What is Islamic Accounting?

Islamic accounting means “A unique approach to financial reporting that follows the principles of Shariah”. It is based on the Quran and the teachings of Prophet Muhammad (PBUH), which promote fairness, transparency, and social justice in all financial transactions. The primary purpose of Islamic accounting is to ensure that financial transactions are carried out in a manner that is beneficial for both individuals and society as a whole. This means taking into consideration the impact on all stakeholders, including customers, employees, and the environment. Islamic accounting is different from conventional accounting in many ways, such as the treatment of profits and losses, as well as the role of interest.

1. Principles of Islamic Accounting

Adhering to a moral and ethical code of conduct, Islamic banking eliminates the concept of interest. Justice and Benevolence stand as the two foundational principles shaping the Islamic accounting system.

| Justice | Benevolence |

| Under all circumstances, justice should be maintained within society. It has to be assured in the banking system that everything is managed according to the rules and regulations of Islam. The system of accounting in Islamic finance and banking does not exploit others. | Benevolence is related to perfection and beauty in Islam. It is the one principle that will keep us away from bitterness and undesirable things, making banking procedures manageable. It would be easier to meet the requirements of the public. |

2. Key Objectives of Islamic Accounting

- It aims to equip users with information that enables them to operate their businesses and organizations in alignment with Shariah law.

- The method has gained popularity for several reasons. Foremost among these is its perceived ethical superiority compared to other accounting forms.

- It offers an improved framework for comprehending both financial and non-financial decisions.

- By providing a transparent overview of a company’s performance, it aids organizations in achieving their objectives more efficiently.

3. Difference Between Islamic Accounting and Conventional Accounting:

| Islamic Accounting | Conventional Accounting |

| Islamic accounting operates within a Shariah framework, which significantly affects the nature of their transactions. | Conventional accounting does not operate within a Shariah framework, resulting in different types of transactions. |

| The information provided by Islamic financial institutions is comprehensive and transparent, catering to the unique needs of its users. | It provides selected well-thought-out information to its users, focusing on fostering investment in the banking system. |

| Principles such as fairness, transparency, and accountability, guide the process of information sharing. | In conventional accounting, the sharing of information is primarily guided by profit maximization for shareholders. |

| Does not recognize interest (usury) based transactions. | Recognizes interest-based transactions. |

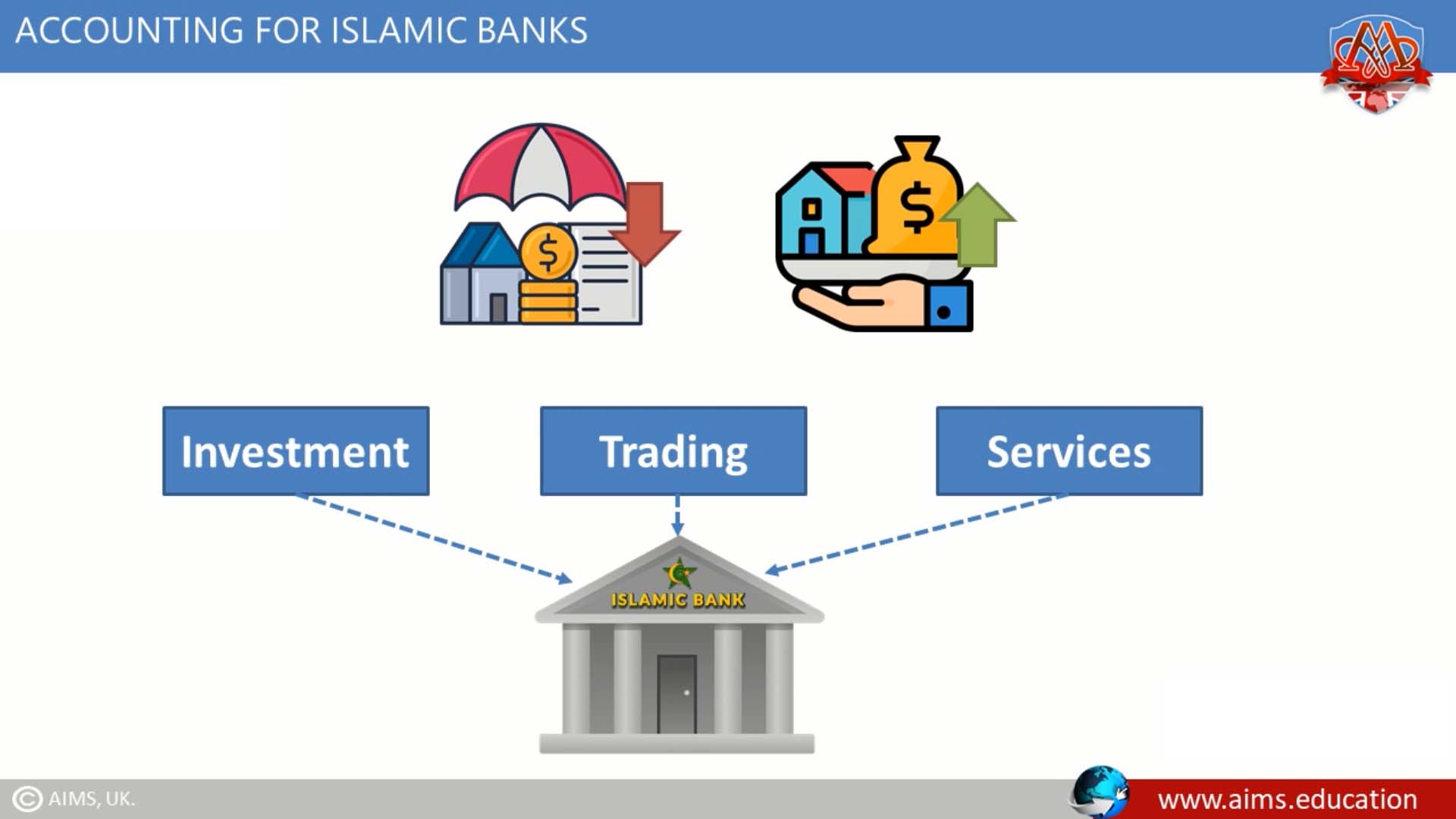

4. Islamic Structuring & Accounting

Islamic structuring & accounting is a comprehensive approach to financial management that takes into account both the technicalities of finance and the moral, ethical, and social principles prescribed by Islam. This approach is holistic and integrated, ensuring that the financial transactions and reporting are in compliance with both Islamic finance principles and international financial reporting standards.

a. ISLAMIC STRUCTURING ASPECT

The structuring aspect focuses on designing financial products and services that adhere to the Islamic prohibition against interest (riba) and uncertainty (gharar), and promote risk-sharing. This includes innovative financial instruments such as sukuk (Islamic bonds), Murabaha (cost-plus financing), and musharakah (partnership financing).

b. ISLAMIC ACCOUNTING ASPECT

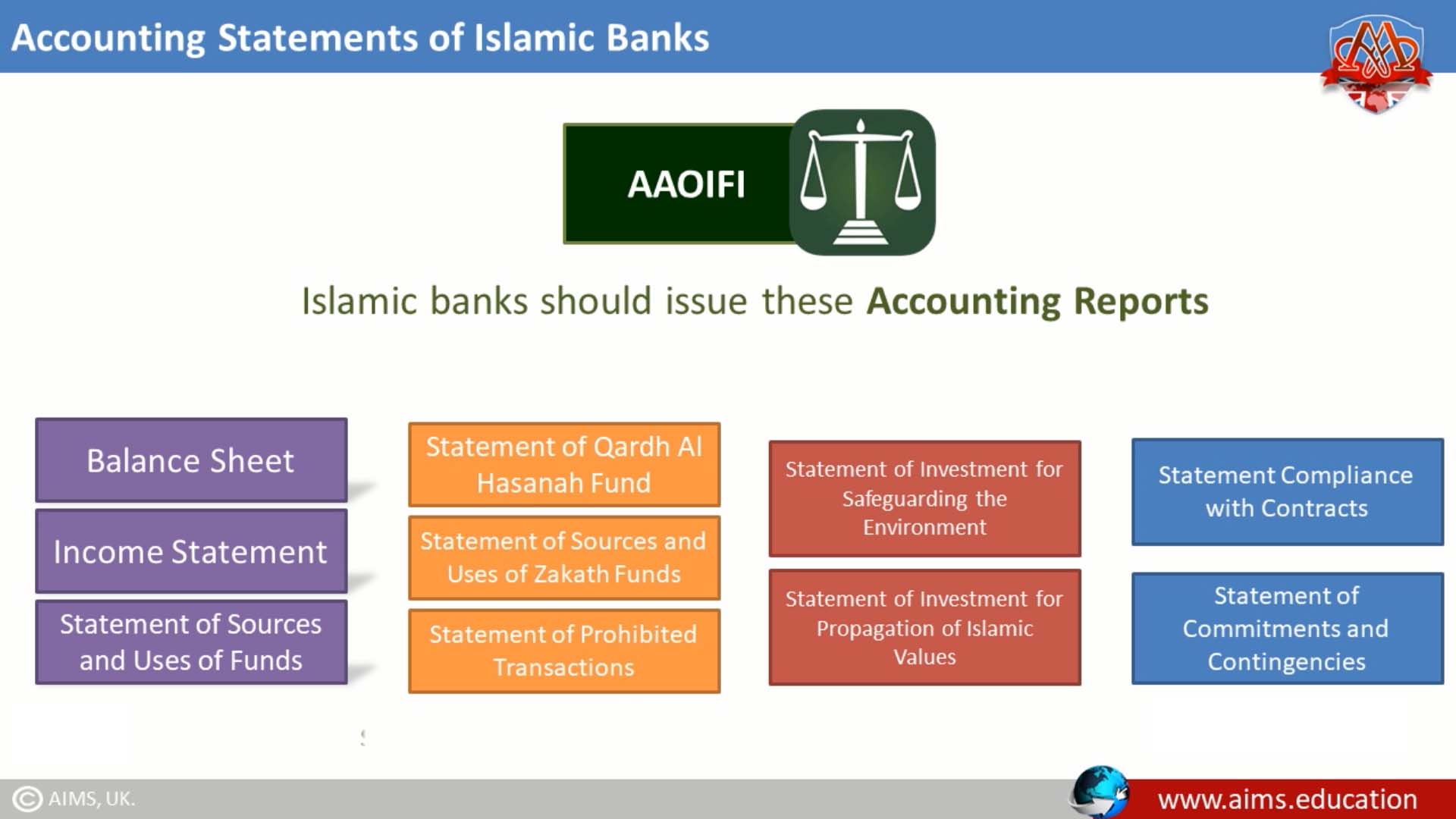

On the other hand, the accounting aspect handles the recording, classifying, interpreting, and communication of financial information of these Shariah-compliant transactions. It follows the accounting standards set by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), ensuring transparency, accountability, and consistency.

5. Islamic Accounting Services

Islamic accounting services provide financial statements aligned with Islamic principles, primarily utilizing halal accounting standards. As an integral part of Sharia-compliant accounting, Islamic accounting underscores the application of systems, guidelines, and practices guided by Islamic doctrine. With an escalating global demand, companies increasingly seek to align their operations with Shariah principles through Islamic accounting services. These services bring numerous advantages, such as heightened transparency and elevated business ethics.

6. Islamic Financial Reporting:

Islamic financial reporting, governed by the principles of transparency, accountability, fairness, and social responsibility, has gained significant importance in the global financial landscape. Recognizing its distinct nature and the potential that Shariah-compliant financial services have in the world economy, educational institutions like AIMS International Centre for Education in Islamic Finance offer specialized courses. AIMS’ robust curricula, including an Islamic Banking Postgraduate Diploma, provide comprehensive knowledge of the nuances of Islamic banking, Islamic accounting, and financial reporting. Also, the Islamic banking course allows the students to grasp the intricacies of Islamic financial transactions and the accounting practices needed to report them accurately and ethically, contributing to the development and propagation of Islamic financial reporting standards.

Islamic Accounting Standards

Islamic accounting employs several critical standards which are encapsulated as follows:

A. INFORMATION MANAGEMENT

It involves the preservation of an extensive library of information. This includes industry reports, accounting standards, and reference books, which act as important resources in the practice of Islamic accounting.

B. REPORT DELIVERY

It ensures that reports and research from Islamic Knowledge for Finance and Commerce (IKFC) are accurately delivered to the company’s stakeholders. These reports provide stakeholders with valuable insights into the state of the company’s finances.

C. ENGAGEMENT WITH ISLAMIC FINANCE LEADERS

Islamic accounting standards encourage engagement with leaders in Islamic finance. This involves conducting surveys and sharing insights with team members to ensure everyone is on the same page.

D. DIALOGUE WITH POLICYMAKERS AND EXPERTS

Discussions with policymakers and experts in the field are an integral part of Islamic accounting. These discussions offer valuable knowledge and are shared with all team members to ensure transparency.

E. MARKET LEADERSHIP AND CLIENT ENGAGEMENT

It also involves the publication of special magazines. These publications create opportunities for sharing leadership insights with the market and clients, promoting greater engagement.

Embracing the Shariah Accounting System

The Shariah accounting system provides comprehensive control over your accounts, profit earnings, and other business-related information. It is designed to facilitate the growth of your organization in the most efficient way, adhering to the principles of fairness, transparency, and accountability inherent in Islamic accounting.

AAOIFI Islamic Accounting Standards

The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) has set numerous standards to regulate Islamic accounting protocols. Here are some key standards:

- FAS 1: General Presentation and Disclosures in the Financial Statements

- FAS 2: Murabaha and Murabaha to the Purchase Orderer

- FAS 3: Profit and Loss Sharing on Deposit Accounts

- FAS 4: Provisions and Reserves

- FAS 5: Disclosure of Bases for Profit Allocation Between Owners’ Equity and Investment Account Holders

- FAS 6: Consolidation

- FAS 7: Investments – Equity of Investment Account Holders, Investments, and Their Equivalents

- FAS 8: Ijarah

- FAS 9: Zakah

- FAS 10: Financial Reporting for Istisna’a and Services Operations.

Each standard covers specific areas of Islamic finance and ensures the operations of Islamic Financial Institutions adhere to Shariah principles.

Islamic Accounting – Key Terms with Definition

The following definitions set out a general conceptual framework for accounting in Islamic banking:

1. ASSET

An asset is anything capable of generating positive cash flows or other economic benefits, either itself or in combination with other assets.

2. LIABILITIES

A liability is an obligation arising from a transaction or other event that has already occurred and that involves the Islamic bank in a probable future transfer of cash, goods, or services, or the forgoing of a future cash receipt, the date of which and the settlement of which are measurable with reasonable accuracy. Generally, a liability should be enforceable under the Shari’ah rules. But if an Islamic bank incurs an obligation that is not valid under the Shari’ah it will still have to be recognized as a liability, although disclosed distinctly as such.

3. EQUITY OF UNRESTRICTED ACCOUNT HOLDERS

The equity of unrestricted account holders refers to funds received by the Islamic bank from depositors on the basis that the bank will have the right to use those funds without restrictions to finance the bank’s investments within the Shari’ah framework.

4. OWNERSHIP EQUITY

Ownership equity refers to the amount remaining on the balance sheet date from the bank’s assets after deducting the bank’s liabilities, the equity of unrestricted investment.

5. CASH AND CASH EQUIVALENT

The cash and cash equivalent include local and foreign currency and demand deposits at other institutions.

6. RESTRICTED INVESTMENTS

Restricted investments are assets acquired by funds provided by holders of restricted investment accounts. The Islamic bank does not own these assets. The bank only manages them either for a fixed fee or, in a Mudarabah contract for a profit.

7. ZAKATH FUNDS

Zakath is an obligatory payment on certain types of wealth and income. It has been prescribed in the Qur’an and Sunna of the Prophet (PBUH). Islamic banks have a dual role concerning this obligation. They collect zakat from the owners, account holders, employees, and anybody else who wishes to pay it through Islamic banks. The banks can charge a fee for managing this fund, and the fee will be the bank’s income. The second role of the bank is to calculate the zakat liability of the owners and pay it into a zakat fund.

8. AL-QARD AL-HASANA FUNDS

The Qard al Hasana fund (a type of Shariah-compliant halal loan) consists of revolving funds for extending interest-free loans for a period of time. In some cases, the loans may be forgiven.

Frequently Asked Questions

Q1: What is Islamic accounting?

It’s a Shariah-based approach to reporting that avoids interest, promotes risk-sharing, and emphasises fairness, transparency, and social responsibility.

Q2: How do the principles of Islamic accounting guide practice?

Justice and benevolence drive truthful disclosure, stewardship, clear contracts, asset-backing, and accountability to wider stakeholders.

Q3: What is the difference between Islamic accounting and conventional accounting?

Islamic accounting prohibits riba and prioritises risk-sharing and societal welfare; conventional systems recognise interest and focus on shareholder returns.

Q4: What are AAOIFI Islamic accounting standards?

They are guidance for Islamic institutions on presentation, measurement, and disclosure, including standards for Murabaha, Ijarah, Zakah, and Istisna’.

Q5: How is Islamic financial reporting different?

It highlights Shariah compliance, profit allocation fairness, risk-sharing outcomes, and disclosures for items like Zakah and restricted investments.

Q6: What does “Islamic structuring & accounting” involve?

Designing Shariah-compliant products (Sukuk, Murabaha, Musharakah) and recording/reporting them per AAOIFI for clarity and accountability.

Q7: Which key terms should practitioners know?

Assets, liabilities, owners’ equity, unrestricted investment account holders’ equity, restricted investments, Zakah funds, and Qard al-Hasan.

Q8: What is included in Islamic accounting services?

AAOIFI-aligned bookkeeping and statements, Zakah calculation, profit allocation, and product-specific reporting for Murabaha, Ijarah, Sukuk, etc.

Q9: When should Islamic accounting standards be applied?

Whenever products or operations are Shariah-compliant, ensuring recognition and disclosure reflect risk-sharing and non-interest structures.

Q10: What common mistakes occur in Islamic financial reporting?

Misclassifying interest-like returns, weak restricted-investment disclosure, profit misallocation, and inadequate Zakah reporting.

Q11: How is Zakah presented?

Through policies, balances, and movements for Zakah funds, including any administration fees and the institution’s collection role.

Q12: How are Qard al-Hasan funds handled?

They’re disclosed as interest-free benevolent loans with sources, uses, and outstanding balances, clarifying repayment or forgiveness terms.