Understanding Capital in Islam

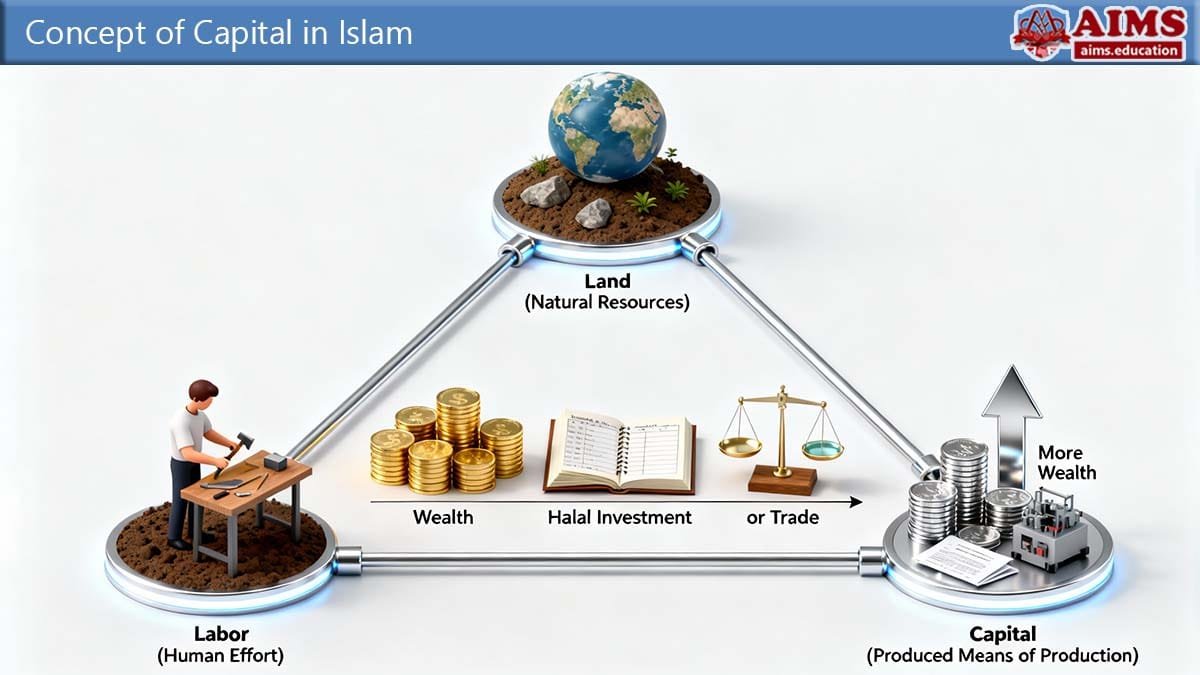

Capital in Islam is a “third factor of production” or “produced means of production.” It refers to a set of acquired consuming values spent to generate more of the same values. For example, wealth is utilized in such a way as to attain more wealth, through a Halal means of investment or business or trade. Generally speaking, all goods that are not produced for immediate consumption but for future production are considered capital. These goods may include tools, machines, irrigation projects (such as canals and dams), transport equipment, raw material stocks, money invested in business, etc.

The above explanation outlines the concept of capital and distinguishes it from land and labor, which are not produced factors but gifts of nature. Thus, land and labor are the original factors of production, while capital in Islam is a “produced” factor.

Concept of Capital in the Holy Qur’an

Capital undeniably acts like blood in the human body, flowing into the capillaries of industries and enabling them to function. Therefore, Islam also gives great importance to capital. The Qur’an Mentions:

““And the cattle hath He created, whence ye have warm clothing and uses, and whereof ye eat……and they bear your loads for you unto a land ye could not reach save with great trouble to yourselves………. And horses and mules and asses that ye may ride them…….”.

Surah 16:Ayat 5-8

“And Lo! In the cattle there is a lesson for you. We give you to drink of that which is in their bellies……….. pure milk palatable to the drinkers.”

Surah 16: Ayat 66

“And Allah hath given you in your houses an abode, and hath given (also), of the hides of cattle, tent-houses which ye find light (to carry) on the day of migration and on the day of pitching camp; and of their wool and their fur their heir, caparison and comfort for a while.

Surah 16: Ayat 80

“Eat and drink, but be not prodigal. Lo! He (Allah) loveth not the prodigals.

Surah 7 Ayat 31

“And squander not (thy wealth) in wantonness. Lo! The squanderers were ever brothers of the devil…”

Surah 17: Ayat 26-27)

Importance of Capital in Islam

Hazrat Umar (RA), one of the companions of Prophet Muhammad (SAW) and the second Caliph of Islam, instructed some recipients of state stipends and allowances to buy goats or other cattle to increase their capital and leave wealth for their children after their death. Capital in Islam is crucial for production, because without capital, production is difficult to achieve. For instance, if a farmer does not use machines and tools in farming and works solely with his hands, it will take more time, effort, and result in low productivity. Therefore, it is necessary to use equipment and tools that assist in production.

- The evolution of science and technology has made it possible for humans to design heavy machinery that aids in production across various fields, such as mining, transportation, agriculture, manufacturing, and communication.

- Recently, it has become impossible to meet production needs without utilizing capital. It plays a pivotal role in economic development and increases employment opportunities.

Classification of Capital in Islam

In Islamic economics, capital is generally categorized into two types: fixed and working:

1. Fixed Capital

Fixed capital consists of durable goods that can be used in further production until they expire. It does not necessarily mean fixed in location. Examples include machines, plants, instruments, tools, trucks, tractors, etc.

2. Working Capital

Working capital consists of goods that are used up in the production process and cannot be reused once consumed. For example, raw materials are working capital as they are consumed once used.

Concept of Capital in Islamic Finance

Islamic finance promotes equity-based financing and emphasizes the concept of profit and loss sharing. This is covered in detail in AIMS’ distance learning Islamic finance certification and online Islamic banking and finance diploma programs. These qualifications also lead to a globally recognized and accredited Master’s degree program in Islamic banking and finance. In this system, both the lender and borrower share the risks and rewards, as seen in contracts like Mudarabah, Musharaka and Ijarah.

1. Mudarabah

In Mudarabah, one party offers capital while the other provides labor, and they share the profits based on a pre-agreed ratio. However, in the case of a loss, the loss is borne entirely by the capitalist, while the labor provider loses only their effort.

2. Musharaka (or Shirkat)

In Musharaka or Shirkat, all partners contribute capital to run a business in partnership, and they share both the profits and losses in accordance with the terms of their agreement.

3. Rented Capital (Ijarah)

Incase of Ijarah or Islamic lease, if a person rents out their land, house, building, factory, plant, or machinery, they can charge a fixed amount of rent.

Example of Capital Formation

An example of capital formation is the investment of money for productive purposes. Suppose a farmer produces 500 kg of cotton in the summer.

- During the winter, a less productive season for cotton farming, the farmer converts some of the cotton into thread and sells it at a higher price. As a result, the farmer obtains 50 kg of cotton thread, leaving 450 kg for further use.

- In the following year, the farmer invents a cotton spinner to convert the entire amount of cotton into thread, thereby increasing his output and capital formation.

By using innovation and reinvestment, the farmer boosts production and capital accumulation.

4-Steps to Measure Capital in Islamic Economics

Capital production in Islamic economics involves several measures such as inspiring savings and investments. These steps are based on principles that avoid excessive fiscal manipulation like tax exemptions, interest rates, or speculative investments. Islam allows all such means except interest (Riba) on investments. Islam encourages capital production through ethical means and clearly defines measures to ensure productive wealth usage.

The following steps outline the key measures for capital production in Islamic economics:

Step 1: Hoarding of Wealth

Islam discourages the hoarding of wealth such as gold, silver, cash, or bank deposits. If wealth is utilized for productive purposes, zakat is not imposed. However, if it is hoarded and left idle, zakat is obligatory and reduces wealth. The Prophet Muhammad (SAW) instructed the guardians of orphans’ wealth to invest it in business to prevent zakat from diminishing it. Therefore, zakat serves as a deterrent against hoarding and encourages the utilization of wealth for productive capital.

Step 2: Tax Exemption on Productive Goods

Islam exempts productive goods from zakat. For instance:

- Agricultural land, cattle used in farming, horses used for transport, tools used by professionals, and machinery used in industries are exempt from zakat.

- If a person sells their property, such as land or a house, it is encouraged in Hadith to reinvest the proceeds into purchasing other property for future use.

Step 3: Avoidance of Extravagant Spending

The concept of moderation could be understood from the following verse of the Holy Quran:

Islam strictly prohibits spending wealth on luxuries. Allah (SWT) has mentioned in the Qur’an: “Eat and drink, but do not waste by extravagance. Indeed, He (Allah) does not like the wasteful.”

Surah 7: Ayat 31

Islam advocates for simple living and moderation in spending (Iqtisad). The principle of Iqtisad emphasizes balanced consumption and wealth management, thereby encouraging the flow of wealth into productive capital rather than wasteful consumption.

Frequently Asked Questions

Q1: What does capital mean in Islam?

In Islam, capital refers to produced means of production used to generate more wealth through lawful trade or investment. It includes assets like tools, machinery, materials, or funds invested in productive activities.

Q2: How is capital different from land and labour in Islamic economics?

Land and labour are original factors of production, while capital is a produced factor created from human effort. Islam recognises capital as a resource that supports production without earning interest (riba).

Q3: What are the main types of capital in Islam?

Capital in Islam is classified into fixed and working capital. Fixed capital includes durable assets like machinery or tools, while working capital consists of consumables such as raw materials used in production.

Q4: How is capital used in Islamic finance?

Islamic finance uses capital through profit-and-loss-sharing models like Mudarabah, Musharaka, and Ijarah. These contracts ensure risk-sharing and forbid interest, promoting fairness and productive investment.

Q5: What is Mudarabah in Islamic finance?

Mudarabah is a partnership where one party provides capital and the other contributes labour. Profits are shared according to a pre-agreed ratio, while any financial loss is borne solely by the investor.

Q6: What is Musharaka or Shirkat?

Musharaka, also called Shirkat, involves multiple partners who contribute capital to a joint venture and share profits and losses based on their investment or mutual agreement.

Q7: What is the concept of Ijarah in Islam?

Ijarah refers to renting or leasing assets like land, buildings, or machinery. The owner receives a fixed rent for allowing the use of their property without transferring ownership.

Q8: How does Islam encourage capital formation?

Islam encourages capital formation by promoting productive investment, discouraging hoarding, and ensuring that wealth circulates ethically through zakat, trade, and reinvestment.

Q9: Why does Islam discourage hoarding of wealth?

Hoarding prevents wealth from benefiting society. Islam imposes zakat on idle assets, motivating individuals to invest productively rather than keeping wealth stagnant.

Q10: What role does moderation play in Islamic economics?

Moderation, or Iqtisad, teaches Muslims to avoid extravagance and wasteful spending. It directs resources toward productive uses, fostering sustainable capital growth.

Q11: Are productive goods exempt from zakat?

Yes, productive assets like agricultural tools, factory machinery, or transport vehicles are exempt from zakat because they contribute directly to income generation.

Q12: What is an example of capital formation in Islam?

A farmer reinvesting cotton profits into building a spinner to increase output is an example of capital formation. Innovation and reinvestment expand productive capacity in line with Shariah.