Are Stocks Haram or Halal?

Investing in stocks often raises questions such as “Is investing in stocks haram?” or “Are stocks haram?”. The answer depends on the nature of the stocks in question and the businesses the company is involved in. While the stock market is not inherently haram, certain stocks can be classified as such if they violate Shariah principles. For example, stocks from companies dealing in alcohol, pork, or usurious financial institutions are obviously haram. However, the answer to the question “Is the stock market halal?” depends on whether the business registered in the stock market is aligned with Shariah principles and whether it focuses on halal-certified businesses.

From Shirkah to the Concept of Shares or Stocks in Islam

There used to be Shirkah, or partnership between few people. However, in the last three centuries, a new form of partnership came into existence. This new form of partnership is called a “joint-stock Company,” which is owned by shareholders.

Share may be defined as ” a ratio of ownership, which the shareholder has in the assets of a company.”

- When a person buys shares of a company, he becomes a shareholder of that company.

- Usually, shareholders send their shares to the stock market.

Once the company is established and all shares have been subscribed to, the shares are traded in the stock market. From the Sharia point of view, this is, in fact, selling and buying shares.

This is how it works:

- Shares float in the market and invite people to purchase them;

- Any person who purchases the shares actually participates in the business of that company, and he enters a Shirkah contract with that company.

An Example of Investing in Halal Stocks

- “Ali” decides to become a partner of a company, and he purchases 10,000 out of its total 100,000 shares.

- Certificate of 10,000 shares is issued to “Ali” against his payment, and so, “Ali” becomes the partial or 10% owner of that company.

- With that ownership, “Ali” also becomes the 10% owner of the assets of that company”.

Shariah Rules for Investing in Shares of New Companies

- It is halal (lawful in Shariah) to purchase the shares of a newly founded company, under the condition that, the company is not going to embark, on any haram business.

- If the company has been established, to conduct any haram (unlawful in Shariah) business, like a factory is produce liquor, or a bank the transactions of which are based on interest, or an insurance company, then one must not purchase those shares.

- If a company that intends to operate in any halal business floats its shares, for example, a textile company, or an automobile company, then there is nothing wrong when purchasing those shares. It is perfectly permissible.

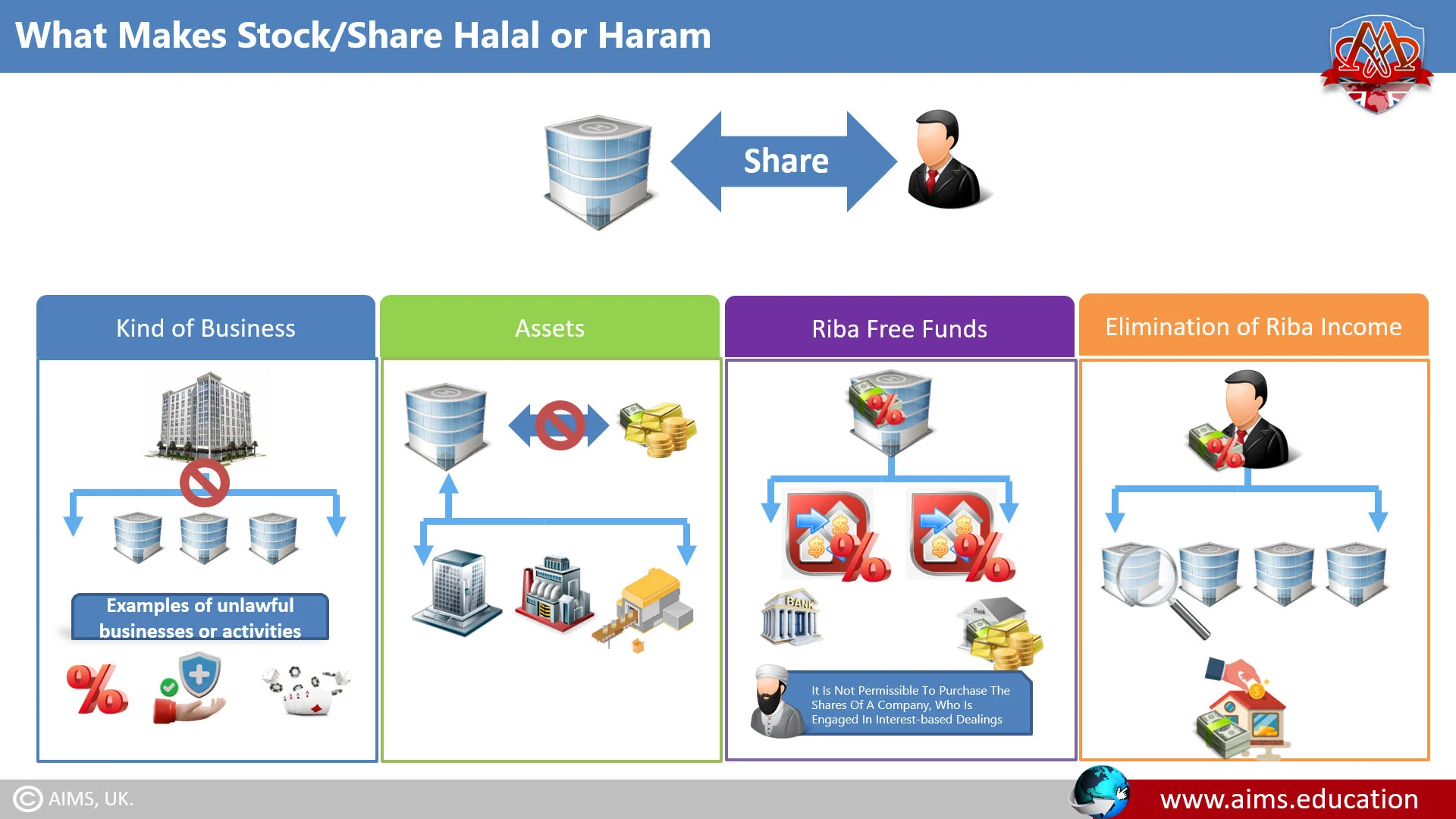

Four Conditions to Check: Is Investing in Stocks Haram? or Are Stocks Haram?

If a person intends to buy shares in the stock market, he will have to see that four conditions are fulfilled.

First Condition: Kind of Business

The first condition is that, the company must not engage itself, in any haram kinds of business, like, for example, interest-based banking, or insurance, based on any type of riba (interest) and gambling (maosir or ميسر), or business involving liquor, or any other haram business. Purchasing the share of a company that engages itself in haram business is not permissible at all, neither at the time of floating nor afterward.

Second Condition: Assets

The second condition to be fulfilled is that, the company’s assets must not comprise liquid assets only, that is, cash. The company must have acquired some fixed assets as well, for example, a building or some machinery. If the company does not get have any fixed assets, if all its assets are liquid, then it will not be halal, to trade these shares, above par or below par, of their face value.

Third Condition: Riba Free Funds

Before one can understand the third condition, one must know that most of the companies that exist today are actually engaging in hala forms of business, like textile mills, automobile factories, etc. Yet, there seems to be hardly any company that is not involved in interest-based transactions.

Companies are usually involved in interest-based transactions in two ways.

- In order to increase funds, companies take interest-based loans from banks.

- The company deposits its surplus, in an interest-bearing account.

Hence, according to Shariah scholars, it is not permissible to purchase shares of a company unless one is certain that the company does not engage in interest-based dealings.

Fourth Condition: Elimination of Riba Income

- That is when the dividend is being distributed, a person should investigate how many percent of the income is based on interest. This can be easily done by perusing the income statement.

- When receiving the dividend, one must deduce the amount that has been generated from interest and give it to charity.

If these four conditions are fulfilled, then it is halal to buy or sell shares in the stock market.

Objectives of Stock Markets

First Objective: Investment

Many people purchase company shares for investment purposes. Their main purpose is to become the share-holder of the company, and receive its dividend.

Second Objective: Gain Capital

Other people buy shares when they estimate that share-value of a company is likely to increase. They sell them to earn profits, once the price has increased.

Such investors do not intend to become a share-holder and earn dividend. So, in that case, shares are considered as a kind of commodity for trading.

Halal and Haram Trading Practices in Stock Markets

Here are some forms of few trading in the stock market and their permissibility in Shariah:

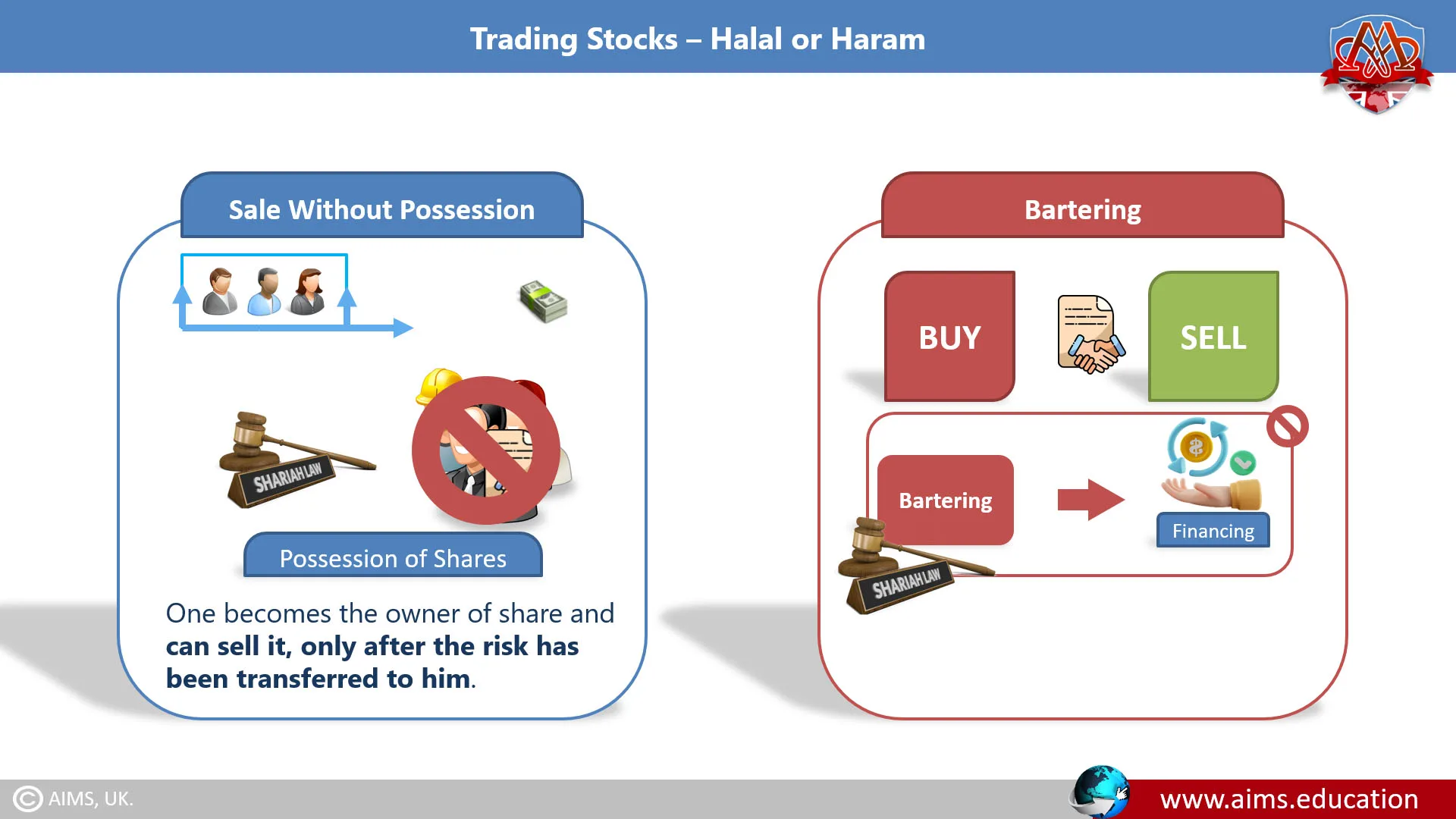

a. Sale Without Possession

Sometimes people buy shares, and then sell them onward, without taking their delivery. Shariah does NOT permit “selling of a thing onward, prior to taking its possession”, and this type of stock market practice is haram.

Regarding the “Possession of Shares”, it is important to understand that:

- Share Certificate is a piece of paper;

- The actual “Share” is one’s ownership in a company; and;

- One becomes the owner of share and can sell it, only after the risk has been transferred to him. And risk management must be complaint with Shariah rules.

b. Bartering

It is commonly practiced to buy and sell shares. Bartering is also a way of financing, which is not permissible in Shariah for stock market.

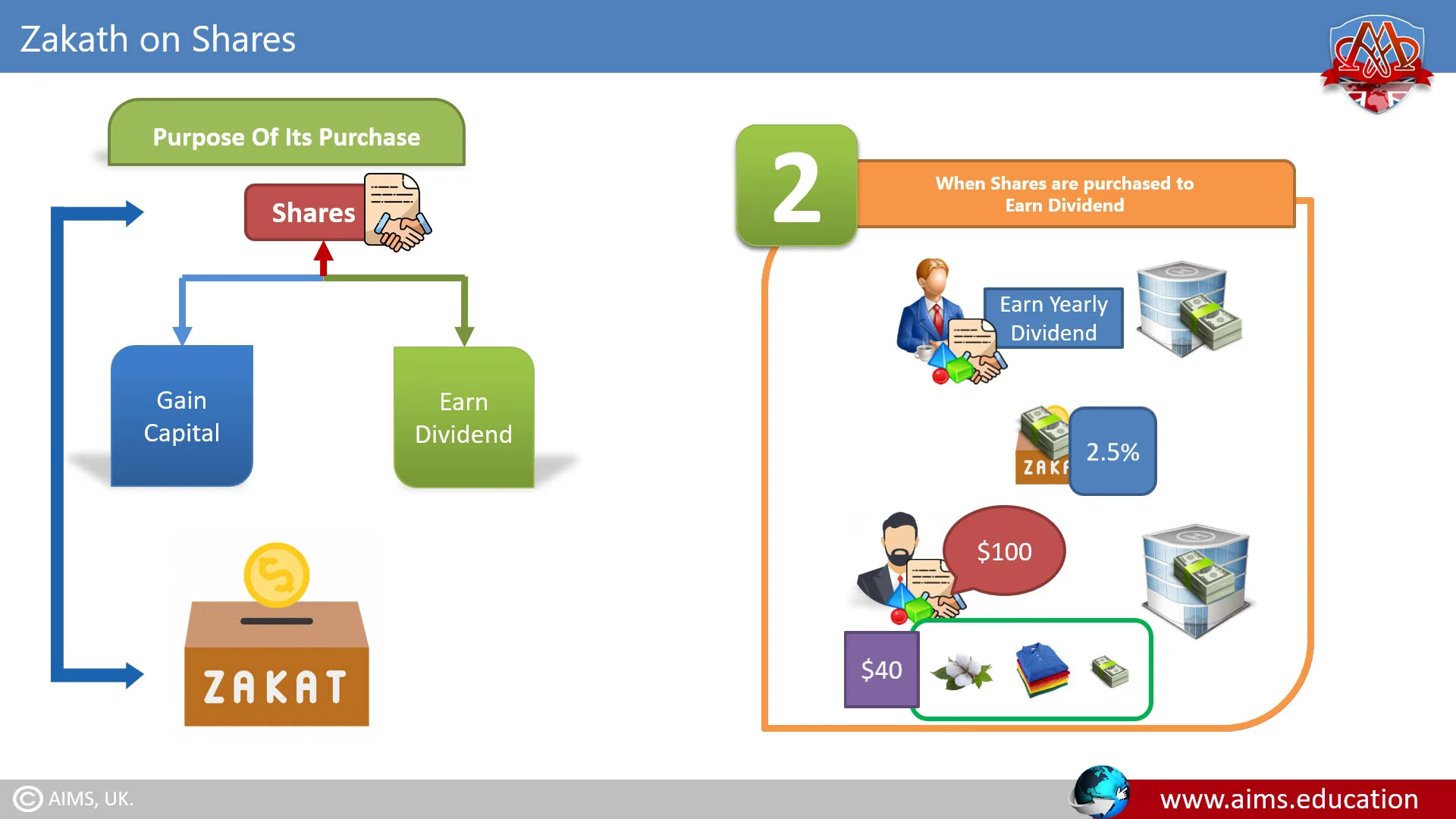

Shariah Rules for Paying Zakath on Shares

Shares are usually purchased for two purposes:

- To Gain Capital, and

- To Earn Dividend.

Zakath payable on shares is depending on the purpose of its purchase. Zakath is an obligation on eligible Muslim individuals, which is 2.5% of their wealth (under some conditions), and which is payable every year for charitable causes.

1st Example: When Shares are Purchased to Gain Capital

If a person buy shares only to sell them onward and gain some capital, and not for yearly dividend, then Zakath will be paid on the market price of those shares.

For Example

- “Bilal” purchases share of a company to gain capital.

- Market price of that share is $100.

- Since the share was purchased for capital gain, it is considered as a “Commodity for Trading”.

- So, “Bilal” will pay 2.5% Zakath on $100.

2nd Example: When Shares are Purchased to Earn Dividend

Suppose a person buys shares with the objective of earning a yearly dividend. In this case, Zakath is payable on that part of the market price of shares, which stands against those company assets, on which Zakath is payable.

For Example

- “Ali” purchases a share of a company to earn yearly dividend.

- The market price of that share is $100.

- Out of that $100: $60 stands against the assets; such as building, office equipment, and machinery.

- And, $40 stands against raw materials, finished products, and cash.

- Since only $40 stands against the assets on which Zakath is payable, “Ali” will pay 2.5% Zakath on $40 only, and no Zakath is payable on $60.

Is Your Selected Stock Halal or Haram: Checklist

From the above discussion can be concluded that, buying and selling of shares is haram or halal, depends on if the following four conditions are fulfilled.

- The company’s actual business must be halal.

- The company must have acquired some fixed assets. The capital should not be in liquid form only.

- If the company engages in interest-based dealings, then one must voice one’s discontent during the company’s annual meeting.

- When receiving the dividend, one must deduce the amount generated from interest and give it to charity.

If these four conditions are fulfilled, buying or selling stocks is halal.

Summary

- Share is the ratio of ownership that the shareholders have got in the company;

- One must not purchase the shares if company conducts any haram business;

- Before buying the shares, four factors must be considered: Kind of Business, Assets, Riba Free Funds, and Elimination of Riba Income;

- People purchase shares either to earn dividend or to gain capital;

- It is not permissible in Shariah to sell something prior to taking its possession;

- Shariah does not permit the bartering of shares.

Frequently Asked Questions

Q1: What makes investing in stocks halal or haram under Shariah?

It’s halal when the business is permissible, the company owns tangible assets, riba is avoided or purified, and you don’t sell before possession. Prohibited sectors make it haram.

Q2: How do I screen a company to know if investing in stocks is haram?

Check business activity, asset mix, financing/deposits, and dividend purification. If these fail, the stock may be impermissible.

Q3: Is stock trading halal when buying for quick profit?

Yes, if the company passes Shariah screens and you take possession before selling. Avoid leverage and speculative bets.

Q4: Are stocks haram if a halal company earns some interest income?

Incidental riba may be tolerated if you purify dividends by donating the interest portion. Heavy reliance on riba is problematic.

Q5: When is the stock market haram for Muslim investors?

When you pick prohibited businesses, trade before possession, or speculate like gambling. Otherwise, it can be halal.

Q6: How does the requirement for fixed assets affect permissibility?

If a company holds only cash, trading shares at market value is problematic. Tangible assets justify market pricing.

Q7: Is selling shares without taking possession haram?

Yes. Sell only after ownership and risk transfer to you are complete.

Q8: How is Zakat calculated on shares held for trading vs. dividends?

For trading, pay Zakat on market value. For dividends, pay only on the portion tied to Zakatable assets like inventory and cash.

Q9: Is stock trading haram in Islam when using margin or derivatives?

Often yes, due to riba, gharar, and maysir. Prefer cash purchases of screened equities.

Q10: What practical steps ensure stock trading is halal?

Apply sector and financial screens, verify tangible assets, avoid selling before possession, and purify any interest portion of dividends.