What is Istisna?

Istisna is a special sale contract where the commodity is transacted before it comes into existence. Istisna in Islamic banking is mostly an order for the producer to manufacture a specific commodity for the purchaser. It resembles the Salam contract, and it may be defined as “Purchaser places an order to manufacture, assemble or construct something, which is to be delivered at a future date.” Then, it becomes an obligation on the manufacturer or the builder to deliver the asset with agreed specifications at the agreed period of time.

“Istisna evolved into Islamic jurisprudence historically due to specific needs in the areas of manual work, leather products, shoes, carpentry, etc. However, it has grown in the modern era as one of the contracts for major infrastructure and industrial projects, such as the building of free-ways, ships, airplanes, and large machineries.”.

History of Istisna Contract!

Conditions of Istisna

There are four basic conditions for sale:

- The subject is always a thing which needs manufacturing or construction;

- The manufacturer uses his own material;

- Quality and quantity should be agreed upon in absolute terms; and;

- The purchase price should be fixed with mutual consent.

It is important to note that:

- It is not compulsory for an undertaking party to accomplish the work itself and;

- Work or part of it can be done by others under the control of the undertaking party.

What is Parallel Istisna?

After executing an Istisna agreement with one party, a buyer or seller may execute another Istisna agreement with a third party, which is called a “Parallel Istisna Agreement.”

However, it is important to note that:

- These are two different contracts that cannot be tied up;

- Performance of one should not be contingent on the other; and;

- Parallel Istisna is allowed with the third party only.

Conditions for Istisna as an Islamic Banking Product

1. Price of Istisna

- It may be in the form of money, commodities, or usufructs.

- It may be spot and differ; therefore, it is applicable where Salam Contract is not applicable.

- It can be paid in instalments.

- The instalments may be tied up with different stages of projects.

2. Option

- When the required goods have been manufactured by the manufacturer, the purchaser can exercise his option of defect, but he can’t use his option of seeing.

3. Revoking of Istisna

- It can be cancelled unilaterally before the manufacturer starts working.

- After starting the work, it cannot be cancelled unilaterally.

4. Security

- A security in form of a guarantee, Islamic mortgage or hypothecation may be required for Istisna in order to ensure that the manufacturer shall deliver the commodity on the agreed date.

- In case of delivery default, the guarantor may be asked to deliver the same commodity. If there is a mortgage, the buyer can sell the mortgaged property, and the sale proceeds can be used either to realize the required commodity by purchasing it from the market or to recover the price advanced by him.

5. Time of Delivery

- It is not necessary that the time of delivery is fixed. However, the purchaser my fix a maximum time for delivery after the appointed time, he will not be bound to accept the goods and pay the price.

- In order to ensure that the goods will be delivered within the specified period, some modern agreement of this nature contain a penalty clause to the effect that in case the manufacturer delays the delivery after the appointed time, the price shall be reduced by a specified amount per day.

How Does Istisna Work in Islamic Banking?

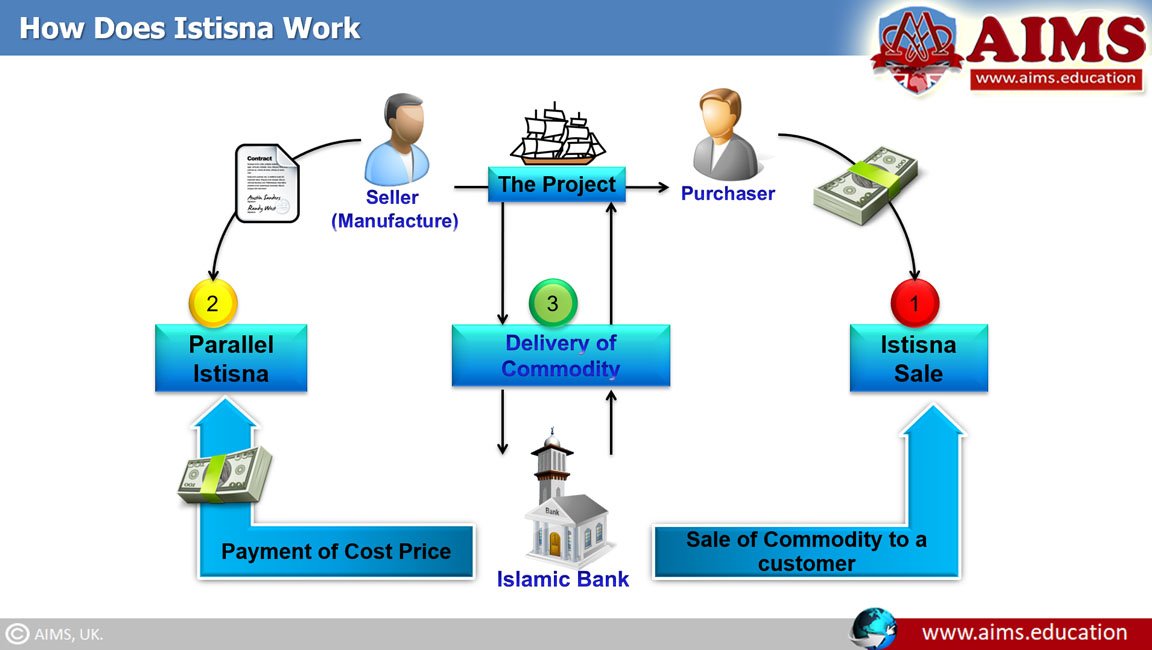

Let us understand its Islamic banking mechanism in three simple steps:

Step-1: Request from Purchaser

The purchaser expresses his desire to purchase an asset, and the contract is signed between the Bank and the purchaser. The bank promises to deliver the commodity on a specific future date.

Step-2: Parallel Istisna Agreement with Manufacturer

The bank enters into a Parallel Istisna contract with a manufacturer, which is to be delivered by the due date in conjunction with the first Istisna contract.

Step-3: Delivery of Asset

The seller delivers the asset to the bank or to the purchaser if the bank requests it. If delivered directly to the purchaser, an agency agreement is signed between the Bank and the Purchaser.

Example of Istisna in Islamic Banking

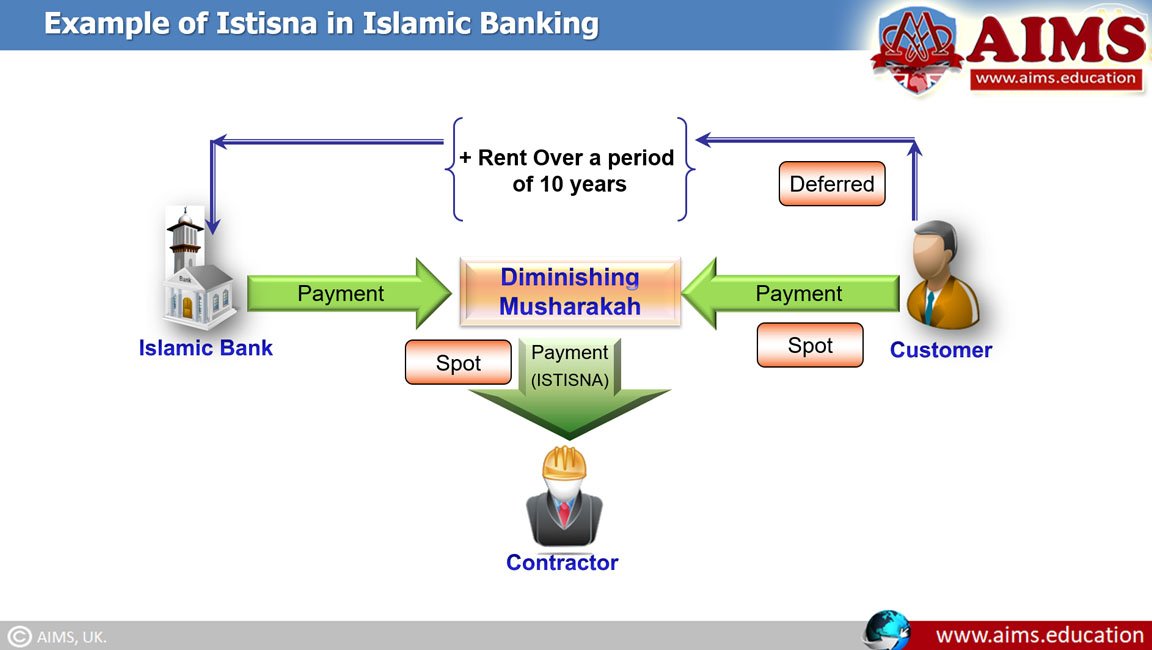

1. Construction of Building

- If the customer or client owns a land, and seeks financing for the construction of a house or plant, financier may undertake to construct it.

- If the client does not own the land, the financier can provide him with a constructed building on a specified piece of land.

- If financier does not construct the building himself, he may either enter into parallel Istisna with a third party, or hire services of a contractor.

2. Mechanism to Finance a Building

- Financial institutions may use this contract to build a “house” or “plant” by considering it a “new product.”

- In such cases, the financial institution is involved in the relationship between the client and the contractor.

- The client and financial institution agree that the institution is responsible for preparing a house within a given period. The client may choose one of the designs offered by the institution, and the price is payable in instalments.

- The financial institution then enters into another agreement with a contractor to construct the house according to the specifications in the first agreement.

- When the contractor builds the house, it is delivered to the financial institution, and then the financial institution delivers it to the client.

- The financial institution pays the price to the contractor during the building period. However, the client pays it to the institution in installments. The price increases if the payment period increases.

Difference Between Istisna and Salam Contracts

| Istisna | Salam |

| The subject is always a thing which needs manufacturing | The subject in Salam can be anything. |

| Price does not necessarily need to be paid in full in advance. | The price must be paid in full and in advance. |

| Time of Delivery does not have to be fixed. | The price must be fixed in Salam. |

| The contract can be cancelled before the manufacturer starts working. | Salam contract cannot be cancelled unilaterally. |

| The manufacturer uses his materials, and the sales price is fixed. | This is not the case in Salam. |

Difference Between Istisna and Ijarah Contracts

| Istisna | Ijarah |

| The manufacturer either uses his own material and, if it is not available to him, obtains it to make the ordered goods. | The material is provided by the customer, and the manufacturer uses only his labor and skill, meaning that his services will be hired for a specified fee paid to him. |

| The purchaser has a right to reject the good after inspection as Shariah permits somebody who purchases a thing not seen by him to cancel the sale after seeing it. The right of rejection only exists if the goods do not conform to the specifications agreed upon between the parties at the time of the contract. | In Ijarah contract, the right to rejection of goods after inspection does not exist. |

Applications of Istisna

Istisna in Construction

This contract may be used to provide financing for house financing.

- If the client owns land and seeks financing for the construction of a house, the financier may undertake to construct the house based on this contract.

- If the client does not own the land and wants to purchase that, the financier can provide him with a constructed house on a specified piece of land.

- Unlike the diminishing musharakah contract, the financier does not have to construct the house himself. He can either enter into a parallel Istisna’ with a third party or hire the services of a contractor.

- He calculates his rest and fix the price of Istisna’ with his client that allows him to make a reasonable profit over his cost.

- The client’s payment of installments may start the day the parties sign the contract.

- In order to secure the payment of installments, the title deeds of the house or land, or any other property of the client may be kept by the financier as a security until the last installment is paid by the client.

- The financier will be responsible to strictly conform to the specifications in the agreement for the construction of the house. The cost of correcting any discrepancy would have to be borne by him.

Istisna for BOT

It may also be used for similar projects like installation of an air-conditioner plant in the client’s factory, building a bridge or a highway.

- The modern BOT (buy, operate and transfer) agreements may be formalized through an agreement as well. So, if the government wants to build a highway, it may enter into an Istisna’ contract with the builder.

- The price ’ may be the right of the builder to operate the highway and collect tolls for a specific period.

Using this contract, the client can get finance for raw materials, working capital, and overhead expenses. Other applications are:

- House Financing;

- Construction of buildings, factories, and plants;

- Project Financing; and;

- Export Pre-Shipment

AAOIFI Shariah Standards for Istisna and Parallel Istisna

The AAOIFI standard applies to transactions, whether the institution is acting as:

- An ultimate purchaser; or;

- A manufacturer; or;

- A builder for construction.

Istisna Contract Review

- The commodity is transacted before it comes into existence;

- After the manufacturer has started working, the contract cannot be cancelled unilaterally;

- Istisna and Parallel Istisna are two different contracts that cannot be tied up;

- Contract is valid for objects that can be manufactured and not valid for natural products;

- The manufacturer must satisfy the obligation, and the article must conform to all the specifications;

- Bank as a manufacturer is liable for Ownership risk, Maintenance, and Insurance expenses.

This lecture is a part of AIMS online Islamic finance qualification, Diploma in Islamic Banking and Finance, and the MBA Islamic Finance degree programs. These programs are accredited, and they are offered through an online and interactive learning system.

Frequently Asked Questions

Q1: What is Istisna in Islamic banking?

Istisna is a manufacturing or construction sale where a buyer orders a specified asset to be produced and delivered in the future at an agreed price and specification.

Q2: How does Istisna differ from Salam?

Istisna does not require full advance payment and delivery time need not be fixed; Salam requires full prepayment and fixed delivery terms.

Q3: What are the key conditions for a valid Istisna?

The subject needs manufacturing, the manufacturer provides materials, specifications are precise, and price is fixed by mutual consent.

Q4: What is Parallel Istisna?

A separate Istisna with a third party used to fulfil the first contract. The two contracts remain independent and not contingent.

Q5: Can an Istisna be cancelled after work starts?

No. Unilateral cancellation is only possible before the manufacturer begins work; afterwards, termination requires agreement or breach remedies.

Q6: How are payments structured in Istisna financing?

Payments can be spot, deferred, or in instalments, and instalments may align with project milestones.

Q7: What delivery and penalty terms are typical?

A maximum delivery time can be set; late delivery may trigger a price-reduction penalty. Goods must match agreed specifications.

Q8: What forms of security are used?

Guarantees, Islamic mortgage, or hypothecation may secure performance or repayment; collateral can be realised on default.

Q9: How is Istisna different from Ijarah?

Istisna sells a manufactured good using the producer’s materials; Ijarah hires the producer’s labour when the customer supplies materials.

Q10: How do banks execute Istisna end-to-end?

Bank contracts with purchaser, then with a manufacturer via Parallel Istisna; delivery goes to bank or directly to the purchaser via agency.

Q11: What are common applications?

House or plant construction, large infrastructure, project finance, export pre-shipment, and BOT concessions.

Q12: Do AAOIFI standards cover Istisna?

Yes. They address roles of purchaser, manufacturer, and builder, and reinforce specification compliance and separation of parallel contracts.