What is Islamic Blockchain?

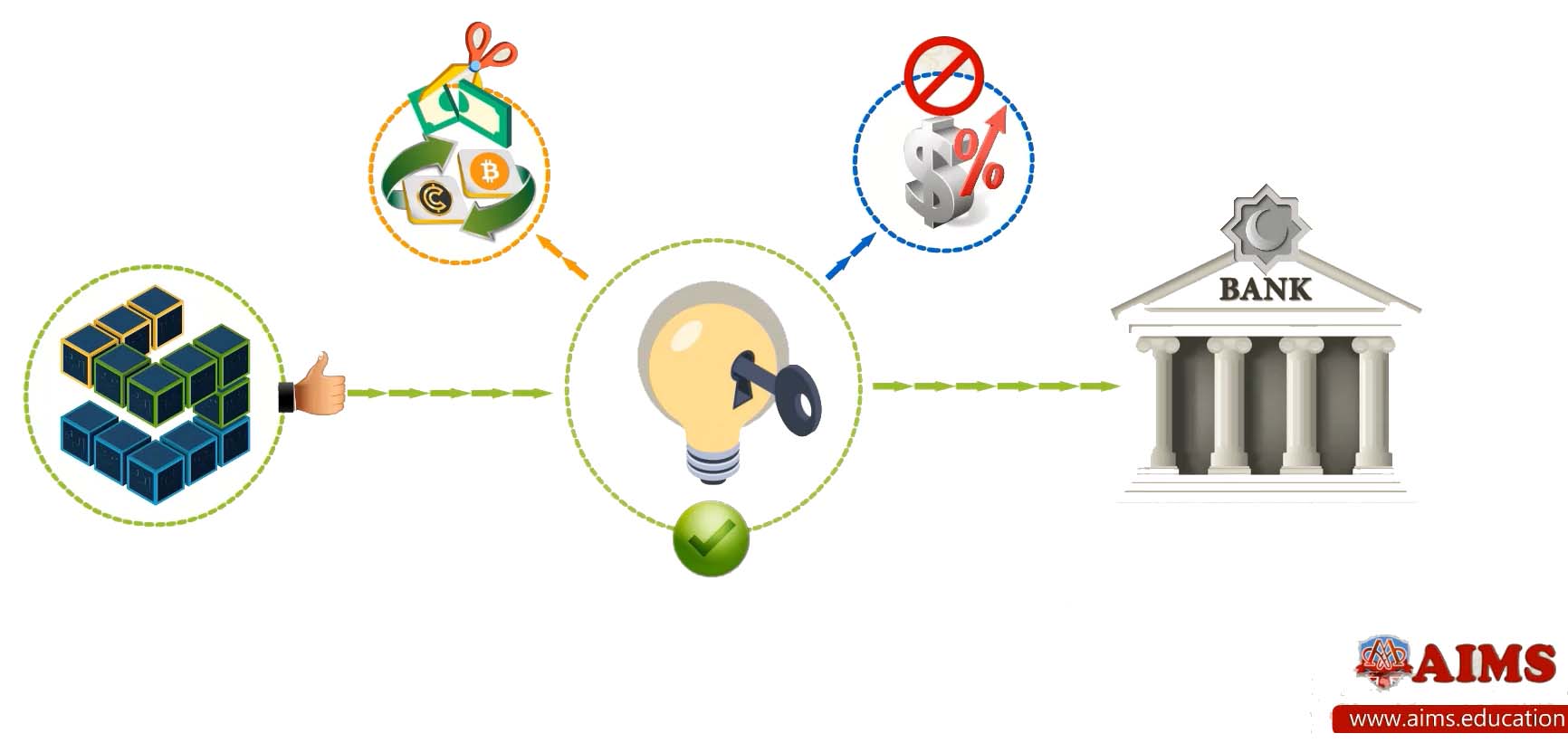

Blockchain technology has been making significant waves in industries around the globe, and the realm of Islamic finance is no exception. With its promise of secure, decentralized systems for financial transactions, blockchain has caught the attention of many banks and financial institutions looking to improve their operations. But what exactly is blockchain in Islamic finance? And how does Islamic blockchain work? Blockchain in Islamic finance refers to the use of blockchain technology following Islamic principles and guidelines. These principles, based on Shariah law, emphasize ethical and just financial practices that prioritize societal well-being over individual gain. Islamic banking and finance have been evolving for centuries, integrating advancements in technology along the way. With the rise of blockchain, it is no surprise that Islamic finance has embraced this disruptive technology.

What is Blockchain?

Blockchain is a distributed ledger technology that enables secure, transparent, and tamper-evident transactions. It operates in a decentralized network, allowing for the safe transfer of value without the need for intermediaries. Each block in the chain contains a record of transactions that cannot be altered, making it a reliable way to store and transfer data.

How Does Blockchain Work in Banking and Finance?

The process of blockchain in banking and finance involves the following steps:

- Transaction Initiation: A transaction is initiated when a party wants to send money or assets to another party. This is usually done through a blockchain wallet.

- Transaction Verification: After the transaction is initiated, it gets verified by participants (also known as ‘nodes’) in the blockchain network. They check the authenticity of the transaction and the parties involved.

- Block Creation: Once the transaction is verified, it gets bundled with other verified transactions into a ‘block’. This block also contains data such as a unique block number and a timestamp.

- Block Addition: The newly created block is then added to the blockchain in a linear, chronological order. The block also contains a reference to the previous block, creating a chain of blocks.

- Transaction Completion: After the block is added to the blockchain, the transaction is considered complete. The recipient of the transaction can now see the funds or assets in their wallet.

The Rise of Blockchain Technology in Shariah-Based Banking System

The implementation of blockchain technology in the Shariah-based banking system signifies a radical shift towards more transparent, secure, and efficient financial operations. Islamic banking, characterized by its adherence to Shariah law, has often faced challenges related to compliance, documentation, and transaction speeds. The advent of blockchain technology has the potential to revolutionize this sector by addressing these issues head-on. Blockchain’s immutable ledger system enhances accountability and trust, aligning with the Islamic principles of fairness and transparency.

Is Blockchain Halal?

For a technology to be accepted in Islamic finance, it must comply with shariah law. This has led to the question of whether blockchain is halal (permissible) or not. Scholars have debated this topic, and while there is no clear consensus, many believe that blockchain is halal as long as it does not support activities that are prohibited in Islam, such as gambling or interest-based transactions.

Benefits of Blockchain in Islamic Finance

There are several benefits of implementing blockchain technology in Islamic finance, including:

- Increased Efficiency: By automating financial processes and reducing the need for intermediaries, blockchain can significantly improve the speed and efficiency of transactions.

- Enhanced Transparency: Blockchain provides a tamper-proof record of all transactions, promoting transparency and accountability in Islamic finance.

- Cost Savings: The elimination of intermediaries and manual processes can lead to significant cost savings for Islamic banks and financial institutions.

- Improved Security: Blockchain uses advanced cryptography techniques to secure data, making it a more secure option compared to traditional systems.

- Shariah Compliance: As mentioned earlier, blockchain technology can be designed to comply with Shariah law, making it a suitable solution for Islamic finance institutions.

Applications of Blockchain in Islamic Finance and Banking:

Blockchains can help banks save billions in the case by reducing transaction and processing costs. There are various interesting applications of blockchain technology in banking that can bring different benefits:

1. Blockchain for Islamic Financial Products:

The best thing about blockchain is that it provides an ideal solution for Islamic banking and finance. It will not only reduce the cost of transactions but also will help get rid of interest rates. In the digital currency system, there is no interest that customers usually have to deal with. It means that the management of Islamic financial products and services will become easier for the service providers.

2. Digital Currencies:

There are different types of digital currencies available, but the development of digital currency is not as simple as it seems. It requires a complete process to manage the services. That is why such currencies come with benefits like improved security and different rewards to miners. However, one of the most notable examples is the Islamic Development Bank’s (IDB) partnership with a blockchain-based startup, OneGram. The partnership aims to develop a Sharia-compliant cryptocurrency backed by gold.

3. Collection of Zakath:

Another example is the use of blockchain in Zakat, which is a form of Islamic charity. Blockchain technology can enable more efficient and transparent collection and distribution of Zakat funds, making it easier for Muslims to fulfill their religious obligations.

4. Smart Contracts:

To avoid the rapidly increasing interest rates, Islamic banks can take help from smart contracts. It will help to reduce uncertainty and speculations. Different types of contracts available in Islamic financing will help in the management of profit-sharing agreements, agency arrangements, and partnerships.

5. Cloud Storage:

The biggest attraction is that banks will get access to cloud storage. It will reduce all types of conflicts and help customers maintain their partnerships. The cryptographic mathematic algorithms will provide access to all the information. It will store all important data that can be accessed by banks and customers to avoid any issues.

Aside from the general benefits that blockchain brings to Islamic finance, there are also specific applications within the industry. Some of these include:

6. Trade Finance:

Blockchain can streamline trade finance processes by automating documentation and reducing fraud risk.

7. Sukuk Issuance:

Sukuk, also known as Islamic bonds, could benefit from blockchain technology by providing a more transparent and efficient way to issue and manage them.

8. Smart Contracts:

Blockchain’s ability to create self-executing smart contracts can improve the efficiency of contract-based transactions in Islamic finance.

9. Crowdfunding:

Blockchain can facilitate crowdfunding for Islamic finance projects, providing a secure and transparent platform for investors and project owners.

10. Blockchain Fintech and Islamic Finance

Blockchain’s application extends beyond conventional finance, reaching the forefront of Islamic finance, particularly in areas where financial technology (FinTech) is increasingly intertwined with traditional financial services. This innovative technology, with its inherent principles of transparency and security, complements the core tenets of Islamic finance — equity, participation, and inclusiveness. Blockchain’s distributed ledger technology can provide end-to-end visibility of contractual obligations and payments, ensuring full compliance with Islamic prohibitive regulations against uncertainty (Gharar) and gambling (Maisir). This synergy between blockchain, FinTech, and Islamic finance opens up new avenues for banking solutions.

Challenges for Implementing Blockchain in Islamic Finance:

Despite the potential benefits of blockchain in Islamic finance, some challenges and considerations need to be addressed.

- One of the main challenges is regulatory compliance. Islamic finance is subject to sharia law, which has specific requirements for financial transactions. Any blockchain-based solution must be compliant with Sharia law to be viable.

- Another challenge is the lack of awareness and education about blockchain technology in the Islamic finance industry. Many financial institutions and customers may not be familiar with blockchain technology, making it difficult to implement and adopt.

Future Trends of Blockchain in the Islamic Finance and Banking Industry:

The future of blockchain in Islamic finance looks promising. As technology becomes more widely adopted, we can expect to see more innovative solutions that align with the principles of Islamic finance.

- One trend that is already emerging is the use of blockchain in Islamic insurance or Takaful. Blockchain technology can enable more transparent and efficient management of Takaful funds, making it easier for customers to access insurance products.

- Another trend is the use of blockchain in Islamic crowdfunding. Blockchain technology can enable more efficient and transparent crowdfunding platforms, making it easier for entrepreneurs and investors to participate in Sharia-compliant investment opportunities.

- Streamlined management of loans and related services will pave the way for seamless operations.

- One potential development is the use of blockchain in Waqf, which is a form of Islamic endowment. Blockchain technology can enable more efficient and transparent management of Waqf funds, making it easier for Muslims to fulfill their religious obligations.

- Another potential development is the use of blockchain in Islamic microfinance. Blockchain technology can enable more efficient and transparent management of microfinance funds, making it easier for low-income individuals to access Sharia-compliant financial services.

Case Studies of Successful Implementation:

There are several examples of successful implementation of blockchain technology in Islamic finance.

- One example is the use of blockchain in Sukuk, which are Sharia-compliant bonds. The Dubai government issued a blockchain-based Sukuk in 2018, which was oversubscribed and attracted global interest.

- Another example is the use of blockchain in cross-border payments. Abu Dhabi-based Al Hilal Bank became the first Islamic bank to use blockchain for cross-border payments in 2018.

The technology enabled faster and more secure transactions between the UAE and Saudi Arabia, reducing the time and cost associated with traditional banking transactions.

Regulatory Considerations for Blockchain in Islamic Finance:

Regulatory compliance is a key consideration for any blockchain-based solution in Islamic finance. Sharia law has specific requirements for financial transactions, and any blockchain-based solution must be compliant with these requirements to be viable. Regulators must also consider the potential risks and challenges associated with blockchain technology, such as cybersecurity and privacy concerns.

Criticisms and Limitations:

Despite the potential benefits of blockchain in Islamic finance, some criticisms and limitations need to be addressed.

- One criticism is that blockchain technology is not yet mature enough for widespread adoption in the industry.

- Another criticism is that blockchain-based solutions may not be suitable for all types of Islamic finance transactions.

Risks and Limitations of Blockchain in Islamic Finance:

Despite the potential benefits of blockchain in Islamic finance, some risks and limitations need to be considered.

- One risk is the potential for cybersecurity breaches and hacking.

- Another risk is the potential for regulatory non-compliance, which could lead to legal and financial repercussions.

The Potential of Blockchain to Transform Islamic Finance:

In conclusion, the potential of blockchain technology to revolutionize the Islamic finance industry is vast. It aligns with Islamic finance principles by facilitating transactions that are secure, transparent, and efficient, without the necessity of intermediaries. Despite the existence of challenges and concerns that require attention, the immense benefits of applying blockchain in Islamic finance cannot be underestimated. As technological progression persists, anticipations are high for the emergence of more innovative solutions that will redefine the future of Islamic finance. In line with this, institutions such as the Institute of Islamic Banking and Finance are offering online certifications like the best Islamic banking course and an online MBA degree in Islamic Banking and Finance. These programs aim to equip individuals with the necessary knowledge and skills to navigate this evolving landscape.