Wakala Meaning

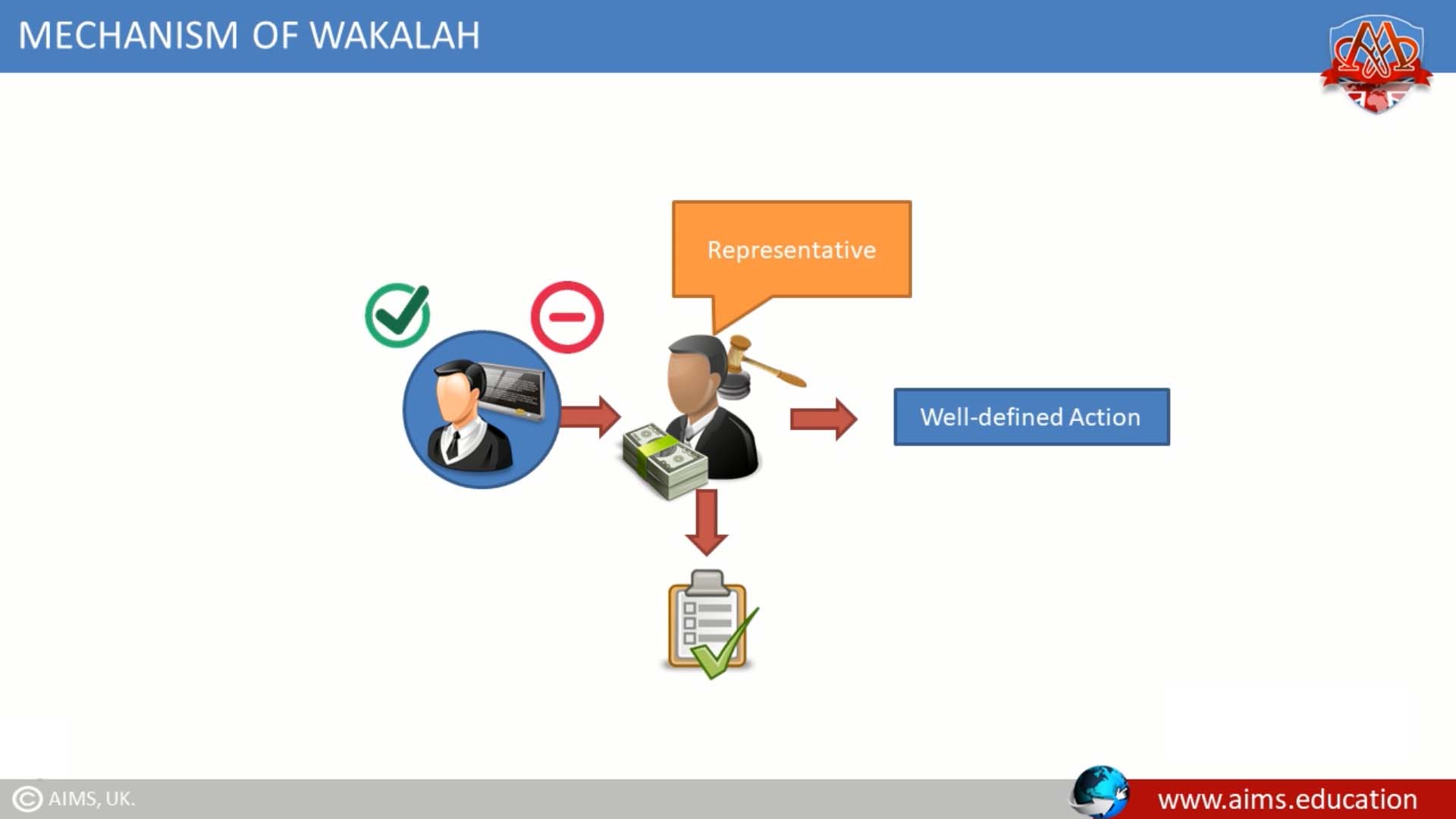

Wakala “وَكَالَة” refers to a contract where a principal (or muwakkil) authorizes or appoints an agent (or wakeel) to do a well-defined legal action on his or her behalf. Wakala meaning in English is “Contract of an Agency”. The wakalah in Islamic banking is about the provision of service, and main features of wakalah are service, representation and power to affect the legal position of the principal.

Wakalah in Islamic Banking

Wakala is used in Islamic banking, where a representative is appointed to undertake transactions on another person’s behalf. The agency law or Wakala law facilitates economic exchanges hindered by distance, size, and numbers or where the principal is unable or unwilling to act personally.

What is the Wakalah Contract?

- The principal appoints an agent to carry out a certain well-defined action as a representative.

- The agent performs the task according to the instructions.

- The agent is entitled to a predetermined fee, regardless of whether the accomplished task satisfied the principal.

Conditions of Wakala in Islamic Banking:

- The agent should also be a competent person.

- The principal should have the power and competence to deal. For example, an insane or minor cannot appoint agents.

- The act should be known and must be lawful.

Types of Wakalah:

1. Particular Wakalah or Special Agency

This agreement is made for a certain known transaction. For Example, An agent is bound to sell or buy a particular house or car.

2. General Wakalah

It is a general delegation of power. For example, the Principal might ask an agent to buy a four-bedroom house.

3. Restricted Agency

Where the agent acts within certain conditions. For example, the agent might buy the house at a certain price within a given time.

4. Absolute Agency

Where no condition is put on the transaction. For example, no specific price or time is given to the agent.

Examples of Wakala

- Lawyers are employed to represent their clients, or brokers are authorized to sell or purchase commodities. Similarly, in organizations such as companies, managers and directors are needed to act on behalf of the companies.

- Specialized middlemen are sometimes needed to make contracts on their principals’ behalf or dispose of their principals’ property. Commerce could come to a standstill if businessmen and merchants could not employ the services of agents and were expected to do everything themselves.

- An agent may obtain a certain wage for his services. If payment is not mentioned, the practice of the people is referred to. For example, a lawyer or a broker is entitled to their wages based on common practice.

Wakalah is a non-binding contract.

What is Wakala Deposit?

Wakala deposit is generally referred to as a Shariah-compliant contract in which a customer authorizes an Islamic bank to invest funds in Shariah-approved activities to earn profits.

Shariah Laws Concerning Wakalah in Islamic Banking & Finance

Wakala in Islamic banking refers to a businessman entrusting another to act in his stead or as his representative. It has been a long-standing custom to appoint an agent to facilitate trade operations. Wakala is the most important element in Shirkah or Islamic partnerships, and in modern law, the relationship between partners is known as a principal-agent relationship.

The main laws concerning an agency are as follows:

- The essence of the appointment of an agent is the proposal and acceptance of the position or permitting a person to act for one.

- The sending of a messenger is not in the same category as the appointment of an agent.

- A person who appoints an agent must be legally competent to do the work for which the agent is appointed. All insane persons or Infants cannot appoint all agents.

- A person who appoints an agent must have attained understanding and sound judgment, but he does not need to be of age.

- A person may appoint all agents to conduct any business transaction that he would be able to do himself.

- An agent should refer the matter to his principal when making contracts concerning gifts, loans for gratuitous use, or deposits, entering into partnerships, or compromising on a matter denied by the other side.

- An agent appointed to buy and sell or to pay and receive a debt is considered to be a custodian of his principal’s property and in the position of a trustee (amin).

- If the property is destroyed without its being his fault or due to his negligence, no compensation can be claimed.

- An agent is entitled to receive remuneration only when so contracted.

- An agent appointed to sell goods cannot buy them for himself without the principal’s consent.

- In the absence of any instructions to the contrary, an agent appointed to sell goods can sell them for cash or on credit and can take a pledge or surety for the price of the goods sold on credit. However, the agent cannot be held responsible if the pledge is destroyed or the surety becomes bankrupt.

- The principal can dismiss his agent, providing that this does not contravene the rights of others.

- An agent is considered discharged on the death of his principal, provided that this does not contravene the rights of others.

- The agency becomes void when the principal becomes a lunatic.

The Wakalah contract and other Islamic financial products are discussed in more detail in the Islamic finance course online and MBA in Islamic Banking and Finance degree programs offered by AIMS’ Institute of Islamic Banking and Finance.

Frequently Asked Questions

Q1: What is Wakala in Islamic Banking and how does the wakalah contract work?

Wakala in Islamic Banking is an agency contract where a principal authorizes an agent to perform a defined, lawful task. The wakalah contract sets scope, instructions, and a fee. The agent acts as a trustee and is not liable for loss unless negligent.

Q2: What is the wakala meaning in English and why is it used in finance?

The wakala meaning in English is “contract of agency.” It allows Islamic banks to execute transactions for clients where distance, scale, or expertise make direct action impractical, maintaining Shariah compliance.

Q3: Which conditions must be met for wakalah in Islamic banking?

Both principal and agent must be competent, the act must be lawful and known, and authority should be clearly defined to align with Wakala Islamic Banking rules.

Q4: What types of wakalah exist and when should each be used?

Particular for a single transaction, General for broad authority, Restricted with price/time limits, and Absolute with no specific constraints.

Q5: How do fees work in a wakalah contract?

The agent’s fee is agreed in advance and payable regardless of outcome. If unspecified, customary practice applies under Wakala Islamic Banking.

Q6: What is a Wakala deposit and how is it structured?

A Wakala deposit authorizes an Islamic bank to invest a customer’s funds in Shariah-compliant activities. The contract defines objectives, roles, and the agent’s fee.

Q7: What examples illustrate wakalah meaning in practice?

Lawyers representing clients and brokers executing trades. In firms, managers or directors may act as agents to execute defined tasks efficiently.

Q8: What rights and liabilities does a wakil have?

The wakil safeguards the principal’s property, follows instructions, and earns the agreed fee. Without negligence, the wakil is not liable for loss.

Q9: When does a wakalah contract end?

It ends by dismissal, the death or insanity of the principal, or when the purpose becomes unlawful. After termination, the agent’s authority ceases.

Q10: How do restrictions in a Restricted Agency help?

Limits like price caps or time frames ensure actions match the principal’s intent and keep the wakalah contract within explicit, lawful boundaries.