What is Musharakah?

Musharakah (مشاركة) is a word of Arabic origin that literally means ‘Sharing.’ Its root word is Shirakah (شركة), which means “Being a Partner”. In Islamic banking and finance, Musharakah definition may be given as: “A joint enterprise formed for conducting some business, in which all partners share the profit according to a pre-agreed ratio, and loss is shared according to the ratio of the contribution”. Musharaka is a Shariah-compliant business financial instrument that is used by Islamic banking and financial institutions to invest in businesses.

Concept of Musharakah in the Quran and Hadith

The following verse of Quran generally indicates the validity of Musharakah and it specifically underlines the rule of Islamic inheritance. However, in general context, Muslim jurists have regarded the text as containing, general permissibility of any form of partnership.

“And, verily, many partners oppress one another, except those who believe, and do righteous good deeds, and they are few. The above reminds the partners to bind themselves to ethical values in dealing with each other”.

Al-Quran Surah Sad, Ayah 24!

The following Quranic verse is normally quoted to support Musharaka.

“Now send one of you with this your silver coin unto the city, and let him see what food is purest there, and bring you a supply thereof. Let him be courteous, and let no man know of you”.

Al-Quran Surah Al-Kahf, Ayah 19!

A well-known Islamic scholar indicates the following three important points in the above Quranic verse:

- Their funds were contributed on a Shirkah basis;

- They bought goods from Shirkah-based funds and;

- It gives validity to utilize food purchased on a Shirkah basis, though one gets more or other less.

The following Hadith of Prophet Mohammad (Peace Be Upon Him) highlights the importance of trust between partners:

“Allah says. I am the third of the two partners, as long as they do not cheat one another. But, when one of them cheats the other, I leave them”.

Hadith of Prophet Mohammad صلى الله عليه وآله وسلم!

Types of Musharakah or Shirkah

Shirkah is divided into the following three types:

- Shirkahtul-Melk.

- Shirkahtul-Amwaal.

- Shirkahtul-Wujooh.

Let us understand each type of Musharakah in detail:

1. Shirkatul-Melk

Here are the key rules related to Shirkatul Melk:

- No partner can use the share of other partner.

- Profit and loss will be according to the ratio of ownership.

- Every partner has the right to sale or gift or lease, to the extent of his share.

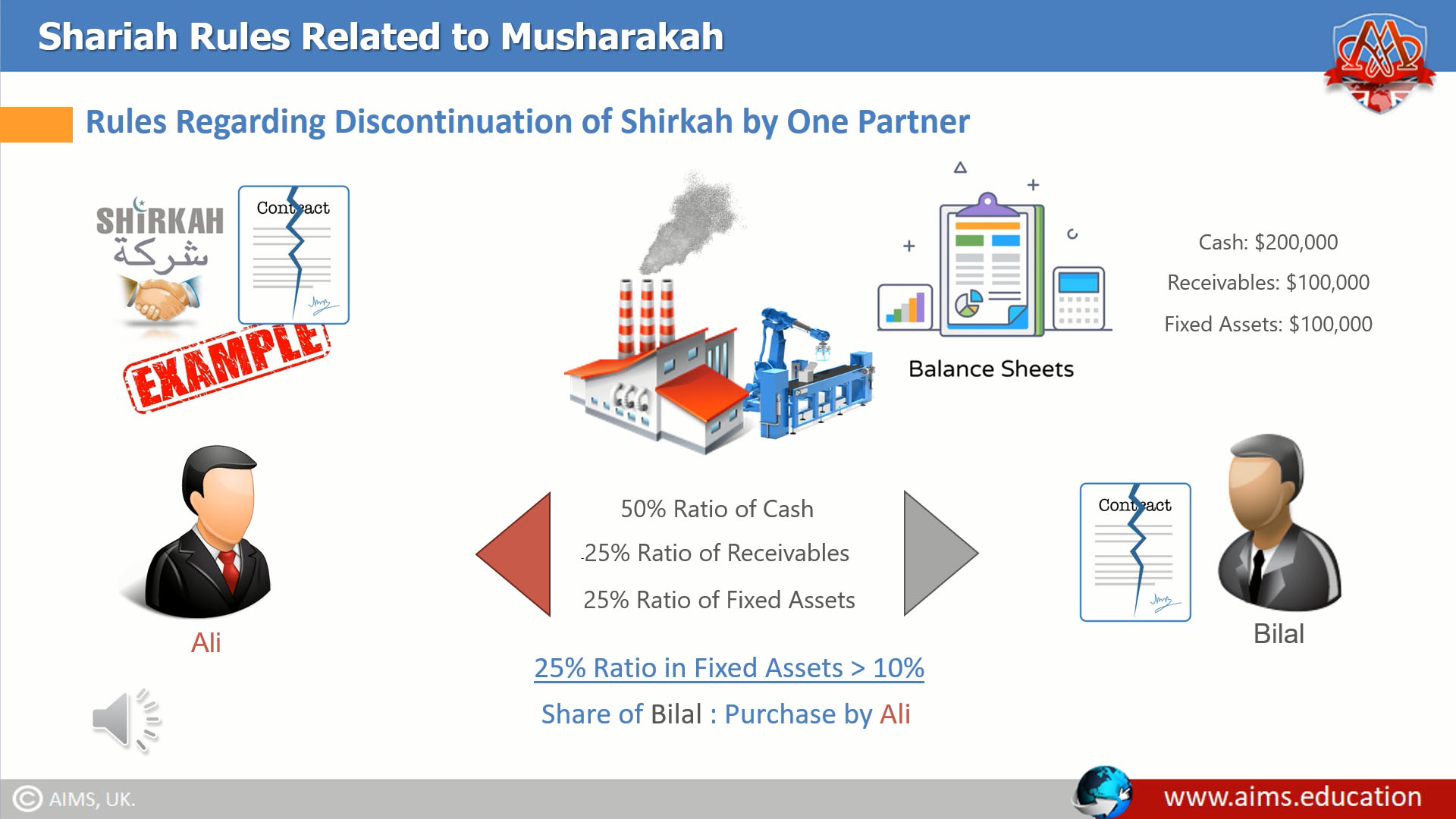

- One partner can promise to purchase the share of other partner at any price. It could be a face value, market value, or pre-agreed price.

If a property is jointly owned by two partners:

- It may be distributed according to timing or place; OR;

- All partners may use it without physical distribution.

2. Shirkatul-Amwal

In Shirkatul Amwal, every partner is an agent of other partner, so:

- No need to get permission from other partners for any business act, such as a sale or purchase.

- Other partner is bound to comply the terms agreed by one partner.

- Customer has a right to claim to each partner.

- Profit may be agreed at any ratio.

- Loss will be distributed exactly at the same ratio at which profit is shared.

Different Opinions of Imams (Scholars) on Shirka-tul-Amwal

If the investment is required in Shirkatul Amwal, the following four scenarios are possible:

The following two types of Musharakah contracts are permissible by all the four Imams.

- 1st Scenario: If both partners are investors and working partners, any ratio of profit may be agreed;

- 2nd Scenario: If only one is an investor, and both are working partners, any ratio of profit may be agreed;

The following two types of Musharakah are permissible only according to Imam Ahmed Bin Hunbal:

- 3rd Scenario: If both are investors and only one is a working partner, and;

- 4th Scenario: If one is an investor and the other is a working partner.

3. Shirkatul-Wujooh

Here are the essential rules related to the Shirkahtul Wujooh:

- Every partner is an agent of the other partner so that any partner can act in the normal course of business, and other is also responsible for the undertaken work.

- The ratio of ownership may be different in a commodity purchased on credit.

- Profit and loss will be according to the ratio of ownership.

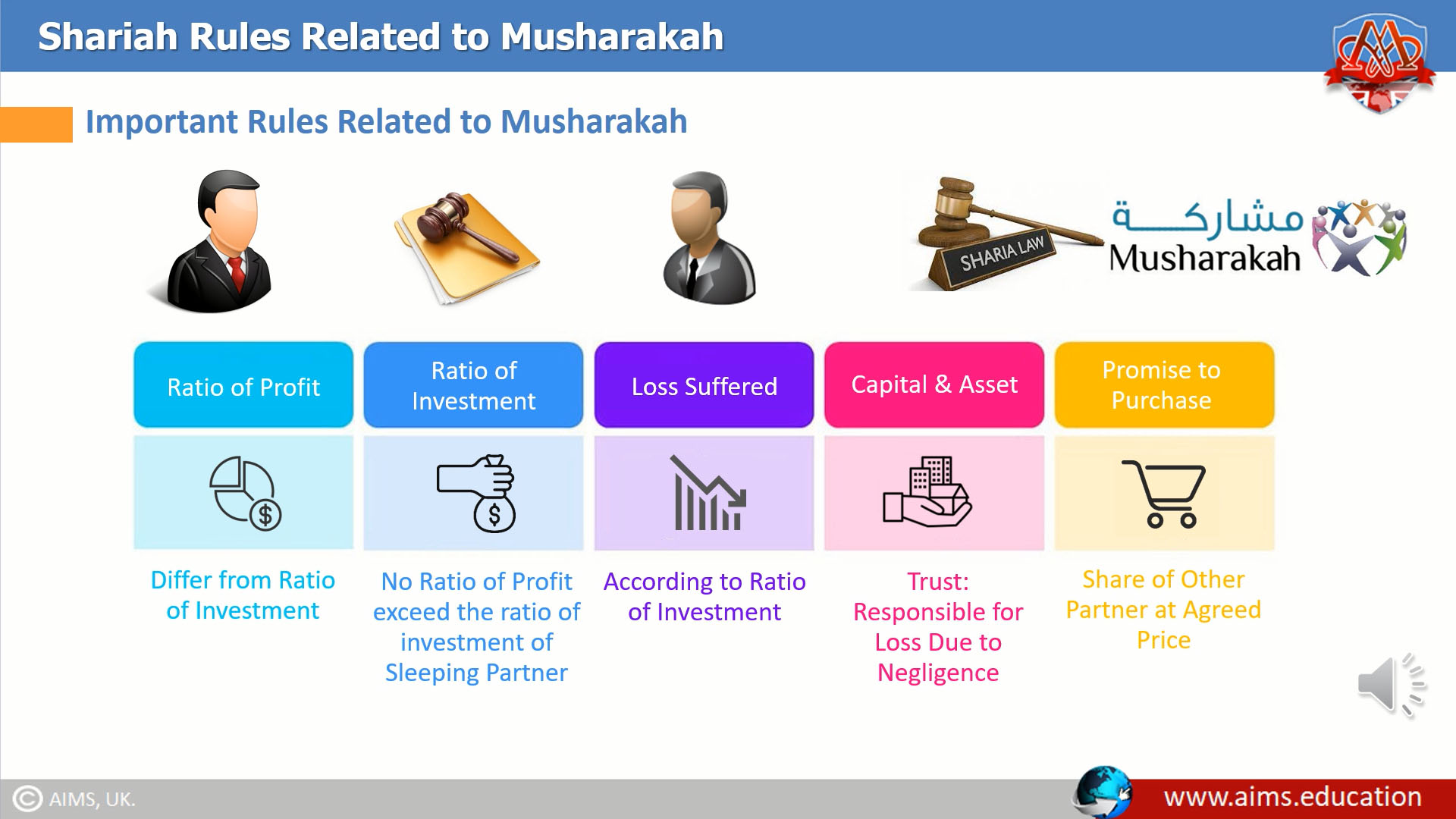

Important Rules Related to the Musharaka Contract

Here are the key rules defined by the Islamic laws of Shariah for the Musharaka contract:

- Partner cannot do any work or activity when there is an apparent loss of business.

- One partner may be a sleeping partner and the other a working partner.

- Any other person may be employed with the mutual consent of all partners. The salary will be accounted for business expenses, and part of profit may also be given as an incentive besides salary.

- Any partner may be employed by the business. In this case, his ratio of profit may be increased, or a salary may be given.

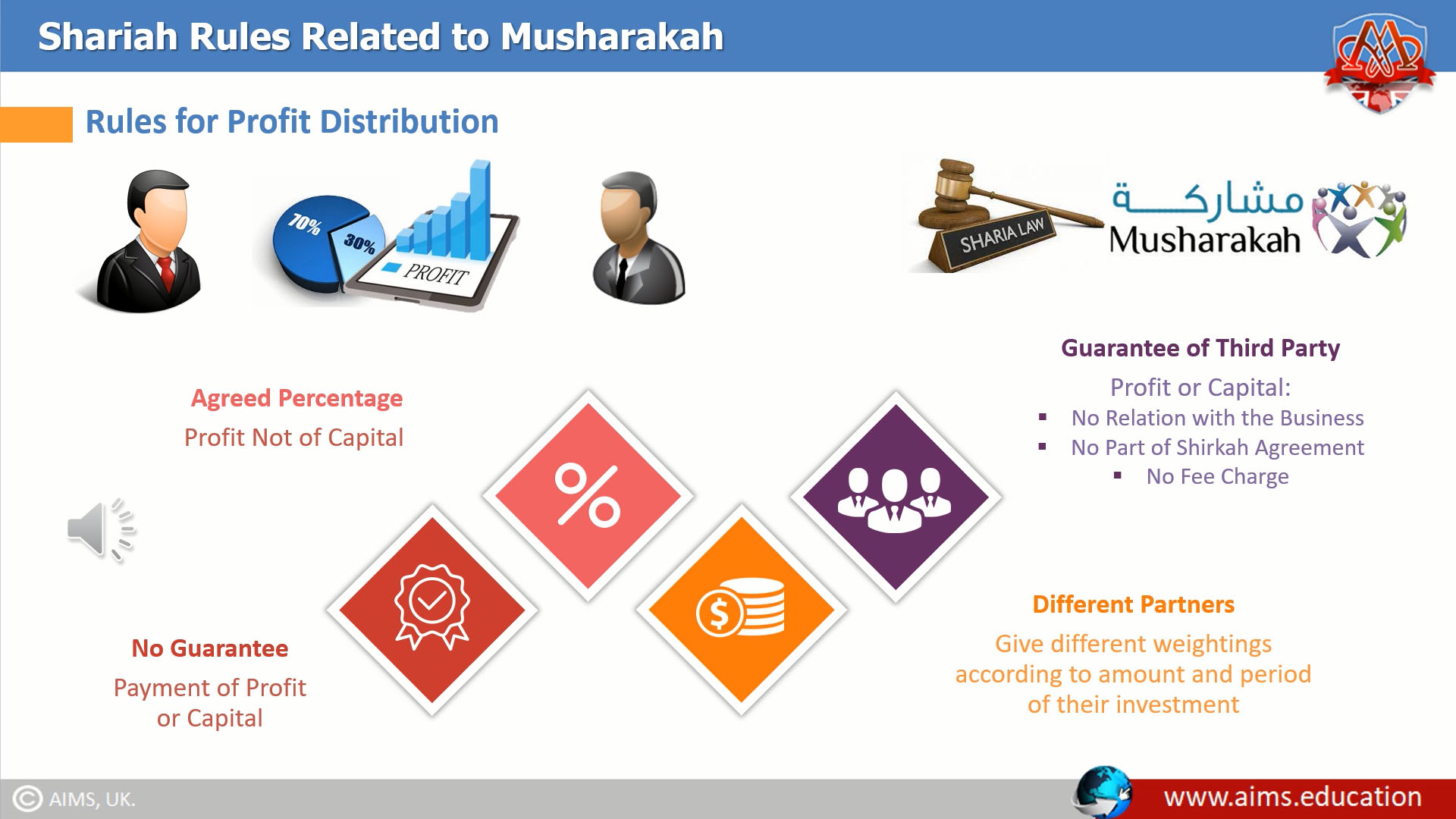

- Profit can be distributed at any mutually agreed ratio.

- The ratio of profit may differ from the ratio of capital or investment.

- The ratio of profit of a sleeping partner cannot exceed the ratio of his investment.

- Losses must be suffered according to the ratio of investment.

- Since capital and asset of Shirkah is a trust, so if loss is occurred due to negligence of a partner, only that particular partner will be responsible of the loss, not other partners.

- Every partner can promise to purchase the share of the other partner at Market Price or at an agreed price at the time of sale. It is not allowed to agree on a fixed price at the time of promise.

- If capital is in shape of commodity, its market value at the time of entering into partnership will be taken.

- Capital must be specified and existing. Debt cannot be a capital, unless it is a nominal part of capital, for example: in case of merger of companies.

Practicing Musharakah in Islamic Banking and Finance

There are two categories of Musharakah is being practiced in Islamic banking and finance:

- Permanent, and,

- Diminishing.

1. Permanent Musharakah

- In this type of partnership, partners contribute capital to a project and share both profits and losses throughout the project’s life.

- The partnership is dissolved once the project is completed OR when one partner decides to withdraw from the Musharakah contract.

2. Diminishing Musharakah

- In the Diminishing Musharakah contract, partners contribute capital to a project (usually an asset), and one partner gradually buys out the other partner’s share until he or she owns all the shares of the asset.

- This type of Musharakah contract is commonly used for Islamic home financing.

Comparison of Shirkah with the Conventional Banking and Financial System

1. Sharing of Risk

In an interest based economic system, lender lends its money to the borrower for risk free return. While in Shirkah based Shariah lending, both parties share their risk and reward and remain conscious.

2. Interest

In conventional loans, borrower is bound to return full principle plus interest, even the losses are suffered. However, Shirkah is based on the principles of Islamic economics, and it prohibits all types of riba. Both the financier and borrower enjoy profit or suffer loss.

3. Value for Society

In interest based economic system, money circulates in few hands. In Musharakah, money circulates throughout society.

Islamic Finance Education: Forging Innovative Paths

Musharakah has been gaining considerable attention in practice. Considering the growing demand for skilled professionals, AIMS’ Islamic Banking and Finance Institute has designed and developed Islamic finance educational programs for students worldwide. AIMS’ postgraduate online diploma in Islamic finance and banking is intended to create a comprehensive understanding of the principles that govern the Islamic banking system.

Through its academic excellence, AIMS also educates professionals to work in top-tier organizations, offering doctorate PhD in Islamic finance and economics and a Master’s program in Islamic banking and finance. Furthermore, the the CIFE Islamic finance course and CIB Islamic banking course are reshaping a new generation of experts ready to pioneer innovative and ethical financial solutions.

AAOIFI Shariah Standards for Musharakah

This standard is applicable to all forms of traditional Fiqh nominate partnerships, that operate on the basis of Shirkat-ul-Aqd or Contractual Partnership. It may be defined as:

“An agreement between two or more parties to combine their assets, labor or liabilities, for the purpose of making profits”.

And, it is classified into two main categories:

- Traditional Fiqh Nominate partnerships; and;

- Modern Corporations.

Traditional Fiqh Nominate partnerships are categorized as:

- Contractual Partnership or Shirkat-ul-Inam;

- Liability Partnership or Shirkaht-ul-Wujooh; and;

- Vocational partnerships and partnerships for undertaking difficult work or accepting jobs; or Shirkaht-ul-Aamal.

Well-known forms of modern corporations are as follows:

- Stock company.

- Joint-liability Company.

- Partnership in Commendams.

- Company limited by shares.

- Allotment partnership.

- Diminishing partnership.

AAOIFI Shariah standards for Musaharaka apply to all forms of partnership except the following:

- Ownership partnership, where the parties jointly own an asset.

- Shirkaht-ul-Mufawazah, because the practical application of this form of partnership is rare.

- Mudarabah, because it has a separate standard.

- Sharecropping Partnerships, such as irrigation and agricultural partnerships.

- Modern partnerships, along with regulatory policies and procedures, are essential for market operations.

Summary

- Musharakah is one of the most important Islamic financial products.

- It is an ideal alternative to interest-based financing and has far-reaching effects on production and distribution.

- In Musharakah, each partner must get the profit exactly in proportion to the investment.

- It is permissible for a partner to rent or lease the other partner’s share for a specified amount and for any duration.

- AAOIFI Shariah standards for Musharaka apply to many forms of traditional Shariah nominate partnerships.

Frequently Asked Questions

Q1: What is Musharakah in Islamic banking?

Musharakah is a Shariah-compliant partnership where parties pool capital and share profit by agreement, while losses follow actual capital contributions. It stems from the broader concept of Shirkah.

Q2: How are profit and loss shared in a Musharakah contract?

Profit may be set at any mutually agreed ratio. Losses must mirror each partner’s invested capital. A sleeping partner’s profit share cannot exceed their investment proportion.

Q3: What are the key types of Shirkah?

The main forms are Shirkatul-Melk (co-ownership), Shirkatul-Amwal (capital partnership), and Shirkatul-Wujooh (creditworthiness-based partnership), each with distinct agency and ownership rules.

Q4: What is Musharakah Mutanaqisah for home financing?

It’s a diminishing partnership where one partner gradually purchases the other’s share in a co-owned asset while paying rent for the remaining share—common in Islamic home financing.

Q5: When should Shirkatul-Amwal be used?

Use it when partners contribute capital and act as agents for one another in trade or production. Profit ratios are flexible; losses must track capital shares.

Q6: How does agency work in Shirkatul-Wujooh?

Each partner can transact in the ordinary course of business on behalf of the other. Ownership and profit/loss follow agreed ratios, even for credit purchases.

Q7: What rules protect partners in Musharakah?

Partners must avoid actions when loss is apparent, agree on hiring, and specify capital. Negligence makes the negligent partner liable for resulting loss.

Q8: How does Musharakah differ from interest-based finance?

Conventional loans fix returns regardless of performance. Musharakah shares risk and reward—profits by agreed ratio, losses by capital—supporting wider value creation.

Q9: Can a partner promise to buy the other’s share?

Yes, at market value or an agreed price at time of sale. Avoid locking a fixed price at the promise stage if it undermines fairness or Shariah intent.

Q10: What AAOIFI guidance applies to Musharaka?

AAOIFI standards cover contractual partnerships and modern corporations, and exclude ownership partnerships and Mudarabah, which has its own standard.

Q11: Is Musharaka suitable for long projects?

Yes. Permanent Musharakah fits ongoing ventures where partners share profit and loss until completion or an agreed exit.

Q12: What mistakes should be avoided?

Don’t fix profit as a lump sum, mismatch losses with capital, or use unspecified capital. Clarify agency roles and keep full Shariah compliance.