Halal Mutual Funds & Other Islamic Investment Options

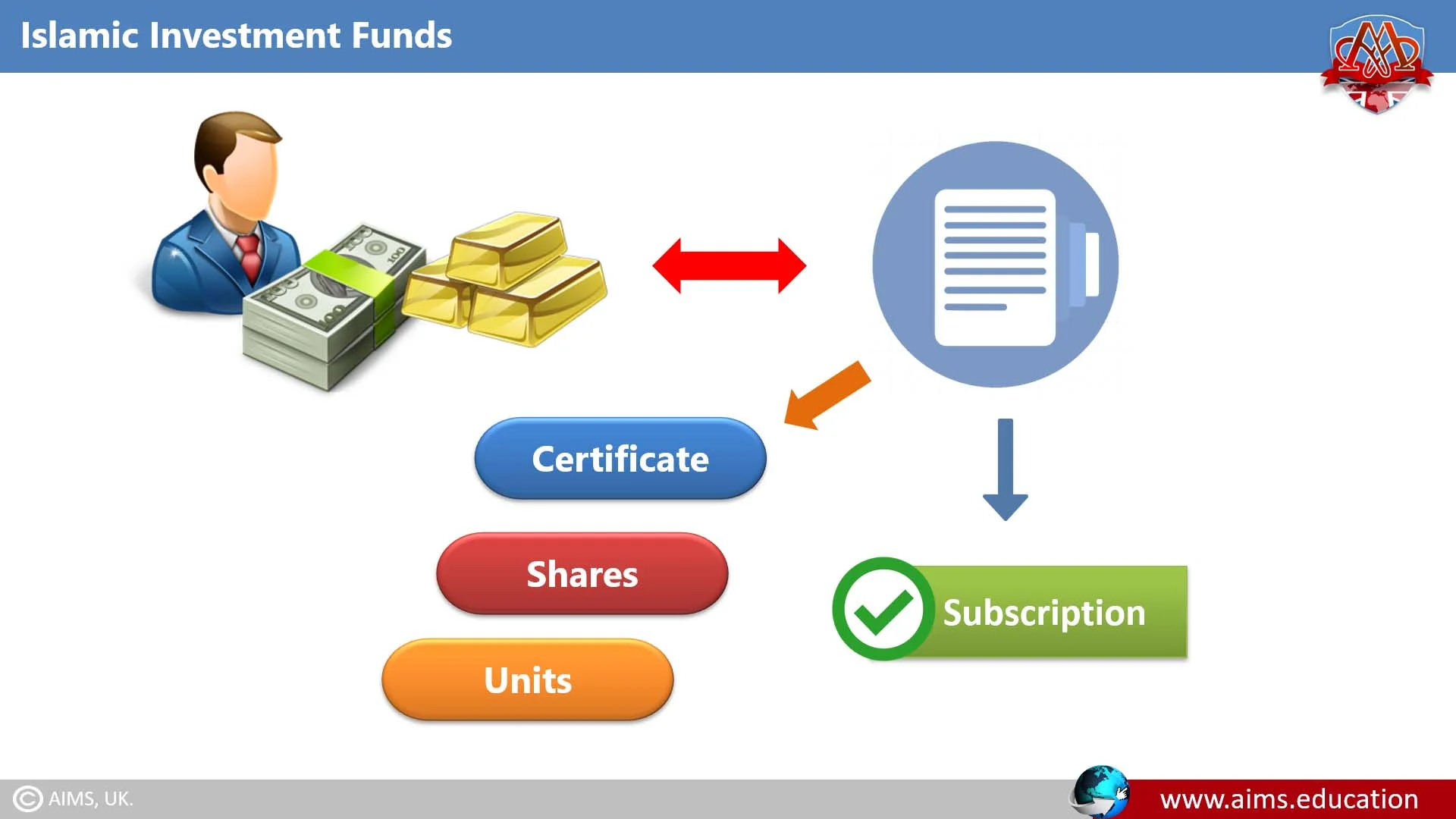

Halal investment has become increasingly popular in recent years, as more and more people seek ways to invest their money in a way that aligns with their religious beliefs. There are various options available for those looking to make halal investments. Halal Investment options include Halal mutual funds, Halal ETFs, Real Estate, REITS, Precious Metals, Islamic Forex Tradings, Islamic Peer-to-Peer Lending, etc. Islamic investment funds refer to a joint pool, where investors contribute their surplus money, to invest and earn halal profits. For example, halal mutual funds invest only in Shariah-compliant investments, which adhere to Islamic principles of investment, namely, investments devoid of riba (interest) and gharar (speculation). Subscribers of Islamic mutual funds receive a document certifying their subscription. This document may be called “Certification”, “Share” or “Unit”, and in Islamic Shariah.

11 Best Halal Investment Options

There are several halal investment options available to investors seeking Sharia-compliant opportunities. These include:

1. Halal Mutual Funds:

These funds are managed according to Sharia law, meaning they only invest in companies that comply with Islamic guidelines. They exclude businesses dealing in forbidden activities such as alcohol, pork, gambling, and usury. Each fund has a board of Sharia scholars who meticulously screen and approve companies before investing.

2. Islamic Bonds (Sukuk):

Sukuk are bonds that comply with Islamic laws against interest. Instead of traditional interest payments, investors receive a portion of the earnings from the asset the bond is backing.

3. Halal Stocks:

These are shares in businesses that are in accordance with Islamic guidelines, known as Shariah law. Investing in halal stocks implies that the company does not deal with haram elements — alcohol, pork-related products, gambling, or any financial institution that benefits from interest (Riba). These stocks undergo a rigorous screening process by Islamic scholars to ensure their compliance with Shariah law.

4. Gold/Silver:

Precious metals like gold and silver are often considered halal investments. These tangible assets hold intrinsic value and can act as a hedge against inflation. However, it is important to ensure that the trading methods align with Islamic principles, avoiding practices like speculative trading (Gharar).

5. Real Estate:

Investing in properties, whether residential or commercial, is a popular halal investment strategy. Profits can be derived from rental income or capital appreciation. It is vital, however, to ensure that the properties are not used for activities prohibited in Sharia law, such as alcohol consumption or gambling.

6. Exchange Traded Funds (ETFs):

Sharia-compliant ETFs are designed to track a specific index of halal stocks, allowing investors to diversify their portfolios without directly purchasing individual stocks. As with any investment, it is crucial to ensure that the ETF is certified as halal by a reputable Islamic financial institution.

7. Halal Start-up Investments:

Investing in start-up businesses that operate in line with Islamic principles can also be a profitable venture. These can range from tech start-ups to retail businesses. The key is to ensure that the business activities and financing methods are Sharia-compliant.

8. Islamic Forex Trading:

Forex trading, or currency trading, can be done in a halal manner under certain conditions. It must be free from interest (Riba), uncertainty (Gharar), and gambling (Maysir). Some brokers offer Islamic forex accounts to cater to this need.

9. Islamic Peer-to-Peer Lending:

This is a form of investment where you lend money to businesses in return for a profit rate. This transaction is done through a contract known as Murabaha, where the buying and selling price, along with the profit margin, is clearly stated.

10. Halal Real Estate Investment Trusts (REITs):

Similar to property investments, REITs can also be utilized as a halal investment strategy. REITs are companies that own, operate or finance income-producing real estate. Halal REITs are those that invest in properties that are used for Sharia-compliant purposes. They provide investors with an opportunity to invest in real estate indirectly, without the need for management or large capital, making it a viable option for many.

11. Crowdfunding:

Similar to peer-to-peer lending, crowdfunding allows individuals to invest in businesses or projects that align with Islamic principles. Profits are shared based on a pre-determined agreement between the investors and the business owners.

What are Halal Mutual Funds?

Exploring the Halal Nature of Mutual Funds

The validity of halal mutual funds is always subject to the following two conditions:

1. First Condition:

Subscribers should clearly understand that the returns are tied up with the sharing of actual profit or loss. However, if the losses are due to the negligence of management then they are not liable to compensate it.

2. Second Condition:

Funds must be invested in Shariah-compliant businesses. And all channels of investment, as well as the business terms must conform to the principles of Islamic banking and finance.

Mechanism of Islamic Mutual Funds:

In halal mutual funds, investment is made in shares of joint stock companies, and profits are earned through capital gains in the share value, and the dividends are distributed by those companies. Dealing in Shariah-compliant stocks is acceptable under the following two conditions:

- The nature of the Business of that company must be Shariah compliant (such as Construction or Export of Halal Meat), and,

- The company is not involved in prohibited elements or activities (such as Riba or Gambling).

Types of Halal Mutual Funds:

1. Ijarah Funds:

The Ijarah funds are based on the concept of Ijarah. The subscription amount is used to purchase assets, such as Real Estate, Vehicles, or Machinery, and they are leased out to users. The Ijarah funds own the assets, and rentals are the profit of the subscribers.

2. Commodities Funds:

The Islamic commodity funds are based on commodities, and the subscription amount is used to purchase different commodities, for resale. Profit generated by the resale is considered income, and it is distributed among the subscribers of funds.

3. Murabahah Funds:

In the Murabahah funds, Islamic banks purchase assets to benefit their clients and sell them to them on deferred payment, and an agreed profit is added to the cost. The Murabaha funds are Closed-End Funds, and due to the nature of Murabahah, their units cannot be negotiated in secondary the market.

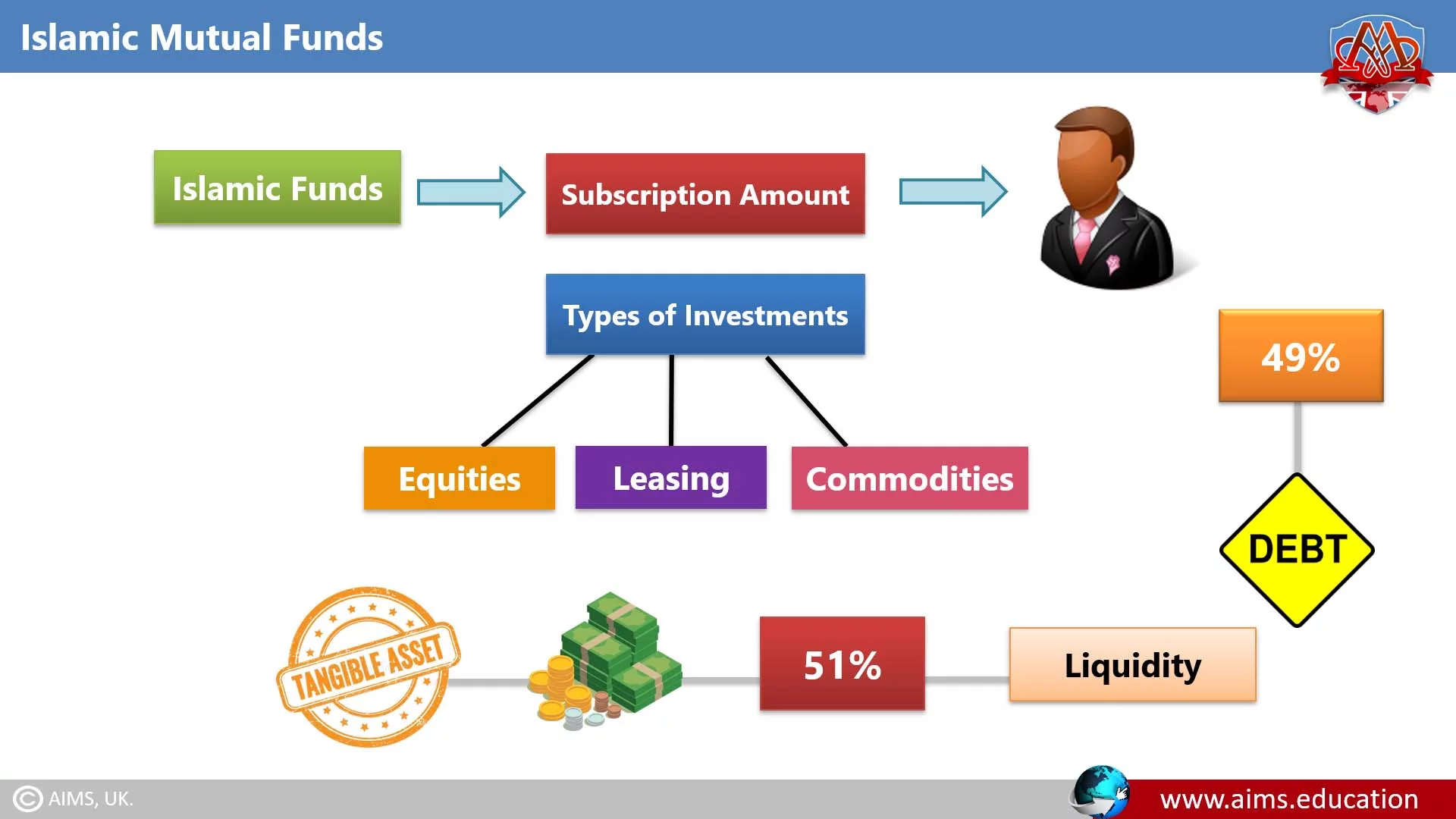

4. Mixed Islamic Funds:

In mixed Islamic investment funds, the subscription amount is employed in different types of investments, such as, such as Equities, Leasing, Commodities, etc. The share of mixed Islamic investment funds is negotiable in the market, only if the tangible assets of the fund are 51% or more, while the liquidity and debts are 49% or less.

5. Sale of Debt or Bai Al Dain

If a person has a debt receivable, and he sells it to another person at a discount through “Bills of Exchange”, it is termed a “Sale of Debt”.

- All Traditional Jurists and the majority of contemporary Muslim scholars are unanimous on the point that the Sale of Debt is not allowed in Shariah.

- However, some Malaysian scholars allowed this kind of sale, and they refer to the ruling of the Shafi School of Thought. However, it still may not be justified because they didn’t pay attention to the fact that Shafi jurists allowed the “Sale of Debt” only if the debt was sold at its “Par Value”.

Management of Halal Mutual Funds:

The Islamic funds may be managed through one of the following two ways:

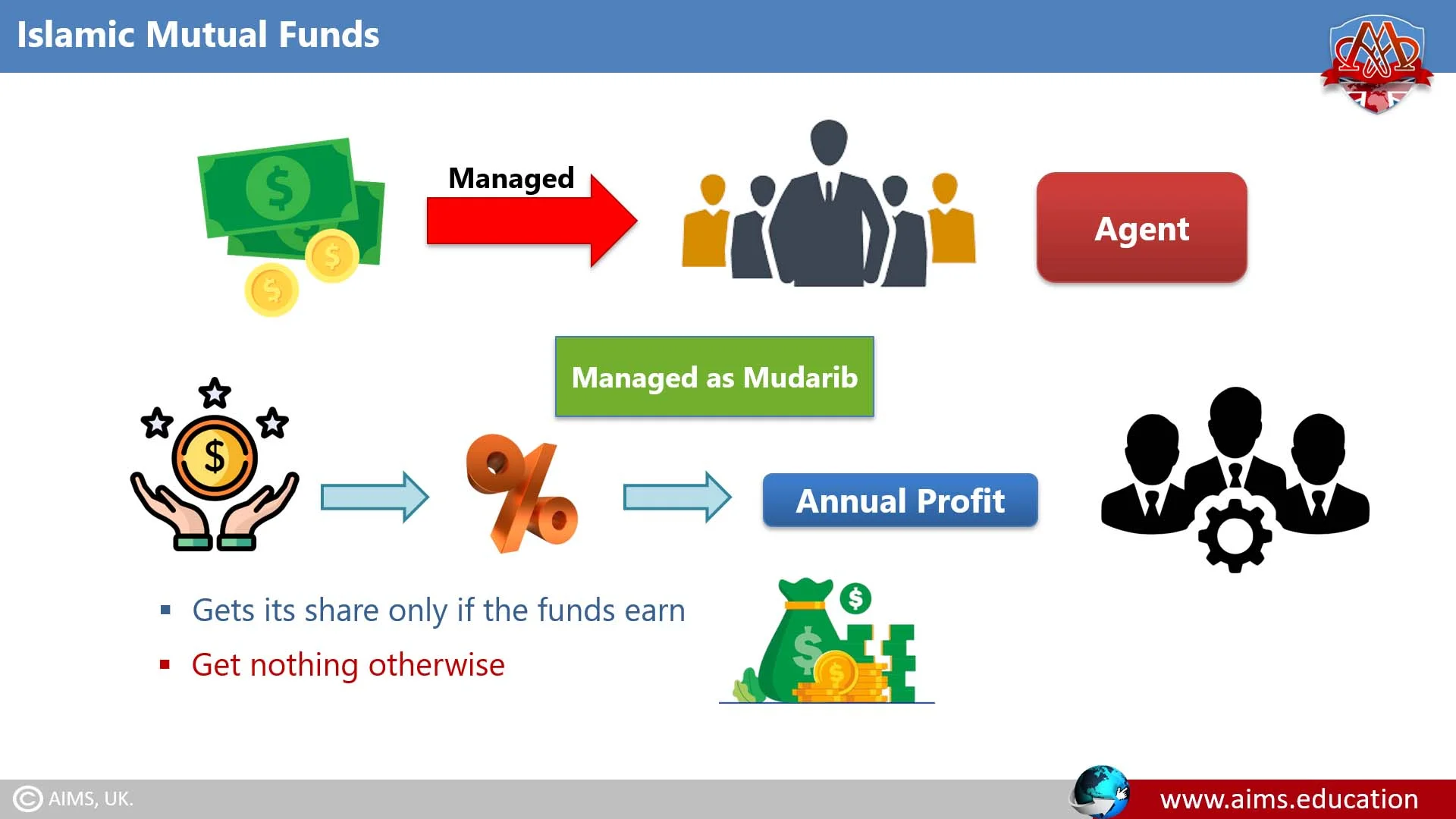

1. Management of Islamic Funds as Mudharib:

If managers of Shairah-compliant funds act as Mudharib for the subscribers, they are rewarded with a certain percentage of annual profit. The management gets its share only if the Islamic funds earn profits, and they get nothing otherwise.

2. Management of Islamic Investment Funds as Agent:

If managers of Islamic funds act as Agents of subscribers, they are rewarded with a pre-agreed fee for these services, which may be paid in a lump sum or every month. The selection of an agent is based on the concept of wakala.

Nurturing Islamic Businesses Through Investment:

When you want to invest your money in an Islamic way, all you have to do is to figure out the right Islamic investment options, that will suit your needs. While there are many challenges to overcome, the reality is rather simple. By investing in Islamic funds, you help the Islamic community grow, and truly speaking, it is probably a good way to achieve such a result. Shariah-compliant mutual funds allow you to invest in dedicated companies in the Islamic world that need those funds to survive.

Halal Mutual Funds VS Conventional Mutual Funds:

Conventional mutual funds tend to be focused on just about any type of investment. You don’t have any particular things that will stop you. The idea is that you can invest in anything you want and get profits fast and easily. It sounds great, but if you want to help the local community, this will not be for you. This is why Shariah-compliant funds are very popular. They can help you get the right value and experience all the time, which in the end will work to your advantage. Worth your time and the outcome can be a very good one. Plus, the great thing is that you can invest in the local community and help Islamic companies grow. This is very important because there are many companies which are in dire need of help and you are the best one to provide that help to them at all times!

Why the Demand for Halal Islamic Funds is Growing?

As you know, there are many Islamic communities all over the globe. With help from this type of investment fund, you get to eliminate the hassle and focus on what matters. You have the unique opportunity to deliver the financial influx that Islamic companies need. All you need to do is to access the Shariah-compliant investment funds. Do that, focus on results and the experience can be second to none for sure!

AAOIFI Accounting Standards for Halal Mutual Funds:

This standard is applied to:

- Islamic funds that are established and managed under Islamic Shariah.

And, it is not applied to:

- Funds in the statement of financial position of establishing institution; and;

- Funds of restricted investment accounts, that are not in the form of shares or units.

A. Financial Statements:

They should contain the following:

B. Statement of Net Assets:

It shall comprise all assets and liabilities, at the end of the financial period.

C. Statement of Portfolio Investments, Receivables, and Financing:

It shall report the amount of each type of asset held.

D. Statement of Operations:

It shall report the increase or decrease in net assets, resulting from the operations.

E. Statement of Changes in Net Assets, or Statement of Cash Flow:

It shall provide information about changes in assets and liabilities, resulting from investments, receivables, financing activities, and share transactions.

F. Statement of Selected Financial Highlights:

This report should precede the notes about Fund’s shares, at the end of the financial period.

G. Disclosure in the Notes to the Financial Statements:

Disclosure shall contain the following: Type of Fund, Main activity, Investment Policies that govern Investment Activities; and; Investment objectives.

H. Comparative Amounts in the Financial Statements:

It includes the financial statements of the comparable prior periods.

I. Real Estate Assets in Funds:

- Real estate assets shall be measured at historical cost, plus any direct expenses related to the ownership.

- Assets shall be revalued at their cash equivalent values.

Conclusion: The Promise of Halal Investing

In conclusion, halal mutual funds and other Shariah-compliant investment options present a viable solution for Muslims seeking to align their financial practices with their faith. Offering diversification, professional management, and ethical investing, these investments are not only religiously appropriate but also financially rewarding. Despite current hurdles such as limited availability and transparency, the future of Islamic investing looks promising with continuous growth and development. It is crucial, however, for investors to conduct thorough research and consult with professionals to ensure their choices align with both their ethical values and financial objectives. With the correct guidance and careful consideration, halal investing can become a potent tool for wealth creation and financial stability.