What is Kafalah?

Kafalah or “الكفالة” originated from the Arabic root word “Kafi”, which means “surety,” “guarantee,” or “support.” Kafalah in Islamic banking and finance provides a formal guarantee, commonly used to safeguard obligations in financial dealings. Kafalah contract serves not only to shield Islamic banks from default risk, where the bank may benefit from the assurance. But it also protects third parties from potential losses arising from a customer’s failure to meet financial obligations, where the bank or a third party acts as a guarantor.

Kafalah in Islamic Banking

The modern application of Kafalah is versatile and offers benefits to both Islamic banks and customers.

- Benefits to Islamic Banks: الكفالة ensures that debtors will fulfill their commitments when due.

- Benefits to Customers: It enables easier access to Shariah-compliant financing by allowing customers to acquire essential goods or capital for investment.

To ensure Shariah compliance, the implementation of Kafalah in Islamic banking must meet specific legal and ethical conditions, including strict adherence to eligibility criteria and regulatory guidelines.

Concept of Kafalah in Qur’an

The Kafala contract is considered permissible based on the following evidence found in the Holy Qur’an:

“They said: We miss the great beaker of the king; for him who produces it, is (the reward of) a camel load; I will be his za’im”.

Surah Yousuf Verse 72

“…So, her Lord (Allah SWT) accepted her with good acceptance. He made her grow in a good manner and put her under the care of Zakariyya (Zechariah)….”.

Surah Aal-e-Imran Verse 37

Kafalah in Hadith

The teachings of Prophet Muhammad (SAW) are the basis of Shariah. He explained every aspect of human life. The following are Hadiths about الكفالة, narrated by various companions of Prophet Muhammad (SAW):

“I and the person who looks after an orphan and provides for him, will be in paradise like this,” putting his index and middle fingers together …”.

Sahih Al Bukhari, Vol. 8, Hadith No. 34

“..Did he leave any wealth?”, they replied “No.” He asked further, “Did he die with any debts outstanding?”, they replied, “Yes, he owed two dinār” (in some narrations three dinār). The Prophet SAW was about to leave when he said “Then pray on your companion.” Abu Qatādah al-Anṣārī interceded and said: “I guarantee his debt, Oh Messenger of Allah SWT” and the Prophet SAW then pray on his soul…”.

Sahih Al Bukhari, Volume 3, Hadith 492, 276

“The guarantor (al-za‘im) is a debtor”.

Sunan Abu Dawood, Vol.3, Hadith # 3343, 247

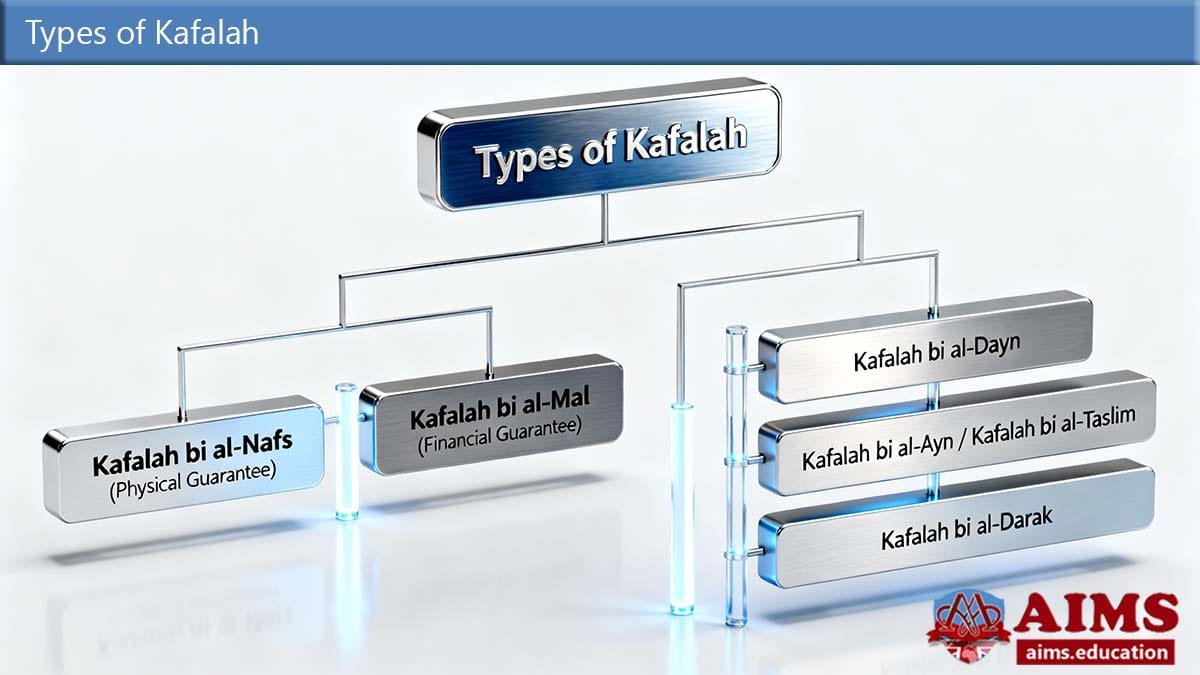

Types of Kafalah

Kafalah is divided into two major types:

- Kafalah bi al-Nafs (Physical Guarantee), and,

- Kafalah bi al-Mal (Financial Guarantee).

1. Kafalah bi al-Nafs (Physical Guarantee)

It refers to a guarantee where an individual is presented to the relevant authority.

Shariah Laws Related to Kafalah bi Al-Nafs

- In the case of suretyship for a person, the guarantor assumes the obligation to ensure that the principal appears in a legal proceeding, particularly when the principal owes a debt to a creditor.

- The guarantor’s role is solely to guarantee the individual’s presence and does not include the responsibility to repay the principal’s debt.

- If the principal passes away, the guarantor is not obligated to settle any debts on their behalf. This is because the guarantee pertains only to the physical presence of the principal, not the repayment of their obligations.

2. Kafalah bi al-Mal (Financial Guarantee)

It serves as a guarantee for the settlement of a debt or the return of a specific item.

Shariah Laws Related to Kafalah bi Al-Mal:

- The guarantor remains liable even if the creditor or the item’s owner dies.

- The beneficiaries of the creditor or owner can require the guarantor to settle the debt or return the item.

Types of Kafalah bi al-Mal

Kafalah bi al-Mal is further categorized into the following three types:

a. Kafalah bi al-Dayn

It is an assurance of repayment for the loan obligation of another party.

b. Kafalah bi al-Ayn or Kafalah bi al-Taslim

It is an assurance of payment for a product or a guarantee of delivery in a transaction.

c. Kafalah bi al-Darak

It is a guarantee that a specific asset is free from any defects or claims when a transaction involves the transfer of title rights.

Application of Kafalah in Islamic Banking

This section illustrates how Kafala is applied in Islamic banking and finance:

1. Personal Kafalah

In personal Kafala, when a customer seeks any Islamic banking service, the bank typically requires a personal guarantor to secure the repayment.

Shariah Rules Regarding Personal Kafala

- If the customer defaults on the financing, both the customer (the principal debtor) and the guarantor will be held jointly responsible for settling the debt.

- The creditor has the right to pursue either the customer or the guarantor, without relieving the customer of their obligation.

- The bank may obtain a personal guarantee with or without additional security charges.

2. Bank Kafalah

It includes performance assurance, tender assurance, and the guarantee of sub-contracts.

Shariah Rules Regarding Bank Kafala

- It is established between the bank and another entity, whereby the bank commits to covering its client’s liability in the event of default or failure to meet the obligations (outlined in the guarantee contract).

- If the client fails to fulfill their responsibilities, the bank must pay the specified amount to the third party.

3. Credit Card Kafalah

a. Mechanism of Kafalah-Based Credit Cards

Credit cards in Islamic finance may be designed based on the principle of Kafalah. This is how it works:

- The bank acts as the card issuer and ensures the fulfillment of all payment obligations for transactions between the customer and the merchant, including cash withdrawals made by the customer from other banks.

- The bank imposes a pre-agreed service fee, which is established before the contract is signed, and the duration of the contract is predetermined.

b. Opinions in Support of Shariah Compliant Credit Cards

Some Islamic banks do offer Shariah-compliant credit cards, and they often claim to structure them using several types of Islamic financial contracts. They include:

- Kafalah (guarantee),

- Ujrah (fee for service),

- Murabaha (cost-plus financing), and,

- Tawarruq (commodity-based financing).

These banks argue that:

- No interest (riba) is charged.

- Fees are fixed and transparent (e.g., annual card fees).

- Payments are due within a grace period, with no late penalty as interest.

c. Why Some Shariah Scholars Prohibit الكفالة in Credit Card

Many Islamic scholars either oppose or are very cautious about Islamic credit cards, and here’s why:

i. Potential for Riba

If a customer fails to pay the full amount by the due date and is charged any late fee or interest, this will fall into Riba.

ii. Prohibition of Debt-based System

Scholars like Sheikh Taqi Usmani argue that credit cards encourage debt and overspending, which conflicts with Islamic financial principles of living within means.

iii. Hidden Risks

Even when no interest is charged, if the card indirectly causes gharar (excessive uncertainty), it’s problematic.

iv. Deposit Insurance System Kafalah

Kafala with Kafalah bil-Ujr (with fee) is utilized in the Islamic deposit insurance scheme. This scheme provides takaful-based coverage and safeguards depositors against potential losses of their deposits held with the Islamic bank, if the Islamic bank fails to meet the customer’s withdrawal requests.

The Kafalah contract is a component of AIMS’ Islamic finance course and Islamic banking and finance diploma, and it is discussed in detail within these internationally accredited and recognized programs. These qualifications lead to our globally accredited Masters in Islamic Banking and Finance.

Understanding the Kafalah Contract

After arriving at a broad agreement on the legal status of the Kafalah contract, many scholarly debates have taken place concerning its specific elements. These elements include:

- Kafalah framework,

- Conditions for Kafala validity,

- Understanding of the guaranteed obligations, and,

- Discharge of the primary party is involved.

We will discuss each of them in detail:

1. Composition of the Contract of Kafalah

The majority of Muslim scholars agree on the following four essential components of a Kafalah contract:

- Al-Kafil (the guarantor) transacts with their individual property.

- A true liability is subject to representation.

- The form (sighah) provided by the guarantor.

- Al-Makful ‘Anhu (the guaranteed party), who initially bears the liability, whether alive or deceased.

2. Conditions for the Validity of Kafalah

Several conditions must be fulfilled for a Kafala contract to be considered valid. These conditions relate to:

- The guarantor,

- The subject of the guarantee,

- The party being guaranteed, and,

- The language used in the guarantee contract.

a. Knowledge of the Guaranteed Liability

According to Islamic scholars, the guarantor is not required to know the exact amount of the debt they are guaranteeing.

b. Exoneration of the Makful ‘Anhu (Guaranteed Party)

When a debt is secured through Kafalah, it does not relieve the Makful ‘Anhu (the guaranteed party or principal debtor) from their original obligation.

Primary Conditions for the Execution of Kafala

Kafalah involves an action that includes the transfer of responsibility or obligation as agreed upon by the principal. The primary elements of Kafalah in the Islamic socioeconomic system are discussed below:

- The Kafala agreement becomes binding with the offer of a surety, provided that the claimant agrees.

- A surety may also be established through a promise, subject to a specified condition.

- It is permissible to act as a surety for another surety.

- In the case of a surety for the delivery of an item, it is required that the obligation falls upon the party primarily responsible for the item.

- A price guarantee for goods sold only takes effect after the delivery of the goods is completed.

- When individuals are jointly liable, each is responsible for the entire debt and guarantees the other’s obligations.

- The discharge of the principal debtor does not automatically discharge the surety.

- Upon the death of the individual for whom bail was provided, the surety is immediately released from obligation.

- If the principal debtor is granted an extension to settle their debts, the same extension must be offered to the surety.