The Concept of Consumption in Islam

Consumption, in Islamic terminology, refers to the act of using goods and services to satisfy human needs and desires. Consumption in Islamic economics is a central activity that comes after production and distribution. It does not consist solely of eating and drinking; it also refers to purchasing and benefiting from resources like housing, clothing, and transportation. Principles of consumption in Islam are derived from Shariah guidelines, which encourage balance in spending and avoidance of excess utilization. These principles advocate satisfying one’s own, family, and community needs while allocating resources towards constructive purposes; proper consumption fosters physical, social, and spiritual well-being while creating a balance between material success and moral responsibility.

Principles of Consumption in the Qur’an

Understanding human behavior and consumption in Islamic economics is deeply enriched by the comprehensive insights of the Holy Quran into human nature. When analyzing Muslim consumption patterns, verses of the holy text serve as invaluable guiding principles of consumption in Islam.

The following Quranic verses highlight traits that influence consumption:

“Human instinct prefers goods which serve survival needs as well as other wants which serve aesthetic desires “.

Surah Al-Imran Verse 14

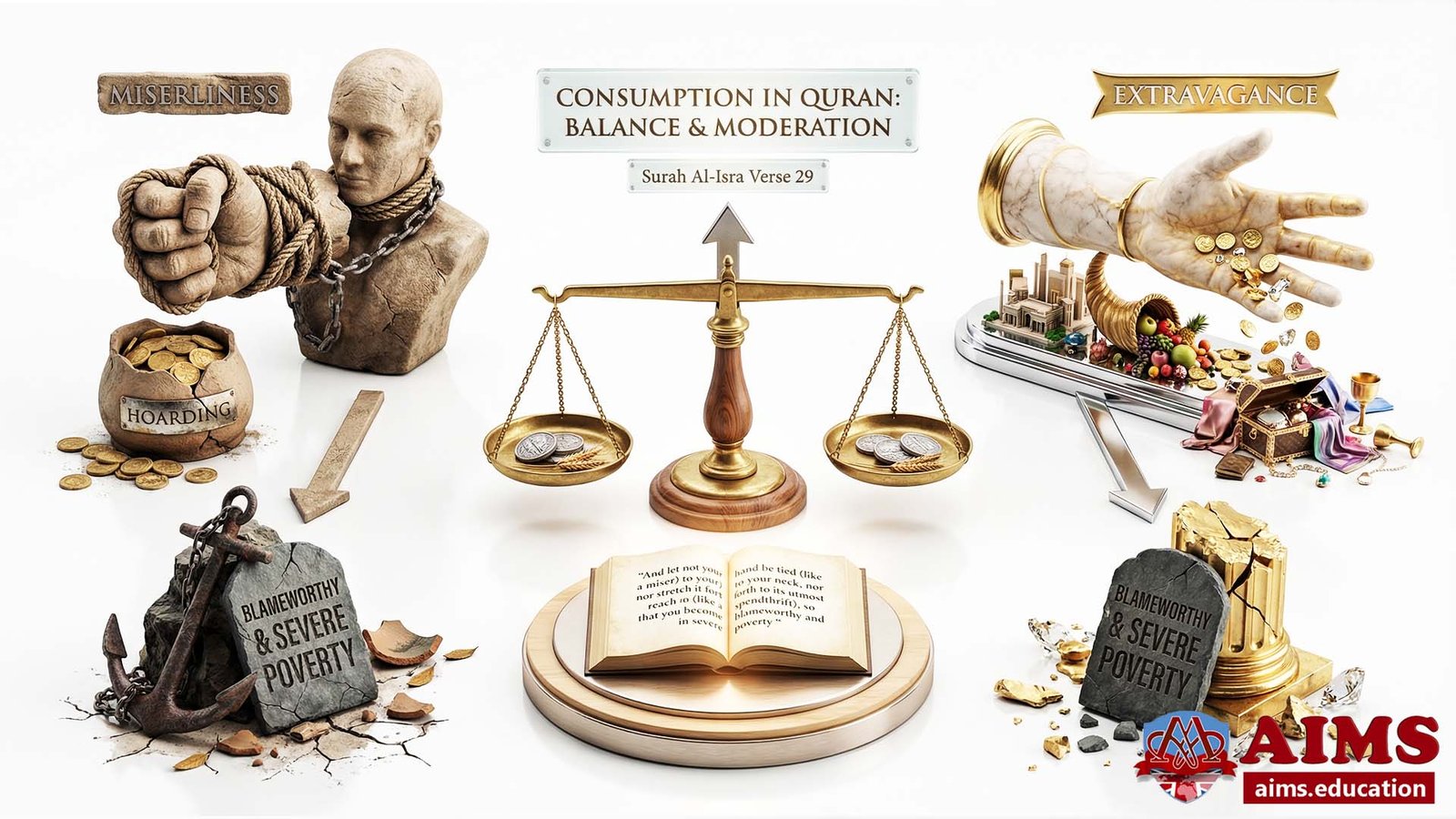

“And let not your hand be tied (like a miser) to your neck, nor stretch it forth to its utmost reach (like a spendthrift), so that you become blameworthy and in severe poverty “.

Surah Al-Isra Verse 29

“And those, who, when they spend, are neither extravagant nor niggardly, but hold a medium (way) between those (extremes) “.

Surah Al-Furqan Verse 67

“Humans are generally hasty”.

Quran Surah Al-Isra : Verse 11

“Humans are generally miserly”.

Surah Al-Isra Verse 100

“Human are impatient”.

Surah Al-Ma’raaj Verse 19

“Humans are generally have love of wealth”.

Surah Al-Adiyat Verse 8

“Waste not by extravagance. Verily, He likes not those who waste”.

Surah Al-Anam Verse 141

“And they give food, despite their love for it, to Miskin (poor), the orphan, and the captive. (Saying): ‘We feed you seeking Allah’s countenance only. We wish for no reward, nor thanks from you”.

Surah Al-Insan Verses 8-9

“Spend not wastefully (your wealth) in the manner of a spendthrift”.

Surah Al-Isra Verse 26

“Eat of that which Allah hath bestowed on you as food lawful and good, and keep your duty to Allah in whom ye are believers”.

Surah Al-Maidah Verse 88

“So give to the kindred his due, and to Al-Miskin (the poor) and the wayfarer”.

Surah Ar-Rum Verse 38

Principles of Consumption in Hadith

The Ahadith of the Prophet Muhammad (SAW) provide invaluable guidance on the principles of consumption in Islam, with particular focus on moderation, contentment, and charity. Here are a few narrations illustrating the value of consumption in Islam:

“If Adam’s son had a valley full of gold, he would like to have two valleys, for nothing fills his mouth except dust (of the grave)”.

Al-Bukhari, Book of Ar-Riqaq Vol 8, Hadith No. 6436

“The heart of an old man remains young with regards to two things: Love of life and wealth”.

Muslim, Book of Zakāt Vol 3, Hadith No. 2410

“Spend according to your means; and do not hoard, for Allah will withhold from you”.

Muslim, Book of Zakāt Vol 3, Hadith No. 2378

“The best charity is to spend (in charity) while you are healthy, aspiring, hoping to survive, and fearing poverty, and not delaying until death comes to you”.

Sunan Abu Dawud, Book of Wills, Vol 3, Hadith No. 2865

Consumption in Islamic Economics

Muslim should emphasize on fulfilling both spiritual and material needs according to the following fundamental principles of consumption:

1. The Role of Consumption in Islamic Economics

The goal of Islamic economics is to meet basic needs while simultaneously balancing spiritual and material aspects of life by applying moral and ethical standards as prescribed by Shariah law to consumption decisions. The ultimate goal is the well-being of individuals and society. Core principles of consumption in Islam include the following:

- Using resources responsibly and avoid Israf (wastefulness).

- Consume only halal and lawful goods, and avoid haram items.

- Support the poor through zakat and sadaqah.

- Focus on needs over luxuries.

- Ensure that all spendings are aligned with Shariah guidance.

2. Differences Between Islamic and Conventional Consumption

Conventional economics focuses on material gain and personal satisfaction. On the other hand, the principles of consumption in Islam incorporates spiritual rewards. And, fulfilling ethical and moral needs through consumption is a part of worship.

3. The Purpose of Wealth in Islam

- Islam permits wealth generation, provided it serves higher purposes such as paying zakat or sadaqah (to help the needy).

- Wealth is a blessing from Allah, and it should be used to meet basic needs, support others, and promote social stability.

- Islam prohibits the misuse of wealth and encourages the circulation of wealth to strengthen the economy as well as the society.

8 Key Principles of Consumption in Islam

A study of the Holy Qur’an and the Sunnah of Prophet Muhammad (SAW) reveals the following core principles of consumption in Islam. Studying both the Holy Qur’an and Sunnah of the Prophet Muhammad (SAW) provides us with the following eight core principles of consumption in Islam.

These principles are as follows:

1. Principle of Lawfulness (Halal vs. Haram)

Consumption in Islam must follow the knowledge of halal (permissible) and haram (forbidden).

- Certain items are clearly prohibited, such as carrion, pig flesh, blood, animals not slaughtered with Takbeer, intoxicants, and specific clothing materials like silk and gold for men.

- Also forbidden are idolatry, sculpture-making, fortune-telling, gambling, and betting.

Aside from these, all other goods are considered lawful, and spending on them is permissible.

2. Principle of Cleanliness (Tayyib)

For an item to be lawful under Islam, it must also be pure, clean, and hygienic for human health. Islam forbids spending money on things that are filthy or harmful; As Allah is Pure, He loves purity in what we consume and spend on. Therefore, Islam promotes healthy and safe consumption practices.

3. Principle of Moderation

It is an important principles, which is essential in all areas of life, particularly financial ones.

- It helps maintain balance between income and expenditure.

- The Islamic Shariah also keeps one away from wasteful spending or extravagance, so a Muslim should ensure financial stability and self-discipline.

4. Principle of Benefit

Principles of consumption in Islam aim at benefiting the body, soul, and community.

- Wealth is a blessing from Allah and should be used to fulfill both individual and societal needs.

- Islamic Shariah discourages spending on frivolous or harmful items and promotes useful, purpose-driven spending.

5. Principle of Morality

Rules for the consumption in Islam and Shariah are governed by ethical standards. While philanthropy and helping the needy are encouraged, spending on immoral content, such as inappropriate films, books, music, or other degrading materials.

Muslims’ spending patterns should be according to Shariah, and they must reflect moral character and social responsibility.

6. Principle of Maximum Welfare

True welfare is achieved when spiritual and material well-being are balanced.

- Muslims are encouraged to direct their spending toward items that promote personal peace, spiritual growth, and social welfare.

- Every purchase should serve a meaningful and beneficial goal, avoiding harm to oneself or others.

- Muslim households can achieve true welfare when both spiritual and material needs are balanced. Spending should prioritize items, such as peace, spiritual growth, and social welfare.

- Every purchase of a Muslim must serve an important and purposeful function, without harm to themselves or others.

For Example:

Donating a portion of your salary to a local charity that provides education to underprivileged children, while also ensuring your own family’s well-being, maintaining a balance between material and spiritual welfare.

7. Principle of Trust (Amanah)

Wealth is a trust (Amanah) from Allah. A Muslim does not possess wealth purely by skill or effort—it is a divine bounty. Therefore, money must be spent in line with Allah’s commands, upholding this trust through ethical and responsible spending.

8. Principle of Gratitude (Shukr)

- Wealth is a gift from Allah that requires expressing gratitude in consumption, according to Allah’s Will.

- True thankfulness is reflected when a person spends money on righteous acts, worship, and helping others, not just for personal luxuries.

For Example

If you are contributing a percentage of your earnings to build a mosque or fund clean water projects in underdeveloped areas, it means your wealth is a means of expressing gratitude to Allah for the blessings you’ve received.

Conclusion

Islamic principles of consumption offer a spiritual and socially responsible alternative to materialistic lifestyles. Consumption in Islam should follow values such maintaining balance in spending, gratitude (Shukr), ethics, and social welfare. Muslims are guided not only toward personal fulfillment but also toward collective harmony. The Qur’an and Sunnah teach us that wealth is a trust or Amanah from Allah, and consumption in Islam should benefit oneself, his or her family, and the society at large.

Learn More with AIMS

For those who wish to explore Islamic economics and ethical consumption in Islam in more depth, AIMS offers flexible, accredited programs, including:

- Globally accredited MBA masters degree in Islamic banking and finance,

- Internationally recognized postgraduate Islamic Banking and Finance Diploma, and

- CIFE Islamic Finance Course offered 100% online.

AIMS’ programs are globally recognized, internationally accredited, and they are offered through an online, self-paced learning system. These programs include in-depth study of consumption in Islam, zakat, halal investments, Islamic financial instruments, AAOIF Shariah Standards, and Islamic Insurance or Takaful.

Shariah-guided purpose of wealth helps you apply the principles of consumption in both personal life and professional practice. By aligning with the Shariah compliant spending habits, Muslims ensure their wealth becomes a source of barakah (blessing) in this life and the Hereafter.

Frequently Asked Questions

Q1: What does consumption mean in Islam?

Using lawful goods and services to fulfil needs in a balanced, purposeful way, guided by Shariah and social responsibility.

Q2: What are the core principles of consumption in Islam?

Halal vs haram, cleanliness (tayyib), moderation, benefit, morality, maximum welfare, trust (Amanah), and gratitude (Shukr).

Q3: How do halal and haram affect spending?

Consume only what is halal and avoid prohibitions such as pork, intoxicants, gambling, and idolatry-related practices.

Q4: What is tayyib in everyday purchases?

Choosing pure, wholesome, and safe items; avoiding what is filthy or harmful to health.

Q5: Why is moderation essential?

It balances income and expenses, curbs extravagance (israf), and supports long-term financial stability.

Q6: How should wealth be used according to Islam?

Meet needs, support family and community, pay zakat and sadaqah, and avoid wasteful or harmful uses.

Q7: How is Islamic consumption different from conventional views?

It integrates spiritual reward and ethical accountability, treating spending as part of worship and social justice.

Q8: How do morality and ethics guide purchases?

Spend on beneficial, dignified items; avoid degrading content and behaviour contrary to Shariah values.

Q9: What is “maximum welfare” in spending?

Direct purchases toward meaningful goals that enhance personal peace and community welfare, while avoiding harm.

Q10: What does Amanah (trust) mean in finance?

Wealth is a trust from Allah; use it lawfully, ethically, and responsibly, with accountability for choices.

Q11: How do Muslims show gratitude (Shukr) through spending?

By prioritising righteous uses—worship, charity, and beneficial projects—over luxury and excess.

Q12: Which Qur’an and Hadith themes guide consumption?

Eat what is lawful and good, support relatives and the poor, practice moderation, give timely charity, and avoid greed.