What is Blockchain in Islamic Banking?

Blockchain technology is rapidly gaining the attention of Organizations of Islamic Cooperation. Various Islamic financial institutes are planning to use the blockchain in Islamic finance to bring its benefits, such as transparency and reduced transactional costs, that come with it. For example, authorities in Dubai have revealed their plan that they will be using Islamic blockchain in the public and private sectors. It is no surprise that even some Mulsim governments are showing interest in the digital currency by implementing blockchain in Islamic banking. Here, we have the information related to the relationship of blockchain in banking and finance.

What is Blockchain in Finance?

- The blockchain in finance is a decentralized digital system which helps in recording the transactions publicly and chronologically.

- It will allow users to access and verify their data. Blockchain is an underlying technology which is used to power Bitcoin and other digital currencies.

- Blockchain will allow you to send money around the world with no or little cost.

- There will be no banks or other third-party companies involved in the system which makes it more reliable.

- There are unlimited uses of Blockchain, and you can manage any type of transactions with it from property to goods and money.

Is Blockchain Halal?

Usually, any technology is considered Halal in Islam as long as it complies with Shariah and sources of Muslim laws. Scholars have debated this topic, and most of them believe that blockchain is halal. However, the case of bitcoin or cryptocurrency in Islam is different.

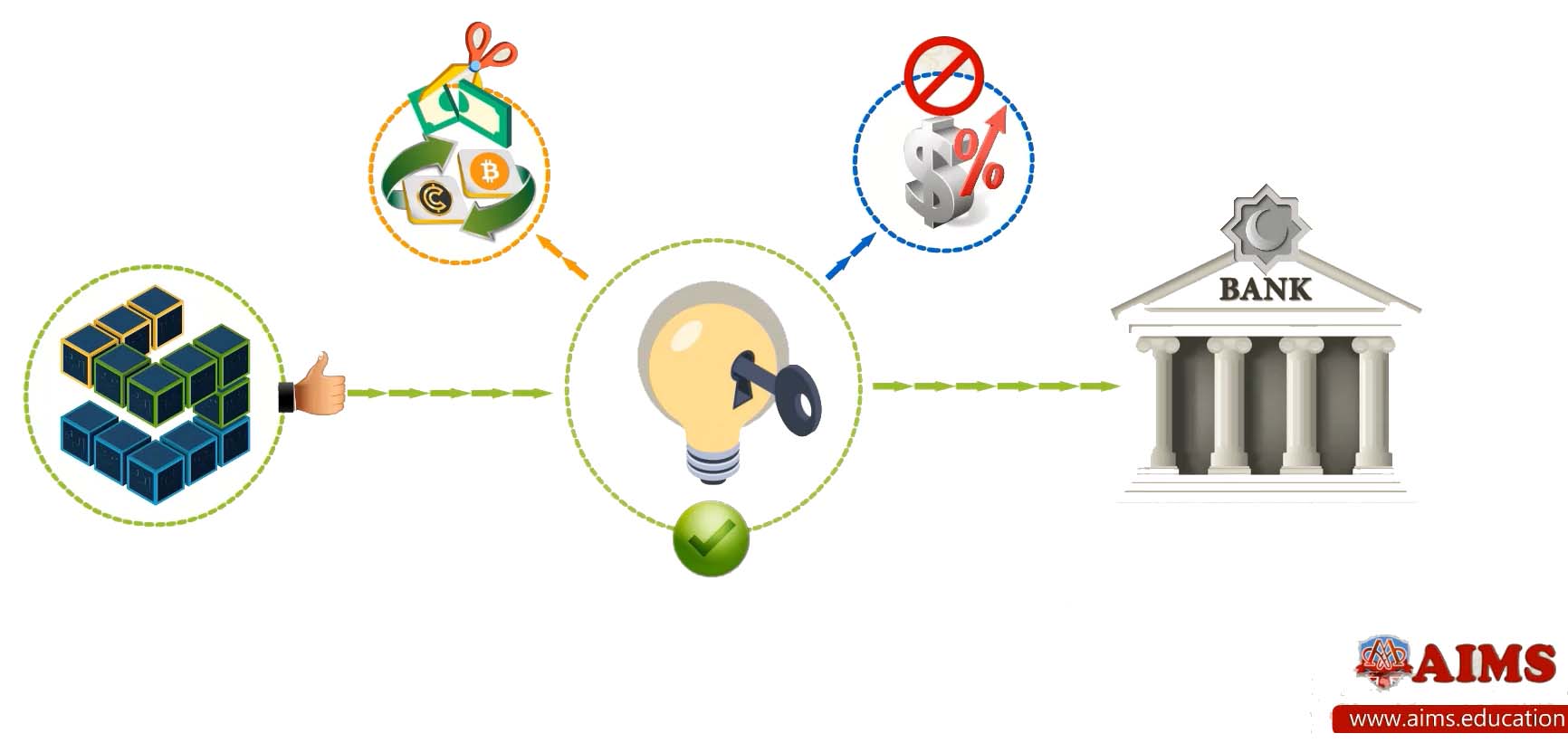

How Blockchain Works in Banking and Finance?

There are some people who are interested in knowing how blockchain in banking and finance can be beneficial. There are two fold solutions provided by blockchain technology in Islamic banking and finance system.

- Blockchain in Islamic banking can help banks save billions in the case by reducing the transaction and processing cost.

- As well as with blockchain technology in finance, there will be a dramatic reduction in the time and paper that is processed.

It will be valuable and profitable for the banks in the long run.

Role of Blockchain in Islamic Financial Transactions

The best thing about blockchain is that it provides an ideal solution for Islamic banking. It will not only reduce the cost of transactions, but also blockchain in Islamic banking will help get rid of interest rate. In the digital currency system, there is no interest that customers usually have to deal with. It means that management of services will become easier for the service providers.

7 Applications of Blockchain in Islamic Banking

There are various interesting applications of blockchain technology in banking that can bring different benefits:

1. Smart Contracts

To avoid the rapidly increasing interest rates, Islamic banks can take help from smart contracts. It will help to reduce gharar or uncertainty and speculations. There are different types of contracts available in Islamic financing that will help in the management of profit sharing agreements (Musharakah), agency arrangements (Wakalah), and cost-plus-proft contract (Murabahah).

2. Cloud Storage

The biggest attraction of blockchain in Islamic banking is that banks will get access to cloud storage. It will reduce all types of conflicts and help customers maintain their partnerships. The cryptographic mathematic algorithms will provide access to all the information. It will store all important data that can be accessed by banks and customers to avoid any issues.

3. Digital Currencies

There are different types of digital currencies available, but the development of digital currency is not as simple as it seems like. It requires a complete process to manage the services. That is why such currencies come with benefits like improved security and different rewards to miners.

4. Collection of Zakath

Blockchain technology can offer more efficient and transparent collection and distribution of Zakat funds.

5. Trade Finance

Blockchain can streamline Islamic trade finance processes by automating documentation and reducing fraud risk.

6. Sukuk Issuance

Sukuk, also known as Islamic bonds, could benefit from blockchain technology by providing a more transparent and efficient way to issue and manage them.

7. Crowdfunding

Blockchain can facilitate crowdfunding for Islamic finance projects, providing a secure and transparent platform for investors and project owners.

5 Key Benefits of Blockchain in Islamic Finance

There are several benefits of blockchain in Islamic finance, such as:

- Blockchain can significantly improve the speed and efficiency of Islamic finance transactions.

- Blockchain in Islamic finance can provides a tamper-proof record of all transactions.

- Elimination of intermediaries and manual processes can lead to significant cost savings for Islamic banks and financial institutions.

- Blockchain uses advanced cryptography techniques, which secures data and increases security.

- Blockchain in Islamic banking and finance will comply with Shariah law, making it acceptable to Muslims worldwide.

Future of Blockchain in the Islamic Banking and Finance Industry

The blockchain in Islamic banking and finance will surely help the Islamic banks and financial institutions to succeed. Without worrying about the riba (means interest) and other prohibited elements, the system can work more productively. Management of halal or Islamic loans and other related services will become easy. It is discussed in more detail in the Islamic banking diploma and Islamic finance course offered online by AIMS Education.

Frequently Asked Questions

Q1: What is blockchain in Islamic banking and finance?

It’s a decentralised ledger that records transactions transparently and immutably, supporting trust, auditability and asset traceability when applied within Shariah rules.

Q2: Is blockchain halal in Islam?

The technology is generally halal if used for Shariah-compliant purposes. Acceptability depends on the application, not the tool itself.

Q3: How does blockchain reduce costs in Islamic banking?

It streamlines verification and reconciliation, cutting intermediaries, paper flow and processing time across financing and payments.

Q4: What are practical uses of Islamic blockchain today?

Smart contracts for Murabahah, Musharakah and Wakalah, transparent Zakat, trade-finance automation, sukuk lifecycle tracking and compliant crowdfunding.

Q5: How do smart contracts reduce gharar?

They auto-execute clear, agreed terms with time-stamped logs, reducing ambiguity and disputes in Islamic contracts.

Q6: Can blockchain support sukuk issuance and management?

Yes—shared ledgers track ownership, automate distributions and deter fraud across the sukuk lifecycle.

Q7: How can blockchain improve Zakat collection?

It enables end-to-end visibility of inflows and disbursements, strengthening accountability and public trust.

Q8: What are common challenges in blockchain implementation?

Regulatory uncertainty, legacy integration, privacy, scalability and ensuring robust Shariah governance.

Q9: Does blockchain itself eliminate riba?

No. It’s an enabling technology; riba avoidance depends on the underlying contract structure and assets.

Q10: When should Islamic financial institutions consider blockchain?

When multi-party reconciliation, auditability and time-stamped proofs are mission-critical—after cost–benefit and Shariah assessments.

Q11: How does blockchain support Shariah screening?

Permissioned ledgers can record screened assets, approved parties and contract states, with immutable logs and automated checks.